Capri Holdings Files Notice of Appeal

Capri Holdings (NYSE:CPRI) announced its intention to jointly file with Tapestry, Inc. a notice of appeal to the U.S. Court of Appeals for the Second Circuit. This appeal challenges the U.S. District Court for the Southern District of New York's decision to grant the Federal Trade Commission's motion for a preliminary injunction that blocks Tapestry's pending acquisition of Capri Holdings.

Capri Holdings (NYSE:CPRI) ha annunciato la sua intenzione di presentare congiuntamente a Tapestry, Inc. un avviso di appello presso la Corte d'Appello degli Stati Uniti per il Secondo Circuito. Questo appello contesta la decisione della Corte Distrettuale degli Stati Uniti per il Distretto Meridionale di New York di concedere la mozione della Federal Trade Commission per un'ingiunzione preliminare che blocca l'acquisizione in sospeso di Capri Holdings da parte di Tapestry.

Capri Holdings (NYSE:CPRI) anunció su intención de presentar conjuntamente con Tapestry, Inc. un aviso de apelación ante la Corte de Apelaciones de EE.UU. para el Segundo Circuito. Esta apelación impugna la decisión del Tribunal de Distrito de EE.UU. para el Distrito Sur de Nueva York de conceder la moción de la Comisión Federal de Comercio para una orden judicial preliminar que bloquea la adquisición pendiente de Capri Holdings por parte de Tapestry.

카프리 홀딩스 (NYSE:CPRI)는 태피스트리, Inc.와 함께 미국 제2 순회 항소 법원에 항소 통지를 공동 제출할 의사를 발표했습니다. 이 항소는 뉴욕 남부 지구 미국 지방 법원이 태피스트리의 카프리 홀딩스 인수에 대한 예비 금지 명령을 허가한 결정을 정당성에 도전하고 있습니다.

Capri Holdings (NYSE:CPRI) a annoncé son intention de déposer conjointement avec Tapestry, Inc. un avis d'appel auprès de la Cour d'appel des États-Unis pour le deuxième circuit. Cet appel conteste la décision du tribunal de district des États-Unis pour le district sud de New York qui a accordé la motion de la Federal Trade Commission pour une injonction préliminaire bloquant l'acquisition en cours de Capri Holdings par Tapestry.

Capri Holdings (NYSE:CPRI) hat seine Absicht bekannt gegeben, gemeinsam mit Tapestry, Inc. eine Berufung beim US-Berufungsgericht für den Zweiten Bezirk einzureichen. Diese Berufung richtet sich gegen die Entscheidung des US-Bezirksgerichts für den südlichen Bezirk von New York, den Antrag der Federal Trade Commission auf eine einstweilige Verfügung zu gewähren, die die bevorstehende Übernahme von Capri Holdings durch Tapestry blockiert.

- None.

- FTC's preliminary injunction blocks Tapestry's acquisition of Capri Holdings

- Legal obstacles potentially jeopardizing the merger completion

- Additional delays and uncertainty in the acquisition process

Insights

The appeal filing against the FTC's preliminary injunction marks a critical development in the

The legal hurdles center on antitrust concerns, particularly regarding market concentration in the accessible luxury segment. The success rate for overturning preliminary injunctions in merger cases is historically low, approximately

This appeal represents significant market implications for both entities. For Capri Holdings, the continued uncertainty affects its strategic positioning and potential operational improvements that were expected from the merger. The stock price volatility will likely persist throughout the appeals process, with downside risk if the merger ultimately fails.

The market's primary concerns include:

- Delayed synergy realization of projected

200 million in cost savings - Uncertainty in executing standalone growth strategies

- Potential impact on Capri's brand portfolio optimization

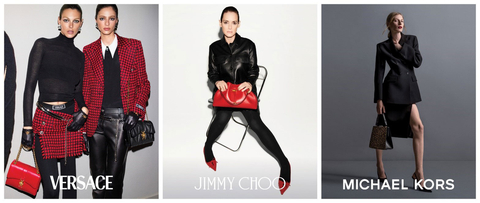

(Photo: Business Wire)

About Capri Holdings Limited

Capri Holdings is a global fashion luxury group consisting of iconic, founder-led brands Versace, Jimmy Choo and Michael Kors. Our commitment to glamorous style and craftsmanship is at the heart of each of our luxury brands. We have built our reputation on designing exceptional, innovative products that cover the full spectrum of fashion luxury categories. Our strength lies in the unique DNA and heritage of each of our brands, the diversity and passion of our people and our dedication to the clients and communities we serve. Capri Holdings Limited is publicly listed on the New York Stock Exchange under the ticker CPRI.

Forward-Looking Statements

This press release contains statements which are, or may be deemed to be, “forward-looking statements.” Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Capri about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. All statements other than statements of historical facts included herein, may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “plans”, “believes”, “expects”, “intends”, “will”, “should”, “could”, “would”, “may”, “anticipates”, “might” or similar words or phrases, are forward-looking statements. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions, which could cause actual results to differ materially from those projected or implied in any forward-looking statements, including regarding the pending merger between Tapestry, Inc. and Capri Holdings Limited. These risks, uncertainties and other factors are identified in the Company's Annual Report on Form 10-K for the fiscal year ended March 30, 2024 filed with the Securities and Exchange Commission. Please consult these documents for a more complete understanding of these risks and uncertainties. Any forward-looking statement in this press release speaks only as of the date made and Capri disclaims any obligation to update or revise any forward-looking or other statements contained herein other than in accordance with legal and regulatory obligations.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241024593346/en/

Investor Relations:

Jennifer Davis

+1 (201) 514-8234

Jennifer.Davis@CapriHoldings.com

Media:

Press@CapriHoldings.com

Source: Capri Holdings Limited