Cyngn Reports Third Quarter 2024 Financial Results

Cyngn (Nasdaq: CYN) reported its Q3 2024 financial results, highlighting key business developments and financial metrics. The company executed its first paid DriveMod Forklift deployment and signed significant commercial contracts, including one with a major automotive service equipment manufacturer. Q3 revenue increased to $47.6K from $25.2K in Q3 2023, driven by EAS software subscriptions. However, net loss remained high at $(5.4) million, slightly improved from $(5.5) million in Q3 2023. The company noted a reduction in R&D and G&A expenses but faced higher costs of revenue due to increased customer deployments. Year-to-date revenue dropped significantly to $61.8K from $1.4M in the previous year. Cyngn's cash and short-term investments decreased to $2.8M from $8.2M at the end of 2023. Despite the financial challenges, Cyngn continues to expand its sales channels and product capabilities, including the deployment of its next-gen 12,000 lb. DriveMod Tugger.

Cyngn (Nasdaq: CYN) ha riportato i risultati finanziari del terzo trimestre 2024, evidenziando i principali sviluppi aziendali e metriche finanziarie. L'azienda ha eseguito il suo primo deployment a pagamento di DriveMod Forklift e ha firmato contratti commerciali significativi, incluso uno con un importante produttore di attrezzature per servizi automobilistici. I ricavi del terzo trimestre sono aumentati a $47.6K rispetto ai $25.2K del terzo trimestre 2023, trainati dagli abbonamenti al software EAS. Tuttavia, la perdita netta è rimasta elevata a $(5.4) milioni, leggermente migliorata rispetto ai $(5.5) milioni del terzo trimestre 2023. L'azienda ha osservato una riduzione delle spese in R&D e G&A, ma ha affrontato costi più elevati per il fatturato a causa dell'aumento dei deployment ai clienti. I ricavi da inizio anno sono diminuite significativamente a $61.8K rispetto a $1.4M dell'anno precedente. Le disponibilità liquide e gli investimenti a breve termine di Cyngn sono scesi a $2.8M dai $8.2M alla fine del 2023. Nonostante le sfide finanziarie, Cyngn continua ad espandere i suoi canali di vendita e le capacità di prodotto, incluso il deployment del suo tugger DriveMod di nuova generazione da 12.000 lb.

Cyngn (Nasdaq: CYN) informó sus resultados financieros del tercer trimestre de 2024, destacando los desarrollos clave del negocio y las métricas financieras. La compañía ejecutó su primer despliegue de DriveMod Forklift pago y firmó contratos comerciales significativos, incluido uno con un importante fabricante de equipos de servicio automotriz. Los ingresos del tercer trimestre aumentaron a $47.6K desde $25.2K en el tercer trimestre de 2023, impulsados por las suscripciones al software EAS. Sin embargo, la pérdida neta se mantuvo alta en $(5.4) millones, ligeramente mejor que los $(5.5) millones del tercer trimestre de 2023. La empresa notó una reducción en los gastos de I+D y G&A, pero enfrentó costos más altos de ingresos debido al aumento de los despliegues a clientes. Los ingresos acumulados hasta la fecha cayeron significativamente a $61.8K desde $1.4M del año anterior. El efectivo e inversiones a corto plazo de Cyngn disminuyeron a $2.8M desde $8.2M a finales de 2023. A pesar de los desafíos financieros, Cyngn continúa expandiendo sus canales de venta y capacidades de producto, incluido el despliegue de su tugger DriveMod de última generación de 12,000 lb.

