Cerrado Gold Announces Q1 2025 Production Results At Its Minera Don Nicolas Mine In Argentina

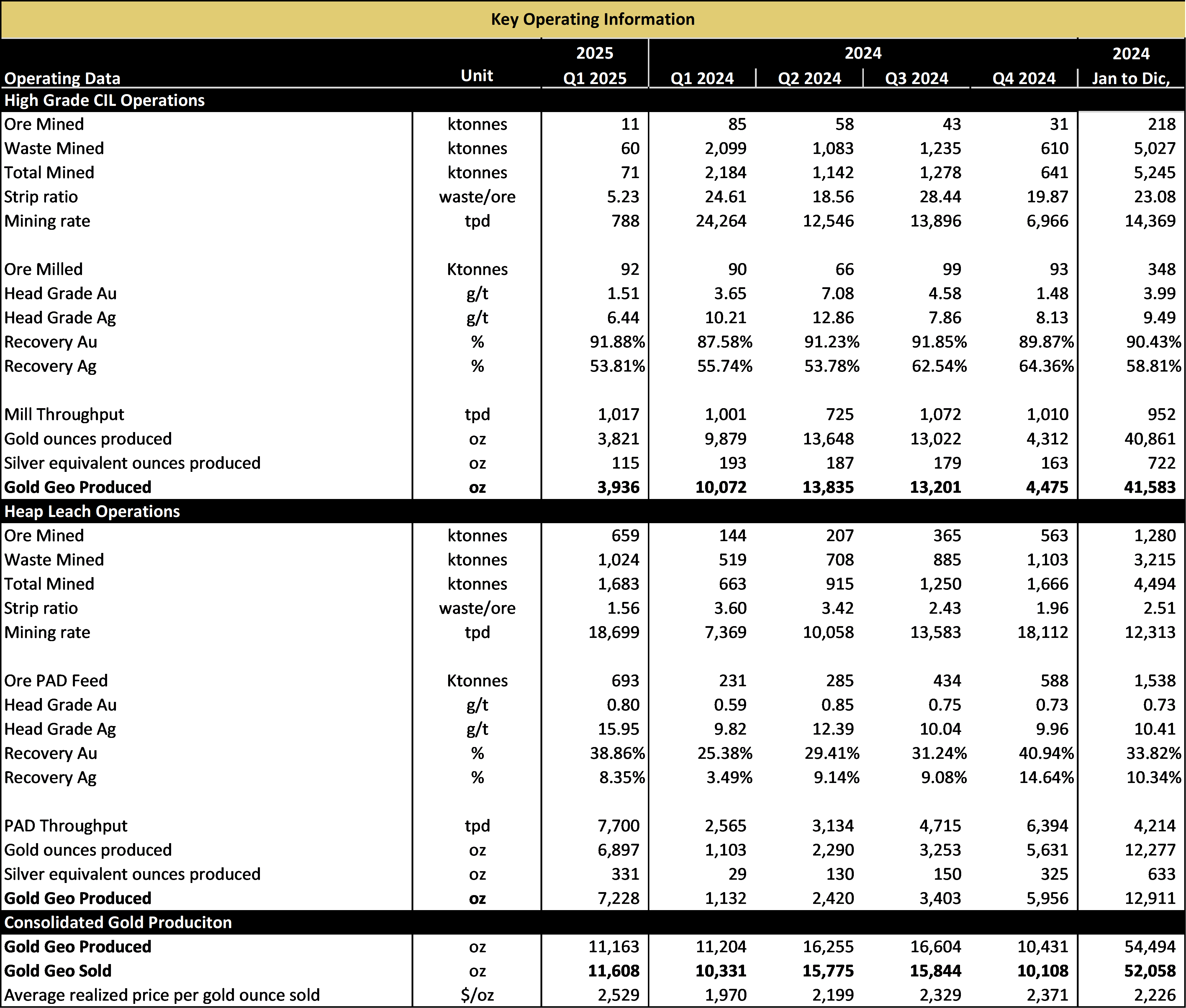

Cerrado Gold (CRDOF) reported Q1 2025 production of 11,163 Gold Equivalent Ounces (GEO) at its Minera Don Nicolas Mine in Argentina, showing improvement from 10,431 GEO in Q4. The company achieved record heap leach production of 7,228 GEO, with March production exceeding 2,800 GEO.

