Camber Energy Provides Update to Shareholders

Camber Energy (OTCQB:CEIN) provides a shareholder update, highlighting key developments:

1. OTCQB Upgrade: Effective August 27, 2024, CEIN stock approved for OTCQB Venture Market quotation.

2. NYSE American Delisting: Company disagrees with NYSE's decision, opting for OTCQB to limit exposure to market volatility.

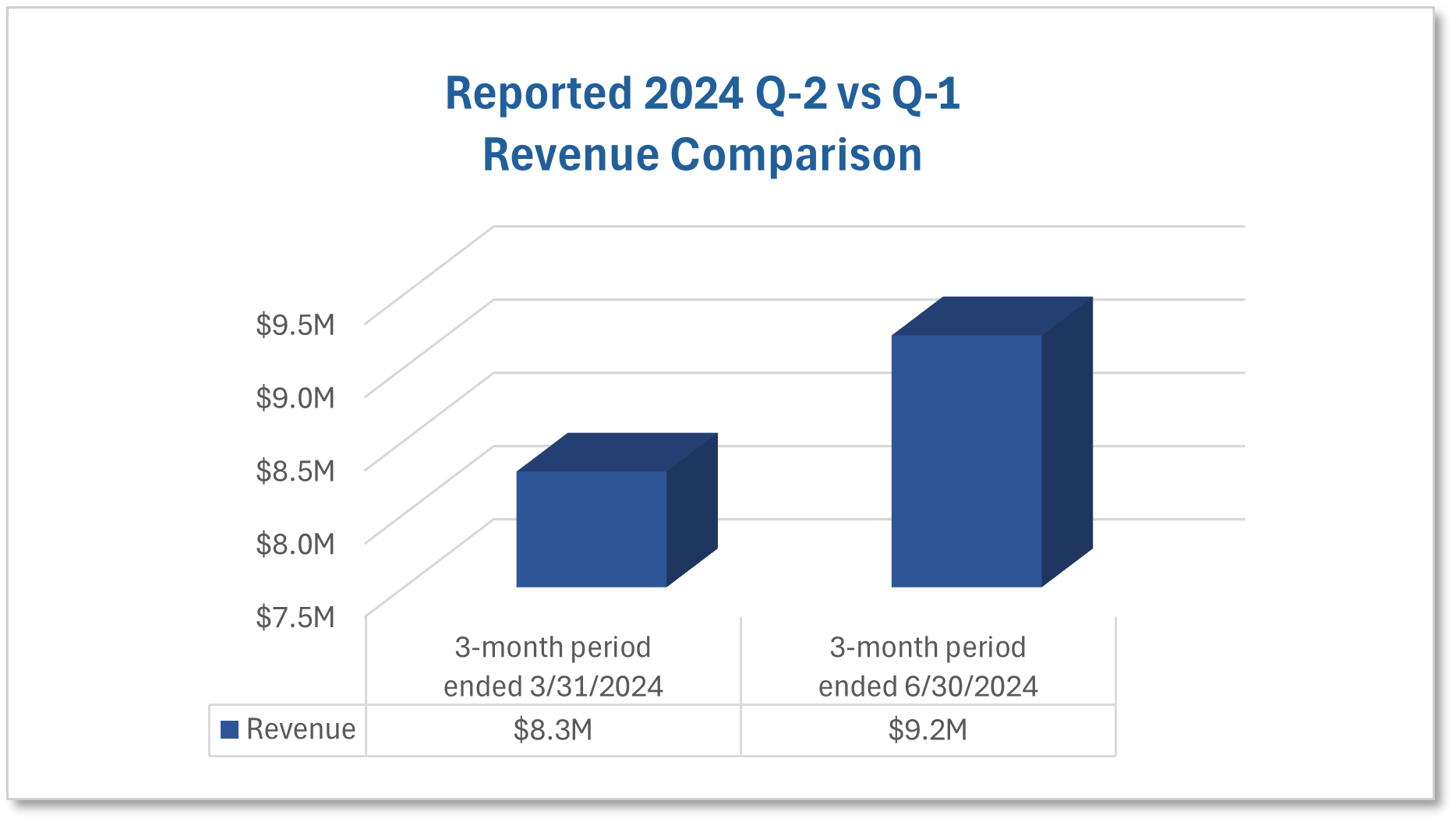

3. Financial Performance: Q2 2024 revenue at $9.22 million, up 19.66% from Q1 2024's $8.29 million.

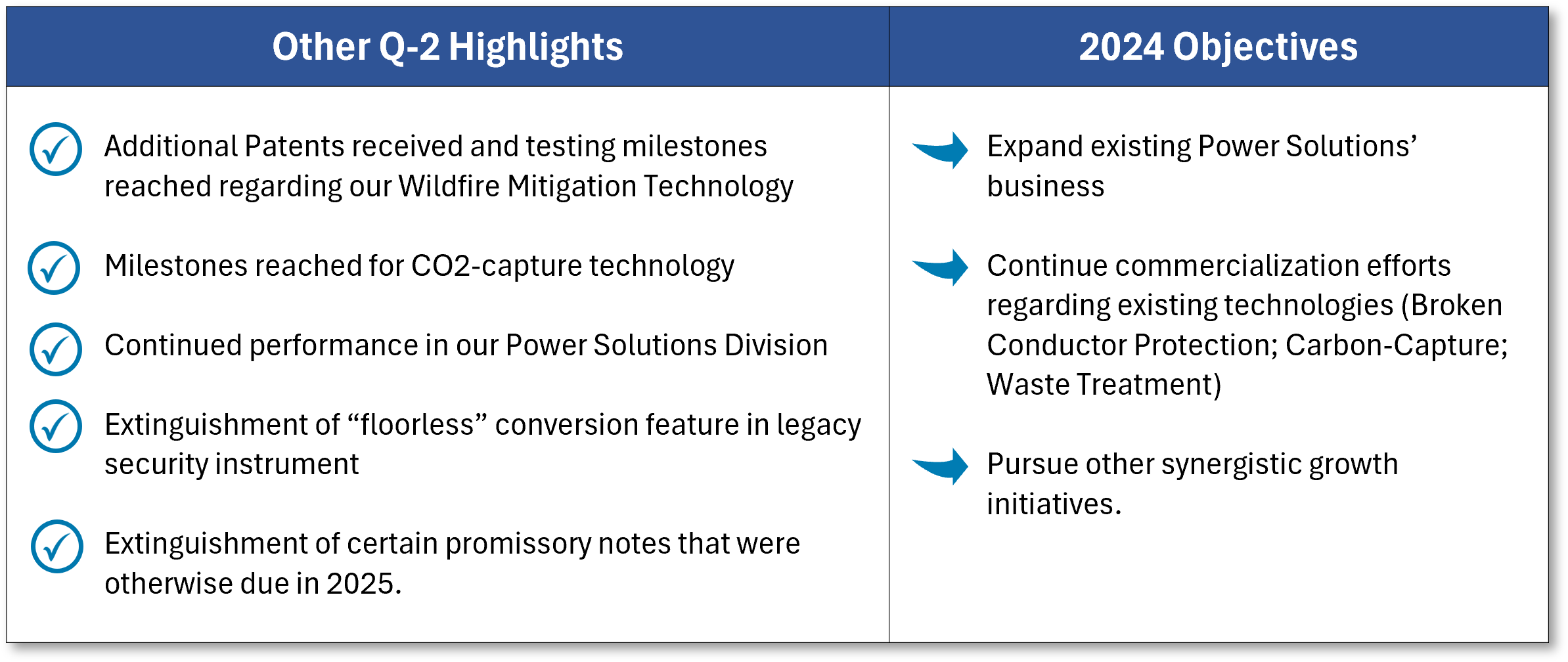

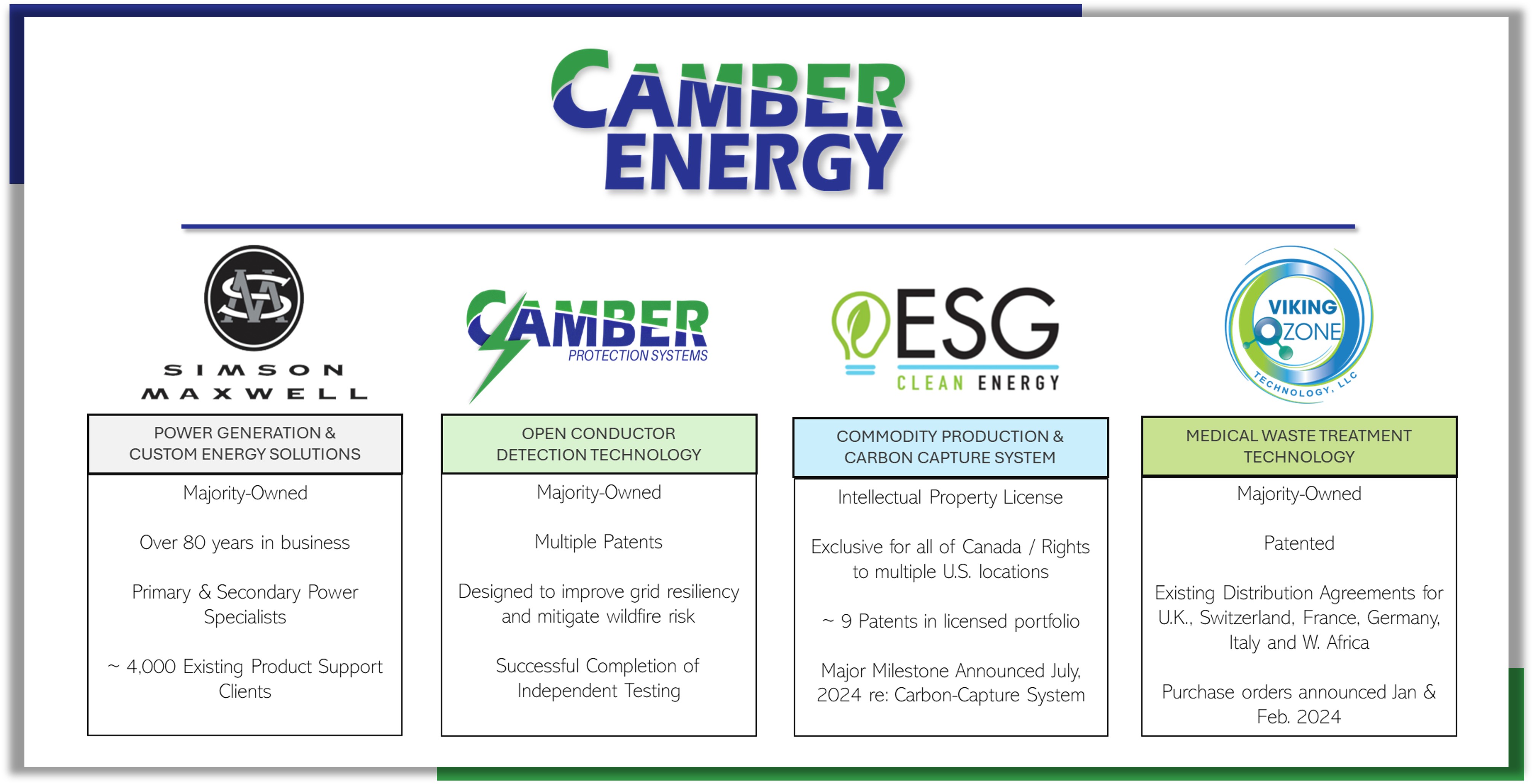

