Cloud DX Reports Fiscal Third Quarter Results

Cloud DX (CDXFF) reports its fiscal Q3 2021 results with overall revenue down 4%, but subscription revenue rising 22%. New partnerships are expected to expand access to 27,000 patients. However, the company faced significant cost pressures due to a 120% increase in operating expenses and a 98% decrease in adjusted EBITDA, primarily due to one-time costs from a Qualifying Transaction. The subscription revenue for the first nine months increased by 22%, but product revenue showed variability compared to the previous year.

- Subscription revenue increased 22% year-to-date.

- New partnerships provide access to up to 27,000 patients.

- Overall revenue declined by 4%.

- Operating expenses surged by 120%.

- Adjusted EBITDA decreased by 98%.

- Subscription revenue was 19% lower in Q3.

Insights

Analyzing...

WATERLOO, ON / ACCESSWIRE / November 29, 2021 / Cloud DX (TSXV:CDX)(OTCQB:CDXFF), Cloud DX, a leading North American provider of virtual care and remote patient monitoring solutions, today reports results for the third quarter of fiscal 2021.

Key Developments:

- Overall revenue lower by

4% ; Subscription revenue increased22% - New partnerships in the quarter resulted in access to up to 27,000 patients

- Inclusion of one-time costs attributed to the Qualifying Transaction impacted expenses;

120% increase in operating expenses98% decrease in adjusted EBITDA

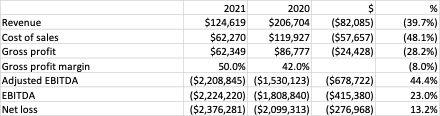

Third Quarter Financial Highlights

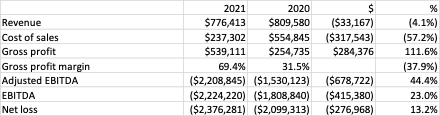

Year to Date Financial Highlights

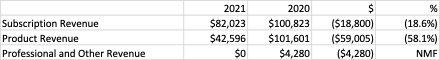

Revenue

In the 3 months ended September 30, 2021 subscription revenue was

In the 9 months ended September 30, 2021 subscription revenue increased

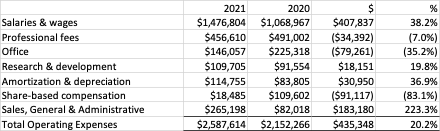

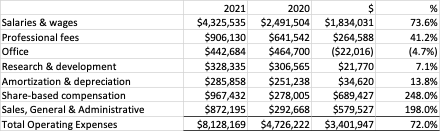

Expenses

In the 3 months ended September 30, 2021 operating expenses increased

In the 9 months ended September 30, 2021, operating expenses increased

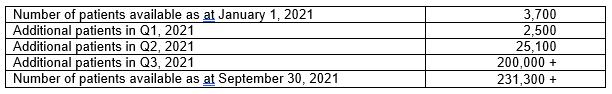

Customer Stats

Cloud DX has seen access to available patients suited to its remote patient monitoring products increase as follows:

About Cloud DX

Accelerating virtual healthcare, Cloud DX is on a mission to make healthcare better for everyone. Our Connected Health TM remote patient monitoring platform is used by healthcare enterprises and care teams across North America to virtually manage chronic disease, enable aging in place, and deliver hospital-quality post-surgical care in the home. Our partners achieve better healthcare and patient outcomes, reduce the need for hospitalization or re-admission, and reduce healthcare delivery costs through more efficient use of resources. Cloud DX is the co-winner of the Qualcomm Tricorder XPRIZE, a 2021 Edison Award winner, a Fast Company "World Changing Idea" finalist, and one of "Canada's Ten Most Prominent Telehealth Providers.

Cloud DX Investor Site https://ir.clouddx.com/overview/default.aspx

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Social Links

Twitter https://twitter.com/CloudDX

Facebook https://www.facebook.com/clouddxinc/

LinkedIn https://www.linkedin.com/company/cloud-dx/

Instagram https://www.instagram.com/cloud.dx/

For investor inquiries please contact:

Jay Bedard

Cloud DX Investor Relations

647-881-8418

jay.bedard@CloudDX.com

SOURCE: Cloud DX Inc.

View source version on accesswire.com:

https://www.accesswire.com/675180/Cloud-DX-Reports-Fiscal-Third-Quarter-Results