Complete Solar Third Quarter Report

Complete Solar (NASDAQ: CSLR) reported Q3 2024 results and significant corporate developments. The company successfully acquired SunPower's assets, including New Homes, Blue Raven, and Dealer businesses, along with rights to the SunPower brand. The acquisition brought 1,204 SunPower employees to Complete Solar, which previously had only 65 employees. The company raised $80 million through convertible debt offerings for the $45 million acquisition and working capital.

Q3 2024 combined revenue reached $117.3 million, though Q4 2024 revenue is expected to decrease to $80 million due to non-recurring backlog benefits. Operating loss is projected to improve from ($40.0M) in Q3 to $2-11 million in Q4 2024, with plans to achieve breakeven in 2025 through significant cost reductions.

Complete Solar (NASDAQ: CSLR) ha riportato i risultati del terzo trimestre 2024 e importanti sviluppi aziendali. L'azienda ha acquisito con successo gli attivi di SunPower, inclusi gli affari New Homes, Blue Raven e Dealer, insieme ai diritti sul marchio SunPower. L'acquisizione ha portato 1.204 dipendenti di SunPower a Complete Solar, che in precedenza contava solo 65 dipendenti. L'azienda ha raccolto 80 milioni di dollari attraverso offerte di debito convertibile per finanziare l'acquisizione di 45 milioni di dollari e il capitale circolante.

Le entrate combinate del terzo trimestre 2024 hanno raggiunto 117,3 milioni di dollari, sebbene le entrate del quarto trimestre 2024 siano previste in diminuzione a 80 milioni di dollari a causa di benefici derivanti da arretrati non ricorrenti. La perdita operativa è prevista in miglioramento, passando da (-40,0 milioni di dollari) nel terzo trimestre a 2-11 milioni di dollari nel quarto trimestre 2024, con l'obiettivo di raggiungere il pareggio nel 2025 attraverso significative riduzioni dei costi.

Complete Solar (NASDAQ: CSLR) ha informado los resultados del tercer trimestre de 2024 y desarrollos corporativos significativos. La compañía adquirió exitosamente los activos de SunPower, incluidos los negocios de New Homes, Blue Raven y Dealer, junto con los derechos sobre la marca SunPower. La adquisición trajo 1,204 empleados de SunPower a Complete Solar, que anteriormente contaba con solo 65 empleados. La compañía recaudó 80 millones de dólares a través de ofertas de deuda convertible para la adquisición de 45 millones de dólares y capital de trabajo.

Los ingresos combinados del tercer trimestre de 2024 alcanzaron los 117.3 millones de dólares, aunque se espera que los ingresos del cuarto trimestre de 2024 disminuyan a 80 millones de dólares debido a beneficios de atrasos no recurrentes. Se prevé que la pérdida operativa mejore de (-40.0 millones de dólares) en el tercer trimestre a entre 2 y 11 millones de dólares en el cuarto trimestre de 2024, con planes de alcanzar el equilibrio en 2025 mediante reducciones significativas de costos.

Complete Solar (NASDAQ: CSLR)는 2024년 3분기 결과와 중요한 기업 발전 사항을 보고했습니다. 회사는 SunPower의 자산을 성공적으로 인수했으며, 여기에는 New Homes, Blue Raven 및 Dealer 사업이 포함되고 SunPower 브랜드에 대한 권한도 포함됩니다. 이 인수로 1,204명의 SunPower 직원이 이전에는 65명만 있었던 Complete Solar에 합류하게 되었습니다. 회사는 4천5백만 달러의 인수금액과 운전 자본을 위해 전환사채 발행을 통해 8천만 달러를 모금했습니다.

2024년 3분기 총 수익은 1억 1천7백30만 달러에 이르렀지만, 2024년 4분기 수익은 비반복적인 적체 이익으로 인해 8천만 달러로 감소할 것으로 예상됩니다. 운영 손실은 3분기 (-4천만 달러)에서 4분기 200만~1천1백만 달러로 개선될 것으로 예상되며, 2025년에는 대규모 비용 절감을 통해 손익 분기점에 도달할 계획입니다.

