Crexendo Announces First Quarter 2022 Results

Crexendo, Inc. (NASDAQ:CXDO) reported a significant 81% year-over-year revenue increase to $8.2 million for Q1 2022, driven by growth in their telecommunications and software services. While service revenue saw a modest 6% increase to $4.4 million, the company reported a GAAP net loss of $1.22 million, up from a loss of $715,000 in Q1 2021. Non-GAAP net income was $405,000, reflecting strong operational performance despite challenges posed by economic uncertainty. Total cash was $5.7 million as of March 31, 2022, signaling ongoing liquidity concerns.

- Total revenue increased 81% year-over-year to $8.2 million.

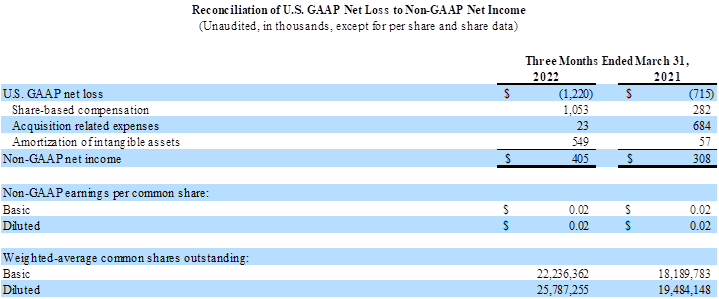

- Non-GAAP net income of $405,000 or $0.02 per share.

- Software solutions revenue reached $3.3 million, compared to $0 in Q1 2021.

- Product revenue increased 34% year-over-year.

- GAAP net loss of $(1,220,000) or $(0.05) per share, larger than previous year's loss.

- Consolidated operating expenses increased 79% to $9.6 million.

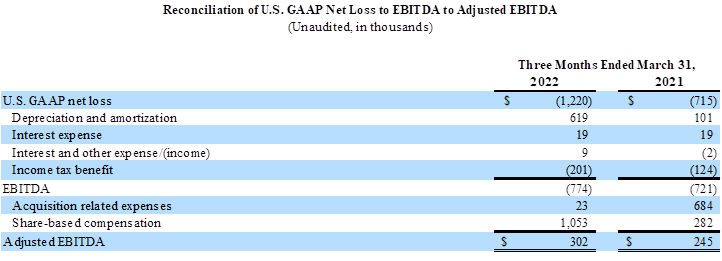

- EBITDA loss of $(774,000), worsening from the previous year.

Insights

Analyzing...

PHOENIX, AZ / ACCESSWIRE / May 12, 2022 / Crexendo, Inc. (NASDAQ:CXDO) is an award-winning premier provider of Unified Communications as a Service (UCaaS), Call Center as a Service (CCaaS), communication platform software solutions, and collaboration services designed to provide enterprise-class cloud communication solutions to any size business through our business partners, software licensees, agents and direct channels. Our solutions currently support over 2.4 million end users globally and was recently recognized as the fastest growing UCaaS platform in the United States. We provide our services through two divisions, our Telecommunications Division and our Software Division. Today, the Company reported financial results for the first quarter ended March 31, 2022.

First Quarter Financial highlights:

- Total revenue increased

81% year-over-year to$8.2 million . - Service revenue increased

6% year-over-year to$4.4 million . - GAAP net loss of

$(1,220,000) or a$(0.05) loss per basic and diluted common share. - Non-GAAP net income of

$405,000 or$0.02 per basic and diluted common share.

