Crexendo Announces Second Quarter 2023 Results

- Total revenue increased 43% YoY to $12.7 million

- Non-GAAP net income of $1.1 million

- GAAP net loss of $(545,000)

Insights

Analyzing...

PHOENIX, AZ / ACCESSWIRE / August 10, 2023 / Crexendo, Inc. (NASDAQ:CXDO), an award-winning premier provider of cloud communication platform and services, video collaboration and managed IT services designed to provide enterprise-class cloud solutions to any size business, today announced financial results for the second quarter ended June 30, 2023.

Second Quarter Financial highlights:

- Total revenue increased

43% year-over-year to$12.7 million - GAAP net loss of

$(545,000) , or$(0.02) per basic and diluted common share - Non-GAAP net income of

$1.1 million , or$0.04 per basic and diluted common share

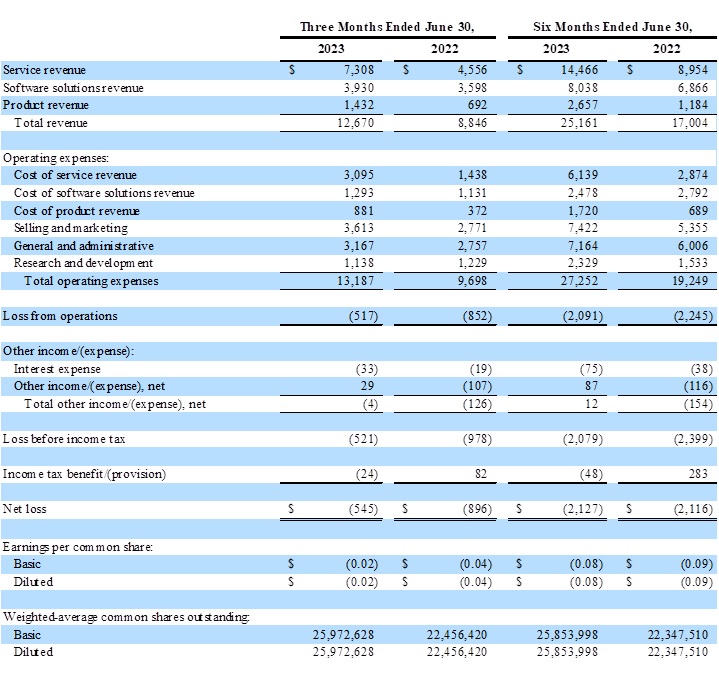

Financial Results for the Second Quarter of 2023 (in thousands, except per share data)

Consolidated total revenue for the second quarter of 2023 increased

Consolidated service revenue for the second quarter of 2023 increased

Consolidated software solutions revenue for the second quarter of 2023 increased

Consolidated product revenue for the second quarter of 2023 increased

Consolidated operating expenses for the second quarter of 2023 increased

The Company reported net loss of

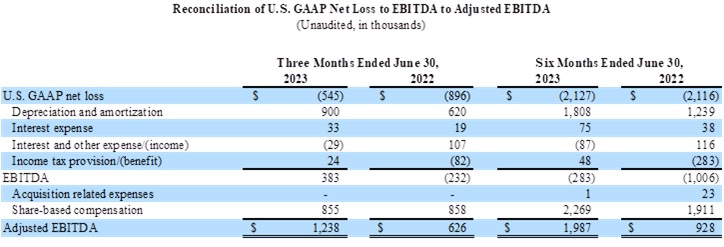

Non-GAAP net income of

EBITDA for the second quarter of 2023 of

Financial Results for the six months ended June 30, 2023 (in thousands, except per share data)

Consolidated total revenue for the six months ended June 30, 2023 increased

Consolidated service revenue for the six months ended June 30, 2023 increased

Consolidated software solutions revenue for the six months ended June 30, 2023 increased

