Core Assets IP Survey Identifies Large-Scale Untested Geophysical Anomalies at Silver Lime

Click Here for Video News Release by CEO Nick Rodway

VANCOUVER, BC / ACCESSWIRE / December 14, 2023 / Core Assets Corp., ("Core Assets" or the "Company") (CSE:CC)(FSE:5RJ)(OTCQB:CCOOF) is pleased to announce results from the 3D-DCIP geophysical survey completed across the 2.4-kilometre long Pete's -Sulphide City- Gally Trend, at the Silver Lime Carbonate Replacement (CRD)-Porphyry Project (the "Silver Lime Project" or "Silver Lime") in 2023, central Blue Property (the "Blue Property"), Atlin Mining District of NW British Columbia.

In August 2023, a modern three-dimensional direct current induced polarization (3D-DCIP) geophysical survey was completed over a 2.3 km2 area of the Silver Lime Project, connecting the Sulphide City Skarn-Porphyry Target, and the Pete's and Gally CRD targets.

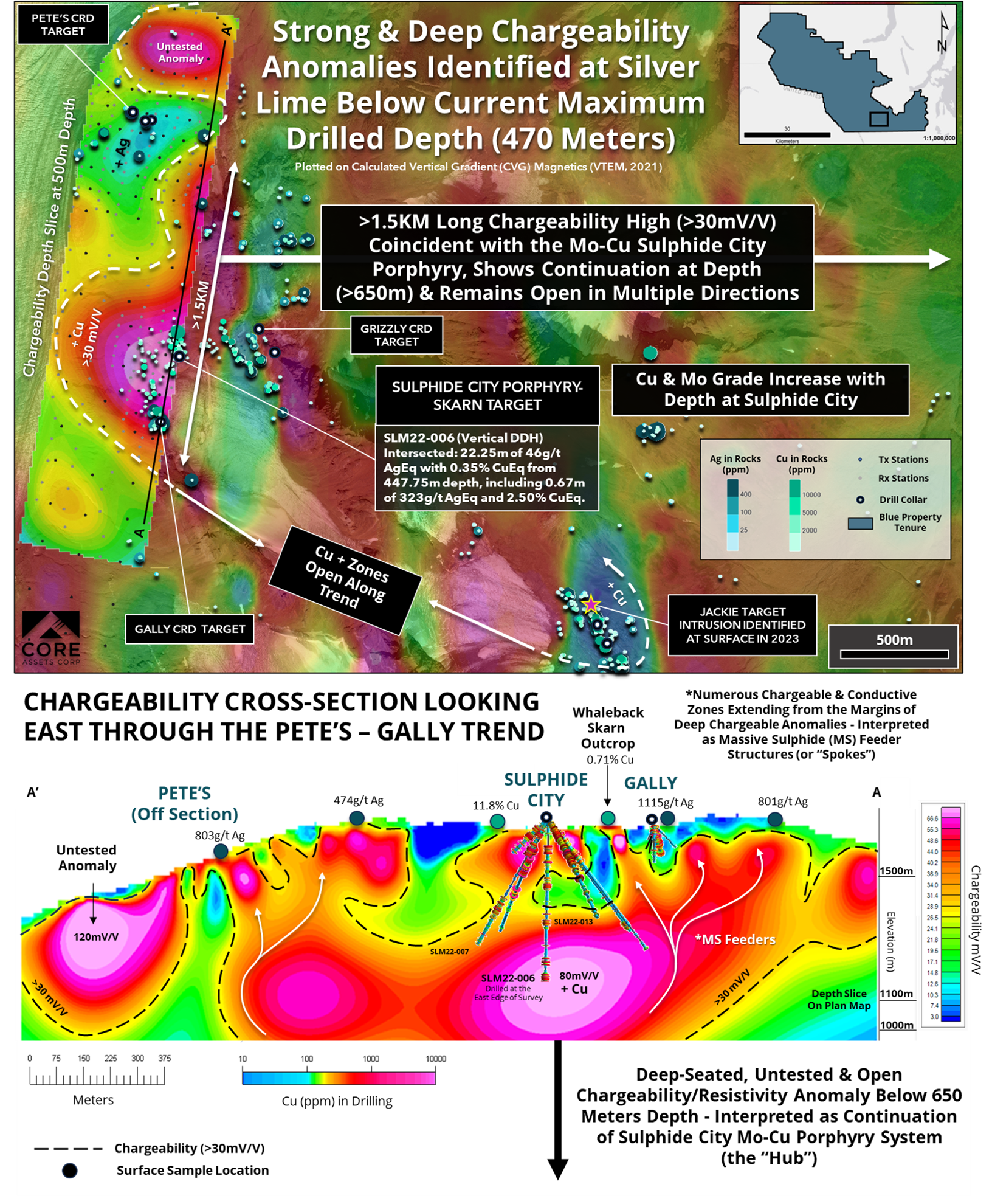

- The survey identified two large/significant deep-seated porphyry targets.