Financial Results for the First Quarter of 2022

Consolidated total revenue for the first quarter of 2022 increased

Consolidated service revenue for the first quarter of 2022 increased

Consolidated software solutions revenue for the first quarter of 2022 of

Consolidated product revenue for the first quarter of 2022 increased

Consolidated operating expenses for the first quarter of 2022 increased

The Company reported net loss of

Non-GAAP net income of

EBITDA for the first quarter of 2022 decreased to a

Total cash and cash equivalents at March 31, 2022 was

Cash used for operating activities for the first quarter of 2022 of

Steven G. Mihaylo, Chief Executive Officer commented, "I am pleased with our total revenue increasing

Mihaylo added, "Our integration continues to be going well and will provide substantial benefits to both customers of the software solutions division and the telecom division. We are seeing continued excitement for the Crexendo VIP™ platform powered by the award winning NetSapiens® technology which I am convinced provides the best benefits in the industry as well as the best support package offered which includes our

Doug Gaylor, President, and Chief Operating Officer, stated, "I agree with Steve that the results are solid, and that we are beginning to see improvements in the deferred purchasing decisions which I believe should continue to improve our results. We will continue to work aggressively on increasing sales while focusing on cost management and improving margins. We will also work aggressively to add new partnerships as we recently did with Mavenir, which I believe will be a substantial benefit to our shareholders."

Conference Call

The Company is hosting a conference call today, May 12, 2022, at 4:30 PM EDT. The dial-in number for domestic participants is 877-545-0523 and 973-528-0016 for international participants. Please dial in five minutes prior to the beginning of the call at 4:30 PM EDT and reference Crexendo earnings call. A replay of the call will be available until May 19, 2022, by dialing toll-free at 877-481-4010 or 919-882-2331 for international callers. The replay passcode is 45490.

About Crexendo

Crexendo, Inc. is an award-winning premier provider of Unified Communications as a Service (UCaaS), Call Center as a Service (CCaaS), communication platform software solutions, video conferencing and collaboration services designed to provide enterprise-class cloud communication solutions to any size business through our business partners, agents, and direct channels. Our solutions currently support over two million end users globally and was recently recognized as the fastest growing UCaaS platform in the United States.

Safe Harbor Statement

This press release contains forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides a "safe harbor" for such forward-looking statements. The words "believe," "expect," "anticipate," "estimate," "will" and other similar statements of expectation identify forward-looking statements. Specific forward-looking statements in this press release include information about Crexendo (i) being pleased with total revenue increasing

For a more detailed discussion of risk factors that may affect Crexendo's operations and results, please refer to the company's Form 10-K for the year ended December 31, 2021, and quarterly Form 10-Qs as filed with the SEC. These forward-looking statements speak only as of the date on which such statements are made, and the company undertakes no obligation to update such forward-looking statements, except as required by law.

CONTACT:

Crexendo, Inc.

Doug Gaylor

President and Chief Operating Officer

602-732-7990

dgaylor@crexendo.com

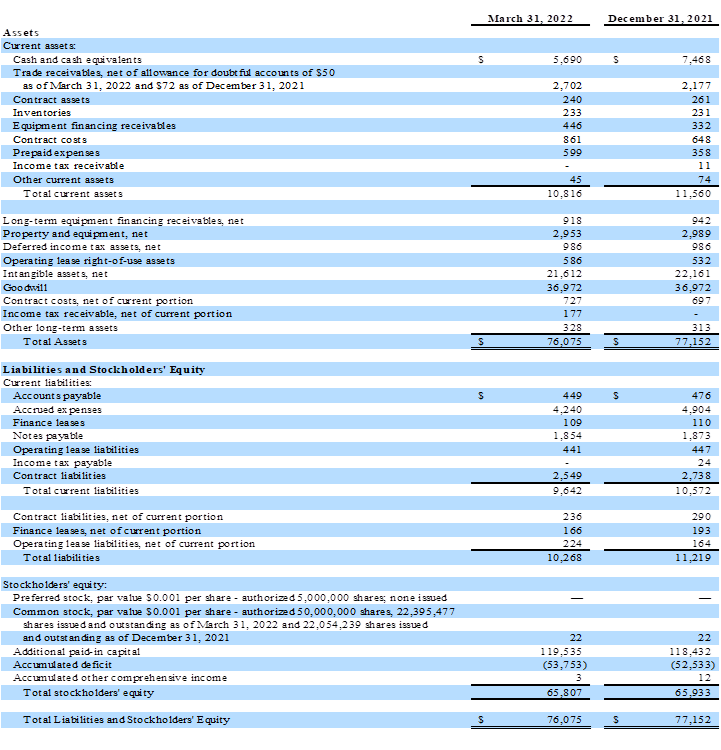

CREXENDO, INC. AND SUBSIDIARIES Condensed Consolidated Balance Sheets (Unaudited, in thousands, except par value and share data) |