Complete Solar (NASDAQ: CSLR) a annoncé les résultats du troisième trimestre 2024 et des développements corporatifs importants. La société a réussi à acquérir les actifs de SunPower, y compris les activités New Homes, Blue Raven et Dealer, ainsi que les droits de la marque SunPower. Cette acquisition a amené 1.204 employés de SunPower à Complete Solar, qui n'avait auparavant que 65 employés. L'entreprise a levé 80 millions de dollars par le biais d'offres de dette convertible pour financer l'acquisition de 45 millions de dollars et le fonds de roulement.

Les revenus combinés du troisième trimestre 2024 ont atteint 117,3 millions de dollars, bien que les revenus du quatrième trimestre 2024 devraient diminuer à 80 millions de dollars en raison des avantages d'arriérés non récurrents. La perte d'exploitation devrait s'améliorer, passant de (-40,0 M$) au troisième trimestre à 2-11 millions de dollars au quatrième trimestre 2024, avec l'objectif d'atteindre le seuil de rentabilité en 2025 grâce à des réductions de coûts significatives.

Complete Solar (NASDAQ: CSLR) hat die Ergebnisse des 3. Quartals 2024 und bedeutende Unternehmensentwicklungen bekannt gegeben. Das Unternehmen hat erfolgreich die Vermögenswerte von SunPower erworben, darunter die Geschäfte New Homes, Blue Raven und Dealer, sowie die Rechte an der Marke SunPower. Durch die Akquisition kamen 1.204 SunPower-Mitarbeiter zu Complete Solar, das zuvor nur 65 Mitarbeiter hatte. Das Unternehmen hat 80 Millionen Dollar durch Wandelanleihen zur Finanzierung der 45 Millionen Dollar umfassenden Akquisition und des Betriebskapitals eingeworben.

Die kombinierten Einnahmen für das 3. Quartal 2024 beliefen sich auf 117,3 Millionen Dollar, wobei die Einnahmen im 4. Quartal 2024 aufgrund nicht wiederkehrender Rückstände voraussichtlich auf 80 Millionen Dollar sinken werden. Der Betriebsverlust wird voraussichtlich von (-40,0 Mio. USD) im 3. Quartal auf 2-11 Mio. USD im 4. Quartal 2024 verbessert, mit dem Ziel, 2025 durch bedeutende Kostensenkungen den Break-even-Punkt zu erreichen.

- Successful acquisition of SunPower's assets and brand rights

- Raised $80 million through convertible debt offerings

- Q3 2024 combined revenue of $117.3 million

- Projected reduction in operating loss from $40M to $2-11M in Q4

- Expected operating expense reduction from $43.5M to $17.0M in Q4

- Q4 2024 revenue expected to decline to $80 million from $117.3M

- Q3 2024 operating loss of $40 million

- Pre-merger Complete Solar Q3 showed negative gross margins of -57%

- Significant operating losses across all divisions in Q3

- Dependency on $14M pending transfer from Chinese investor

Insights

The Q3 results reveal significant financial challenges and transformative changes. The combined entity shows

The projected Q4 revenue decline to

The acquisition of SunPower's assets represents a complex integration challenge. Scaling from 65 to over 1,200 employees through acquisition presents significant operational risks. The rapid headcount expansion followed by immediate restructuring signals potential integration difficulties and cultural challenges.

The reorganization into geographical divisions with centralized administrative functions is logical but ambitious. The projected cost synergies and breakeven timeline appear optimistic given the scale of integration required and historical performance of both entities. The successful integration will heavily depend on maintaining customer relationships and operational efficiency during this transition period.

OREM, Utah, Nov. 13, 2024 (GLOBE NEWSWIRE) -- Complete Solaria, Inc. d/b/a Complete Solar (“Complete Solar” or the “Company”) (Nasdaq: CSLR), a solar technology, services, and installation company, today will present its Q3’24 results via webcast at 5:00 p.m. EST. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: investors.completesolar.com/news-events/events.

Q3’24 actuals and Q4’24 forecasts (based on non-GAAP results unless noted) are as follows:

- Complete Solar completed the successful acquisition of SunPower’s assets in the New Homes, Blue Raven, Dealer businesses, and rights to the SunPower brand

- The Company also won a Delaware Bankruptcy Court ruling giving it rights to the SunPower brand in the U.S.