- The anomaly at Sulphide City (Anomaly 1) is coincident with the mineralized Mo-Cu Porphyry (confirmed by drilling in 2022) and shows continuation of a highly chargeable and resistive body at depth. This strong chargeability anomaly resides below the current depth of drilling at the Sulphide City Porphyry-Skarn Target and appears to extend to the east (Figures 1 - 2).

- In 2022, SLM22-006 intersected the interpreted top of the chargeability anomaly at the eastern most edge of the 2023 IP survey. Drill core assays show an increase in Cu with depth at Sulphide City. The bottom of hole SLM22-006 returned 22.25m of 46g/t AgEq with

0.35% CuEq from 447.75m depth, including 0.67m of 323g/t AgEq with2.5% CuEq1. - The Chargeability Anomaly below Sulphide City measures >1.5 kilometres in the northeast-southwest direction, >500 metres in the east-west direction, and extends to depths of >650 metres (the depth limit of 3D-DCIP survey).

- Overlapping magnetics/chargeability anomalies suggests that the Sulphide City Chargeability Anomaly may connect to a very chargeable, untested body north of Pete's CRD Target (CVG Magnetics, 2021 VTEM).

- Chargeability values increase to 80mV/V around the limit of the depth of investigation below Sulphide City, and up to 120mV/V at the core of the anomaly (Anomaly 2) located north of Pete's CRD Target.

- The anomalies remain open for exploration at depth and in multiple directions, including possible extensions to the northeast and east below Grizzly Ridge.

- A follow-up survey is planned for 2024, in conjunction with deeper exploratory drilling, to expand and test these significant geophysical anomalies.

- Drilling results for the Jackie and Grizzly CRD Targets will be released in the coming weeks.

Core Assets' President & CEO, Nick Rodway commented, "Our new IP geophysical data indicates that the drilling completed at Sulphide City in 2022, which intersected anomalous copper at the bottom of hole SLM22-006, was not deep enough to properly test the core of this large and hot chargeability anomaly below Sulphide City. The shallow CRD drilling completed in 2023, which intersected >1kg/tonne silver values at Pete's and Gally, were drilled along the margins of several highly conductive and chargeable bodies within the survey area that show continuity along trend and increased thickness to depths of more than 100m. Now that we are fully funded, we can test these exciting features with deeper drilling and continue to connect the dots of this robust and high-grade CRD-Porphyry system at Silver Lime.

