Core Assets Identifies Numerous Drilling Targets Using 3D Inverted Magnetics & Commences Drilling This Week

Core Assets announced the results of a 3D Magnetic Vector Inversion Model applied to the Silver Lime CRD-Porphyry Project in British Columbia. The findings reveal that the Sulphide City Mo-Cu Porphyry Stock extends deeper and connects to a larger magnetic body, potentially feeding three additional porphyry stocks. Drillhole SLM22-006 confirmed significant porphyry-style alteration at 471m depth, with high molybdenum and copper grades. Core Assets will commence up to 5,000m of diamond drilling this week, focusing initially on the Sulphide City Mo-Cu Porphyry Stock. The drilling aims to explore the deeper extensions and confirm the presence of high-grade mineralized systems.

- 3D model indicates deeper extension of Sulphide City Mo-Cu Porphyry Stock.

- Confirmed high molybdenum and copper grades at 471m depth.

- Fully funded for up to 5,000m diamond drilling.

- Drilling to commence this week, enhancing project momentum.

- 3D magnetic model assists in better understanding of geological structures.

- No specific mention of revenue or financial gains from the project.

- High initial investment required for extensive drilling programs.

- Potential risks if the deeper extensions do not yield expected mineral grades.

- Dependence on favorable geological interpretations for successful outcomes.

CLICK HERE TO VIEW A VIDEO VERSION OF THIS RELEASE

VANCOUVER, BC / ACCESSWIRE / June 5, 2024 / Core Assets Corp., ("Core Assets" or the "Company") (CSE:CC)(FSE:5RJ)(OTC.QB:CCOOF) is pleased to announce the results and interpretation of a 3-Dimensional Magnetic Vector Inversion Model collected over the 2024 drilling area at the Silver Lime CRD-Porphyry Project (the "Silver Lime Project" or "Silver Lime"), central Blue Property (the "Blue Property"), Atlin Mining District of NW British Columbia.