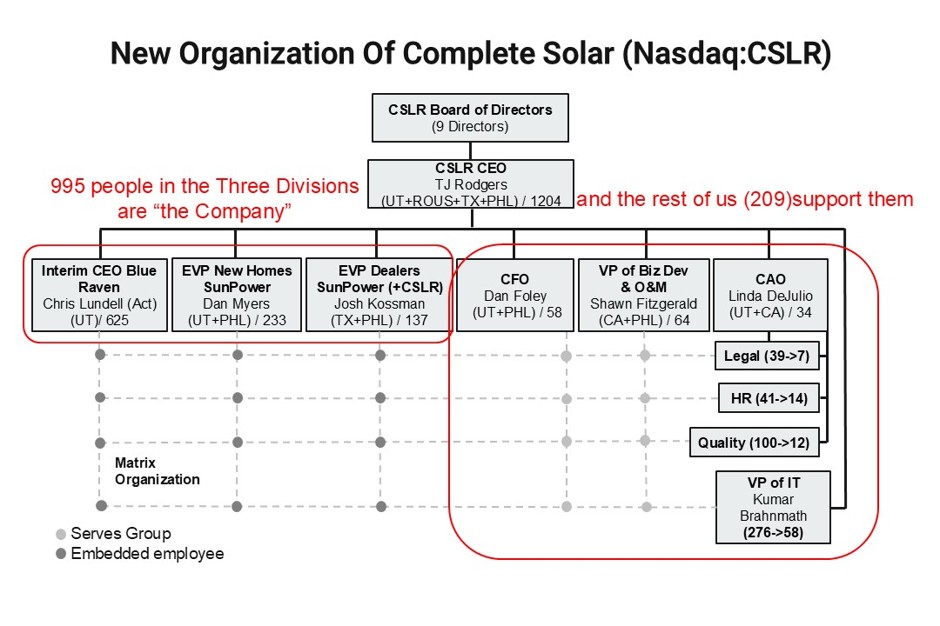

- 1204 SunPower employees have been hired by Complete Solar, which had only 65 employees to form “NewCo”

- In Q3 the Company raised

$80 million through convertible debt offerings to provide capital for the$45 million SunPower asset acquisition and working capital, the last$14 million of which will transfer in early December 2024 from a Chinese investor.

Fellow Shareholders:

The revenue, earnings and cashflow for pre-merger Complete Solar Q3’24 are given below, compared with the Q2’24 & Q1’24 prior quarter actual results. This is the last 10Q filing (here) for the “old Complete Solar.”

| ( | GAAP | Non-GAAP1 | |||||||||||||||

| Q3 2024 | Q2 2024 | Q1 2024 | Q3 2024 | Q2 2024 | Q1 2024 | ||||||||||||

| Revenue | 5,536 | 4,492 | 10,040 | 5,536 | 4,492 | 10,040 | |||||||||||

| Gross Margin | -57 | % | -20 | % | 23 | % | 2 | % | -20 | % | 24 | % | |||||

| Operating Income | (29,768 | ) | (9,494 | ) | (7,544 | ) | (6,546 | ) | (6,624 | ) | (6,179 | ) | |||||

| Cash Balance | 79,502 | 1,839 | 1,786 | 79,502 | 1,839 | 1,889 | |||||||||||

| 1. GAAP/non-GAAP reconciliation attached. | |||||||||||||||||

Acquiring SunPower Assets

In early September ’24 Complete Solar was presented with an opportunity to hire SunPower employees and acquire SPWR assets that would scale Complete Solar and its value at a rate unachievable just weeks before. We needed to raise money (

