DocSend 2023 Q1 Data Shows Founder Persistence Amid Economic Uncertainty and Increased Investor Diligence

DocSend, a secure document sharing platform and a Dropbox company, released Q1 2023 data reflecting a cautious investment climate. Year-over-year (YoY), pitch deck interactions dropped by 13.6%, while founder pitch deck distributions declined by 4.8%. Despite these challenges, there was a quarter-over-quarter (QoQ) increase in founder activity of 5.4% and investor activity of 4.8%. Investors are becoming more selective, spending less time on reviewing pitch decks. Global funding fell by 53% YoY, affecting all stages of fundraising. DocSend's unique metrics show founder links created, investor interactions, and time spent reviewing decks, offering insights into the state of venture capital. The data highlights founder persistence amid economic headwinds.

- Founder activity rose 5.4% QoQ.

- Investor activity increased 4.8% QoQ.

- Q1 2023 marks the fourth consecutive quarter of increased founder activity compared to investor activity.

- Investor pitch deck interactions dropped 13.6% YoY.

- Founder pitch deck distributions fell by 4.8% YoY.

- Global funding decreased 53% YoY.

Insights

Analyzing...

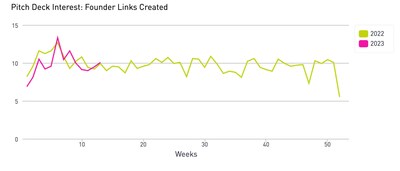

Investor-friendly market situation continues, but startup fundraising activity shows some positive movement from previous quarter

SAN FRANCISCO, April 13, 2023 /PRNewswire/ -- DocSend, a secure document sharing platform and Dropbox (NASDAQ: DBX) company, released a new data analysis of its Pitch Deck Interest (PDI) metrics showing that founder and investor activity decreased year-over-year (YoY), but saw a quarter-over-quarter (QoQ) uptick in Q1. Founder activity reached a weekly high mid-quarter despite the volatile macro climate, but the road to funding remains rocky. Investors holding large amounts of capital are increasingly selective in its deployment, creating a challenging market for founders seeking funding.

Cautious Market Continues to Favor Investors in Yearly Analysis

Founders' fundraising efforts in early 2022 benefited from 2021's end-of-year momentum, while Q1 2023 demonstrates a significantly weakened market 12 months later.

YoY analysis shows investor pitch deck interactions slipped

According to Crunchbase, global funding fell

Additionally, investors are spending less time reviewing pitch decks and seeking new deals and opportunities. Time spent on deck declined YoY and YTD by

"The investors seeking out investments in 2023 are not fearful of missing out on deals and are okay with walking away from a pitch deck that doesn't meet their standards from the beginning," said Justin Izzo, senior data and trends analyst at Dropbox DocSend. "Investors may have their hands full working to make their current portfolio companies leaner and more efficient, causing limited attention for new deals. There are plenty of 'ifs' impacting dealflow right now, but lack of founders seeking capital is not one of them."

Founders Working Hard, Despite Quarterly Turbulence

Despite volatile public and private markets, and macroeconomic headwinds, both founders and investors showed an uptick in activity and were slightly more active in Q1 compared to Q4. Founder activity rose

Time spent by investors reviewing pitch decks stabilized from last quarter's all-time low, increasing by

"The quarterly increase in founder and investor activity in Q1 is a bright spot among macro headwinds," said Izzo. "Considering all of the external factors that have impacted fundraising in the new year, including the recent instability in regional banks like Silicon Valley Bank, founders are still willing to seek funding when needed. Founders still need to make an immediate impression and demonstrate positive momentum, which is extremely important to investors who aren't racing to the next deal."

DocSend releases quarterly data analyses via the Pitch Deck Interest metrics to track and predict the investment landscape, informing founders of volatility or stability in the venture capital environment.

Key Leading Indicators of Fundraising Activity

There are three core metrics unique to DocSend for tracking investors' hunger for deals and founders' quest for capital.

- Founder links created - the average number of pitch deck links each founder is creating via DocSend. This serves as a proxy for the supply of startups seeking funding. A "link" refers to the unique URL a founder creates using DocSend to share their pitch deck with investors. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor deck interactions - the average number of investor interactions for each pitch deck link. This serves as a proxy for demand for investments. The higher the interaction metric, the more often decks are viewed, shared, and revisited by potential investors.

- Investor time spent - the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 30,000 customers of all sizes use DocSend today. Learn more at docsend.com.

About Dropbox

Dropbox is one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in San Francisco, CA. For more information on our mission and products, visit dropbox.com.

Media Contact:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2023-q1-data-shows-founder-persistence-amid-economic-uncertainty-and-increased-investor-diligence-301796047.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2023-q1-data-shows-founder-persistence-amid-economic-uncertainty-and-increased-investor-diligence-301796047.html

SOURCE DocSend