Cloud DX Reports FY2023 Results

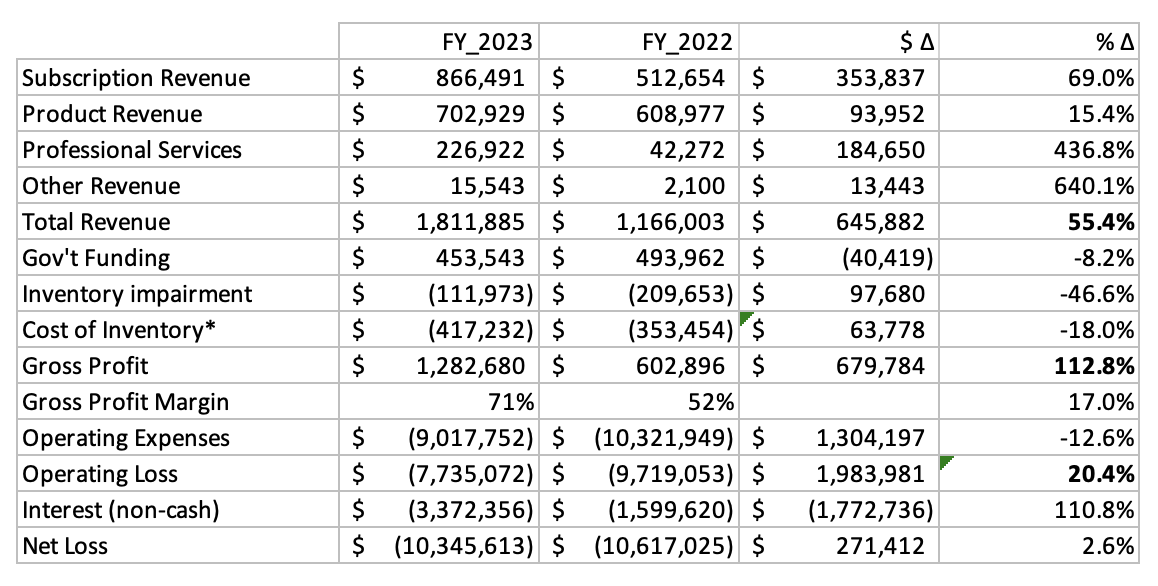

Cloud DX reported strong financial performance for FY2023 with a 55.4% increase in total revenue, 69% increase in subscription revenue, 112.8% increase in gross profit, and 20.4% reduction in operating loss compared to FY2022. The company saw significant growth in new contracts, especially in the healthcare sector, leading to improved revenues. Operating expenses were reduced, leading to increased profitability. Cloud DX also announced several new contracts and contract extensions post FY2023, showcasing continued growth and business expansion.

55.4% increase in total revenue for FY2023.

69% increase in subscription revenue.

112.8% increase in gross profit compared to FY2022.

Reduction of 20.4% in operating loss for FY2023.

Strong growth in new contracts in the healthcare sector.

Reduction in operating expenses by 12.6% leading to increased profitability.

Announcement of 24 new contracts and contract extensions post FY2023.

8.2% decrease in government grant funding for FY2023.

Decrease in professional services revenue and grant funding amounts due to payment timing.

Cost of inventories increased in 2023 compared to 2022.

Announcement of Private Placement offering up to 27,500,000 Units at $0.12/Unit for gross proceeds of $3.3 million.

Highlights include

Key Developments:

- Total Revenue of

$1,811,885 represents an increase of55.4% compared to FY2022 due to increases in both new contracts signed and growth of existing contracts. - Gross profit in FY2023 doubled from

$602,896 t o$1,282,680 compared to FY2022 due to increased subscription revenue (up69% YoY), product revenue (up15.4% YoY) and professional services revenue (up436.8% YoY). - Operating expenses were reduced by

$1,304,197 or12.6% in 2023 vs 2022 due to increases in efficiency, and reductions in staff costs. - Operating loss was reduced by

$1,990,085 or20.4% due to reduced costs and increased profitability.

KITCHENER, ON / ACCESSWIRE / April 29, 2024 / Cloud DX (TSXV:CDX)(OTCQB:CDXFF), a leading North American digital health platform and provider of remote patient monitoring (RPM) solutions, is pleased to report results for the 12 months ending December 31, 2023.

Earnings Call Webinar:

Monday April 29, 2024

11:00 AM PDT / 2:00 PM EDT

Registration - click here

Fiscal Year 2023 Financial Highlights:

Summary of Results:

Revenue:

For the year end December 31, 2023, total reported revenue of

Subscription increased by

Professional services revenue increased by

These positive results show that Cloud DX revenues from new and expanded contracts are accelerating year-over-year.

