Capital Senior Living Sets the Record Straight for Shareholders

Capital Senior Living Corporation (NYSE: CSU) has issued a letter urging shareholders to support amended financing transactions to raise up to $154.8 million. The company refutes claims from Ortelius and Invictus, stating that their proposals are misleading and conditional. The board emphasizes that the amended transactions are essential for immediate liquidity, stating that without them, the company risks insolvency. The special meeting for shareholder voting is scheduled for October 22, 2021, and the board strongly advocates for voting on the WHITE card to protect investments.

- Amended transactions to raise $154.8 million provide immediate liquidity for working capital and capital expenditures.

- Engagement with major shareholders, Arbiter Partners and Silk Partners, supports the board's proposal.

- Proceeds will address near-term debt maturities and stabilize the company.

- Company is over-leveraged with a debt-to-market cap ratio of 91%, risking insolvency without significant capital infusion.

- Failure to secure financing may lead to a liquidity crisis and possible insolvency relief.

Sends Letter Highlighting Benefits of Amended Transactions and Enhanced Opportunities for Shareholder Participation

Refutes Misleading Claims from Ortelius and Invictus and Makes Clear There are No Credible, Actionable Financing Alternatives on the Table

Notes that the Terms of the Invictus Proposal are Highly Conditional and Would Add Leverage to Company at a Time When the Exact Opposite is Needed

Urges Shareholders to Support Amended Transactions by Voting on the WHITE Card at Special Meeting on

(Graphic: Business Wire) Figure 1

(1) Represents initial capital raise exclusive of incremental

The Company also recently issued a supplemental presentation rebutting several misleading and factually inaccurate claims made in recent public statements by

The full text of the letter is below.

As you know, we will hold a Special Meeting of Stockholders (the “Special Meeting”) on

-

The private placement of convertible preferred stock, common stock and warrants to

Conversant Capital (“Conversant”); -

An amended common stock rights offering to our existing stockholders, with a revised subscription price of

$30 -

An incremental

$25 million

We, the members of your Board of Directors (the “Board”), believe that the Amended Transactions are in the best interests of shareholders and are writing today to strongly urge you to support the Amended Transactions to protect your investment in the Company.

The Reality is Simple

- CSU is over-levered, with no unencumbered assets. Based on our current cash burn and near-term liabilities, the Company will likely run out of cash by year-end.

- The Amended Transactions provide immediate liquidity to address working capital deficits, fund greatly needed capital expenditures, resolve near-term debt maturities, and stabilize the Company.

- There are no credible, actionable and immediate alternatives to the Amended Transactions that will resolve the Company’s urgent need for significant capital.

- Voting against the Amended Transactions likely will send the Company down the path of insolvency.

Unfortunately, recent public statements by

Ortelius’ Claims Misrepresent the Availability of

Two existing, large shareholders

In its

With regard to Ortelius, its purported capital commitment includes no disclosure around terms, source or conditionality. And this is after 8 weeks of Ortelius publicly and aggressively opposing the proposed transactions and canvassing the markets for a capital source. Vague public “commitments” are not a standard that shareholders should be willing to accept, particularly when the continued viability of your company is at stake.

With regard to Invictus, in its

Even if the Invictus Proposal was Actionable (And It is Not), It is Not Superior

In addition to being highly conditional, the Invictus proposal would also compound the already significant financial challenges of the Company by incurring even more excess leverage.

Specifically, Invictus is proposing a capital raise solely in the form of debt, at a time when the Company is significantly over levered and cash flow negative. With a debt to total market capitalization ratio of

Further, the Invictus proposal is not more favorable for common shareholders. All of Invictus’ capital would be senior to existing shareholders, and their proposed structure prioritizes payments to them over sustainable investment and growth of the business. On the other hand, the Amended Transactions provide for more than

Finally, Invictus’ proposed debt financing is NOT less expensive than the Amended Transactions. In fact, it is quite costly, the senior note at ~

Ortelius Misrepresents --- Dangerously --- CSU’s Financial Situation

The Company faces an immediate and critical need for financing and has warned stockholders about significant doubt that it could continue as a “going concern” since reporting its Q1 2020 financial results. Without a meaningful infusion of capital, the Company is facing a liquidity crisis, the probability of running out of cash and the very real possibility of seeking insolvency relief.

The Company has

Ortelius chooses to ignore the detailed financial disclosures provided by the Company each of the last 6 quarters. Its claims are riddled with inconsistencies and fundamental misunderstandings of the business. Despite asserting that the Company does not need substantial capital and should be pursuing a

There is No Real, Actionable Alternative on the Table

Even after the Board’s solicitation of 33 counterparties and Ortelius’ public solicitation of alternatives for approximately eight weeks, no real alternatives have been presented by any party.

