Capstone Green Energy Secures 3.6 MW EaaS Contract for a Large West Texas Oil Producer

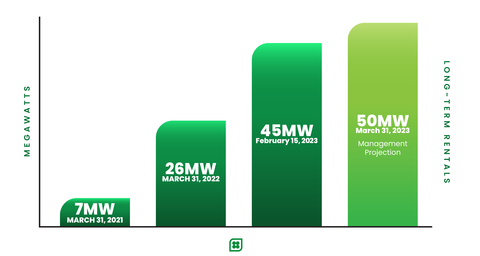

EaaS Rental Units under Contract Hits 45 MW with a Plan to Reach 50 MW by

Capstone Is Focused On Growing the EaaS Business Model as Quickly as Possible Because It Provides Higher Margins, More Constant and Predictable Revenue Streams

Capstone Green Energy EaaS Contract Growth Chart (Graphic: Business Wire)

The Company is confident in its ability to achieve sustained positive adjusted EBITDA results when it reaches its target of 50 MW - of deployed rental units, combined with its recent across-the-board price increase that went into effect on

The 3.6 MW of Capstone systems will replace traditional reciprocating engine generator rental units. Capstone Green Energy’s EaaS solution was selected due to its proven track record of reliability in the oil and gas fields across the world and its extremely low emissions profile as the energy company looks to decarbonize its operations. Additionally, the customer will benefit from fixed operating costs for the duration of the rental since all maintenance is included in the contract, providing cost savings and added convenience.

“Our focus remains our EaaS rental business and the benefits it brings us, including higher margin rates and predictable revenues and cash flow while transitioning us away from being only a manufacturing company. The growth shows our customers both need and want this solution and that we can provide it, solving both our customer’s needs and driving returns for our shareholders,” stated

“Our overall financial goals are unchanged: we are focused on growing revenue and reaching positive Adjusted EBITDA on a sustainable basis. EaaS is a pivotal factor in achieving this goal in conjunction with our recent price increase and cost control initiatives. I am confident we will meet our strategic goal of 50 MW by

About

To date, Capstone has shipped over 10,000 units to 83 countries and estimates that in FY22, it saved customers over

For customers with limited capital or short-term needs, Capstone offers rental systems; for more information, contact: rentals@CGRNenergy.com.

For more information about the Company, please visit www.CapstoneGreenEnergy.com. Follow

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including statements regarding expectations for green initiatives and execution on the Company's growth strategy and other statements regarding the Company's expectations, beliefs, plans, intentions, and strategies. The Company has tried to identify these forward-looking statements by using words such as "expect," "anticipate," "believe," "could," "should," "estimate," "intend," "may," "will," "plan," "goal" and similar terms and phrases, but such words, terms and phrases are not the exclusive means of identifying such statements. Actual results, performance and achievements could differ materially from those expressed in, or implied by, these forward-looking statements due to a variety of risks, uncertainties and other factors, including, but not limited to, the following: the ongoing effects of the COVID-19 pandemic; the availability of credit and compliance with the agreements governing the Company's indebtedness; the Company's ability to develop new products and enhance existing products; product quality issues, including the adequacy of reserves therefor and warranty cost exposure; intense competition; financial performance of the oil and natural gas industry and other general business, industry and economic conditions; the Company's ability to adequately protect its intellectual property rights; and the impact of pending or threatened litigation. For a detailed discussion of factors that could affect the Company's future operating results, please see the Company's filings with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20230215005357/en/

Investor and investment media inquiries:

818-407-3628

ir@CGRNenergy.com

Source: