Oscilar Launches Revolutionary Device and Behavioral Intelligence Solution to Combat AI-Powered Fraud

Rhea-AI Summary

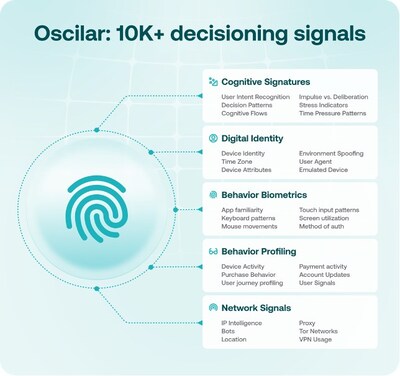

Oscilar has launched its Cognitive Identity Intelligence Platform to combat AI-powered fraud, which is projected to cause $40 billion in losses by 2027. The platform analyzes thousands of digital markers to create unique cognitive signatures that are reportedly impossible to replicate, even with advanced AI tools. Led by former Confluent co-founder Neha Narkhede, the solution features advanced polymorphic code, dynamic execution paths, and real-time processing capable of handling over 100,000 transactions per second. The platform is already being utilized by several financial institutions, including Happy Money and Curve, demonstrating improvements in fraud prevention while maintaining user experience.

Positive

- Platform can process over 100,000 transactions per second, demonstrating robust scalability

- Already adopted by multiple financial institutions including Happy Money and Curve

- Addresses growing market need with AI fraud losses projected to reach $40B by 2027

- Technology leverages thousands of digital markers for enhanced security

Negative

- New product in highly competitive market with established players

- Success depends on staying ahead of rapidly evolving AI-powered fraud techniques

News Market Reaction

On the day this news was published, CFLT declined 1.62%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

New offering intended to protect against projected

At its current growth rate, Deloitte's Center for Financial Services predicts that generative AI could enable fraud losses to reach

Led by CEO Neha Narkhede–who previously co-created Apache Kafka and founded Confluent (NASDAQ: CFLT), growing it into a

"Traditional device intelligence and behavioral biometrics haven't kept pace with fraudsters' increasingly sophisticated techniques," said Narkhede. "We've assembled an AI-first team of top risk and Machine Learning engineers to develop technology that fundamentally changes how organizations approach digital identity, behavior and intent analysis in the AI era."

Oscilar's Digital & Behavior Identification revolutionary approach analyzes thousands of digital markers across network, device, and behavioral layers to create cognitive signatures that are impossible to replicate – even with advanced AI tools. Unlike traditional solutions that expose their detection logic, Oscilar's security-first architecture employs advanced polymorphic code and dynamic execution paths, ensuring no two sessions look alike and making it virtually impossible for automated tools to learn our patterns. This complex signal network is processed in real-time through Oscilar's distributed architecture, enabling ML models to instantly adapt to new fraud patterns while maintaining consistent protection even during peak loads of over 100,000 transactions per second.

The solution was developed under the leadership of Chief Product Officer Saurabh Bajaj, who brings extensive experience building and scaling fraud prevention technologies that protect Fortune 500 companies, 8 of the top US banks, government agencies, telecommunications providers, healthcare organizations, and various fintechs and financial institutions.

"We've combined deep cybersecurity principles with fraud prevention expertise to create something entirely new and groundbreaking," said Bajaj. "Our security-first architecture makes it practically impossible for fraudsters to reverse engineer or circumvent our technology, while simultaneously reducing friction for legitimate users."

The platform introduces several industry-first innovations:

- Advanced Cognitive Signature Technology: Creates unique digital fingerprints and cognitive signatures to identify users across different devices and user journeys, making synthetic identity creation virtually impossible

- Security-First Architecture: Prevents sophisticated reverse engineering attempts through military-grade protection that keeps detection methods hidden from fraudsters

- End-to-End Journey Protection: Continuous authentication across all user touchpoints with real-time risk assessment and adaptation

- Real-Time AI Intelligence: Leverages generative AI to continuously adapt ML models and risk strategies, staying ahead of emerging threats

- Seamless Enterprise Integration: Native compatibility with existing risk systems and Oscilar's Decision Engine, Case Management, and AI-Analytics suite, enabling rapid deployment and immediate value

The solution is already being used by over a dozen major financial institutions, including Happy Money and Curve, demonstrating significant improvements in fraud prevention while enhancing legitimate user experiences.

"At Happy Money, protecting our business from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance," said Angela Kernell, Manager, Fraud Operations at Happy Money. "Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Learn more about Oscilar's Cognitive Identity Intelligence Platform by visiting https://oscilar.com/blog/cognitive-identity-intelligence-platform.

About Oscilar

Based in

Contact: press@oscilar.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/oscilar-launches-revolutionary-device-and-behavioral-intelligence-solution-to-combat-ai-powered-fraud-302305720.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/oscilar-launches-revolutionary-device-and-behavioral-intelligence-solution-to-combat-ai-powered-fraud-302305720.html

SOURCE Oscilar