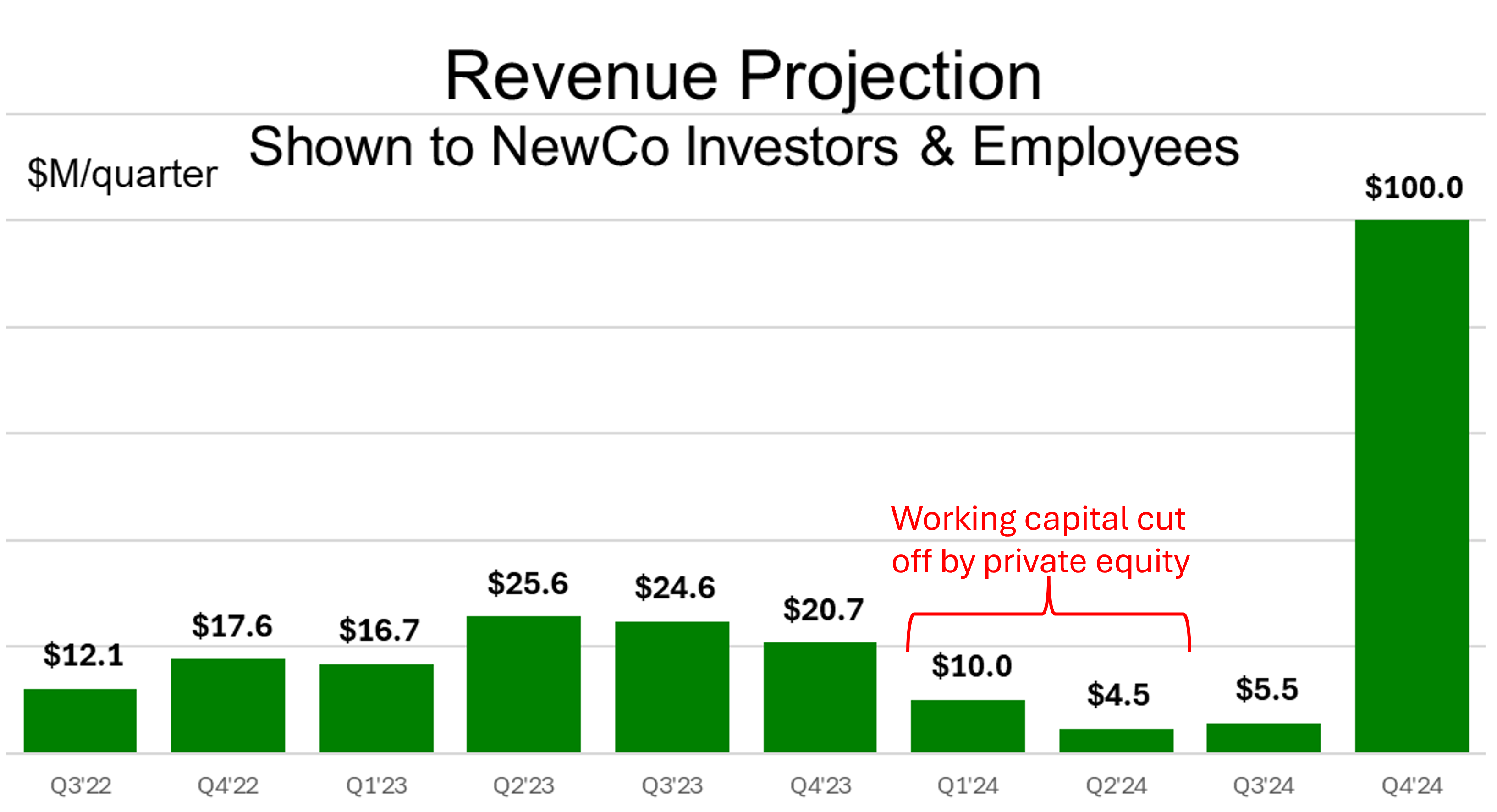

The first five-quarter plan (Q4’24-Q4’25) presented to investors in the

“NewCo” (Complete Solar Plus “Old SunPower” Plus its Blue Raven Solar Subsidiary)

The combined team worked throughout October and early November to reorganize into a new start-up like organization designed to be lean enough to achieve breakeven with

Complete Solar Announces Preliminary Q3’24 Results

Our companies were not combined until October 1, 2024, so there are no GAAP and non-GAAP results to report for the combined business for Q3’24, but the following chart shows preliminary and unaudited Q3’24 results based on a simple summing of the separate results shown on November 6 to employees and investors.

| Operating Income | ||||||||||

| Division | Charter | Revenue | Prior Report by Division | |||||||

| New Homes | Sales to homebuilders | N/A | ( | |||||||

| Blue Raven Solar | Sales direct to customer | N/A | ( | |||||||

| Dealer (+ CSLR) | Sales of jobs from dealers | N/A | ( | |||||||

| ( | ( | |||||||||

1. Contains

- Combined revenue in Q3’24 for NewCo was

$117.3 million . On a standalone basis, Complete Solar’s Q3’24 revenue was$5.5 million of the$20.6 reported for “Dealer” - Revenue for Q4’24 is now expected to be