4. Business Portfolio: Includes Simson-Maxwell (power solutions), Broken Conductor Protection (wildfire risk reduction), ESG Clean Energy System (carbon-capture technology), and Viking Ozone Technology (waste treatment).

The company emphasizes its focus on executing growth strategy and improving in all controllable areas.

Camber Energy (OTCQB:CEIN) fornisce un aggiornamento agli azionisti, evidenziando sviluppi chiave:

1. Upgrade OTCQB: A partire dal 27 agosto 2024, le azioni di CEIN sono state approvate per la quotazione nel mercato OTCQB Venture.

2. Delisting NYSE American: L'azienda non è d'accordo con la decisione della NYSE, optando per l'OTCQB per limitare l'esposizione alla volatilità del mercato.

3. Performance Finanziaria: Le entrate del secondo trimestre 2024 ammontano a 9,22 milioni di dollari, in aumento del 19,66% rispetto agli 8,29 milioni di dollari del primo trimestre 2024.

4. Portfolio Aziendale: Include Simson-Maxwell (soluzioni energetiche), Protezione da Conduttori Rotti (riduzione del rischio di incendi), Sistema di Energia Pulita ESG (tecnologia di cattura del carbonio) e Tecnologia Ozonizzante Viking (trattamento dei rifiuti).