Consolidated product revenue for the six months ended June 30, 2023 increased

Consolidated operating expenses for the six months ended June 30, 2023 increased

The Company reported net loss of

Non-GAAP net income of

EBITDA loss for the six months ended June 30, 2023 of

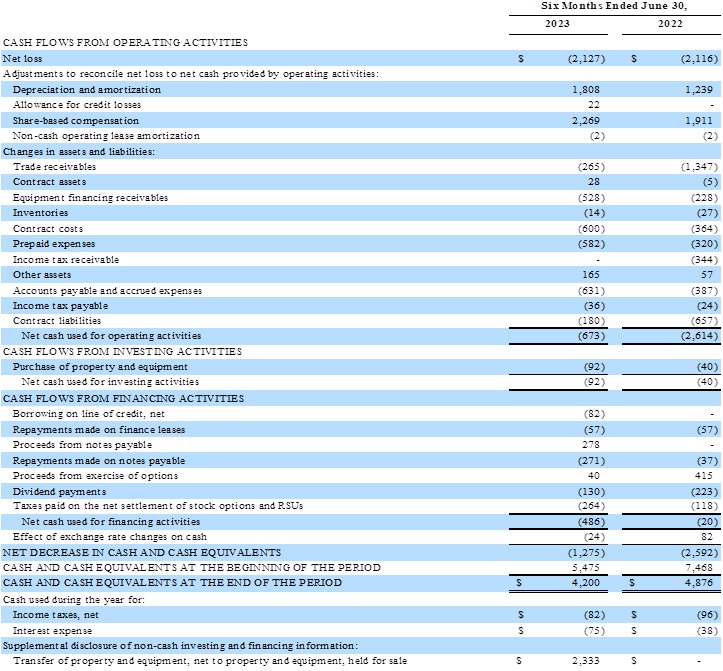

Total cash and cash equivalents at June 30, 2023 was

Cash used for operating activities for the six months ended June 30, 2023 was

Management Commentary

"In the second quarter, we continued to drive strong, organic, topline growth while making great strides in our cost reduction plan as well," said Crexendo Chief Executive Officer Jeff Korn. "I am very pleased with total revenue increasing

"We have also continued to make great strides in our integration efforts. Over the last few months we completed a reorganization of reporting responsibilities to create cross utilization amongst all divisions, making us a more efficient and collaborative organization. We have also expedited the migration of customers to our best-in-class VIP™ platform, which will substantially reduce costs as we sunset our legacy platform and transition existing team resources to other parts of the business."

"In the second quarter we saw a record number of installs in our Telecommunication Services segment, fueled by significant partner and agent sales contributions. We also had a strong performance internationally, which bodes well for future growth in this key area of focus. Our master dealer channel is continuing to perform nicely as we're seeing strong contributions from our resellers creating more enterprise sales opportunities. Looking ahead, we will continue to judiciously invest in delivering innovative features to drive greater customer satisfaction as well as demand from the largely underpenetrated UCaaS market. I am very excited by our results, and I am confident that our strong performance will continue."

Conference Call

Crexendo management will hold a conference call today, August 10, 2023, at 4:30 PM Eastern time to discuss these results.

Company CEO Jeff Korn, CFO Ron Vincent, and President and COO Doug Gaylor will host the call, followed by a question-and-answer period.

Dial-in Numbers:

Domestic Participants: 888-506-0062

International Participants: 973-528-0011

Participant Access Code 435639

Please dial in five minutes prior to the beginning of the call at 4:30 PM Eastern time and reference the Crexendo earnings call.

A replay of the call will be available until August 17, 2023 by dialing toll-free at 877-481-4010 or 919-882-2331 for international callers. The replay passcode is 48728.

About Crexendo

Crexendo, Inc. is an award-winning premier provider of cloud communication platform and services, video collaboration and managed IT services designed to provide enterprise-class cloud solutions to any size business. Our solutions currently support over three million end users globally.

Safe Harbor Statement

This press release contains forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for such forward-looking statements. The words "believe," "expect," "anticipate," "estimate," "will" and other similar statements of expectation identify forward-looking statements. Specific forward-looking statements in this press release include information about Crexendo (i) making great strides in its cost reduction plan; (ii) being very pleased with results and that being a strong indication that the plan is working; (iii) diligent cost management efforts are translating to strong improvements in profitability; (iv) completing the terms of the sale of the property in Tempe, which effectively will remove almost all of our outstanding debt and build on the already-strong cash position; (v) continuing to make great strides in integration efforts and completing a reorganization of reporting responsibilities to create cross utilization amongst all divisions making a more efficient and collaborative organization; (vi) expediting the migration of customers to the best-in-class VIP™ platform, which will substantially reduce costs; (vii) having had a strong performance internationally which bodes well for future growth in this key area; (viii) master dealer channel continuing to perform nicely creating more enterprise sales opportunities; (ix) continuing to judiciously invest in delivering innovative features to drive greater customer satisfaction; and (x) being very excited by results and I being confident that our strong performance will continue.