HIGHLIGHTS

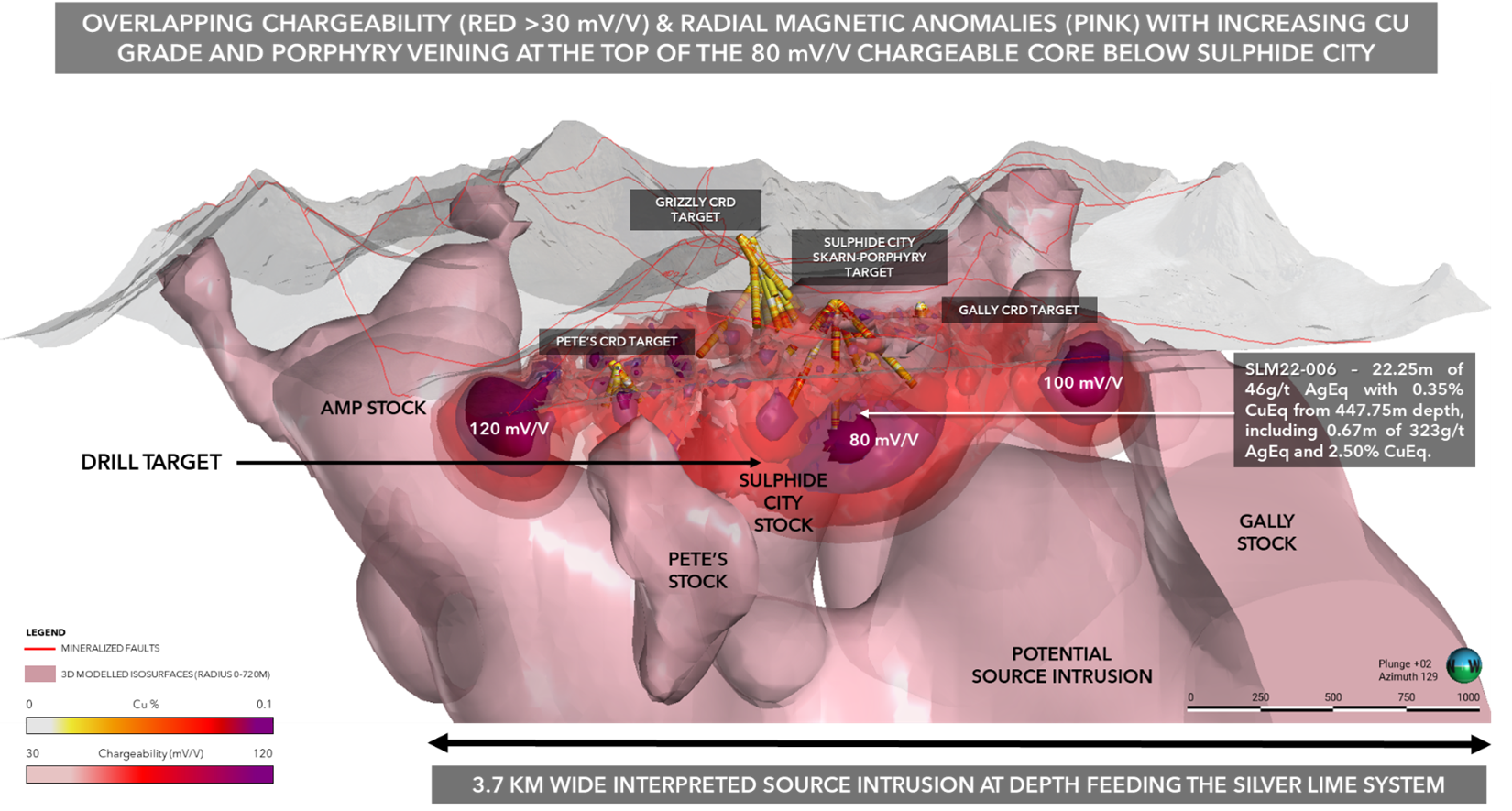

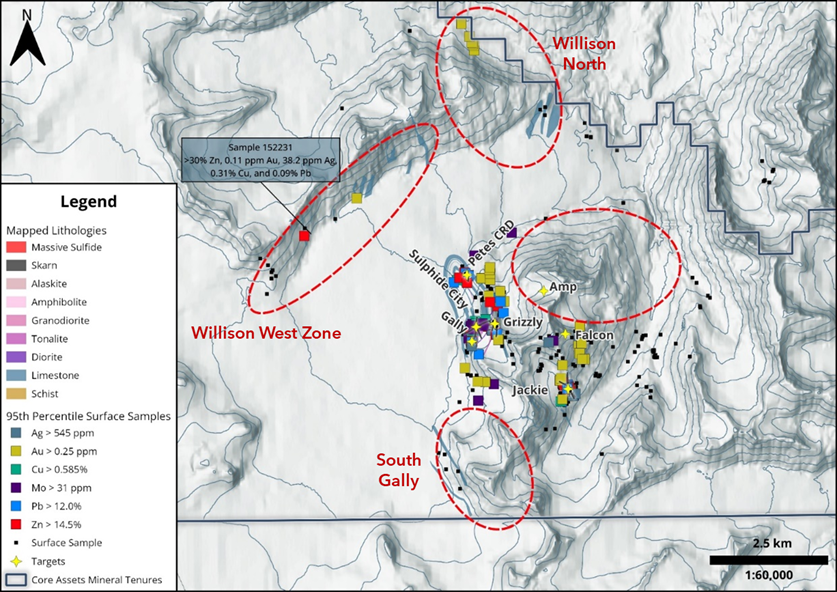

1.) Source Intrusion Discovery: The 3D magnetic model indicates that the Sulphide City Mo-Cu Porphyry Stock extends deeper and connects to a larger magnetic body measuring ~3.7 kilometres wide, which feeds at least three additional porphyry stocks beneath the Pete's CRD and AMP targets, and south of the Gally CRD target (Figure 1).