L'azienda sottolinea il suo impegno nell'eseguire la strategia di crescita e nel migliorare in tutte le aree controllabili.

Camber Energy (OTCQB:CEIN) proporciona una actualización a los accionistas, destacando desarrollos clave:

1. Mejora a OTCQB: A partir del 27 de agosto de 2024, las acciones de CEIN han sido aprobadas para cotizar en el mercado OTCQB Venture.

2. Delisting de NYSE American: La empresa no está de acuerdo con la decisión de la NYSE y opta por el OTCQB para limitar la exposición a la volatilidad del mercado.

3. Desempeño Financiero: Los ingresos del segundo trimestre de 2024 son de 9,22 millones de dólares, un aumento del 19,66% respecto a los 8,29 millones de dólares del primer trimestre de 2024.

4. Cartera de Negocios: Incluye Simson-Maxwell (soluciones energéticas), Protección de Conductores Rotos (reducción del riesgo de incendios), Sistema de Energía Limpia ESG (tecnología de captura de carbono) y Tecnología de Ozono Viking (tratamiento de residuos).

La empresa enfatiza su enfoque en ejecutar la estrategia de crecimiento y mejorar en todas las áreas controlables.

Camber Energy (OTCQB:CEIN)는 주주 업데이트를 제공하며, 주요 발전 사항을 강조합니다:

1. OTCQB 업그레이드: 2024년 8월 27일부터 CEIN 주식이 OTCQB 벤처 시장에서 상장 승인을 받았습니다.

2. NYSE American 상장 폐지: 회사는 NYSE의 결정에 동의하지 않으며, 시장 변동성 노출을 제한하기 위해 OTCQB로 이동하기로 했습니다.

3. 재무 성과: 2024년 2분기 수익이 922만 달러로, 2024년 1분기의 829만 달러에서 19.66% 증가했습니다.

4. 사업 포트폴리오: Simson-Maxwell(전력 솔루션), Broken Conductor Protection(산불 위험 감소), ESG 청정 에너지 시스템(탄소 포집 기술), Viking Ozone Technology(폐기물 처리)를 포함합니다.

회사는 성장 전략 실행 및 모든 통제 가능한 분야에서의 개선에 집중하고 있음을 강조합니다.

Camber Energy (OTCQB:CEIN) fournit une mise à jour aux actionnaires en mettant en avant des développements clés :

1. Amélioration OTCQB : À compter du 27 août 2024, l'action CEIN a été approuvée pour cotation sur le marché OTCQB Venture.

2. Radiation de NYSE American : L'entreprise n'est pas d'accord avec la décision de la NYSE et choisit l'OTCQB pour limiter son exposition à la volatilité du marché.

3. Performance Financière : Les revenus du deuxième trimestre 2024 s'élèvent à 9,22 millions de dollars, en hausse de 19,66% par rapport aux 8,29 millions de dollars du premier trimestre 2024.

4. Portefeuille d'Affaires : Comprend Simson-Maxwell (solutions énergétiques), Protection de Conducteurs Cassés (réduction des risques d'incendie), Système d'Énergie Propre ESG (technologie de capture du carbone) et Technologie d'Ozone Viking (traitement des déchets).

L'entreprise souligne son engagement à exécuter la stratégie de croissance et à s'améliorer dans tous les domaines contrôlables.

Camber Energy (OTCQB:CEIN) gibt ein Update für Aktionäre und hebt wichtige Entwicklungen hervor:

1. OTCQB-Upgrade: Ab dem 27. August 2024 wurde die CEIN-Aktie für die OTCQB Venture Market-Zulassung genehmigt.

2. Delisting von NYSE American: Das Unternehmen stimmt der Entscheidung der NYSE nicht zu und entscheidet sich für OTCQB, um die Exponierung gegenüber Marktschwankungen zu begrenzen.

3. Finanzielle Leistung: Der Umsatz im 2. Quartal 2024 beträgt 9,22 Millionen Dollar, was einem Anstieg von 19,66% gegenüber 8,29 Millionen Dollar im 1. Quartal 2024 entspricht.

4. Geschäftsportfolio: Umfasst Simson-Maxwell (Energielösungen), Broken Conductor Protection (Reduzierung des Waldbrandrisikos), ESG Clean Energy System (CO2-Abscheidetechnologie) und Viking Ozone Technology (Abfallbehandlung).