Cyngn (Nasdaq: CYN)은 2024년 3분기 재무 결과를 보고하며 주요 비즈니스 개발 및 재무 지표를 강조했습니다. 이 회사는 처음으로 유료 DriveMod Forklift 배포를 실행했으며, 주요 자동차 서비스 장비 제조업체와의 계약을 포함하여 중요한 상업 계약을 체결했습니다. 3분기 수익은 EAS 소프트웨어 구독에 힘입어 25.2K 달러에서 47.6K 달러로 증가했습니다. 그러나 순손실은 여전히 $(5.4) 백만으로 2023년 3분기의 $(5.5) 백만보다 약간 개선되었습니다. 이 회사는 R&D 및 G&A 비용 감소를 언급했지만, 고객 배포 증가로 인해 매출 비용이 증가했습니다. 연초부터의 수익은 지난해의 1.4M 달러에서 61.8K 달러로 크게 감소했습니다. Cyngn의 현금 및 단기 투자는 2023년 말 8.2M 달러에서 2.8M 달러로 줄어들었습니다. 재무적인 도전에도 불구하고, Cyngn은 판매 채널 및 제품 기능을 확장해 나가고 있으며, 12,000 파운드 DriveMod Tugger의 배포를 포함하고 있습니다.

Cyngn (Nasdaq: CYN) a publié ses résultats financiers pour le troisième trimestre 2024, mettant en avant les développements clés de l'entreprise et les indicateurs financiers. L'entreprise a effectué son premier déploiement payant de DriveMod Forklift et a signé des contrats commerciaux significatifs, dont un avec un grand fabricant d'équipements de service automobile. Les revenus du troisième trimestre ont augmenté à 47,6 K$ contre 25,2 K$ au troisième trimestre 2023, soutenus par les abonnements au logiciel EAS. Cependant, la perte nette est restée élevée à 5,4 millions de dollars, légèrement améliorée par rapport à 5,5 millions de dollars au troisième trimestre 2023. La société a noté une réduction des dépenses en R&D et G&A, mais a fait face à des coûts plus élevés de revenus en raison de l'augmentation des déploiements chez les clients. Les revenus depuis le début de l'année ont chuté de manière significative à 61,8 K$ contre 1,4 M$ l'année précédente. La trésorerie et les investissements à court terme de Cyngn ont diminué à 2,8 M$ contre 8,2 M$ à la fin de 2023. Malgré les défis financiers, Cyngn continue d'élargir ses canaux de vente et ses capacités produit, y compris le déploiement de son tugger DriveMod de nouvelle génération pesant 12 000 lb.

Cyngn (Nasdaq: CYN) hat die finanziellen Ergebnisse für das dritte Quartal 2024 veröffentlicht und dabei wichtige Geschäftsentwicklungen sowie Finanzkennzahlen hervorgehoben. Das Unternehmen hat sein erstes kostenpflichtiges DriveMod Forklift-Deployment durchgeführt und bedeutende Handelsverträge unterzeichnet, darunter einen mit einem großen Hersteller von automobilem Serviceequipment. Die Umsätze im dritten Quartal stiegen auf $47.6K von $25.2K im dritten Quartal 2023, angetrieben durch Abonnements für die EAS-Software. Allerdings blieb der Nettverlust mit $(5.4) Millionen hoch, leicht verbessert gegenüber $(5.5) Millionen im dritten Quartal 2023. Das Unternehmen verzeichnete eine Reduzierung der Aufwendungen für F&E und allgemeine Verwaltung, sah sich jedoch höheren Kosten für den Umsatz aufgrund gestiegener Kundenbereitstellungen gegenüber. Die Umsätze bis dato sanken erheblich auf $61.8K von $1.4M im Vorjahr. Die liquiden Mittel und kurzfristigen Investitionen von Cyngn fielen auf $2.8M von $8.2M Ende 2023. Trotz der finanziellen Herausforderungen erweitert Cyngn weiterhin seine Vertriebskanäle und Produktfähigkeiten, einschließlich der Bereitstellung seines nächstgen DriveMod Tugger mit 12.000 lb.

- Q3 2024 revenue increased to $47.6K from $25.2K in Q3 2023.

- First paid deployment of DriveMod Forklift.

- Signed commercial contracts with major manufacturers.

- Reduced R&D expenses by $133.6K and G&A expenses by $60.3K.

- Expanded sales channels through Motrec dealers and third-party system integrators.

- Net loss for Q3 2024 was $(5.4) million.