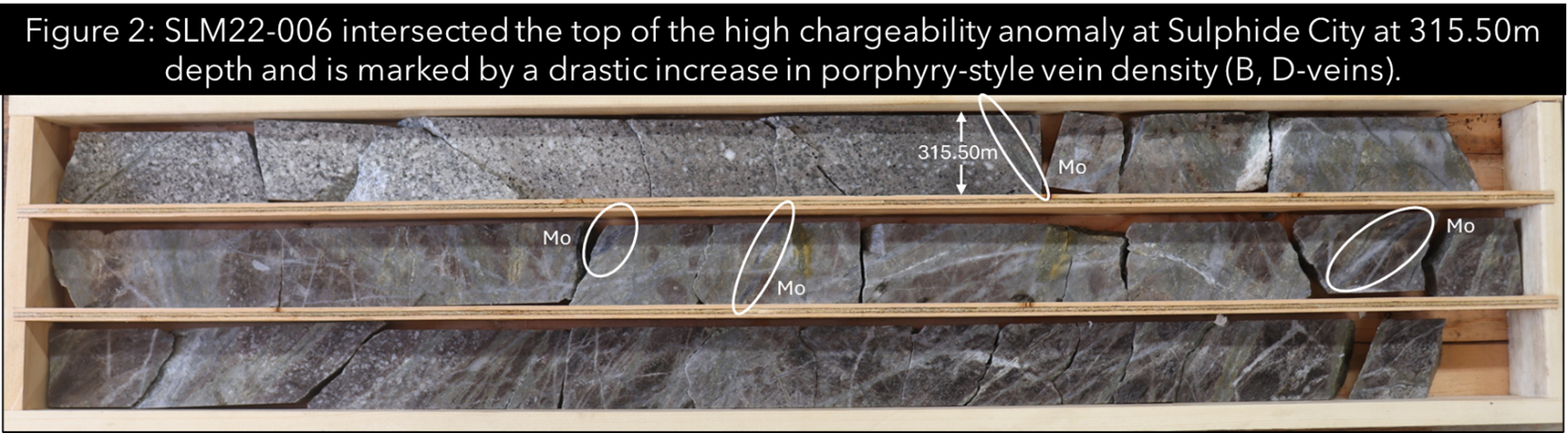

2.) Drilling Confirmation: In 2022, drillhole SLM22-006 at Sulphide City reached a depth of 471 meters, showing significant porphyry-style alteration, veining, and increased molybdenum (Mo) and copper (Cu) grades at around 315 meters depth (Figures 1, 2). Grades near the EOH returned up to

3.) 2024 Drilling Plan: Core Assets is fully funded for up to 5,000m of diamond drilling as well as project-wide mapping and rock sampling campaigns. We will start by drill-testing the Sulphide City Mo-Cu Porphyry Stock (80 mV/V) (Figure 1), and the potential source intrusion. Drilling is on-track to begin this week at the Silver Lime CRD-Porphyry Project.

Supporting technical information is located below.

Core Assets' President & CEO Nick Rodway commented, "Overlaps observed between our favourable magnetics, highly chargeable and conductive zones, Cu and Mo grade downhole, and the current drilled extent of the Sulphide City Mo-Cu Porphyry all point towards the continuation of the mineralized Sulphide City Porphyry to depths exceeding 1 kilometer. These overlapping datasets indicate the presence of a large, long-lived, and multi-stage, mineralized porphyry system feeding the high-grade Silver Lime skarn and CRM targets. This interpretation comes with an enhanced understanding of our 3D project geology and structures that acted as fluid pathways for the high-grade massive sulphide and epithermal mineralization observed outboard of the Sulphide City Target. Everything is on schedule, and we are excited to begin drilling this week. We'll start by testing the prospective overlap zones for porphyry Cu potential."

In early 2024, Core Assets contracted Fathom Geophysics to create a 3D magnetic inversion model utilizing the VTEM (Versatile Time Domain Electromagnetic) geophysical data collected over the Silver Lime CRD-Porphyry Project in 2021.

The 3D radial magnetic models at Silver Lime (isosurfaces; pale pink shapes in Figure 1) correlate well with highly chargeable zones below the Sulphide City, Pete's and Gally targets identified by the 2023 3D-IP (Three-Dimensional Induced Polarization) survey (high chargeability plotted as red and purple contours in Figure 1).

In 2022, SLM22-006 drill-tested the Sulphide City Mo-Cu Porphyry to a true depth of 471m and encountered strong porphyry-style alteration, veining and increased Mo and Cu grades upon intersecting the top of the highly chargeable core (80mV/V) near 320m true depth (See News Release dated December 14, 2023).

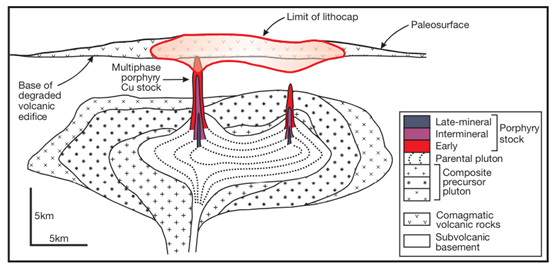

The 3D radial magnetic models (isosurface; pale pink shape in Figure 1) indicate a continuation of the Sulphide City Mo-Cu Porphyry Stock to depth where it connects to a larger magnetic body interpreted as the source intrusion (Figures 1, 3). This source intrusion measures 3.7-kilometres wide and appears to be feeding at least three additional interpreted porphyry stocks situated below the Pete's CRD and Amp targets, and 750m south of the Gally CRD Target.