Das Unternehmen betont seinen Fokus auf die Umsetzung der Wachstumsstrategie und die Verbesserung in allen kontrollierbaren Bereichen.

- Upgrade to OTCQB Venture Market, providing improved transparency and information access for investors

- Q2 2024 revenue increased by 19.66% compared to Q1 2024, reaching $9.22 million

- Diversified portfolio including power solutions, wildfire risk reduction technology, carbon-capture systems, and waste treatment technology

- Delisting from NYSE American due to low stock price

- Potential exposure to market volatility and questionable trading practices on national exchanges

HOUSTON, TX / ACCESSWIRE / August 27, 2024 / Camber Energy, Inc. (OTCQB:CEIN) ("Camber" or the "Company"), a growth-oriented diversified energy company, today shares an open letter to shareholders.

Dear Shareholders,

We take this opportunity to provide a brief update on certain matters involving the Company.

OTC:QB Designation

Effective August 27, 2024, the Company's shares of common stock, trading under the symbol "CEIN", have been approved for upgraded quotation on the OTCQB Venture Market. The OTCQB is a premier marketplace for entrepreneurial and development stage U.S. and international companies that are committed to providing a high-quality trading and information experience for their U.S. investors. To be eligible, companies must be current in their financial reporting, pass a minimum bid price test, and undergo an annual company verification and management certification process every six months. The OTCQB quality standards provide a strong baseline of transparency, as well as the technology and regulation to improve investors' access to information and trading experience.

NYSE (American)

We respectfully disagree that it was necessary for the staff at the NYSE (American) to exercise their discretion and commence delisting proceedings vis-à-vis Camber due to the low stock price, in particular given current macroeconomic conditions and geopolitical tensions in certain regions. We were confident in the ability to successfully appeal the NYSE's decision if we demonstrated an immediate intent to effect a reverse stock split at a significant consolidation ratio but we were concerned about immediately re-exposing shareholders to the vagaries of the stock market and to what some believe have been questionable trading practices on the national exchanges over the past twelve to eighteen months, in particular involving small and mid-cap companies. It is very possible that our stock price would decline immediately or shortly thereafter, as has happened with other companies recently as well as our own in prior years following a stock split.

As we continue to focus on executing our growth strategy, we believe it is appropriate for the near term to limit the Company and its shareholders' exposure to as many external factors as possible while still being listed on a reputable and recognized trading platform that provides liquidity for shareholders.

Recent Milestones / Current Portfolio

Thanks to our dedicated team, Camber has achieved many important milestones over the past several months.

