DocSend 2022 Year-End Data Reveals Healthy Fundraising Activity Relative to Historic Timeline, Despite Recent Slowdown

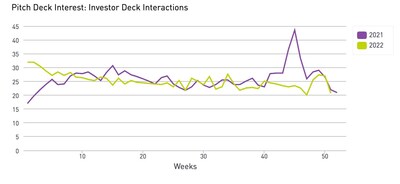

DocSend, a document sharing platform under Dropbox (NASDAQ: DBX), reported steady investor engagement with pitch decks in 2022 but saw a 20% decline in Q4. Throughout the year, founder activity increased by 6.6%, while investor engagement decreased by 4.6% year-over-year. Notably, Q4 2022 engagement was 26% higher than pre-2021 levels, indicating a relatively healthy early-stage fundraising environment despite macroeconomic challenges. Investors spent an average of 2 minutes and 18 seconds per deck, marking an all-time low. The report highlights that venture capitalists are currently focusing more on existing portfolios rather than new deals.

- Founder activity increased by 6.6% year-over-year.

- Q4 2022 engagement was 26% higher than pre-2021 levels.

- Investor engagement dropped 19.8% year-over-year in Q4.

- Investor time spent on pitch decks decreased to an all-time low of 2 minutes and 18 seconds.

Insights

Analyzing...

Pitch Deck Interest Metrics show Investor engagement with pitch decks remained steady throughout the year, but dipped almost

SAN FRANCISCO, Jan. 18, 2023 /PRNewswire/ -- DocSend, a secure document sharing platform and Dropbox (NASDAQ: DBX) company, released a new data analysis based on its weekly Pitch Deck Interest (PDI) metrics showing that founder and investor activity remained relatively healthy in comparison to 2021, despite macroeconomic concerns, external global factors, and a steady stream of cutbacks in the tech sector. The data also tracked an all-time low for the amount of time investors spend reviewing startup pitch decks.

2022: Still founder-friendly, even by 2021's standards

Founders remained active in sending out pitch decks (a proxy for supply) to investors throughout 2022, while investors' interaction with decks (a proxy for demand) slowed in comparison to 2021's furious pace. Both founders and investors had a minimal quarter-over-quarter (QoQ) decline in activity of

While the YoY drop in Q4 investor activity is noticeable, YTD data suggests that 2021's health spilled into 2022. Across the full year in 2022, investor activity was down

The expected mid-quarter pre-holiday rush that exploded in 2021 never materialized in Q4 2022, contributing significantly to the YoY decline in investor engagement. While investor interest waned in Q4, when compared to years prior to 2021, Q4 2022 engagement is actually

"Founders and investors continue to maintain a steady pace as 2023 kicks off, with founders slightly outpacing investors in activity," said Justin Izzo, lead data and trends analyst at Dropbox DocSend. "These metrics, despite their declines, indicate that the early stage fundraising market is still healthy overall. Early stage founders can be slightly optimistic, but should know that investors may not significantly pick up the pace early in Q1, which is historically a time when VCs have been quite active."

Dry powder, or deployable capital, has been a topic of discussion for much of 2022. VCs are sitting on record amounts of capital, as high as

Continuous decline in investor time spent

Throughout 2022, investor time spent reviewing pitch decks remained low. Notably, an all-time low occurred in Q4, at an average of two minutes and 18 seconds spent per pitch deck.

Time spent on reviewing pitch decks is contextual. Economic factors, founder competition and existing portfolios all play a role. Investor time spent declined

"A record number of VC funds came to market in late 2021 and through 2022 and quickly deployed capital at peak valuations," said Nisha Desai, Founder and Managing General Partner at Andav Capital. "Those VCs have shifted their relative focus from frantic deal-hunting to existing portfolio triage – resetting from growth at all costs to growth at a reasonable burn and to solvency positioning in today's unsteady environment. Early stage deal quality, however, has not universally deteriorated, so 2023 will seed healthy returns for resilient founders and VCs."

Dealmaking has slowed in 2022 with investors seeking profitability, according to PitchBook. Despite this challenge, the activity level for investors shows founders can remain optimistic.

DocSend releases quarterly analyses via the Pitch Deck Interest metrics to track and predict the investment landscape and better inform founders about the volatility or stability of the venture capital environment.

Key Leading Indicators of Fundraising Activity

There are three core metrics unique to DocSend for tracking investors' hunger for deals and founders' quest for capital.

- Founder links created - the average number of pitch deck links each founder is creating via DocSend. This serves as a proxy for the supply of startups seeking funding. A "link" refers to the unique URL a founder creates using DocSend to share their pitch deck with investors. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor deck interactions - the average number of investor interactions for each pitch deck link. This serves as a proxy for demand for investments. The higher the interaction metric, the more often decks are viewed, shared, and revisited by potential investors.

- Investor time spent - the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 30,000 customers of all sizes use DocSend today. Learn more at docsend.com.

Dropbox is one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in San Francisco, CA. For more information on our mission and products, visit dropbox.com.

Media Contact:

Carol Boyko

104 West for DocSend

carol.boyko@104west.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2022-year-end-data-reveals-healthy-fundraising-activity-relative-to-historic-timeline-despite-recent-slowdown-301724158.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/docsend-2022-year-end-data-reveals-healthy-fundraising-activity-relative-to-historic-timeline-despite-recent-slowdown-301724158.html

SOURCE DocSend