Canadian Pacific Files Formal Objection to Canadian National Using Merger Waiver that STB Granted To CP/KCS Transaction

Canadian Pacific Railway Limited (CP) filed a formal objection to the U.S. Surface Transportation Board, arguing that the Canadian National (CN) proposal to acquire Kansas City Southern (KCS) should not receive a waiver of STB's merger rules. CP asserts that the CN/KCS transaction fails to meet the criteria for the waiver, highlighting that CN is significantly larger than CP, which would destabilize rail competition. They emphasize six main points, including market overlap concerns, heightened acquisition premiums, and potential harm to competition, reinforcing the benefits of the CP/KCS combination.

- Potential competitive advantages of the CP/KCS combination.

- Preservation of a balanced six-carrier structure in North America's rail network.

- CN's larger size could significantly threaten CP's market position.

- Increased competition risks undermining CP's proposed merger with KCS.

Letter outlines six principal arguments for why the CN/KCS transaction be reviewed under 2001 merger rules

CN/KCS transaction plainly flunks the "end-to-end" test for applying the pre-2001 rules

CALGARY, AB, May 1, 2021 /PRNewswire/ - Canadian Pacific Railway Limited ("CP") (TSX: CP) (NYSE: CP) yesterday filed a formal objection with the Surface Transportation Board ("STB") stating that Canadian National ("CN") does not qualify for a waiver of the STB's rules for major transactions with respect to CN's unsolicited proposal for Kansas City Southern ("KCS").

In its letter, CP explains that the CN/KCS transaction does not satisfy any of the criteria that the STB relied upon in finding that the waiver should apply to a CP/KCS transaction, which the STB granted to CP on April 23, 2021.

The submission outlined the following reasons why a waiver should be rejected for CN's proposal:

1. CN is a much larger railroad than CP.

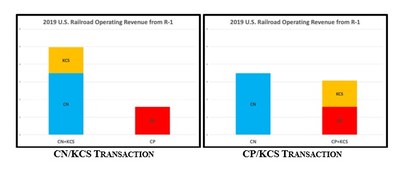

A combined CN/KCS would greatly expand the size of the fifth largest U.S. Class 1 railroad, vastly increasing the gap between CN/KCS and the new smallest Class 1, which would be CP. A combined CN/KCS would be more than three-times the size of CP, whereas the proposed CP/KCS would still be 13 percent smaller than CN (as measured by U.S. operating revenue). (Figure 1)

2. A potential CN/KCS combination heavily overlaps across much of KCS' U.S. system, unlike a CP/KCS combination.

A CN/KCS transaction plainly flunks the "end-to-end" test, notwithstanding CN's occasional and misleading assertions that such a transaction would be end-to-end. As explained in CP's April 27, 2021 letter filed with the STB, economic analysis of Waybill Sample data identifies a significant number of origin-destination corridors where the number of independent rail competitors will be reduced from 2-to-1 or 3-to-2 by the CN/KCS transaction. The verified statement of economist W. Robert Majure was filed with CP's submission and explains the screening analysis that confirmed these impacts and also confirmed that CP/KCS is in fact end-to-end.

3. The potential downstream impacts of a CN transaction are material.

Whereas CP/KCS preserves the basic six-carrier structure of the North American rail network (two in the East, two in the West, and two in Canada with routes to the Gulf), the CN/KCS transaction would destabilize that structure. To borrow CN's own words, unlike CP/KCS, the CN/KCS transaction would be a "significant restructuring of the rail industry," and the Board needs the new rules to address the "likely strategic responses."

4. CN's acquisition premium should cause the STB concern.

The extraordinary premium price CN is offering to try to disrupt CP's proposed combination with KCS ought to concern the STB, as it will not only extinguish the new competition that a CP/KCS combination would bring to CN but also require CN to find ways to recoup those extra costs. All of these consequences would arise immediately upon KCS being placed into trust as part of a CN acquisition, and the "public interest" standard of the Board's 2001 rules should be applied.

