Chilean Metals Closes $2.2 Million Financing

Chilean Metals Inc. has successfully closed a $2.2 million non-brokered private placement, issuing 3.6 million common shares at $0.25 and 3 million flow-through shares at $0.40. The funds will be allocated for exploration expenditures on the NISK Nickel project in Quebec and support its upcoming Plan of Arrangement, which includes a name change to Power Nickel Inc.. The company aims for an updated 43-101 compliant resource in Q3/Q4 2021, highlighting the potential for high-grade nickel-copper production.

- Closed a $2.2 million financing, providing capital for exploration.

- Funds will support initial drill programs at the NISK project, which has high-grade nickel-copper potential.

- Proposed name change to Power Nickel Inc. to better reflect focus on battery metals and the NISK project.

- Historical resource estimates at NISK cannot be relied upon until verified under NI 43-101.

- Acquisition and exploration success are subject to market conditions and regulatory approvals.

TORONTO, ON / ACCESSWIRE / May 4, 2021 / Chilean Metals Inc. ("Chilean Metals," "CMX" or the "Company") (TSXV:CMX)(OTCQX:CMETF)(SSE:CMX)(MILA:CMX) has closed a non-brokered private placement of

The Company has paid brokers fees and broker warrants in conjunction with the transaction. Total brokerage fees amounted to

"The additional capital will enable us to commence our initial drill program at our recently acquired option on the NISK Nickel project in James Bay Quebec. Our objective would be to provide an updated 43-101 in late Q3 or early Q4. We are excited about NISK potential to provide a high-grade Nickel Copper Cobalt Palladium project that would be well received in a market where Battery Metal pricing looks better and better!" commented Chilean CEO Terry Lynch.

Funds will also be used in the Company's proposed Plan of Arrangement. As previously announced Chilean Metals will be changing its name to, Power Nickel Inc. and will focus its efforts on the exploration and development of the Nisk project. On February 1, 2021 Chilean Metals completed the acquisition of its option to acquire up to

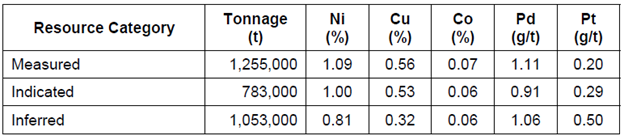

Table ‑1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its high-grade nickel-copper PGE mineralization and historical resource, identifying additional high-grade mineralization at other untested areas on the property, and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

In addition, through the Plan of Arrangement it is expected that the Companies Golden Ivan Project, in the heart of BC Golden Triangle, will become a stand-alone Public Company as will the Companies Chilean subsidiary Chilean Metals Ltd. The proposed plan of arrangement is subject to shareholder and regulatory approvals and receipt of certain tax, fairness and legal opinions and is expected to be concluded in H2 of 2021. The Company also has granted 250,000 options to a consultant.

About Chilean Metals

Chilean Metals is a Canadian junior exploration company focusing on high-potential copper, gold and battery metal prospects in Chile and Canada.

Chilean Metals is 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for

Chilean Metals has as of January 13, 2021 completed the acquisition of its option to acquire the Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in total of 67 million ounces of gold, 569 million ounces of silver and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

On February 1, 2021 Chilean Metals completed the acquisition of its option to acquire up to

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel-copper PGE mineralization historical resource to be prepared in accordance with NI 43-101, identifying additional high-grade mineralization and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

Qualified Person

Qualified Person Luke van der Meer, P.Geo. (Licence # 37848), Independent Geological Consultant, Qualified Person under NI 43-101, has reviewed and approved the technical content of this release.

ON BEHALF OF THE BOARD OF DIRECTORS

Chilean Metals Inc.

Terry Lynch, CEO

647-448-8044

For further information, readers are encouraged to contact:

CHILEAN METALS INC.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Terry Lynch

Contact: terry@chileanmetals.com

Forward-looking Statements: This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that CMX expects to occur, are forward looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although CMX believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Chilean Metals, Inc.

View source version on accesswire.com:

https://www.accesswire.com/644634/Chilean-Metals-Closes-22-Million-Financing

FAQ

What is the significance of the $2.2 million financing for CMETF?

How will the funds from the private placement be used?

What are the future plans for the NISK project?

What are the terms of the shares and broker warrants issued?