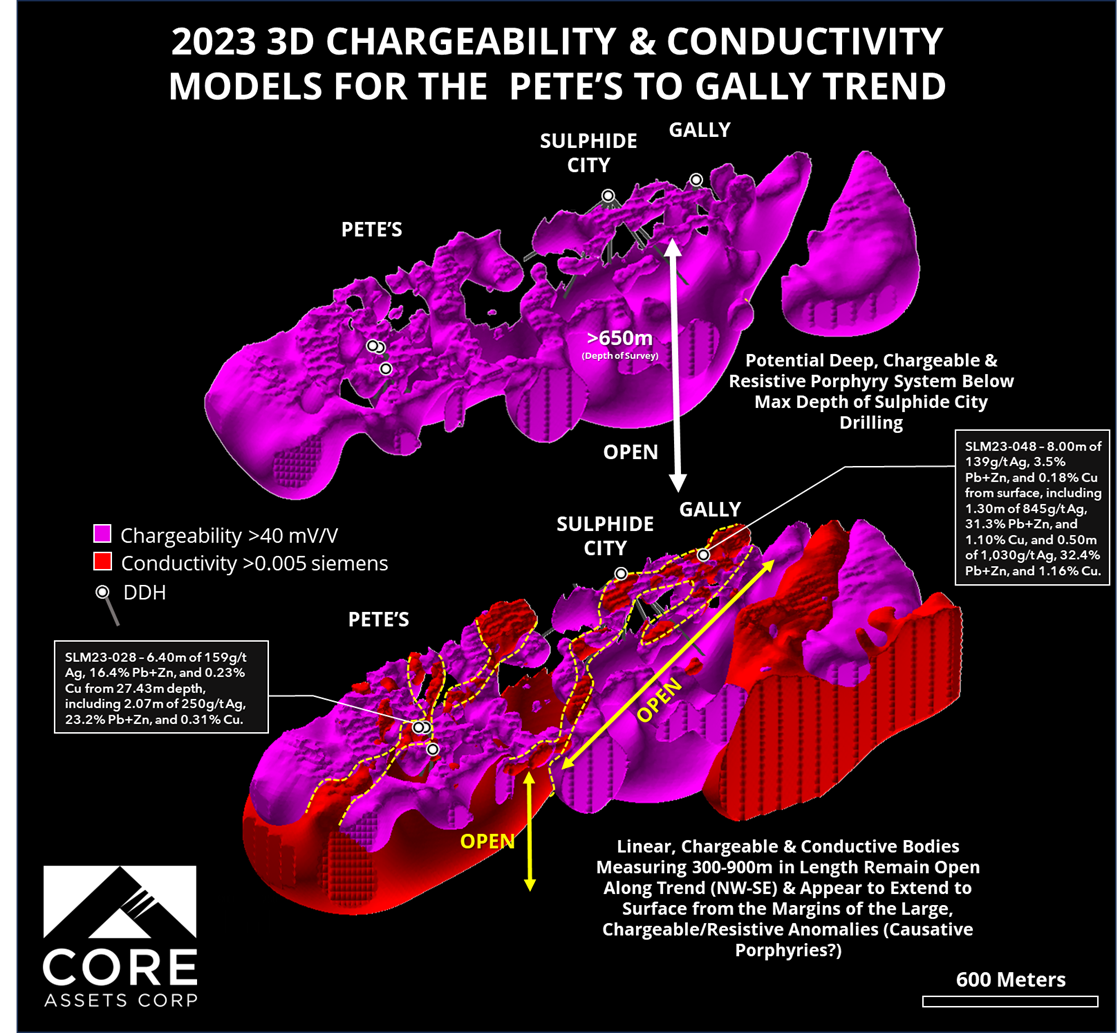

The survey was also successful in delineating several highly conductive and chargeable, northwest-southeast trending, linear bodies that range from 320 to 900 metres in length and extend from surface to depths of approximately 120 metres (Figures 1 - 2).

- These prospective, near surface linear anomalies correspond with known surficial and drilled massive sulphide skarn and carbonate replacement (CRD) occurrences and provides evidence of their continuity along strike.

- 2023 Drilling at the Pete's and Gally CRD Targets tested the margins of these features:

- SLM23-028 (Pete's CRD Target) intersected 6.40m of 159g/t Ag,

16.4% Pb+Zn, and0.23% Cu from 27.43m depth, including 0.57m of 301g/t Ag,22.2% Pb+Zn, and0.31% Cu. - SLM23-048 (Drilled 1.4km SSE at the Gally CRD Target) returned 8.00m of 139g/t Ag,

3.5% Pb+Zn, and0.18% Cu from surface, including 1.30m of 845g/t Ag,31.3% Pb+Zn, and1.10% Cu, and 0.50m of 1,030g/t Ag,32.4% Pb+Zn, and1.16% Cu.

- SLM23-028 (Pete's CRD Target) intersected 6.40m of 159g/t Ag,

- These conductive, mineralized features connect to the strong chargeable porphyry anomalies at depth via steeply dipping geophysical features - interpreted as massive sulphide carbonate replacement feeder structures.

- All prospective conductive anomalies remain open for exploration along trend and at depth.

1 Assay results are presented as uncut weighted averages and assume

Figure 1: Plan Map (Chargeability Depth Slice cut to 1100m Elevation/500m Depth, overlain on CVG Magnetics - 2021 VTEM Survey, high magnetics = hot colours) and Cross-Section Looking East illustrating the results of the deep, 2023 3D-DCIP Geophysical Survey at Silver Lime. Deep, strong chargeability anomalies are shown within and below the 2.3km survey area that includes the Sulphide City Porphyry-Skarn Target, and Gally and Pete's CRD targets (the Pete's - Gally Trend). Chargeable and conductive zones extend to surface from the margins of the strong chargeability/resistivity anomalies and are interpreted as potential massive to semi-massive skarn and CRD feeder structures; CRD = carbonate replacement; MS = massive sulphide; mV/V = millivolts/Volt (units of Chargeability - high = hot colors).