For a more detailed discussion of risk factors that may affect Crexendo's operations and results, please refer to the company's Form 10-K for the year ended December 31, 2022, and quarterly Form 10-Qs as filed with the SEC. These forward-looking statements speak only as of the date on which such statements are made, and the company undertakes no obligation to update such forward-looking statements, except as required by law.

Contacts

Company Contact:

Crexendo, Inc.

Doug Gaylor

President and Chief Operating Officer

602-732-7990

dgaylor@crexendo.com

Investor Relations Contact:

Gateway Investor Relations

Matt Glover and Tom Colton

949-574-3860

CXDO@gateway-grp.com

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except par value and share data)

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share and share data)

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

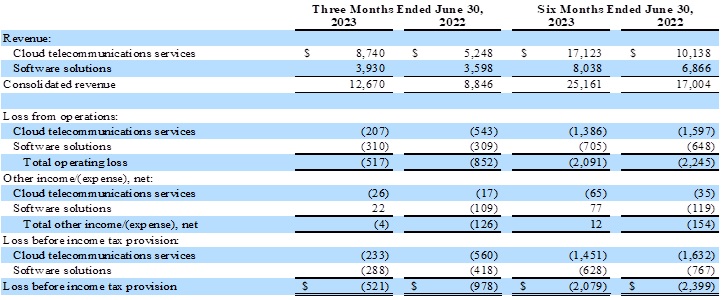

CREXENDO, INC. AND SUBSIDIARIES

Supplemental Segment Financial Data

(In thousands)

Use of Non-GAAP Financial Measures

To evaluate our business, we consider and use non-generally accepted accounting principles ("Non-GAAP") net income and Adjusted EBITDA as a supplemental measure of operating performance. These measures include the same adjustments that management takes into account when it reviews and assesses operating performance on a period-to-period basis. We consider Non-GAAP net income to be an important indicator of overall business performance because it allows us to evaluate results without the effects of share-based compensation, acquisition related expenses, changes in fair value of contingent consideration, amortization of intangibles, and goodwill and long-lived asset impairment. We define EBITDA as U.S. GAAP net income/(loss) before interest expense, interest income and other expense/(income), goodwill and long-lived asset impairments, provision/(benefit) for income taxes, and depreciation and amortization. We believe EBITDA provides a useful metric to investors to compare us with other companies within our industry and across industries. We define Adjusted EBITDA as EBITDA adjusted for acquisition related expenses, changes in fair value of contingent consideration and share-based compensation. We use Adjusted EBITDA as a supplemental measure to review and assess operating performance. We also believe use of Adjusted EBITDA facilitates investors' use of operating performance comparisons from period to period, as well as across companies.

In our August 10, 2023 earnings press release, as furnished on Form 8-K, we included Non-GAAP net income, EBITDA and Adjusted EBITDA. The terms Non-GAAP net income, EBITDA, and Adjusted EBITDA are not defined under U.S. GAAP, and are not measures of operating income, operating performance or liquidity presented in analytical tools, and when assessing our operating performance, Non-GAAP net income, EBITDA, and Adjusted EBITDA should not be considered in isolation, or as a substitute for net income/(loss) or other consolidated income statement data prepared in accordance with U.S. GAAP. Some of these limitations include, but are not limited to:

- EBITDA and Adjusted EBITDA do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- they do not reflect changes in, or cash requirements for, our working capital needs;

- they do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt that we may incur;

- they do not reflect income taxes or the cash requirements for any tax payments;

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will be replaced sometime in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements;

- while share-based compensation is a component of operating expense, the impact on our financial statements compared to other companies can vary significantly due to such factors as the assumed life of the options and the assumed volatility of our common stock; and

- other companies may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

We compensate for these limitations by relying primarily on our U.S. GAAP results and using Non-GAAP net income, EBITDA, and Adjusted EBITDA only as supplemental support for management's analysis of business performance. Non-GAAP net income, EBITDA and Adjusted EBITDA are calculated as follows for the periods presented.

Reconciliation of Non-GAAP Financial Measures

In accordance with the requirements of Regulation G issued by the SEC, we are presenting the most directly comparable U.S. GAAP financial measures and reconciling the unaudited Non-GAAP financial metrics to the comparable U.S. GAAP measures.

SOURCE: Crexendo, Inc.

View source version on accesswire.com:

https://www.accesswire.com/773516/Crexendo-Announces-Second-Quarter-2023-Results