- Year-to-date revenue dropped to $61.8K from $1.4M in the previous year.

- Cash and short-term investments decreased to $2.8M from $8.2M at the end of 2023.

- Working capital decreased to $2.6M from $7.4M at the end of 2023.

Recent Operating Highlights:

- Executed its first paid DriveMod Forklift Deployment.

- Signed a commercial contract with a major automotive service equipment manufacturer.

- Executed LOI to sell multiple DriveMod Tuggers to global automotive supplier.

- Successfully completed DriveMod Tugger Initial Deployment with a major defense contractor.

- Hired Experienced Industrial Automation VP of Sales, Marty Petraitis.

- Started deploying its next-gen 12,000 lb. DriveMod Tugger at customer facilities.

- Expanded its sales channels through Motrec dealers and 3rd party system integrators that combine for billions of dollars of robotics and material handling equipment annual sales.

- Secured its 20th and 21st

U.S. Patent. - Expanded DriveMod capabilities to outdoor operations in response to demand.

"Our third quarter marked meaningful additional commercial traction of our autonomous DriveMod technology," said Lior Tal, Cyngn CEO. "Building on the progress we made with direct sales efforts in the first half of the year, including being selected by Deere to supply the DriveMod Tugger, we have expanded our strategy to increase our channel sales efforts.

"We have also achieved a significant milestone with the first paid deployment of our DriveMod Forklift, an important progression into sales activities after initial R&D and projects focused on funding development."

"Through our OEM partner Motrec, we are able to expand our sales strategy beyond direct sales by leveraging a strong incumbent dealer network while also adding specialized distributors and system integrators like Kennedy Robotics AI and RobotLAB.

"By expanding our sales and distribution collaborations, we are enhancing our sales channels and creating consistent opportunities that strengthen our sales pipeline."

In addition to increasing lead generation and building a more robust pipeline, we also hired Marty Petraitis, a seasoned vet of the industrial automation industry, as our VP of Sales to capitalize on our growing opportunities. Broadly, our sales pipeline has matured into more advanced stages as per the process outlined in our recent update. We are actively converting more Pilot Purchases, creating a larger pool of existing and newly onboarded customers to grow into Fleet Purchases.

We are continuing to see validation of our solution through traction in heavy manufacturing industries like automotive and defense, highlighted by the first deployments of our next-generation 12,000 lb. DriveMod Tugger at customer facilities and multiple new customer contracts and LOIs as outlined above.

The next-gen DriveMod Tugger boasts increased towing capacity and enhanced autonomous capabilities that enable it to support outdoor operations. These improvements have expanded our use cases, broadened the environments where our autonomous vehicles deliver value, and ultimately created new sales opportunities.

Having ramped up the production of our DriveMod Tugger, we have also been able to shift to revenue-generating activities with our autonomous forklift solution. Our first paid DriveMod Forklift deployment marks a key turning point in monetizing the valuable solution offered by an autonomous forklift.

The global forklift market is expected to double to

When reviewing the financial information below, note that all share and per share information, Common stock and Additional paid-in capital, has been restated to reflect the 1-for-100 reverse stock split effected on July 3, 2024.

Q3 2024 Three Month Financial Review:

- Third quarter revenue was

$47.6 thousand $25.2 thousand - Total costs and expenses of

$5.6 million $133.6 thousand $60.3 thousand $114.8 thousand - Net loss for the third quarter was

$(5.4) million $(5.5) million $(2.74) $(11.03)

Q3 2024 Nine Month Financial Review:

- Year-to-date third quarter revenue was

$61.8 thousand $1.4 million - Total costs and expenses in the third quarter were

$17.3 million $19.4 million $547.7 thousand $666.9 thousand $835.8 thousand - Net loss for the third quarter was

$(17.2) million $(17.5) million $(12.91) $(35.50)

Balance Sheet Highlights:

Cyngn's cash and short-term investments at September 30, 2024 total

For more information on Cyngn, visit the Investor Relations Page of the Company's website.