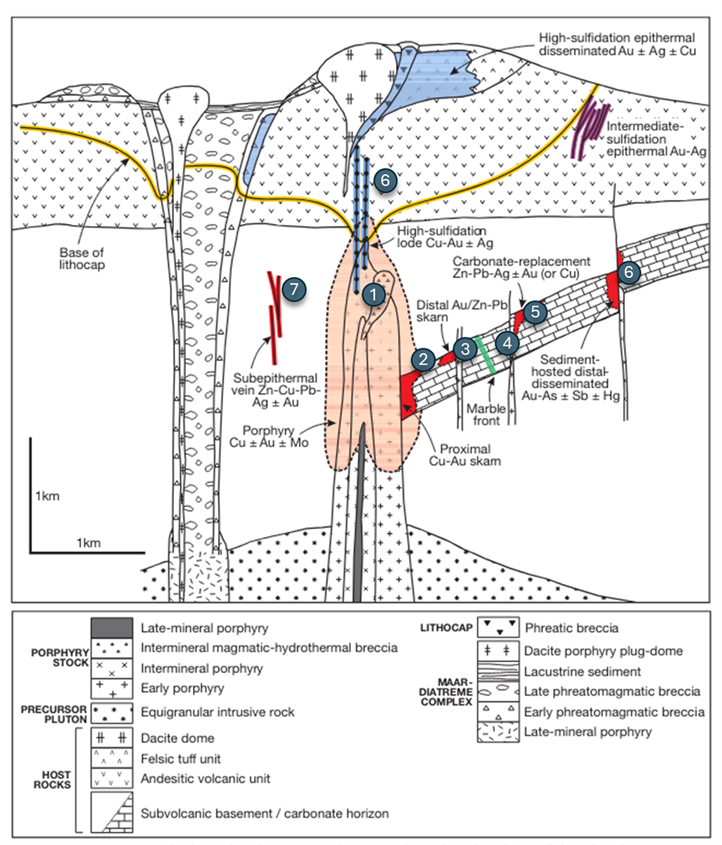

Interpreted mineralized porphyry stocks (pale pink shapes) along the Pete's - Sulphide City - Gally Trend are associated with overlapping chargeable and conductive anomalies along their margins that are interpreted as probable zones of high-grade Zn-Fe-Cu massive sulphide skarn deposits.

All prospective porphyry targets presented in Figure 1, including the interpreted main source intrusion, are bound by major deep-seated faults within a 13.7km2 area (red lines in Figure 1). These structures are believed to have acted as the main pathways for the distal and widespread, high-grade massive sulphide Ag-Zn-Pb-Cu±Au carbonate replacement mineralization at the Silver Lime Project.

ADDITIONAL INFORMATION ABOUT THE 3D MAGNETIC VECTOR INVERSION (3D-MVI)

In the Winter of 2024, Fathom Geophysics Ltd. was contracted to carry out a 3D MVI on Versatile Time Domain Electromagnetic (VTEM) geophysical data obtained in 2021 for porphyry target generation and 2D and 3D structure detection. Current interpretations of the 3D amplitude, remnant magnetization, and radial symmetry inversions indicate a large, deep, buried intrusion underlying the majority of the main Silver Lime Project area. Several apparent stocks extending from the larger radial feature at depth are continuous to surface, inter-connecting each of the drilled Silver Lime targets, as well as the Amp Target, to a single large system at depth. Radially symmetrical isosurfaces from 180-720m in radius were used in this interpretation, and features are generally continuous across all relative values in the inversions.

The 3D MVI shows a possible continuation of the Sulphide City Mo-Cu Porphyry. This continuation is represented by the pale pink, magnetic radial stock (isosurface) in Figure 1 that correlates near perfectly with the boundaries of the newly modelled Mo-Cu Porphyry.

Mapped dykes and sills that are considered causative to the project-wide massive sulphide carbonate replacement and skarn mineralization show a perfect correlation to a magnetic isosurface/stock extending below the Pete's CRD Target, and proximal to the untested high chargeability anomaly (120 mV/V) located north of the 2023 drilling area. The dykes at Pete's Target are geochemically related to the Sulphide City Porphyry and may be connected to the rest of the system by narrow dykes that were not picked up by the resolution of the 3D MVI (60m resolution).

Amplitude isosurfaces, representing the overall strength of the magnetic response, correlate well with the proximal CRD and skarn skin surrounding the Sulphide City stock. Remanent magnetism isosurfaces, representing zones with a magnetic field of their own (i.e. different to that of the Earth - usually caused by magnetite or pyrrhotite) also overlie skarn and proximal CRD zones that have been mapped and cut with the drill bit at the Grizzly and Sulphide City targets. The geological model of the Sulphide City Stock, which was built without utilizing the 3D inversion data, and associated dykes correlate extremely well with the radial symmetry inversion data, bolstering the confidence of the team's interpretation of the magnetic inversion dataset. These coincident data will be used by Core Assets geologists for broader targeting across the Blue Property.