The company has increased its 2025 production guidance to 55,000-60,000 GEO (up from 50,000-55,000), with AISC costs projected at $1,500-$1,700 per GEO. Underground development at Paloma will commence in Q2 2025, with initial production expected in Q3 2025.

Key operational improvements include expanded crushing capacity installation at Calandrias Sur (completion in Q2 2025) and improved heap leach recoveries from 33% to 38%. The company continues progress on its Mont Sorcier iron project, with feasibility study completion targeted for Q1 2026.

Cerrado Gold (CRDOF) ha riportato una produzione nel primo trimestre 2025 di 11.163 once equivalenti d'oro (GEO) presso la miniera Minera Don Nicolas in Argentina, mostrando un miglioramento rispetto alle 10.431 GEO del quarto trimestre. L'azienda ha raggiunto una produzione record da heap leach di 7.228 GEO, con la produzione di marzo che ha superato le 2.800 GEO.

La società ha aumentato le previsioni di produzione per il 2025 a 55.000-60.000 GEO (in crescita rispetto a 50.000-55.000), con costi AISC stimati tra 1.500 e 1.700 dollari per GEO. Lo sviluppo sotterraneo a Paloma inizierà nel secondo trimestre 2025, con la produzione iniziale prevista per il terzo trimestre 2025.

Tra i principali miglioramenti operativi si annoverano l'espansione della capacità di frantumazione a Calandrias Sur (completamento previsto nel secondo trimestre 2025) e un aumento del recupero da heap leach dal 33% al 38%. L'azienda continua a progredire nel progetto di ferro Mont Sorcier, con il completamento dello studio di fattibilità previsto per il primo trimestre 2026.

Cerrado Gold (CRDOF) reportó una producción en el primer trimestre de 2025 de 11,163 onzas equivalentes de oro (GEO) en su mina Minera Don Nicolas en Argentina, mostrando una mejora respecto a las 10,431 GEO del cuarto trimestre. La compañía alcanzó una producción récord en lixiviación en pilas de 7,228 GEO, con una producción en marzo que superó las 2,800 GEO.

La empresa ha incrementado su guía de producción para 2025 a 55,000-60,000 GEO (desde 50,000-55,000), con costos AISC proyectados entre $1,500 y $1,700 por GEO. El desarrollo subterráneo en Paloma comenzará en el segundo trimestre de 2025, con producción inicial esperada para el tercer trimestre de 2025.

Las mejoras operativas clave incluyen la ampliación de la capacidad de trituración en Calandrias Sur (finalización en el segundo trimestre de 2025) y una mejora en las recuperaciones por lixiviación en pilas del 33% al 38%. La compañía continúa avanzando en su proyecto de hierro Mont Sorcier, con la finalización del estudio de factibilidad prevista para el primer trimestre de 2026.

Cerrado Gold (CRDOF)는 아르헨티나 Minera Don Nicolas 광산에서 2025년 1분기 11,163 골드 등가 온스(GEO)를 생산했다고 보고했으며, 이는 4분기 10,431 GEO에서 개선된 수치입니다. 회사는 힙 리치 생산에서 기록적인 7,228 GEO를 달성했으며, 3월 생산량은 2,800 GEO를 초과했습니다.

회사는 2025년 생산 가이드를 55,000-60,000 GEO로 상향 조정했으며(기존 50,000-55,000), GEO당 AISC 비용은 1,500~1,700달러로 예상됩니다. Paloma 지하 개발은 2025년 2분기에 시작되며, 초기 생산은 2025년 3분기에 예상됩니다.

주요 운영 개선 사항으로는 Calandrias Sur에서 파쇄 용량 확장(2025년 2분기 완료 예정)과 힙 리치 회수율이 33%에서 38%로 향상된 점이 있습니다. 회사는 Mont Sorcier 철광 프로젝트도 계속 진행 중이며, 타당성 조사는 2026년 1분기 완료를 목표로 하고 있습니다.

Cerrado Gold (CRDOF) a annoncé une production au premier trimestre 2025 de 11 163 onces équivalentes or (GEO) dans sa mine Minera Don Nicolas en Argentine, montrant une amélioration par rapport aux 10 431 GEO du quatrième trimestre. La société a atteint une production record en lixiviation sur tas de 7 228 GEO, avec une production en mars dépassant les 2 800 GEO.

La société a relevé ses prévisions de production pour 2025 à 55 000-60 000 GEO (contre 50 000-55 000), avec des coûts AISC prévus entre 1 500 et 1 700 dollars par GEO. Le développement souterrain à Paloma débutera au deuxième trimestre 2025, avec une production initiale attendue au troisième trimestre 2025.

Les principales améliorations opérationnelles incluent l'extension de la capacité de concassage à Calandrias Sur (achèvement prévu au deuxième trimestre 2025) et une amélioration des récupérations par lixiviation sur tas de 33 % à 38 %. La société poursuit également ses avancées sur son projet de fer Mont Sorcier, avec une étude de faisabilité prévue pour le premier trimestre 2026.

Cerrado Gold (CRDOF) meldete für das erste Quartal 2025 eine Produktion von 11.163 Goldäquivalent-Unzen (GEO) in seiner Minera Don Nicolas Mine in Argentinien, was eine Verbesserung gegenüber 10.431 GEO im vierten Quartal darstellt. Das Unternehmen erzielte eine Rekordproduktion von 7.228 GEO durch Heap-Leaching, wobei die Produktion im März über 2.800 GEO lag.

Das Unternehmen hat seine Produktionsprognose für 2025 auf 55.000-60.000 GEO angehoben (vorher 50.000-55.000), mit prognostizierten AISC-Kosten von 1.500 bis 1.700 USD pro GEO. Die unterirdische Erschließung bei Paloma beginnt im zweiten Quartal 2025, die erste Produktion wird im dritten Quartal 2025 erwartet.

Wesentliche betriebliche Verbesserungen umfassen die Erweiterung der Brechkapazität bei Calandrias Sur (Fertigstellung im zweiten Quartal 2025) sowie eine Verbesserung der Heap-Leach-Rückgewinnung von 33 % auf 38 %. Das Unternehmen macht auch Fortschritte bei seinem Mont Sorcier Eisenprojekt, mit der Fertigstellung der Machbarkeitsstudie im ersten Quartal 2026.

- Record heap leach production of 7,228 GEO in Q1 2025

- Production guidance increased to 55,000-60,000 GEO for 2025

- Heap leach recoveries improved from 33% to 38%

- Upcoming underground operations expected to increase overall production

- Future payments of US$25M expected from asset sales

- AISC costs increased to $1,500-$1,700 per GEO from previous $1,300-$1,500

- CIL plant processing lower-grade stockpiles due to depleting high-grade ore

- Higher costs due to rental crushing equipment and ongoing inflationary pressure in Argentina

Gold Equivalent Ounce ("GEO") Production of 11,163 GEO for the 1st Quarter 2025

Record Production of 7,228, GEO from Heap Leach operations during the quarter

2025 Production Guidance Increased to 55,000 - 60,000 GEO

Underground Production commencing in H2/2025

TORONTO, ON / ACCESS Newswire / April 15, 2025 / Cerrado Gold Inc. (TSXV:CERT)(OTCQX:CRDOF) ("Cerrado" or the "Company") announces production results for the first quarter ended March 2025 ("Q1 2025") from the Minera Don Nicolas Mine in Santa Cruz Province, Argentina ("MDN"). Full quarterly financial results are expected to be released prior to May 30, 2025.

