Apartments.com Publishes Multifamily Rent Report for First Quarter of 2024

The

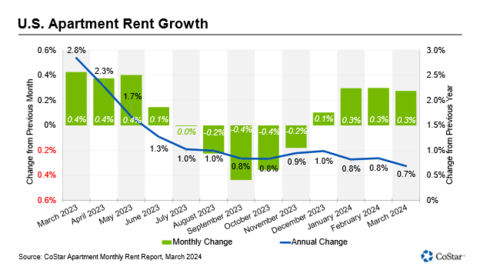

The national average annual asking rent rose by

Midwest and Northeast markets have avoided oversupply conditions and maintained solid rent growth over the year at

At

At the opposite end of the scale, rents fell by

Absorption was led by 4&5-Star units, with just over 88,000 units in the quarter. But with most new supply aimed at the luxury market, annual asking rent growth remained negative in that segment and finished March at -

Demand for 1&2-Star properties remains the weakest of all market segments, with two and a half years of negative absorption. Households at this price point struggle with higher housing costs and the elevated costs of everyday items, pushing some to seek alternative housing solutions such as moving in with roommates or returning to the family home.

After completions of multifamily units reached a 40-year record in 2023, this year may offer the multifamily market a chance to catch its breath. The multifamily market is projected to add only 495,000 units in 2024, a

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240404033182/en/

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com

Source: CoStar Group