5. CN's proposal to acquire KCS would kill the CP/KCS combination and all the procompetitive effects that go with it.

The STB stated in its April 23, 2021 filing that it was applying the pre-2001 rules to the proposed CP/KCS transaction because that transaction "fall[s] neatly into the Board's rationale for adopting the waiver in the first instance." The decision emphasized the "CP and KCS networks would appear to result in the fewest overlapping routes when compared to a merger between KCS and any other Class 1 carrier". Unlike the "end-to-end" CP/KCS transaction – after which the combined company would still be the smallest Class 1 railroad – the CN/KCS proposal raises all of the concerns that the 2001 rules were adopted to address.

6. CN has already committed itself to the new merger rules.

Despite CN stating that its merger application would proceed under the current (2001) rules for major mergers, CN has also implied that its embrace of the 2001 rules was only "voluntar[y]", perhaps suggesting that the STB would lack authority to bind CN to compliance with those rules. That is another reason to make it official that the waiver does not apply and the new rules will govern.

A copy of CP's full filing is available here.

For more information on the CP/KCS transaction and the benefits it is expected to bring to the full range of stakeholders, visit FutureForFreight.com.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This news release includes certain forward looking statements and forward looking information (collectively, FLI). FLI is typically identified by words such as "anticipate", "expect", "project", "estimate", "forecast", "plan", "intend", "target", "believe", "likely" and similar words suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact may be FLI.

Although we believe that the FLI is reasonable based on the information available today and processes used to prepare it, such statements are not guarantees of future performance and you are cautioned against placing undue reliance on FLI. By its nature, FLI involves a variety of assumptions, which are based upon factors that may be difficult to predict and that may involve known and unknown risks and uncertainties and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by these FLI, including, but not limited to, the following: the timing and completion of the transaction, including receipt of regulatory and shareholder approvals and the satisfaction of other conditions precedent; interloper risk; the realization of anticipated benefits and synergies of the transaction and the timing thereof; the success of integration plans; the focus of management time and attention on the transaction and other disruptions arising from the transaction; estimated future dividends; financial strength and flexibility; debt and equity market conditions, including the ability to access capital markets on favourable terms or at all; cost of debt and equity capital; the pending share split of CP's issued and outstanding common shares; potential changes in the CP share price which may negatively impact the value of consideration offered to KCS shareholders; the ability of management of CP, its subsidiaries and affiliates to execute key priorities, including those in connection with the transaction; general Canadian, U.S., Mexican and global social, economic, political, credit and business conditions; risks associated with agricultural production such as weather conditions and insect populations; the availability and price of energy commodities; the effects of competition and pricing pressures, including competition from other rail carriers, trucking companies and maritime shippers in Canada, the U.S. and Mexico; industry capacity; shifts in market demand; changes in commodity prices; uncertainty surrounding timing and volumes of commodities being shipped; inflation; geopolitical instability; changes in laws, regulations and government policies, including regulation of rates; changes in taxes and tax rates; potential increases in maintenance and operating costs; changes in fuel prices; disruption in fuel supplies; uncertainties of investigations, proceedings or other types of claims and litigation; compliance with environmental regulations; labour disputes; changes in labour costs and labour difficulties; risks and liabilities arising from derailments; transportation of dangerous goods; timing of completion of capital and maintenance projects; currency and interest rate fluctuations; exchange rates; effects of changes in market conditions and discount rates on the financial position of pension plans and investments; trade restrictions or other changes to international trade arrangements; the effects of current and future multinational trade agreements on the level of trade among Canada, the U.S. and Mexico; climate change and the market and regulatory responses to climate change; anticipated in-service dates; success of hedging activities; operational performance and reliability; customer, shareholder, regulatory and other stakeholder approvals and support; regulatory and legislative decisions and actions; the adverse impact of any termination or revocation by the Mexican government of Kansas City Southern de Mexico, S.A. de C.V.'s Concession; public opinion; various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and technological changes; acts of terrorism, war or other acts of violence or crime or risk of such activities; insurance coverage limitations; material adverse changes in economic and industry conditions, including the availability of short and long-term financing; and the pandemic created by the outbreak of COVID-19 and resulting effects on economic conditions, the demand environment for logistics requirements and energy prices, restrictions imposed by public health authorities or governments, fiscal and monetary policy responses by governments and financial institutions, and disruptions to global supply chains.