Q1 Operating Highlights

Q1 Production of 11,163 GEO vs 10,431 in Q4

Heap leach production ramping up to expanded capacity with over 2,800 GEO produced in March and 7,228 GEO for the quarter

CIL plant to continue to process low-grade stockpiles in anticipation of blending with high-grade ore from underground in H2/2025

Underground development at Paloma to commence in Q2 with initial production expected in Q3/2025

Expanded crushing capacity installation at Calandrias Sur to be completed in Q2 2025

Operational results for Q1 2025 showed a modest improvement in production over the previous quarter, driven by the ongoing ramp-up and transition to a focus on heap leach production as the high-grade ore feed for the CIL plant has been depleting as we await ongoing exploration activities. The CIL plant will continue to process lower-grade stockpiles until underground operations at Paloma are initiated in Q3 2025 with development commencing in Q2 2025. The heap leach operational performance continued to improve over the quarter, reaching record production levels as more ore was added to the pad. The performance of the heap leach continues to improve, exiting the quarter at near full capacity.

The second phase of the expansion of the crushing circuit is set to be concluded in May, supporting a doubling of capacity which will increase feed stability in order to deliver steady ore to the pad. While supporting higher production, additional crushing facilities are also expected to reduce the feed size to the pad and result in increased recoveries. Despite the introduction of material from the primary zone, recoveries have increased from

In addition, the company is currently well advanced with detailed analysis and preparations for equipment sourcing to commence underground development during Q2 2025 beneath the Palmoa pit. While initial production expectations are relatively modest given the current known underground resource, underground access is expected to provide a platform for major exploration activities at lower costs than drilling from surface. Underground exploration aims to materially expand resources at MDN, leveraging the underground development for a potential expansion in production and/or mine life.

The Company is raising its 2025 annual production guidance to 55,000 to 60,000 GEO, up from 50,000 - 55,000 GEO, to include the addition of modest underground production. AISC costs are expected to be modestly higher than previously anticipated with an ASIC of between

Mark Brennan, CEO and Chairman commented, "Q1 results are generally in line with expectations based upon the current mine plan and the ramp-up profile of the expanded heap leach operations. The addition of underground mining in the second half of 2025 should see overall production levels increase as the year progresses, delivering strong cash flows to support extensive exploration activities which are expected to expand resources and mine life. Cerrado continues to progress the Mont Sorcier project towards completion of the feasibility study by Q1/2026."

Mont Sorcier Project Update

At the Mont Sorcier high-purity iron project, detailed metallurgical test work and flow sheet design continued during the quarter. As announced in early December 2024, (see press release dated December 4, 2024) test work has reaffirmed the potential to produce high grade and high purity iron concentrate grading in excess of

Current test work and overall process design are to be at the core of the NI 43-101 Bankable Feasibility Study ("BFS") which is targeted to be completed by the end of Q1 2026. The Bankable Feasibility Study will look to provide greater detail of the potential for the project that was highlighted in the previous 2022 NI 43-101 Preliminary Economic Assessment ("PEA") that delivered a project NPV

Corporate Activities

The Company has also continued to make progress on improving its working capital position during the quarter with the receipt of cash from asset sales in Q4/2024 and steady production cashflows, allowing for an ongoing deleveraging of the MDN balance sheet. The Company's balance sheet is expected to further improve following receipt of future payments from the sale of the Brazilian Monte do Carmo asset sale totaling US

During the quarter the Company also announced the proposed acquisition of Ascendant Resources Inc. (see announcement dated February 3, 2025 for details). This transaction is expected to close in May 2025 subject to all necessary approvals.

Table 1. Key Operating Information

Review of Technical Information

The scientific and technical information from Minera don Nicolas in this press release has been reviewed and approved by Cid Bonfim, P. Geo., Senior Geologist Cerrado Gold, and Pierre Jean LaFleur, P. Geo., VP Exploration for Voyager Metals, a

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias Heap Leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, production forecasts and estimated AISC for 2025 and beyond, the potential for additional crushing capacity that may be added and the performance of the heap leach pad, the possibility of commencing underground mining, the potential to produce iron concentrate grading in excess of

SOURCE: Cerrado Gold Inc.

View the original press release on ACCESS Newswire