About Cyngn

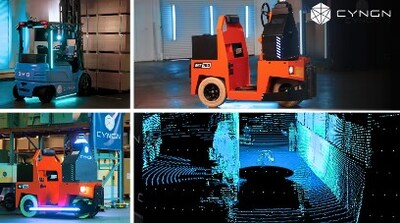

Cyngn develops and deploys scalable, differentiated autonomous vehicle technology for industrial organizations. Cyngn's self-driving solutions allow existing workforces to increase productivity and efficiency. The Company addresses significant challenges facing industrial organizations today, such as labor shortages, costly safety incidents, and increased consumer demand for eCommerce.

Cyngn's DriveMod Kit can be installed on new industrial vehicles at end of line or via retrofit, empowering customers to seamlessly adopt self-driving technology into their operations without high upfront costs or the need to completely replace existing vehicle investments.

Cyngn's flagship product, its Enterprise Autonomy Suite, includes DriveMod (autonomous vehicle system), Cyngn Insight (customer-facing suite of AV fleet management, teleoperation, and analytics tools), and Cyngn Evolve (internal toolkit that enables Cyngn to leverage data from the field for artificial intelligence, simulation, and modeling). For all terms referenced within, please refer to the Company's annual report on Form 10-K with the SEC filed on March 7, 2024.

Find Cyngn on:

- Website: https://cyngn.com

- Twitter: https://twitter.com/cyngn

- LinkedIn: https://www.linkedin.com/company/cyngn

- YouTube: https://www.youtube.com/@cyngnhq

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as "expects," "anticipates," "believes," "will," "will likely result," "will continue," "plans to," "potential," "promising," and similar expressions. These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including the risk factors described from time to time in the Company's reports to the Securities and Exchange Commission (SEC), including, without limitation the risk factors discussed in the Company's annual report on Form 10-K filed with the SEC on March 7, 2024. Readers are cautioned that it is not possible to predict or identify all the risks, uncertainties and other factors that may affect future results No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Cyngn undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

CYNGN INC. AND SUBSIDIARIES | |||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||

2024 | 2023 | 2024 | 2023 | ||||||||||||

Revenue | $ | 47,584 | $ | 25,210 | $ | 61,762 | $ | 1,448,961 | |||||||

Costs and expenses | |||||||||||||||

Cost of revenue | 157,251 | 42,414 | 285,949 | 1,121,732 | |||||||||||

Research and development | 2,795,583 | 2,929,225 | 9,149,357 | 9,697,099 | |||||||||||

General and administrative | 2,602,952 | 2,663,272 | 7,913,222 | 8,580,113 | |||||||||||

Total costs and expenses | 5,555,786 | 5,634,911 | 17,348,528 | 19,398,944 | |||||||||||

Loss from operations | (5,508,202) | (5,609,701) | (17,286,766) | (17,949,983) | |||||||||||

Other income, net | |||||||||||||||

Interest income, net | 46,336 | 32,905 | 45,994 | 98,698 | |||||||||||

Other income | 34,467 | 105,284 | 24,342 | 397,616 | |||||||||||

Total other income, net | 80,803 | 138,189 | 70,336 | 496,314 | |||||||||||

Net loss | $ | (5,427,399) | $ | (5,471,512) | $ | (17,216,430) | $ | (17,453,669) | |||||||

Net loss per share attributable | $ | (2.74) | $ | (11.03) | $ | (12.91) | $ | (35.50) | |||||||

Weighted-average shares | 1,981,907 | 496,009 | 1,333,255 | 491,656 | |||||||||||

CYNGN INC. AND SUBSIDIARIES | ||||||||

(Unaudited) | ||||||||

September 30, | December 31, | |||||||

2024 | 2023 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash | $ | 1,974,441 | $ | 3,591,623 | ||||