Government grant funding was

Expenses:

Annual operating expenses decreased

Cost of inventories increased by

Please see the Q3 Consolidated Financial Statements and Q3 MD&A for more details.

Customer Statistics FY2023

The Company announced the following contracts or contract extensions in 2023: 7 contracts were executed with Ontario Community Paramedic Services, funded under the Community Paramedicine for Long-Term Care program (CPLTC). 3 contracts were executed with Provincial or Territorial Health Ministries. 4 contracts were executed with Ontario Family Health Teams (FHTs). 4 contracts were executed with Canadian hospitals or academic medical centers. 2 contracts were executed with clinics including a US based clinic in Illinois. Notable customers include Alberta Health Services, Alberta Primary Care Networks, University of Ottawa Heart Institute, and Mohawk Medbuy, the premier hospital procurement agency in Canada.

Subsequent events:

Since January 1, 2024, Cloud DX has announced 24 contracts and contract extensions valued at over

On March 19, 2024, the Company announced that

On April 8, 2024, the Company announced a Private Placement offering up to 27,500,000 Units consisting of 1 common share and 1 share purchase warrant, at

About Cloud DX

Accelerating digital healthcare, Cloud DX is on a mission to make healthcare better for everyone. Our Connected Health™ remote patient monitoring platform is used by healthcare enterprises and care teams across North America to virtually manage chronic disease, enable aging in place, and deliver hospital-quality post-surgical care in the home. Our partners achieve better healthcare and patient outcomes, reduce the need for hospitalization or re-admission, and reduce healthcare delivery costs through more efficient use of resources. Cloud DX is the co-winner of the Qualcomm Tricorder XPRIZE, winner of "2022 Top Innovator" from Canadian Business, a 2021 "Edison Award" winner, a Fast Company "World Changing Idea" finalist, and one of "Canada's Ten Most Prominent Telehealth Providers." Cloud DX is an exclusive partner to Medtronic Canada, Teladoc Health Canada and Sanrai International.

Cloud DX Investor Site https://ir.clouddx.com/overview/default.aspx

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

# # #

Social Links

Twitter https://twitter.com/CloudDX

Facebook https://www.facebook.com/clouddxinc/

LinkedIn https://www.linkedin.com/company/cloud-dx/

Instagram https://www.instagram.com/cloud.dx/

For media inquiries please contact:

Marketing Enquiries

Phone 888-543-0944

marketing@clouddx.com

For investor inquiries please contact:

Jay Bedard (Canada)

Cloud DX Investor Relations

Phone 647-881-8418

investors@clouddx.com

Officer responsible for this Press Release:

Simon Selkrig

Chief Financial Officer

Phone 888-543-0944

simon.selkrig@clouddx.com

Forward Looking Statements

This news release contains forward-looking statements and information within the meaning of applicable securities legislation. Often, but not always, forward-looking statements and information can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "estimates", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward looking statements or information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements or information contained in this news release. In particular, this news release includes certain forward-looking statements concerning the terms of the contract extension, the expected proceeds therefrom, as well as management's objectives, strategies, beliefs and intentions.

Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, the Company's the ability of the Company to fulfill the terms of and derive the benefits from the contract extension.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information.

À propos de Cloud DX

Accélérant les soins de santé virtuels, Cloud DX a pour mission d'améliorer les soins de santé pour tous. Notre plateforme de surveillance à distance des patients Connected HealthMC est utilisée par des entreprises de soins de santé et des équipes de soins partout en Amérique du Nord pour gérer virtuellement les maladies chroniques, permettre aux gens de vieillir chez eux et fournir des soins post-chirurgicaux de qualité hospitalière à domicile. Nos partenaires obtiennent de meilleurs résultats pour les soins de santé et les patients, réduisent le besoin d'hospitalisation ou de réadmission, et réduisent les coûts de prestation des soins de santé grâce à une utilisation plus efficace des ressources. Cloud DX est co-lauréate du prix Qualcomm Tricorder XPRIZE, lauréate du prix Edison 2021, finaliste du concours « World Changing Idea » de Fast Company et un des dix plus importants fournisseurs de télésanté au Canada.

Site des relations avec les investisseurs de Cloud DX https://ir.clouddx.com/overview/default.aspx

La Bourse de croissance TSX et son fournisseur de services de réglementation (tel que ce terme est défini dans les politiques de la Bourse de croissance TSX) n'assument aucune responsabilité quant à la pertinence ou à l'exactitude du présent communiqué.

Tous les énoncés prospectifs sont assujettis à des risques et à des incertitudes, tels que ceux décrits dans les rapports périodiques de Medtronic déposés auprès de la Securities and Exchange Commission. Les résultats réels peuvent sensiblement différer des résultats anticipés.

SOURCE: Cloud DX Inc.

View the original press release on accesswire.com