As detailed in our proxy, after due diligence, two of the three parties with whom we were discussing potential transactions declined to proceed. A diligence condition (which Invictus’ proposal includes) is highly significant and not something on which we are willing to bet the Company’s future or your investment.

Although it is true that we are prohibited from soliciting or encouraging any alternative proposal, that does not stop a potential partner from privately or publicly communicating a firm, actionable commitment (particularly where, as here, a stockholder (Ortelius) has been running a campaign to solicit one). No one has. Knowing that the Company was engaged in discussions to renegotiate the original Conversant deal, Ortelius could have proposed changes – or an alternative – and did neither. Ortelius has chosen not to be constructive; as explained in the proxy, they signed an NDA and were provided an opportunity to discuss the Amended Transactions, and they chose not to engage until publicly responding more than a week later.

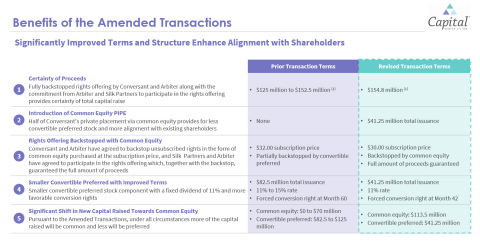

The Amended Transactions Have Significantly Improved Terms and a Structure that Enhances Alignment with Shareholders

The Amended Transactions clearly benefit shareholders and address many of the concerns previously expressed. They reflect extensive engagement with shareholders and include the participation of two of the Company’s largest holders –

The reality is simple: Voting FOR the Amended Transactions is voting for a sustainable future for CSU.

We strongly urge you to vote FOR the Amended Transactions at the upcoming Special Meeting.

Sincerely,

The Capital Senior Living Board of Directors

No Offer or Solicitation / Additional Information and Where to Find It

This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of any securities in any state or other jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The amended rights offering will be made pursuant to the Company’s shelf registration statement on Form S-3, which became effective on

In connection with the proposed transaction with Conversant, the Company filed a proxy statement with the

INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT, AS AMENDED, AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE

Investors and security holders are able to obtain free copies of the definitive proxy statement, and when available, the amendment to the proxy statement and other documents containing important information about the Company and the proposed transaction through the website maintained by the

Participants in the Solicitation

The Company and its executive officers and directors and certain other members of management and employees may, under the rules of the

About

About Conversant

Safe Harbor

The forward-looking statements in this press release are subject to certain risks and uncertainties that could cause the Company’s actual results and financial condition to differ materially, including, but not limited to, the Company’s ability to obtain stockholder approval for the proposed transaction; the satisfaction of all conditions to the closing of the proposed transaction; other risks related to the consummation of the proposed transaction, including the risk that the transaction will not be consummated within the expected time period or at all; the costs related to the proposed transaction; the impact of the proposed transaction on the Company’s business; any legal proceedings that may be brought related to the proposed transaction; the continued spread of COVID-19, including the speed, depth, geographic reach and duration of such spread; new information that may emerge concerning the severity of COVID-19; the actions taken to prevent or contain the spread of COVID-19 or treat its impact; the legal, regulatory and administrative developments that occur at the federal, state and local levels in response to the COVID-19 pandemic; the frequency and magnitude of legal actions and liability claims that may arise due to COVID-19 or the Company’s response efforts; the impact of COVID-19 and the Company’s near-term debt maturities on the Company’s ability to continue as a going concern; the Company’s ability to generate sufficient cash flows from operations, additional proceeds from debt refinancings, and proceeds from the sale of assets to satisfy its short and long-term debt obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all, including the transfer of certain communities managed by the Company on behalf of other owners; the Company’s ability to improve and maintain adequate controls over financial reporting and remediate the identified material weakness; the risk of oversupply and increased competition in the markets which the Company operates; the risk of increased competition for skilled workers due to wage pressure and changes in regulatory requirements; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; the risks associated with a decline in economic conditions generally; the adequacy and continued availability of the Company’s insurance policies and the Company’s ability to recover any losses it sustains under such policies; changes in accounting principles and interpretations; and the other risks and factors identified from time to time in the Company’s reports filed with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20211007006066/en/

Media Inquiries:

dzacchei@sloanepr.com / jgermani@sloanepr.com

Investor Inquiries:

(212) 440-9850, chayden@georgeson.com

Company:

President and Chief Executive Officer

(972) 308-8323, klody@capitalsenior.com

Source:

FAQ

What are the details of the financing transactions for Capital Senior Living (CSU)?

When is the special meeting for shareholders of Capital Senior Living (CSU)?

Why is Capital Senior Living (CSU) urging shareholders to vote on the WHITE card?