Spetz Announces Results for the Three and Six Months Ended June 30 2024

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) reported financial results for Q2 2024, showing a strategic shift towards the Israeli market. Key highlights include:

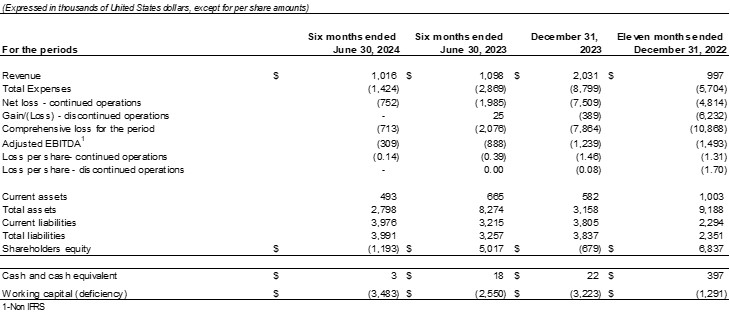

- Revenue of US$1,016K for H1 2024, down 7.47% year-over-year

- Total expenses decreased by 50.37% to US$1,424K

- Net loss reduced by 61.63% to US$752K

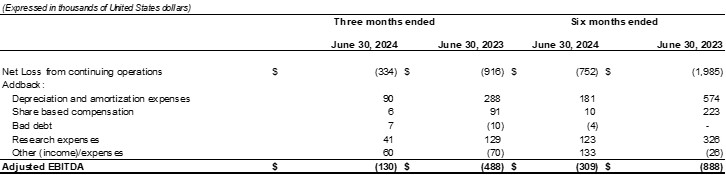

- Adjusted EBITDA loss decreased by 65.2% to US$309K

CEO Yossi Nevo emphasized the company's focus on efficiency and cost reduction, aiming for positive cash flow. Spetz is seeking additional investments in its Israeli subsidiary and offering debt-to-equity conversion opportunities to support profitability.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) ha riportato i risultati finanziari per il secondo trimestre del 2024, evidenziando un cambio strategico verso il mercato israeliano. I punti salienti includono:

- Ricavi di 1.016.000 US$ per il primo semestre del 2024, in calo del 7,47% rispetto all'anno precedente

- Le spese totali sono diminuite del 50,37% a 1.424.000 US$

- La perdita netta è stata ridotta del 61,63% a 752.000 US$

- La perdita EBITDA rettificata è diminuita del 65,2% a 309.000 US$

Il CEO Yossi Nevo ha sottolineato l'attenzione dell'azienda sull'efficienza e la riduzione dei costi, mirando a un flusso di cassa positivo. Spetz sta cercando investimenti aggiuntivi nella sua controllata israeliana e offre opportunità di conversione del debito in capitale per supportare la redditività.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) reportó resultados financieros para el segundo trimestre de 2024, mostrando un cambio estratégico hacia el mercado israelí. Los puntos destacados incluyen:

- Ingresos de 1.016.000 US$ para el primer semestre de 2024, una disminución del 7,47% interanual

- Los gastos totales disminuyeron un 50,37% a 1.424.000 US$

- La pérdida neta se redujo un 61,63% a 752.000 US$

- La pérdida ajustada de EBITDA disminuyó un 65,2% a 309.000 US$

El CEO Yossi Nevo enfatizó el enfoque de la compañía en la eficiencia y la reducción de costos, con el objetivo de lograr un flujo de caja positivo. Spetz está buscando inversiones adicionales en su filial israelí y ofreciendo oportunidades de conversión de deuda a capital para apoyar la rentabilidad.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF)는 2024년 2분기 재무 결과를 발표하며 이스라엘 시장으로의 전략적 전환을 보여주었습니다. 주요 강조 사항은 다음과 같습니다:

- 2024년 상반기 매출 1,016K US$, 전년 대비 7.47% 감소

- 총 비용이 50.37% 감소하여 1,424K US$

- 순손실이 61.63% 감소하여 752K US$

- 조정된 EBITDA 손실이 65.2% 감소하여 309K US$

CEO 요시 네보는 회사의 효율성과 비용 절감에 대한 집중을 강조하며 긍정적인 현금 흐름을 목표로 하고 있습니다. Spetz는 이스라엘 자회사에 대한 추가 투자 및 수익성을 지원하기 위해 부채-자본 전환 기회를 제공하고 있습니다.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) a annoncé ses résultats financiers pour le deuxième trimestre 2024, montrant un changement stratégique vers le marché israélien. Les principaux points à retenir incluent :

- Un revenu de 1 016 000 US$ pour le premier semestre 2024, en baisse de 7,47% par rapport à l'année précédente

- Les dépenses totales ont diminué de 50,37% pour atteindre 1 424 000 US$

- La perte nette a été réduite de 61,63% à 752 000 US$

- La perte d'EBITDA ajustée a diminué de 65,2% pour atteindre 309 000 US$

Le PDG Yossi Nevo a souligné le focus de l'entreprise sur l'efficacité et la réduction des coûts, visant à obtenir un flux de trésorerie positif. Spetz cherche à attirer des investissements supplémentaires dans sa filiale israélienne et offre des opportunités de conversion de dettes en actions pour soutenir la rentabilité.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) hat die finanziellen Ergebnisse für das 2. Quartal 2024 veröffentlicht und einen strategischen Wandel hin zum israelischen Markt aufgezeigt. Zu den wichtigsten Punkten gehören:

- Umsatz von 1.016.000 US$ für das erste Halbjahr 2024, ein Rückgang von 7,47% im Jahresvergleich

- Die Gesamtausgaben sanken um 50,37% auf 1.424.000 US$

- Der Nettoverlust wurde um 61,63% auf 752.000 US$ reduziert

- Der bereinigte EBITDA-Verlust sank um 65,2% auf 309.000 US$

CEO Yossi Nevo betonte den Fokus des Unternehmens auf Effizienz und Kostenreduktion mit dem Ziel, einen positiven Cashflow zu erreichen. Spetz sucht zusätzliche Investitionen in seine israelische Tochtergesellschaft und bietet Möglichkeiten zur Umwandlung von Schulden in Eigenkapital an, um die Rentabilität zu unterstützen.

- Total expenses decreased by 50.37% to US$1,424K for H1 2024

- Net loss reduced by 61.63% to US$752K for H1 2024

- Adjusted EBITDA loss decreased by 65.2% to US$309K for H1 2024

- Strategic focus on the Israeli market to improve efficiency

- Seeking additional investments and offering debt-to-equity conversions to support profitability

- Revenue decreased by 7.47% to US$1,016K for H1 2024

- Scaling back investments in regions outside Israel

TORONTO, ON / ACCESSWIRE / July 29, 2024 / SPETZ INC. (the "Company" or "Spetz") (CSE:SPTZ)(OTC PINK:DBKSF) today reported its financial results for the three and six months ended June 30, 2024. All figures are in US Dollars.

Highlights:

For the six months ending June 30, 2024, revenue was US

$1,016 K, a decrease of7.47% from US$1,098 K in the same period the previous year. This revenue, generated from referral service fees, reflects a strategic shift towards focusing on the Israeli market while scaling back investments in other regions. This strategic realignment has contributed to a reduction in the company's net loss as part of its ongoing efficiency initiatives.Total expenses decreased by

50.37% to US$1,424 K for the six months ended June 30, 2024, compared to US$2,869 K for the six months ended June 30, 2023Net Loss for the period decreased by

61.63% to US$752 K for the six months ended June 30, 2024, compared to US$1,960 K for the six months ended June 30, 2023.Adjusted EBITDA loss, as defined in the management discussion and analysis, decreased by

65.2% to US$309 K for the six months ended June 30, 2024, compared to US$888 K for the six months ended June 30, 2023.

"We are pleased to present our financial results for Q2 2024, which highlight our ongoing commitment to efficiency and improvement," said Yossi Nevo, CEO of Spetz Inc. "Our strategic efficiency plan has led to a substantial reduction in expenses, with an impressive decrease of approximately

For full financial information, notes, and management commentary, please refer to the Company's Management's Discussion and Analysis (MD&A) and the Consolidated Financial Statements as of June 30, 2024, posted on the Company's website and available on SEDAR. All financial information is provided in U.S. dollars unless otherwise indicated. In addition, all financial information provided herein is unaudited unless otherwise stated.

About Spetz Inc.

Spetz Inc. is a multinational technology company that operates Spetz, a global online, AI-powered marketplace platform that dynamically connects consumers to nearby top-rated service providers in around 30 seconds. Spetz is available in the USA, United Kingdom, Australia, and Israel. The Spetz vision is to reinvent how people around the world connect to services in their moment of need. Connecting them immediately with the top-matched service provider for any need, anytime, anywhere.

Spetz Website: www.spetz.app

Spetz Investor information: https://investor.spetz.app/

Company Contacts:

Ofir Friedman | Investor Relations |

|

|

|

|

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information in this press release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements and are based on expectations, estimates and projections as at the date of this press release. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "plans" "expect", "potential", "believe", "intend" or negatives of these terms and similar expressions. In this press release, forward-looking statements relate, among other things, to: the ability of Spetz to achieve cash-flow positivity and growth on a go-forward basis.

Forward-looking statements are based on certain assumptions. While the Company considers these assumptions to be reasonable based on information currently available, they are inherently subject to significant business, economic and competitive uncertainties and contingencies and they may prove to be incorrect. In this press release, such assumptions include, but are note limited to: the ability of Spetz to maintain its current growth trajectory.

Forward-looking statements also necessarily involve known and unknown risks, including without limitation: risks associated with general economic conditions; the inability of Spetz to achieve growth; and increased competition in the mobile application and home-services market.

Readers are cautioned that the foregoing is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ from those anticipated. Forward-looking statements are not guarantees of future performance. The purpose of forward-looking information is to provide the reader with a description of management's expectations, and such forward-looking information may not be appropriate for any other purpose. Except as required by law, the Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise. Forward-looking statements contained in this news release are made as to the date hereof and are expressly qualified by this cautionary statement. Except as required by law, the Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

SOURCE: Spetz Inc.

View the original press release on accesswire.com