Short-term investments | 812,750 | 4,561,928 | ||||||

Prepaid expenses and other current assets | 1,664,063 | 1,316,426 | ||||||

Total current assets | 4,451,254 | 9,469,977 | ||||||

Property and equipment, net | 2,067,411 | 1,486,672 | ||||||

Right of use asset, net | 474,149 | 992,292 | ||||||

Intangible assets, net | 1,488,328 | 1,084,415 | ||||||

Total Assets | $ | 8,481,142 | $ | 13,033,356 | ||||

Liabilities and Stockholders' Equity | ||||||||

Current liabilities | ||||||||

Accounts payable | $ | 190,488 | $ | 196,963 | ||||

Accrued expenses and other current liabilities | 1,136,258 | 1,201,142 | ||||||

Current operating lease liability | 505,231 | 682,718 | ||||||

Total current liabilities | 1,831,977 | 2,080,823 | ||||||

Non-current operating lease liability | - | 317,344 | ||||||

Total liabilities | 1,831,977 | 2,398,167 | ||||||

Commitments and contingencies | ||||||||

Stockholders' Equity | ||||||||

Preferred stock, Par | - | - | ||||||

Common stock, Par | 20 | 8 | ||||||

Additional paid-in capital | 183,883,194 | 170,652,800 | ||||||

Accumulated deficit | (177,234,049) | (160,017,619) | ||||||

Total stockholders' equity | 6,649,165 | 10,635,189 | ||||||

Total Liabilities and Stockholders' Equity | $ | 8,481,142 | $ | 13,033,356 | ||||

CYNGN INC. AND SUBSIDIARIES | ||||||||

Nine Months Ended | ||||||||

2024 | 2023 | |||||||

Cash flows from operating activities | ||||||||

Net loss | $ | (17,216,430) | $ | (17,453,669) | ||||

Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

Depreciation and amortization | 692,848 | 707,337 | ||||||

Stock-based compensation | 1,871,466 | 2,517,890 | ||||||

Realized gain on short-term investments | (105,414) | (396,141) | ||||||

Patent impairment | 118,831 | - | ||||||

Changes in operating assets and liabilities: | ||||||||

Prepaid expenses, operating lease right-of-use assets, and other current assets | (345,122) | 261,034 | ||||||

Accounts payable | (6,475) | 78,414 | ||||||

Accrued expenses, lease liabilities, and other current liabilities | (559,715) | (154,967) | ||||||

Net cash used in operating activities | (15,550,011) | (14,440,102) | ||||||

Cash flows from investing activities | ||||||||

Purchase of property and equipment | (739,947) | (904,417) | ||||||

Acquisition of intangible asset | (540,756) | (698,527) | ||||||

Disposal of assets | - | 130,898 | ||||||

Purchase of short-term investments | (6,755,408) | (17,050,782) | ||||||

Proceeds from maturity of short-term investments | 10,610,000 | 24,892,000 | ||||||

Net cash provided by investing activities | 2,573,889 | 6,369,172 | ||||||

Cash flows from financing activities | ||||||||

Proceeds from at-the-market equity financing, net of issuance costs | 6,789,427 | 1,012,511 | ||||||

Proceeds from private placement offering and pre-funded warrants, net of offering costs | 4,570,110 | - | ||||||

Proceeds from exercise of stock options | - | 8,527 | ||||||

Issuance of stock dividend, net of issuance costs | (597) | - | ||||||

Net cash provided by financing activities | 11,358,940 | 1,021,038 | ||||||

Net increase (decrease) in cash | (1,617,182) | (7,049,892) | ||||||

Cash, beginning of period | 3,591,623 | 10,586,273 | ||||||

Cash, end of period | $ | 1,974,441 | $ | 3,536,381 | ||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cyngn-reports-third-quarter-2024-financial-results-302297356.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cyngn-reports-third-quarter-2024-financial-results-302297356.html

SOURCE Cyngn

FAQ

What were Cyngn's Q3 2024 financial results?

How did Cyngn's Q3 2024 revenue compare to Q3 2023?

What is the significance of Cyngn's first paid DriveMod Forklift deployment?

What were the key business developments for Cyngn in Q3 2024?