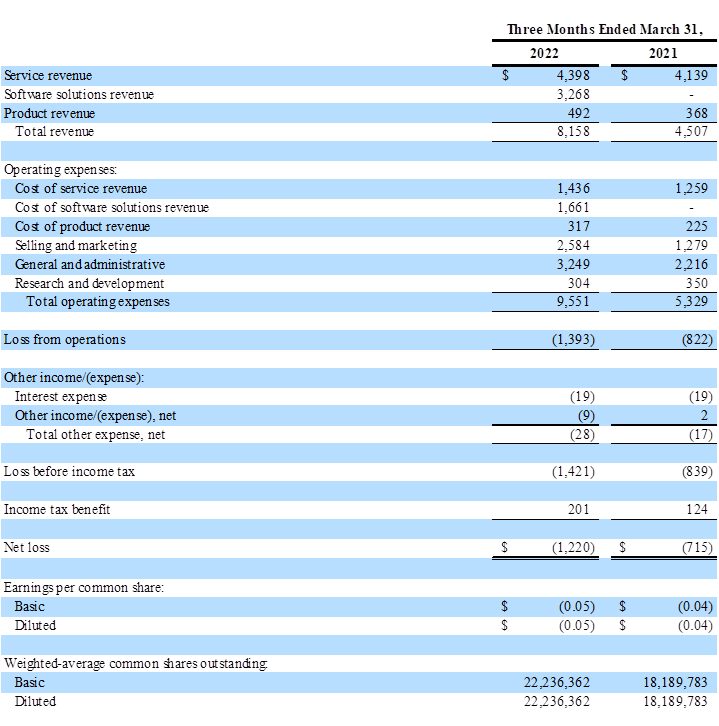

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share and share data)