A newly discovered feature of note from this data is a radially symmetrical, anomalous, and tubular amplitude feature with a remnant magnetization halo - located approximately 750m to the south of the Gally Target. The southern end of the 2023 3D DC/IP survey covers a portion of this feature and has overlapping high chargeability and high conductivity anomalies. Marble beds with massive sulfide-bearing veinlets (see Figure 1 in News Release dated April 4, 2024) are also mapped overlying the otherwise overburden covered feature. This overlap of multiple features of note is tentatively interpreted as another intrusion related to the system at large with a surrounding massive sulphide skarn-CRD skin.

The 2D structure detection analysis applied to the 2021 VTEM data coincides strongly with mapped faults and dykes at Silver Lime. Mineralized structures and pebble dykes that were mapped and sampled in the Gally area and through the Gally-Sulphide City-Pete's Mineralized Trend over the 2023 field season and were traced for up to 225m along strike, have been traced through the structure detection filters applied by Fathom. Multiple un-sampled structures with similar strike lengths and apparent dips have also been traced via the structure detection analysis. Additional, larger-scale structures with a variety of strikes appear to encircle or bound the main mineralized areas and radially symmetrical isosurfaces at Silver Lime.

The filters and inversions were applied to the portion of the 2021 VTEM survey overlying the 9.5x10 km mineralized footprint of the SLM project, the entire VTEM survey was flown over approximately

THE 2024 EXPLORATION PROGRAM

The team is excited to continue building on several high priority targets for 2024 field season:

- The Sulphide City Cu-Mo Porphyry Target

- High-grade, near surface, structurally controlled CRD and skarn massive sulphide mineralization (Gally, Grizzly, Pete's, and Jackie)

- Vein-Hosted Au+/-Cu+/-Ag (Falcon and Amp)

- High-grade massive sulphide zinc skarn and mineralized porphyry potential (Willison West)

- The newly interpreted porphyry stock south of Gally

Drilling over the 2024 field season will prioritize the deep extension of the Sulphide City Stock - utilizing the mag inversion data, geochemistry, and structural data to guide drilling. The intrusion south of the Gally target will be ground-truthed, and if boots on the ground data is supportive of the current interpretation this new target will be drill tested. Shallow CRD and skarn massive sulphide mineralization will also be opportunistically targeted with the diamond drill.

Figure 5 breaks down the highest priority generative targets for the 2024 field season. Early season ground-truthing and mapping will be conducted at the Willison West Target to follow up on sample 152231, which graded >

NATIONAL INSTRUMENT 43-101 DISCLOSURE

Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101- Standards of Disclosure for Mineral Projects. Mr. Rodway has reviewed and approved the technical content in this release.

EQUIVALENCE CALCULATION

Assay results in this news release are presented as uncut weighted averages and assume

ABOUT CORE ASSETS CORP.

Core Assets Corp. is a Canadian mineral exploration company focused on the acquisition and development of mineral projects in British Columbia, Canada. The Company currently holds

On Behalf of the Board of Directors

CORE ASSETS CORP.

"Nicholas Rodway"

President & CEO

Tel: 604.681.1568

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include, but are not limited to, expectations regarding the pending core assays, including speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of diamond drilling at the Silver Lime Project and the Laverdiere Project, as applicable; the Company's plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at the Silver Lime Project through additional field work and diamond drilling and any planned or proposed program related thereto; and any other general statement regarding the Company's planned or future exploration efforts at the Blue Property. It is important to note that the Company's actual business outcomes and exploration results could differ materially from those in such forward-looking statements. Risks and uncertainties include that expectations regarding pending core assays based on preliminary visual observations from diamond drilling results at the Silver Lime Project and the Laverdiere Project, as applicable, may be found to be inaccurate; that results may indicate further exploration efforts at the Silver Lime Project and the Laverdiere Project, as applicable, as not warranted; that the Company may be unable to implement its plans to further explore at the Silver Lime Project and the Laverdiere Project, as applicable; that certain exploration methods, including the Company's proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company's operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; that the Company may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. The ongoing COVID-19 pandemic, labour shortages, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company's operating performance, financial position, and prospects. Collectively, the potential impacts of this economic environment pose risks that are currently indescribable and immeasurable. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company's SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

SOURCE: Core Assets Corp.

View the original press release on accesswire.com

FAQ

What did Core Assets discover using 3D inverted magnetics?

When will Core Assets commence drilling at the Silver Lime Project?

How deep was drillhole SLM22-006 at Sulphide City?

What mineral grades were found near the end of hole SLM22-006?