Camber Reports Q1 Revenue of $8.3M & $20.2M of Stockholders' Equity

Camber Energy, Inc. reported Q1 revenue of $8.3M and stockholders' equity of $20.2M. The company highlighted revenue growth following the merger with Viking Energy Group, Inc. Revenues primarily came from the power solutions business. Other Q1 highlights include improved stockholders' equity, patents received for technology, milestones in CO2-capture technology, and performance in the power solutions division.

Improved Q1 revenue compared to previous years, showcasing growth following the merger

Enhanced stockholders' equity of $20.2M, a significant improvement from the previous year

Received additional patents for Broken Conductor Protection Technology, indicating innovation and technological advancements

Achieved milestones in CO2-capture technology, demonstrating progress in environmental initiatives

Successful performance in the Power Solutions Division, showcasing operational efficiency and revenue generation

Execution of distribution agreements and announced purchase orders in the Viking Ozone Division, indicating business expansion and revenue potential

- None.

Insights

Historical Q-1 Revenue Comparison Highlights Growth Following Merger

HOUSTON, TX / ACCESSWIRE / May 13, 2024 / Camber Energy, Inc. (NYSE American:CEI) ("Camber" or the "Company") filed on May 10, 2024 its quarterly report on Form 10-Q for the quarter ended 3/31/2024, and is pleased to share a comparison of revenues reported in Q-1 2024 versus revenues reported by the Company in Q-1 for the preceding few years, demonstrating growth following the closing of CEI's merger with Viking Energy Group, Inc.

Q-1 Revenue Comparison:

| CEI - Q1 Reported Revenue Comparison | |||||||||||||||||

| 3-month period ended 3/31/2021 | 3-month period ended 3/31/2022 | 3-month period ended 3/31/2023 | 3-month period ended 3/31/2024 | ||||||||||||||

Revenue | $ | 33,689 | $ | 136,407 | $ | 93,471 | $ | 8,292,532 | |||||||||

Revenues for Q-1 2024 were derived primarily from the Company's power solutions' business, including from the design, sale and/or service of power generation units and systems.

Other Q-1 Highlights:

- Stockholders' Equity of

$20.2 million , compared to deficit of ($19.5 million ) in Q-1 2023 - Additional Patents received for Broken Conductor Protection Technology

- Milestones reached for CO2-capture technology

- Performance in Power Solutions Division

- Distribution Agreements Executed and P.O.'s Announced in Viking Ozone Division

About Camber Energy, Inc.

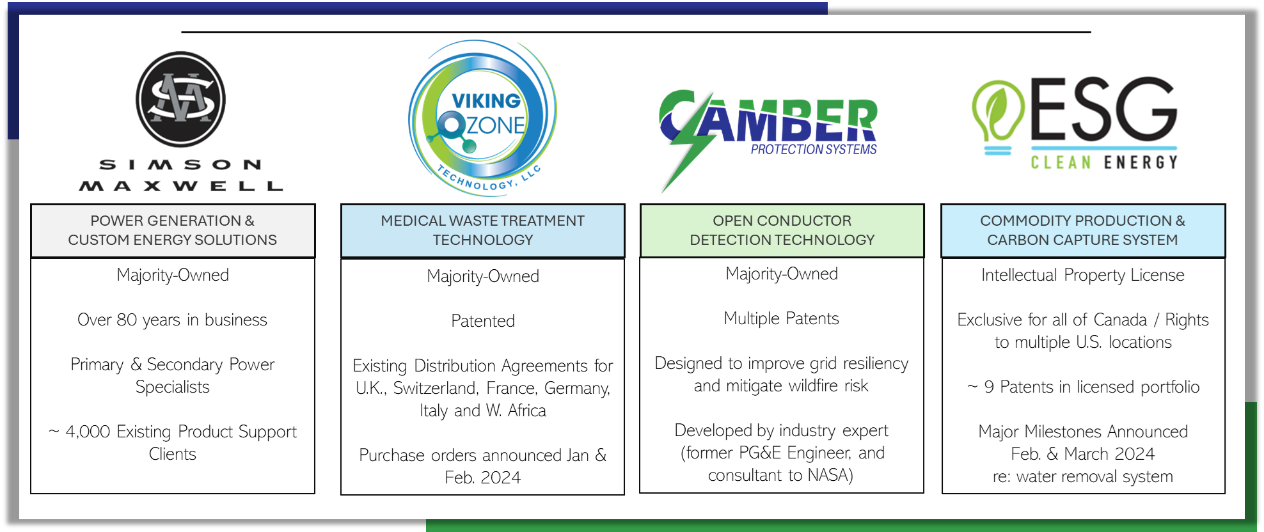

Camber Energy, Inc. is a growth-oriented diversified energy company. Through its wholly-owned subsidiary, Viking Energy Group, Inc., Camber: (i) provides custom energy & power solutions to commercial and industrial clients in North America; (ii) holds an exclusive license in Canada to a patented carbon-capture system; and (iii) has a majority interest in: (a) an entity with intellectual property rights to a patented, ready-for-market proprietary Medical & Bio-Hazard Waste Treatment system using Ozone Technology; and (b) entities with the intellectual property rights to patented and patent pending, ready-for-market proprietary Electric Transmission and Distribution Open Conductor Detection Systems. For more information, please visit the company's website at www.camber.energy.

SEC Reports

All figures referenced herein are approximate and all descriptions above are qualified in their entirety by Camber's filings with the Securities and Exchange Commission ("SEC") including, without limitation, Camber's Quarterly Report on Form 10-Q filed on May 10, 2024 with the SEC (the "10-Q") and available under "Investors -- SEC Filings" at www.camber.energy. The prior period comparative financial information in the 10-Q is, as noted therein, that of Viking Energy Group, Inc. ("Viking"), a wholly-owned subsidiary of Camber as a result of the Merger involving Camber and Viking that closed on or about August 1, 2023.

Forward-Looking Statements

This press release may contain forward-looking information within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Any statements that are not historical facts contained in this press release are "forward-looking statements", which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipates," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward-looking statements are based on current expectations, involve known and unknown risks, a reliance on third parties for information, transactions that may be cancelled, and other factors that may cause our actual results, performance or achievements, or developments in our industry, to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially from anticipated results include risks and uncertainties related to the fluctuation of global economic conditions or economic conditions with respect to the oil and gas industry, the COVID-19 pandemic, the performance of management, actions of government regulators, vendors, and suppliers, our cash flows and ability to obtain financing, competition, general economic conditions and other factors that are detailed in Camber's filings with the Securities and Exchange Commission. We intend that all forward-looking statements be subject to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Camber cautions that the foregoing list of important factors is not complete, any forward-looking statement speaks only as of the date on which such statement is made, and Camber does not undertake to update any forward-looking statements that it may make, whether as a result of new information, future events or otherwise, except as required by applicable law. All subsequent written and oral forward-looking statements attributable to Camber or any person acting its behalf are expressly qualified in their entirety by the cautionary statements referenced above.

Contact Information:

Investors and Media:

Tel. 281.404.4387

SOURCE: Camber Energy, Inc.

View the original press release on accesswire.com