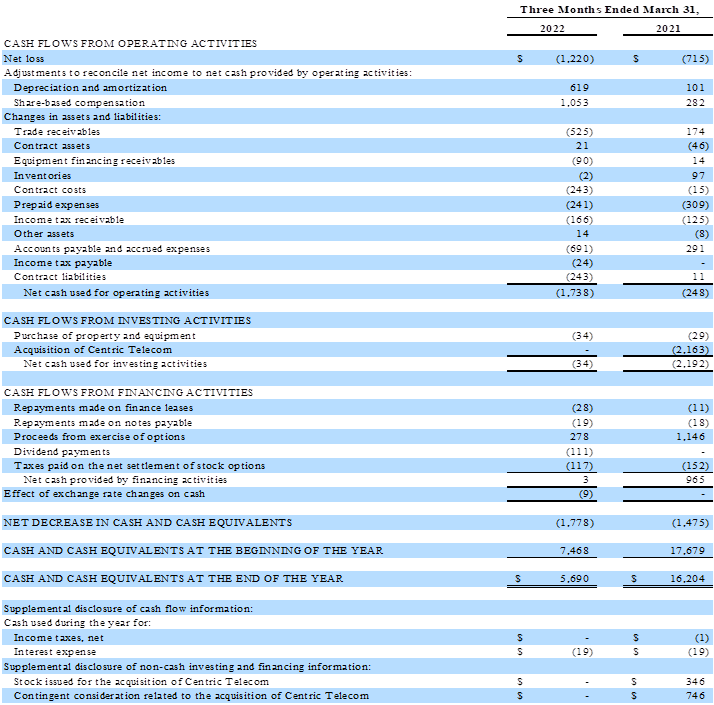

CREXENDO, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

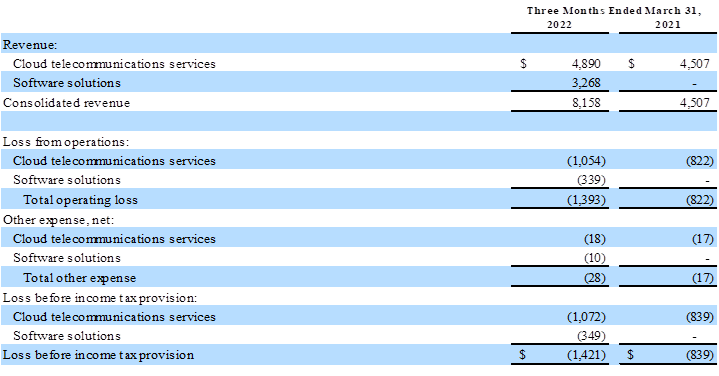

CREXENDO, INC. AND SUBSIDIARIES

Supplemental Segment Financial Data

(In thousands)

Use of Non-GAAP Financial Measures

To evaluate our business, we consider and use non-generally accepted accounting principles ("Non-GAAP") net income and Adjusted EBITDA as a supplemental measure of operating performance. These measures include the same adjustments that management takes into account when it reviews and assesses operating performance on a period-to-period basis. We consider Non-GAAP net income to be an important indicator of overall business performance because it allows us to evaluate results without the effects of share-based compensation, acquisition related expenses, changes in fair value of contingent consideration and amortization of intangibles. We define EBITDA as U.S. GAAP net income/(loss) before interest income, interest expense, other income and expense, provision for income taxes, and depreciation and amortization. We believe EBITDA provides a useful metric to investors to compare us with other companies within our industry and across industries. We define Adjusted EBITDA as EBITDA adjusted for acquisition related expenses, changes in fair value of contingent consideration and share-based compensation. We use Adjusted EBITDA as a supplemental measure to review and assess operating performance. We also believe use of Adjusted EBITDA facilitates investors' use of operating performance comparisons from period to period, as well as across companies.

In our May 12, 2022, earnings press release, as furnished on Form 8-K, we included Non-GAAP net income, EBITDA and Adjusted EBITDA. The terms Non-GAAP net income, EBITDA, and Adjusted EBITDA are not defined under U.S. GAAP, and are not measures of operating income, operating performance or liquidity presented in analytical tools, and when assessing our operating performance, Non-GAAP net income, EBITDA, and Adjusted EBITDA should not be considered in isolation, or as a substitute for net income/(loss) or other consolidated income statement data prepared in accordance with U.S. GAAP. Some of these limitations include, but are not limited to:

- EBITDA and Adjusted EBITDA do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- they do not reflect changes in, or cash requirements for, our working capital needs;

- they do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt that we may incur;

- they do not reflect income taxes or the cash requirements for any tax payments;

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will be replaced sometime in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements;

- while share-based compensation is a component of operating expense, the impact on our financial statements compared to other companies can vary significantly due to such factors as the assumed life of the options and the assumed volatility of our common stock; and

- other companies may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

We compensate for these limitations by relying primarily on our U.S. GAAP results and using Non-GAAP net income, EBITDA, and Adjusted EBITDA only as supplemental support for management's analysis of business performance. Non-GAAP net income, EBITDA and Adjusted EBITDA are calculated as follows for the periods presented.

Reconciliation of Non-GAAP Financial Measures

In accordance with the requirements of Regulation G issued by the SEC, we are presenting the most directly comparable U.S. GAAP financial measures and reconciling the unaudited Non-GAAP financial metrics to the comparable U.S. GAAP measures.

SOURCE: Crexendo, Inc.

View source version on accesswire.com:

https://www.accesswire.com/701068/Crexendo-Announces-First-Quarter-2022-Results