CreditRiskMonitor Announces Second Quarter Results

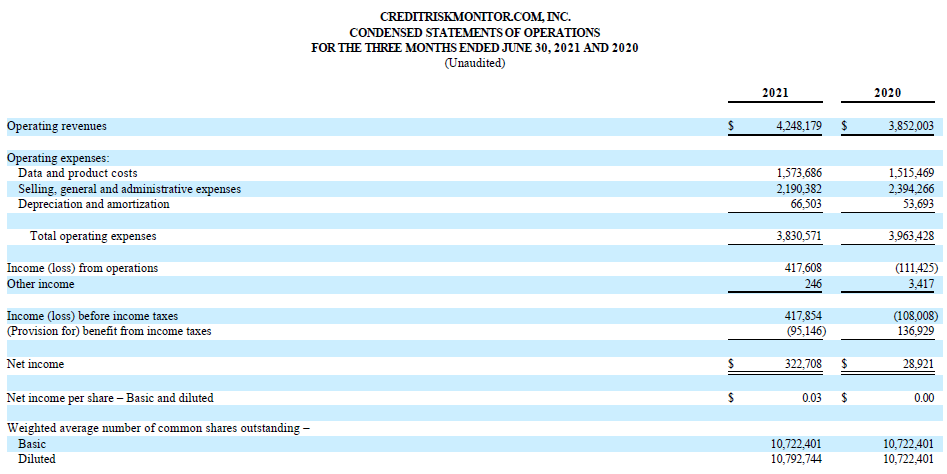

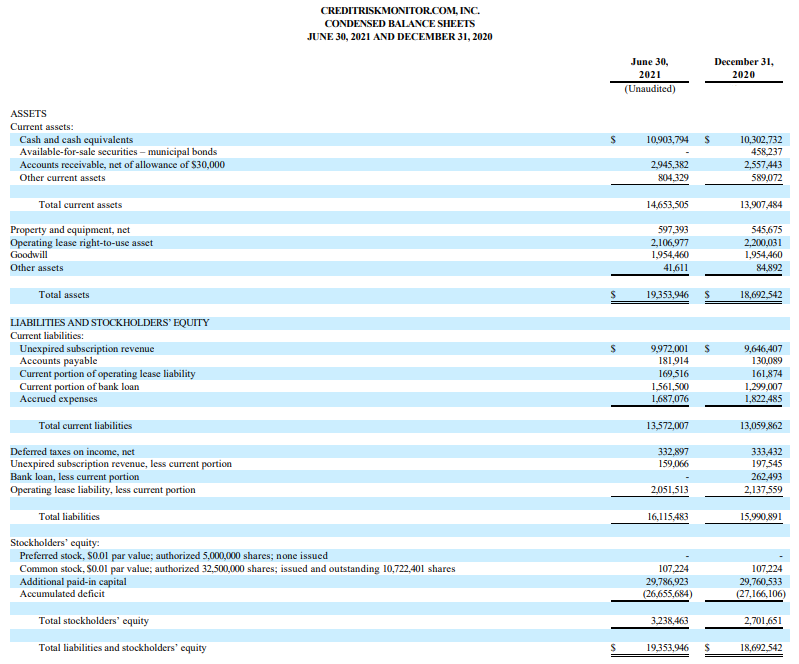

CreditRiskMonitor reported a strong second quarter for 2021, with revenues rising to $4.25 million, marking a 10.3% increase from $3.85 million in 2020. Operating expenses decreased by approximately $103,850 or 3.4%, thanks to a new commission methodology and reduced commission expenses. The company achieved a pre-tax income of approximately $417,600, a significant turnaround from a pre-tax loss of $108,000 the previous year. President Mike Flum highlighted ongoing investments in product development and infrastructure to enhance service value and support growth.

- Revenue increased by 10.3% to $4.25 million.

- Operating expenses decreased by approximately $103,850 or 3.4%.

- Achieved a pre-tax income of approximately $417,600, improving from a loss of $108,000.

- None.

VALLEY COTTAGE, NY / ACCESSWIRE / August 12, 2021 / CreditRiskMonitor (OTCQX:CRMZ) reported that revenues for the quarter ended June 30, 2021 increased to

Mike Flum, President & COO, said, "We are committed to our ongoing plan of reinvesting in the service through new product development, additional data acquisition, and employee retention. We continue to work on enhancing the value proposition of our services and expanding our staff to support the financial risk analysis needs of our clients and attract qualified prospects. We remain focused on the development and testing of our new supply chain focused platform as well as expanding our private company coverage through a major data enhancement. Both of these initiatives represent significant growth opportunities for our business; however, they require substantial resources to create, test, and launch. Our continued investments in infrastructure systems are allowing us to improve the operating efficiency of the business while also supporting our ambitions to scale up over time."

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (http://www.crmz.com) is a web-based publisher of financial information that helps corporate credit and procurement professionals stay ahead of business financial risk quickly, accurately and cost effectively. The service offers comprehensive commercial credit reports and financial risk analysis covering public companies worldwide.

The Company also collects a significant amount of trade receivable data on both public and a select group of private companies every month, to help subscribers determine payment performance.

Over

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, President & COO

(845) 230-3037

ir@creditriskmonitor.com

SOURCE: CreditRiskMonitor.com, Inc.

View source version on accesswire.com:

https://www.accesswire.com/659536/CreditRiskMonitor-Announces-Second-Quarter-Results

FAQ

What were CreditRiskMonitor's revenues in Q2 2021?

How much did operating expenses decrease in Q2 2021 for CRZM?

What was the pre-tax income for CreditRiskMonitor in Q2 2021?