Figure 2: 3D Block Model highlighting chargeability values >40mV/V (purple) within the survey area (top); 3D Block Model showing the overlap of highly chargeable and strongly conductive zones (>0.005 siemens, red) which outline the potential extent of the near surface, linear, massive sulphide carbonate replacement and/or skarn bodies within the survey area (bottom).

About the 2023 Deep 3D-DCIP Geophysical Survey

In August of 2023, Core Assets contracted DIAS Geophysical Corporation based out of Vancouver, BC for the acquisition and processing of a modern 3D-DCIP/Resistivity survey over a 2.3km2 area of the Silver Lime CRD-Porphyry Project (the Pete's - Gally Trend), connecting the Sulphide City Porphyry-Skarn Target and the Pete's and Gally CRD Targets.

13 lines of 3D rolling distributed pole-dipole array in common voltage reference (CVR) mode were collected. The survey was comprised of 7 receiver lines and 6 current injection lines, oriented north-northeast-south-southwest with an azimuth of 10.5° and varied in from 400 to 3,200 metres in length. Station and line station spacing was designed in two geometries; 100 metres and 200 metres apart, respectively, and 50 metres and 100 metres apart over areas where higher resolution was desired (see Figure 1). A total of 91 injections were completed, resulting in 97,595 pole - dipole data points, much higher than traditional 2D-DCIP survey methods. This increase in data density increases the confidence of the inversion products.

The survey was designed with two primary purposes in mind:

1. Imaging deep, project-scale, structures, and potential sources of CRD mineralization, including porphyry-skarn deposits.

2. Imaging of shallow, target-scale, massive sulphide zones through strategic, higher-density receiver and transmitter arrays.

The survey was successful in delineating several prospective near surface - carbonate replacement mineralization trends and an interpreted deep seated mineralized porphyry intrusion and related skarn anomalies.

Background values were determined and used to define anomalous values of conductivity as those greater than 0.005 siemens or conversely, resistivity values below 200-ohm metres (Ωm), and chargeability values greater than 35mV/V. Background geology has a significant impact on what is regarded as an "anomalous or high" value of the output inversion. Sulphides in host rocks that typically have very low conductivity/chargeability values (such as limestone) will have a relatively lower background cutoff than sulphides hosted in more conductive and chargeable units such as mafic volcanic rocks or shales. Intrusions often show relatively low conductivity values due to the silica-rich nature of their mineralogy (quartz, feldspars etc.). However, the concentration of disseminated sulphides within an intrusive body has a positive correlation with the chargeability of an intrusion. Porphyry targets are typically characterized as poorly conductive but moderately-to-high chargeability values. CRD and skarn mineralization present as highly conductive and chargeable features, due to the predominance of massive sulphides and their continuous and connected nature.

The depth limits of investigation is approximately 650 metres for this survey. This is based on the offsets achieved between sources and receivers. Beyond this depth the data becomes less reliable, and the decreased signal can cause apparent weakening of anomalies. This survey has been clipped to the geometry of receivers, removing some edge effects, however sampling density inherently decreases towards the edge of the survey.

National Instrument 43-101 Disclosure

Nicholas Rodway, P. Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects. Mr. Rodway has reviewed and approved the technical content in this release.

About Core Assets Corp.

Core Assets Corp. is a Canadian mineral exploration company focused on the acquisition and development of mineral projects in British Columbia, Canada. The Company currently holds

On Behalf of the Board of Directors

CORE ASSETS CORP.

"Nicholas Rodway"

President & CEO

Tel: 604.681.1568

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include, but are not limited to, expectations regarding the pending core assays, including speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of diamond drilling at the Silver Lime Project; the anomalies outlined by the 3D-DCIP Survey may not signify anomalous mineralization in the subsurface; the Company's plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at the Silver Lime Project through additional field work and diamond drilling and any planned or proposed program related thereto; and any other general statement regarding the Company's planned or future exploration efforts at the Blue Property. It is important to note that the Company's actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that expectations regarding pending core assays based on preliminary visual observations from diamond drilling results at the Silver Lime Project, may be found to be inaccurate; that results may indicate further exploration efforts at the Silver Lime Project is not warranted; that the Company may be unable to implement its plans to further explore at the Silver Lime Project; that certain exploration methods, including the Company's proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company's operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; that the Company may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. The ongoing COVID-19 pandemic, labour shortages, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company's operating performance, financial position, and prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company's SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

SOURCE: Core Assets Corp.

View the original press release on accesswire.com