Blackwolf Announces Brokered Private Placement for up to C$7.5 Million with Lead Order from Frank Giustra

Blackwolf Copper and Gold Ltd. (TSXV:BWCG, OTC:BWCGF) has announced a private placement agreement with Red Cloud Securities Inc. to raise up to C$5,000,000. The offering will involve the sale of units priced at C$0.20 each and flow-through common shares at C$0.24. Notably, Frank Giustra is set to become the largest shareholder, owning up to 17.5% of shares post-offering. Funds will be directed towards exploration at the Hyder Gold-Silver Properties and the Niblack copper-gold project. The offering is subject to regulatory approval and is expected to close around March 28, 2023.

- Successful agreement for a private placement of up to C$5,000,000.

- Frank Giustra's investment indicates confidence in Blackwolf's potential.

- Funding will support exploration of high-potential mineral properties.

- None.

Insights

Analyzing...

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESSWIRE / March 6, 2023 / Blackwolf Copper and Gold Ltd. ("Blackwolf", or the "Company") (TSXV:BWCG)(OTC:BWCGF) is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. (the "Agent") to act as sole agent and bookrunner in connection with a best efforts, private placement (the "Offering") for gross proceeds of up to C

"The potential for a new discovery of wide, gold and silver rich veins at Blackwolf's Cantoo Property, coupled with Management's expertise in the Golden Triangle as well as the deep value in the Niblack copper-gold deposit are very compelling, said Mining Entrepreneur, Frank Giustra. "I am excited to ‘become' an insider and the largest shareholder of Blackwolf and I am particularly excited to see the results of this season's exploration program of its Cantoo Property. Although its early days, I think the potential for a high-grade discovery is exceptional."

Mr. Giustra is expected to own or control approximately

Each Unit will consist of one common share of the Company (each, a "Unit Share") and one half of one common share purchase warrant (each whole warrant, a "Warrant"). Each whole Warrant shall entitle the holder to purchase one common share of the Company (each, a "Warrant Share") at a price of C

The Agent will have an option, exercisable in full or in part, up to 48 hours prior to the closing of the Offering, to sell up to an additional C

The Company intends to use the net proceeds from the Offering for the exploration and advancement of the Company's

Proceeds from the sale of FT Shares will be used to incur "Canadian exploration expenses" as defined in subsection 66.1(6) of the Income Tax Act and "flow through mining expenditures" as defined in subsection 127(9) of the Income Tax Act. Such proceeds will be renounced to the subscribers with an effective date not later than December 31, 2023 and incurred no later than December 31, 2024, in the aggregate amount of not less than the total amount of gross proceeds raised from the issue of FT Shares.

The Offering is scheduled to close on or around March 28, 2023 and is subject to certain conditions including, but not limited to, receipt of all necessary approvals including the approval of the TSX Venture Exchange. The Unit Shares, FT Shares and Warrant Shares will have a hold period ending on the day that is four months and one day following the closing date of the Offering.

The securities described herein have not been, and will not be, registered under the United States Securities Act, or any state securities laws, and accordingly may not be offered or sold within the United States except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction.