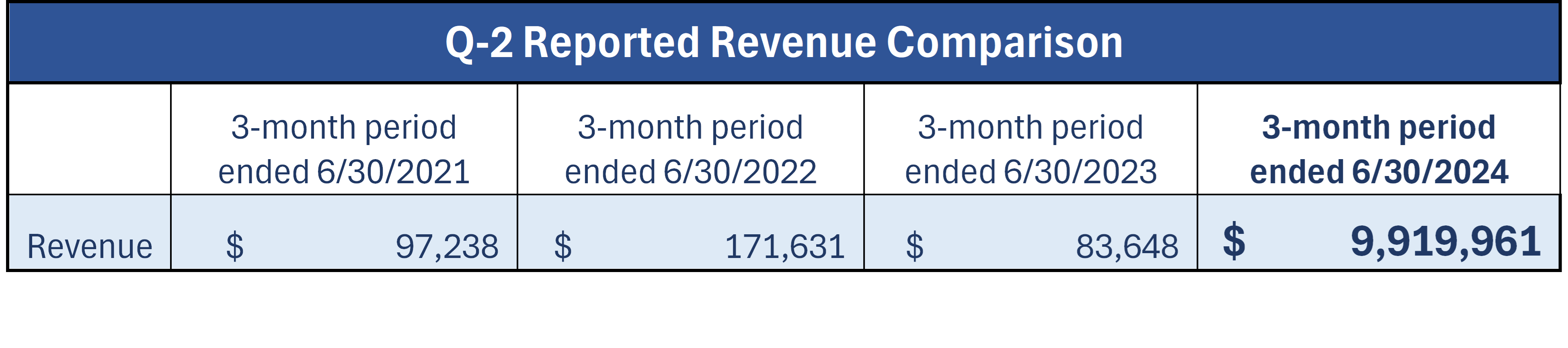

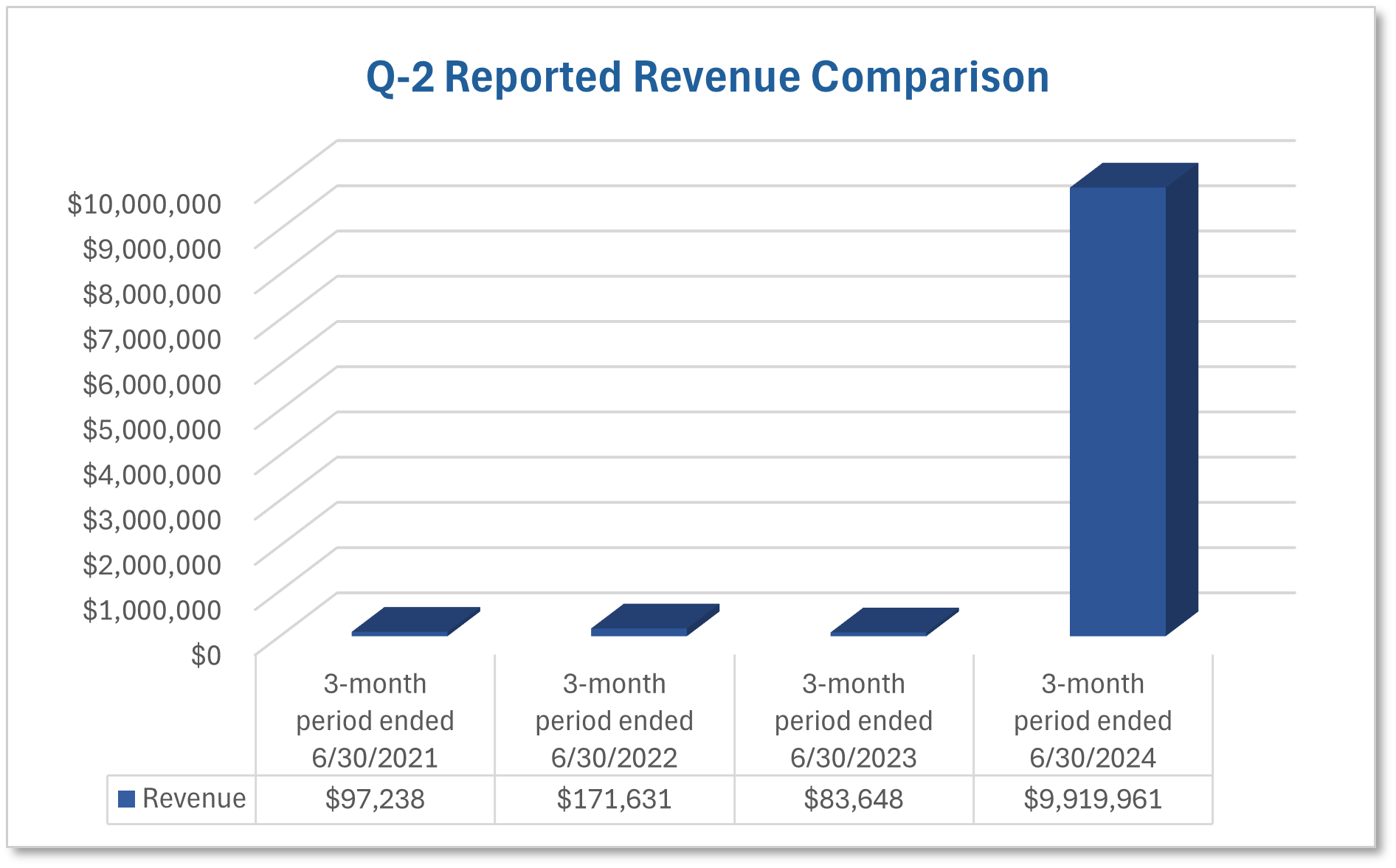

Revenue Comparison

Q-2 Historical Reported Revenue Comparison:

Revenues for Q-2 2024 were derived primarily from the Company's power solutions' business, including from the design, sale and/or service of power generation units and systems.