We caution that the foregoing list of factors is not exhaustive and is made as of the date hereof. Additional information about these and other assumptions, risks and uncertainties can be found in reports and filings by CP and KCS with Canadian and U.S. securities regulators, including any proxy statement, prospectus, material change report, management information circular or registration statement to be filed in connection with the transaction. Due to the interdependencies and correlation of these factors, as well as other factors, the impact of any one assumption, risk or uncertainty on FLI cannot be determined with certainty.

Except to the extent required by law, we assume no obligation to publicly update or revise any FLI, whether as a result of new information, future events or otherwise. All FLI in this webpage is expressly qualified in its entirety by these cautionary statements.

ABOUT CANADIAN PACIFIC

Canadian Pacific (TSX: CP) (NYSE: CP) is a transcontinental railway in Canada and the United States with direct links to major ports on the west and east coasts. CP provides North American customers a competitive rail service with access to key markets in every corner of the globe. CP is growing with its customers, offering a suite of freight transportation services, logistics solutions and supply chain expertise. Visit www.cpr.ca to see the rail advantages of CP. CP-IR

ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

CP will file with the U.S. Securities and Exchange Commission (SEC) a registration statement on Form F-4, which will include a proxy statement of KCS that also constitutes a prospectus of CP, and any other documents in connection with the transaction. The definitive proxy statement/prospectus will be sent to the shareholders of KCS. CP will also file a management proxy circular in connection with the transaction with applicable securities regulators in Canada and the management proxy circular will be sent to CP shareholders. INVESTORS AND SHAREHOLDERS OF KCS AND CP ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND MANAGEMENT PROXY CIRCULAR, AS APPLICABLE, AND ANY OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC OR APPLICABLE SECURITIES REGULATORS IN CANADA IN CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KCS, CP, THE TRANSACTION AND RELATED MATTERS. The registration statement and proxy statement/prospectus and other documents filed by CP and KCS with the SEC, when filed, will be available free of charge at the SEC's website at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the registration statement, proxy statement/prospectus, management proxy circular and other documents which will be filed with the SEC and applicable securities regulators in Canada by CP online at investor.cpr.ca and www.sedar.com, upon written request delivered to CP at 7550 Ogden Dale Road S.E., Calgary, Alberta, T2C 4X9, Attention: Office of the Corporate Secretary, or by calling CP at 1-403-319-7000, and will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by KCS online at www.investors.kcsouthern.com, upon written request delivered to KCS at 427 West 12th Street, Kansas City, Missouri 64105, Attention: Corporate Secretary, or by calling KCS's Corporate Secretary's Office by telephone at 1-888-800-3690 or by email at corpsec@kcsouthern.com.

You may also read and copy any reports, statements and other information filed by KCS and CP with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-732-0330 or visit the SEC's website for further information on its public reference room. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

PARTICIPANTS IN THE SOLICITATION OF PROXIES

This communication is not a solicitation of proxies in connection with the transaction. However, under SEC rules, CP, KCS, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the transaction. Information about CP's directors and executive officers may be found in its 2021 Management Proxy Circular, dated March 10, 2021, as well as its 2020 Annual Report on Form 10-K filed with the SEC and applicable securities regulators in Canada on February 18, 2021, available on its website at investor.cpr.ca and at www.sedar.com and www.sec.gov. Information about KCS's directors and executive officers may be found on its website at www.kcsouthern.com and in its 2020 Annual Report on Form 10-K filed with the SEC on January 29, 2021, available at www.sec.gov and www.investors.kcsouthern.com. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such potential participants in the solicitation of proxies in connection with the transaction will be included in the proxy statement/prospectus and management proxy circular and other relevant materials filed with the SEC and applicable securities regulators in Canada when they become available.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/canadian-pacific-files-formal-objection-to-canadian-national-using-merger-waiver-that-stb-granted-to-cpkcs-transaction-301281577.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/canadian-pacific-files-formal-objection-to-canadian-national-using-merger-waiver-that-stb-granted-to-cpkcs-transaction-301281577.html

SOURCE Canadian Pacific

FAQ

Why did CP object to the CN/KCS transaction?

What are the main concerns outlined by CP regarding CN's acquisition of KCS?

How does CP argue that its proposed merger with KCS is more beneficial?

What is the potential impact of CN's acquisition premium for KCS?