Capstone Green Energy Continues Its Success in the EaaS Market with Multiple New Oil and Gas Long-Term Rental Contracts Totaling 2.2 MW

Capstone is Focused on Growing the EaaS Business Rental Fleet to 50 MW, Using a Portion of the Proceeds from the Recent

(Graphic: Business Wire)

The new orders include:

-

A 1.4 MW long-term rental contract that is to be deployed in early 2023 in

Louisiana , -

An additional six C65 microturbines totaling 390kW of rental power in the

U.S. shale fields, and -

Another 400kW of power generation to an oil and gas operator on the North Slopes of

Alaska at an existing rental location.

“This 2.2 MW rental expansion into the oil and gas market further diversifies the rental fleet’s customer base, now covering all major market verticals: oil and gas, agriculture, hospitality, datacenters as well as commercial and industrial sites. The rental program eases access to Capstone’s premium product, allowing customers to enjoy the benefits of clean, low cost, reliable power where capital is limited or competing for other spends,” said

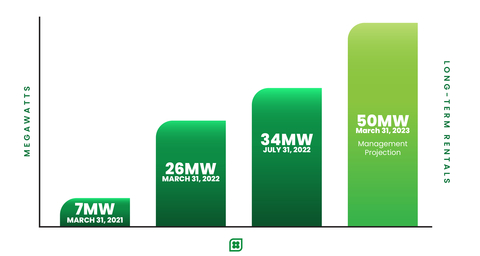

“Capstone is seeing strong customer demand across industries for its EaaS long-term rental services, which had 7 MW under contract in

The 1.4 MW solution, which features a Capstone Green Energy C800 and C600 Signature Series microturbine will replace an existing rental reciprocating genset and produce clean and reliable electricity using natural gas directly from the pipeline. The power generated by the microturbines will provide 100 percent of the electricity needed to power on-site pumping equipment such as coolers, motors, pumps, and lights, in addition to an on-site office.

The facility operators wanted a modular, reliable, and cost-effective solution to replace their high-maintenance reciprocating genset. The microturbines, which have only one moving part and use no consumables or lubricants, are a low-maintenance solution, which is a key benefit given the site's remote location. Compared to the former gensets, the new microturbine solution will operate with N+1 redundancy and can be easily expanded.

The additional C65 rental contracts will be deployed across various oil and gas sites and be fueled by natural gas directly from the well sites. This allows customers to keep operational costs low by avoiding extra fuel-cleaning equipment and significantly reducing the negative impact on the environment.

"Facing growing pressure to address climate change, oil and gas companies are pledging to prepare for a ‘lower-carbon’ future. For many, that involves investing in new technologies and infrastructure that can support new, greener ways of generating electricity. These are the key areas in which

About

To date, Capstone has shipped over 10,000 units to 83 countries and estimates that in FY22, it saved customers over

For customers with limited capital or short-term needs, Capstone offers rental systems; for more information, contact: rentals@CGRNenergy.com.

For more information about the Company, please visit www.CapstoneGreenEnergy.com. Follow

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s target for growth of its rental fleet and other statements regarding the Company's expectations, beliefs, plans, intentions, and strategies. The Company has tried to identify these forward-looking statements by using words such as "expect," "anticipate," "believe," "could," "should," "estimate," "intend," "may," "will," "plan," "goal" and similar terms and phrases, but such words, terms and phrases are not the exclusive means of identifying such statements. Actual results, performance and achievements could differ materially from those expressed in, or implied by, these forward-looking statements due to a variety of risks, uncertainties and other factors, including, but not limited to, the following: the sufficiency of the Company’s working capital to meet its rental fleet growth target; the ongoing effects of the COVID-19 pandemic; the availability of credit and compliance with the agreements governing the Company's indebtedness; the Company's ability to develop new products and enhance existing products; product quality issues, including the adequacy of reserves therefor and warranty cost exposure; intense competition; financial performance of the oil and natural gas industry and other general business, industry and economic conditions; the Company's ability to adequately protect its intellectual property rights; and departures and other changes in management and other key employees. For a detailed discussion of factors that could affect the Company's future operating results, please see the Company's filings with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20220824005258/en/

Investor and investment media inquiries:

818-407-3628

ir@CGRNenergy.com

Source: