SunPower Seeks to Designate Complete Solar as Stalking Horse in Its Bankruptcy Asset Purchase Agreement (APA)

Rhea-AI Summary

Complete Solar (Nasdaq: CSLR) has submitted a $45 million bid to become the stalking horse in SunPower's Chapter 11 bankruptcy Asset Purchase Agreement (APA). The bid includes assuming up to $7.2 million in liabilities for SunPower's New Homes business. Despite low Q2'24 revenue of $4.5 million due to working capital constraints, the company raised $46 million in July through a convertible debenture offering. This move eliminated private equity debt, resulting in a 32.1% stock increase. Q2'24 non-commission operating expenses reached a two-year low of $4.4 million. The company expects revenue to recover to $20 million in Q4'24 and aims to exceed 30% gross margin in Q3'24. Complete Solar has integrated 37 employees from Core Energy and plans to make all new SunPower employees shareholders based on merit.

Positive

- Submitted $45 million bid to acquire SunPower assets in bankruptcy proceedings

- Raised $46 million through convertible debenture offering in July 2024

- Eliminated all long-term debt and paid off critical overdue accounts

- Stock traded up 32.1% on record 132.6 million shares after debt elimination announcement

- Q2'24 non-commission operating expenses reached two-year low of $4.4 million

- Integrated 37 Core Energy employees, expanding workforce and capabilities

- Expects revenue to recover to $20 million in Q4'24

- Aims to exceed 30% gross margin in Q3'24

Negative

- Q2'24 revenue was only $4.5 million due to near-total lack of working capital

- Gross profit reduced by three one-time events related to inventory and project clean-up

- Operating losses of $6.6 million in Q2'24, although reduced from $12.2 million in Q4'23

- COO Brian Wuebbels leaving the company on August 16, 2024

News Market Reaction 1 Alert

On the day this news was published, CSLR gained 1.25%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

LEHI, Utah, Aug. 14, 2024 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. (now renamed “Complete Solar” or the “Company,” for more information please click here) (Nasdaq: CSLR) published its Q2’24 results to be presented via webcast today, August 14, 2024 at 5:00 p.m. EDT. Interested parties may access the webcast by registering here or by visiting: https://investors.completesolaria.com/news-events/events.

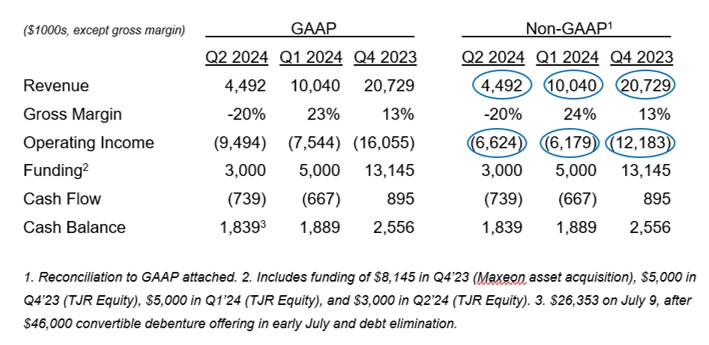

Q2’24 actuals and Q3’24 forecasts (based on non-GAAP results unless noted) are as follows:

- SunPower is seeking to have Complete Solar designated as the stalking horse in its Chapter 11 bankruptcy APA with a

$45 million bid for certain assets. The hearing to approve the stalking horse motion is scheduled for August 29, before the U.S. Bankruptcy Court in Delaware, with the likely closing of the sale by the end of Sept. 2024 - In order to stabilize the SunPower business, Complete Solar’s bid also will assume certain liabilities, including up to

$7.2 million for the SunPower New Homes business - Retention employment offers (contingent on executing the APA) were made to a group of SunPower New Homes employees

- As previously discussed, the Company’s Q2’24 revenue was low, only

$4.5 million , due to a near-total lack of working capital which limited operations for most of Q2 - In response, the Company raised

$46 million in a July 2024 convertible debenture offering that provided working capital and paid off all long-term debt and critical overdue accounts - When the total elimination of the private equity debt was announced on July 1, the Company’s stock (Nasdaq: CSLR) traded up

32.1% on a record 132.6 million shares - Q2’24 non-commission opex reached a two-year low of

$4.4M (peak Q2’23,$12.9M ) - 37 Core Energy employees have been integrated into the Company

Fellow Shareholders:

Our revenue, earnings and cashflow for Q2’24 are given below, compared with the Q1’24 & Q4’23 prior quarter actual results. See our 10Q filing (here) for the Q1’24 report.

Complete Solar’s revenue was nearly cut off in Q1’24 due to a six-month impasse with our private equity lenders. We expect revenue to recover to

The financial data circled above show the benefits of our vigorous cost reduction program. Despite the working capital crunch that cut revenue in half twice, from

Cost Reductions

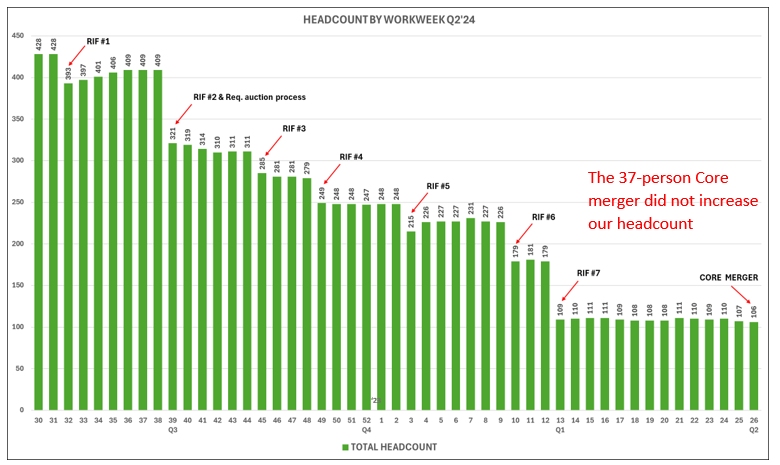

To achieve the cost reductions described above, we had to maintain our headcount discipline. As shown in the headcount graph below, the Company made its seventh and final reduction to 109 employees in Q1’24 for both financial and productivity reasons. The latest Q2’24 data show that we have maintained a flat headcount, even after integrating 37 new employees from Core Energy, a Logan, Utah-based solar company very similar to Complete Solar.

Rodgers stated, “The merger brought to us Core Energy CEO Cole Farmer, a solar marketing and sales expert who reports to me, as well as Rick Guy’s California installing crew (three jobs per day), which replaced our Complete Solar crew. In our plan, the integration with SunPower will also be merit-based and focus on cash and cost efficiency.

Rodgers continued, “All Complete Solar employees now hold stock options (in a

Organization Changes

On August 16, COO Brian Wuebbels will leave the Company to take on a CEO role in a manufacturing company near his home in Highland, Illinois. Brian said, “I appreciate the opportunity that Complete Solar has afforded me, and I especially want to thank T.J. Rodgers for all that I have learned from him the past year. Complete Solar is well positioned to be a leader in the residential solar industry and has a leadership team in place to make that a reality.”

Rodgers replied, “We deeply appreciate the fact that Brian put up with his commuter flights for eight months more than he had planned in order to lead us through the second quarter report with our new auditors, BDO, the fifth largest auditing firm in the world. I have appointed Linda DeJulio, our VP of Quality, to be the Acting COO and the ranking officer in the Company.”

Conclusion

Complete Solar has been presented with a tremendous opportunity to hire SunPower people and acquire SPWR assets to scale CSLR and its value at a rate unimaginable to us just weeks ago. We need to get Delaware court approval on our APA and then we need to execute on it. We have a detailed plan that is in its fourth revision at this writing.

About Complete Solar

Complete Solar is a solar company with unique technology and an end-to-end customer offering – which includes financing, design and project fulfilment, and follow-on customer service – allowing it to sell more products across more markets and enable more options for customers wishing to make the switch to a more energy-efficient lifestyle. To learn more, visit https://www.completesolaria.com.

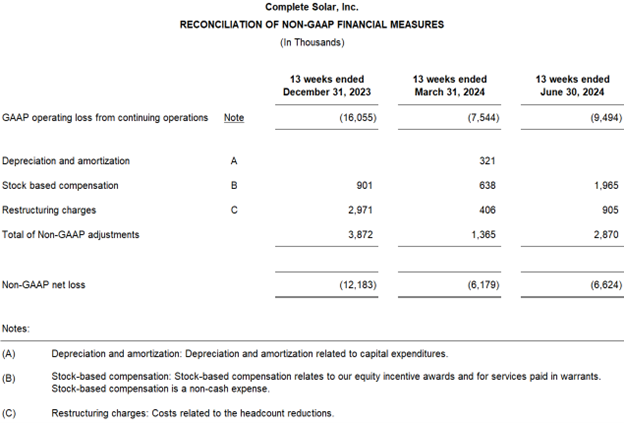

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Complete Solar provides an additional financial metrics that is not prepared in accordance with GAAP ("non-GAAP"). Management uses non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solar’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect. The non-GAAP financial measures do not replace the presentation of Complete Solar’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solar’s financial results presented in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form 10K filed, which was declared effective by the Securities and Exchange Commission (the “SEC”) on June 30, 2023. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solar assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

| Contacts: | |

| Dan Foley | Genevieve Swords |

| CFO | Investor Relations |

| dfoley@completesolar.com | InvestorRelations@completesolar.com |

| (801) 477-5847 | |

Source: Complete Solar, Inc.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0961c46-4741-4b7d-8ecc-d08a9416560a

https://www.globenewswire.com/NewsRoom/AttachmentNg/eabf14d2-d706-45d9-8668-2993a23f7814

https://www.globenewswire.com/NewsRoom/AttachmentNg/d8ec4a7f-b125-4673-a888-b6a2a47d9290