$80 million , lower sequentially due to benefits accumulated backlog in Q3 that will not carry over to Q4’24 - The operating income loss is now expected to drop from (

$40.0M ) in Q3’24 to$2 -11 million in Q4’24 due to the significant headcount reduction

Complete Solar CEO, T.J. Rodgers said, “On Wednesday, November 6, 2024 at our Orem, Utah HQ, we presented to over 1,000 employees the details of our Rev. 5 Annual Operating Plan for cutting headcount and other costs to achieve breakeven operating income in 2025.

Rodgers continued, “Our Q3’24 results of

Rodgers concluded, “Our Q3’24 opex of

About Complete Solar

With its recent acquisition of SunPower assets, Complete Solar has become a leading residential solar services provider in North America. Complete Solar’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.completesolar.com.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), Complete Solar provides an additional financial metrics that is not prepared in accordance with GAAP ("non-GAAP"). Management uses non-GAAP financial measures, in addition to GAAP financial measures, as a measure of operating performance because the non-GAAP financial measure does not include the impact of items that management does not consider indicative of Complete Solar’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect. The non-GAAP financial measures do not replace the presentation of Complete Solar’s GAAP financial results and should only be used as a supplement to, not as a substitute for, Complete Solar’s financial results presented in accordance with GAAP.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our expectations regarding our Q4 ’24 and fiscal 2025 financial performance, including with respect to our Q4 ’24 combined revenues and profit before tax loss, expectations and plans relating to further headcount reduction, cost control efforts, and our expectations with respect to when we achieve breakeven operating income and positive operating income. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 1, 2024, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Complete Solar assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

| Company Contacts: | |

| Dan Foley | Sioban Hickie |

| CFO | Investor Relations |

| dfoley@completesolar.com | InvestorRelations@completesolar.com |

| (801) 477-5847 |

| Complete Solaria, Inc. | |||||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |||||||||||||||||

| (In Thousands) | |||||||||||||||||

| COMPLETE SOLARIA, INC. - REPORTED | CSLR + ACQUIRED ASSETS1 | ||||||||||||||||

| 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended | 13 weeks ended1 | |||||||||||||

| Note | December 31, 2023 | March 31, 2024 | June 30, 2024 | September 29, 2024 | September 29, 20241 | ||||||||||||

| GAAP operating loss from continuing operations | (16,055 | ) | (7,544 | ) | (9,494 | ) | (29,768 | ) | (73,764 | ) | |||||||

| Depreciation and amortization | A | - | 321 | - | - | 3,686 | |||||||||||

| Stock based compensation | B | 901 | 638 | 1,965 | 5,406 | 5,579 | |||||||||||

| Restructuring charges | C | 2,971 | 406 | 905 | 17,816 | 23,037 | |||||||||||

| Total of Non-GAAP adjustments | 3,872 | 1,365 | 2,870 | 23,222 | 32,302 | ||||||||||||

| Non-GAAP net loss | (12,183 | ) | (6,179 | ) | (6,624 | ) | (6,546 | ) | (41,462 | ) | |||||||

| Notes: | |||||||||||||||||

| (1) | Complete Solaria acquired SunPower assets (as described in the asset purchase agreement) on October 1, 2024. GAAP and Non-GAAP figures in this column reflect unaudited results as if Complete Solaria owned these assets as of July 1, 2024. | ||||||||||||||||

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||

| (C) | Restructuring charges: Costs primarily related to acquisition, headcount reductions, severance and other non-recurring charges. | ||||||||||||||||

Source: Complete Solar, Inc.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/69f8526f-2992-4a95-8d35-2c44e198d9e8

https://www.globenewswire.com/NewsRoom/AttachmentNg/7f16f41b-cd7e-428a-bbd3-d29f935d74cc

FAQ

What was Complete Solar's (CSLR) Q3 2024 revenue?

How much did Complete Solar (CSLR) raise in convertible debt offerings?

What is Complete Solar's (CSLR) projected Q4 2024 revenue?