2024 Q-2 versus Q-1 Comparison:

Revenues for the quarter ended 6/30/2024 were

All figures referenced above are approximate and all descriptions above are qualified in their entirety by Camber's filings with the Securities and Exchange Commission (the "SEC") including, without limitation, Camber's Quarterly Report on Form 10-Q filed on August 26, 2024 with the SEC (the "10-Q") and available under "Investors -- SEC Filings" at www.camber.energy. The prior period comparative financial information in the 10-Q is, as noted therein, that of Viking Energy Group, Inc. ("Viking"), a wholly-owned subsidiary of Camber as a result of the merger involving Camber and Viking that closed on or about August 1, 2023.

Other Highlights

Other highlights from 2024, as previously disclosed, include:

Current Portfolio

Camber has a majority interest in a long-standing, active business in a high-demand / high-growth sector, along with interests in industry-changing technologies that are beyond the research and development phase and in the early stages of commercialization:

Simson-Maxwell Ltd . (https://www.simson-maxwell.com/) - Majority owned by Camber

Reputable participant in the power solutions' business for over 80 years

Demand for primary and secondary power solutions is going to increase for many years as power consumption increases

Appropriate catalyst/platform to facilitate and manage growth given existing team (100 employees) and relationships (approx. 4,000 customers)

Broken Conductor Protection (https://camberprotection.com/)

Solution designed to assist utilities with reducing wildfire risk and improving grid resiliency

Multiple patents

Independently tested by two nationally-recognized laboratories

ESG Clean Energy System / Carbon-Capture Technology (https://esgcleanenergy.com/)

License to expansive intellectual property portfolio to unique clean energy & carbon-capture system

Exclusive for all of Canada and for several locations in the U.S.

Multiple revenue streams available through patented system

Designed to make carbon-capture economically viable (existing methods are energy-intensive and cost prohibitive)

Viking Ozone Technology (https://vkin-ozone.com/)

clean, safe and sustainable technology for waste treatment

institutions (e.g. hospitals) and waste management companies are actively searching for alternatives to existing methods

Our majority-owned subsidiary, Simson-Maxwell, is already an approved vendor with a UK-based National Health Services Trust that manages approx. 1,000 hospitals

Established distribution arrangements in the UK, France, Switzerland and other countries

We are grateful for the support and contributions of our talented team and for the support from our stakeholders, and remain steadfast in our commitment to improve in all areas within our control.

*****

Sincerely,

James A. Doris

President & CEO

Camber Energy, Inc.

About Camber Energy, Inc.

Camber Energy, Inc. is a growth-oriented diversified energy company. Through its wholly-owned subsidiary, Viking Energy Group, Inc., Camber: (i) provides custom energy & power solutions to commercial and industrial clients in North America; (ii) holds an exclusive license in Canada to a patented carbon-capture system; and (iii) has a majority interest in: (a) entities with the intellectual property rights to patented and patent pending electric transmission and distribution broken conductor protection systems; and (b) an entity with intellectual property rights to a patented medical & bio-hazard waste treatment system using ozone technology. For more information, please visit the company's website at www.camber.energy.

SEC Reports

All figures referenced herein are approximate and all descriptions above are qualified in their entirety by Camber's filings with the SEC and available under "Investors -- SEC Filings" at www.camber.energy.

Forward-Looking Statements

This press release may contain forward-looking information within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Any statements that are not historical facts contained in this press release are "forward-looking statements", which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward-looking statements are based on current expectations, involve known and unknown risks, a reliance on third parties for information, transactions that may be cancelled, and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from anticipated results include risks and uncertainties related to the fluctuation of global economic conditions or economic conditions with respect to the oil and gas industry, the COVID-19 pandemic, the performance of management, actions of government regulators, vendors, and suppliers, our cash flows and ability to obtain financing, competition, general economic conditions and other factors that are detailed in Camber's filings with the Securities and Exchange Commission. We intend that all forward-looking statements be subject to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Camber cautions that the foregoing list of important factors is not complete, any forward-looking statement speaks only as of the date on which such statement is made, and Camber does not undertake to update any forward-looking statements that it may make, whether as a result of new information, future events or otherwise, except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Camber or any person acting its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Contact Information

Investors and Media:

Tel. 281.404.4387

SOURCE: Camber Energy, Inc.

View the original press release on accesswire.com