Complete Solaria Update: Operational Progress & PE Debt

FREMONT, Calif., April 11, 2024 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. (“Complete Solaria” or the “Company”) (Nasdaq: CSLR) today reported on its current financial status, which includes progress on its cash burn rate, and the status of its debt with private equity firms Kline-Hill Partners and Carlyle, which together hold about

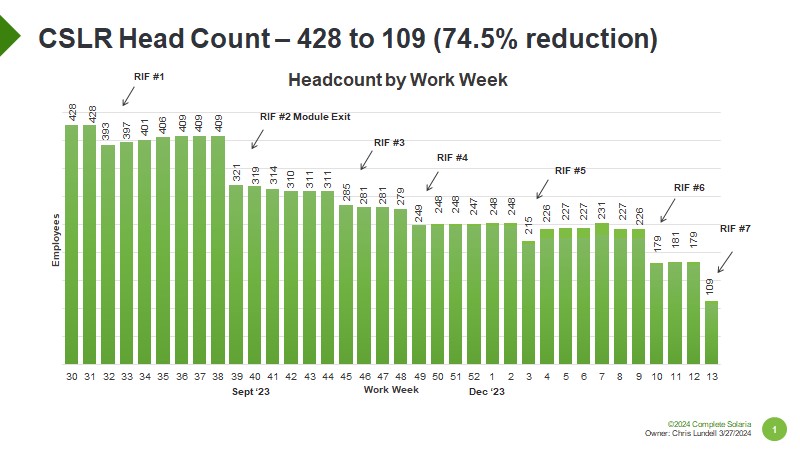

These layoffs were very unfortunate, but necessary for survival. And when any company keeps only the top

T.J. Rodgers, Complete Solaria chairman, commented, “In the conclusion of my November report to shareholders, I said:

‘Our planned future cash need is less than

Rodgers continued, “Since that time, I have put

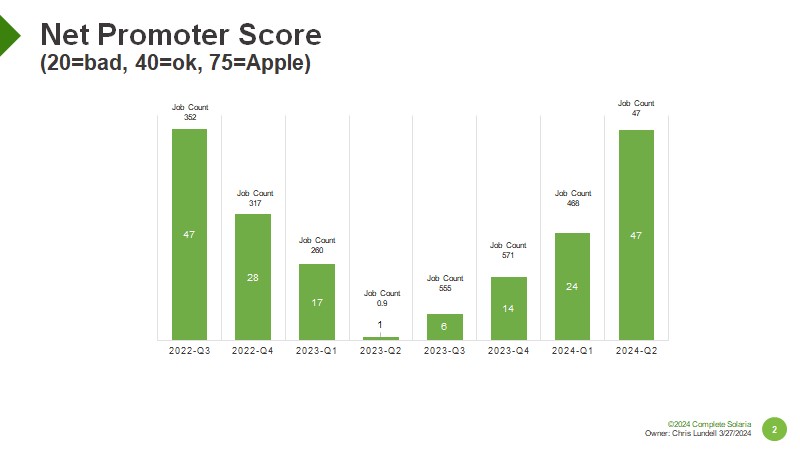

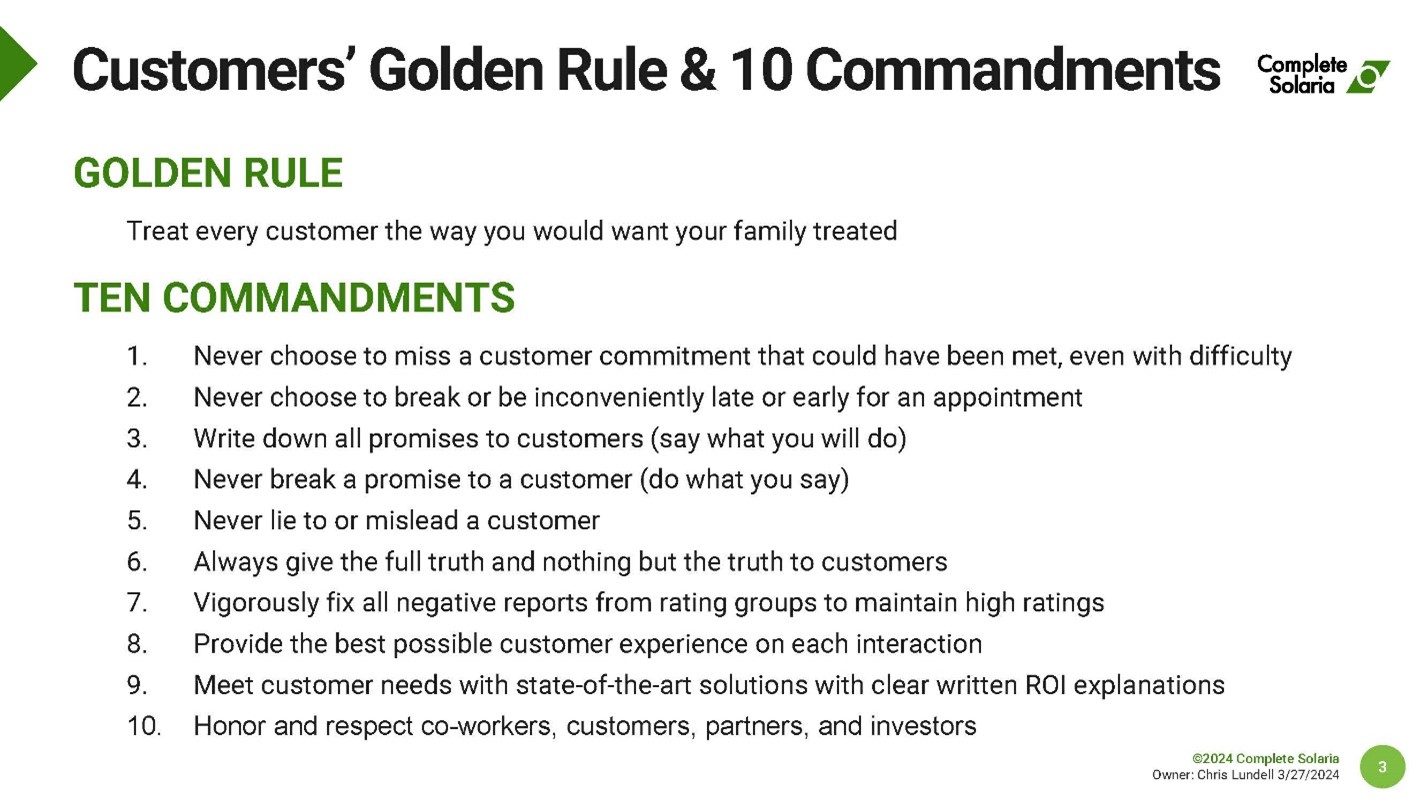

Rodgers continued, “Our operations group has reduced our cycle time from 104-133 days in the pre-Nov’23 period to 26-40 days today. Our customers have awarded that effort by raising our Net Promoter Score as shown below. We have also made significant progress in improving our attitude regarding customers.”

Rodgers continued, “Our proposition was compelling for Kline-Hill, always a supportive investor with whom we are in the final stages of negotiation of a debt-equity swap. Not so for Carlyle, which has rejected our equivalent 9.9 million share offer by complaining that they “have not heard back” from us on a day in which they dodged six phone calls and emails. The Carlyle story is long and does not reflect well on them, but we do owe them over

Rodgers continued, “I have been working on CSLR for Carlyle for free for nine months – with no salary or stock options – and my prior Enphase turnaround results (from a share price of

Rodgers concluded, “So, Carlyle’s threat to “not go forward” created a compelling vision of freedom for me, worth every penny I would lose. But, I would choose not to undermine their efforts because that’s too expensive. I wish them well. I will even come back for one week to train one of the solar hot-shots they claim to have in their broad solar portfolio – and leave him or her with 1) 110 great employees eager to make money on their new stock options, 2) a bank account of one million dollars, and 3) a credible zero-cash plan. They will have no need to force chapter 11 on us. I will leave the keys under the mat. Unfortunately, the 15 Ayna consultants I have helping me – the very same group that helped me turn around Enphase – are working for equity, rather than their usual

About Complete Solaria

Complete Solaria is a solar company with unique technology and end-to-end customer offering, which includes financing, project fulfilment and customer service. Complete Solaria’s digital platform together with premium solar products enable one-stop service for clean energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.CompleteSolaria.com and follow us on LinkedIn.

Forward Looking Statements

This press release may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the referenced transactions. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” and similar expressions, but the absence of these words does not mean that a statement is not a forward-looking statement. Forward-looking statements are forecasts, predictions, projections and other statements about future events that are based on current expectations, hopes, beliefs, intentions, strategies and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) risks that the sale of certain assets and other business items will not be completed on the terms set forth in the Asset Purchase Agreement or the ancillary agreements referenced in the Asset Purchase Agreement, if at all; (ii) the sale of assets disrupts current plans and operations of the companies or diverts managements’ attention from Complete Solaria’s business operations; (iii) the outcome of any legal proceedings that may be instituted in connection with the assets sale; (iv) the price of Complete Solaria’s securities may be volatile due to a variety of factors, including changes in the applicable competitive or regulatory landscapes, variations in operating performance across competitors, changes in laws and regulations affecting Complete Solaria’s business, and changes in the combined capital structure; (v) the ability to implement business plans, forecasts, and other expectations after the completion of the business combination, and identify and realize additional opportunities; (vi) the evolution of the markets in which Complete Solaria will compete.

The foregoing list of factors is not exhaustive. Readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4 filed, which was declared effective by the Securities and Exchange Commission (the “SEC”) on June 30, 2023. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solaria assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

For investor inquiries, please contact:

Complete Solaria, Inc.

Sioban Hickie

Phone: +1 (510) 270-2537

CompleteSolariaIR@icrinc.com

Source: Complete Solaria, Inc.

_________________________

1 This is an internal plan which is subject to external events and execution errors, but we do use it internally to make decisions.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ff9d8420-c2a5-4559-9cf6-bb6cd3e6cc9b

https://www.globenewswire.com/NewsRoom/AttachmentNg/e5ed33bb-2aab-4760-b4b9-3154243c6586

https://www.globenewswire.com/NewsRoom/AttachmentNg/3251214a-72c9-4ca6-bbcb-a2f2c4dedf07