CANTOO TARGET AND HYDER AREA PROPERTIES

Acquired through staking in 2021 and 2022, Blackwolf has a

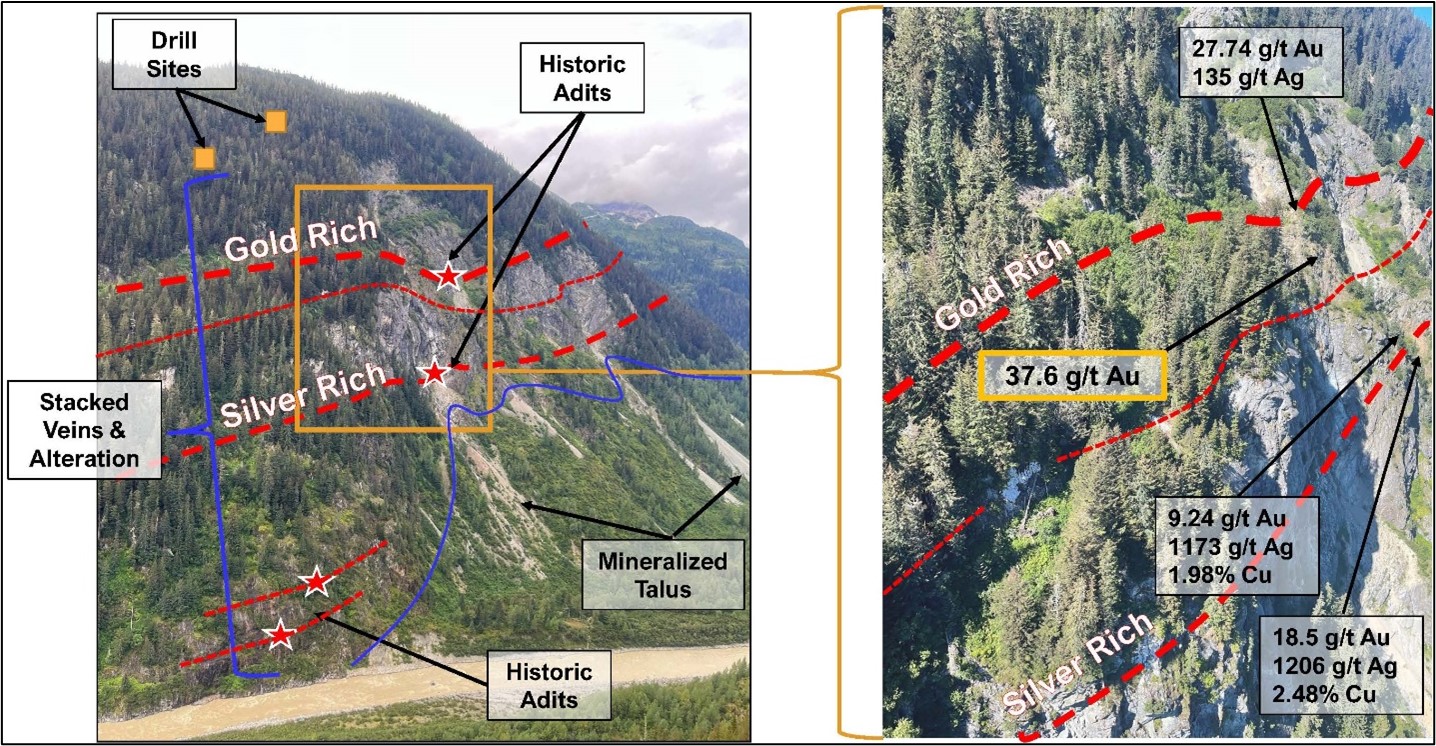

The Cantoo Property is located due west of the past-producing Premier, Silver Coin and Big Missouri mines, that are currently in redevelopment by Ascot Resources and likely part of the same metallogenic system. It hosts a series of shallow, southeast-dipping breccias, stockworks and vein structures up to 30 meters in thickness. Historic literature describes an upper ‘gold rich' vein and a lower ‘silver rich vein'. These veins outcrop on cliff faces that are clearly observable from the air. Historic adits and two, aerial tram line cables dating back to the late 1920's, helped Blackwolf's geologists to locate the veins, and according to Alaskan territorial records, ore was directly recovered and shipped from surface without blasting. Work ceased on ambitious development plans at Cantoo after the stock market crash of 1929. Experienced climbing technicians were able to access the ‘upper', 30 meter-wide, gold-rich vein, and a composite chip sample from it averaged 37.6 g/t Au.(1) The mineralization was associated with silicification, stockwork quartz veining, and up to

(1) Refer to the Company's New Release dated January 17, 2023. Available on SEDAR.

QA/QC AND QUALIFIED PERSON

The analytical work on the Hyder project was performed by MSALABS a certified, analytical services provider, at its laboratory in Langley, British Columbia. All rock samples were prepared using procedure PRP-910 (dry, crush to

The reported work was completed using industry standard procedures, including a quality assurance/quality control ("QA/QC") program consisting of the insertion of certified standard, blanks and duplicates into the sample stream. The Qualified Person has reviewed the data and detected no significant QA/QC issues.

Jodie Gibson, P.Geo., Vice President Exploration for the Company, a Qualified People under NI 43-101, has reviewed and approved the scientific and technical content of this release.

About Blackwolf Copper and Gold

Blackwolf's founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a

On behalf of the Board of Directors

"Robert McLeod"

Robert McLeod

President, CEO and Director

For more information, contact:

Rob McLeod | Liam Morrison |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding the Offering including the use of proceeds of the Offering. These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, receipt of regulatory approvals of the Offering, inability to complete the Offering on the proposed terms or all at, market volatility; the state of the financial markets for the Company's securities; and changes in the Company's business plans. In making the forward-looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that required regulatory approvals will be obtained, the Offering will proceed and be completed as planned and the Company will continue with its stated business objectives. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/742183/Blackwolf-Announces-Brokered-Private-Placement-for-up-to-C75-Million-with-Lead-Order-from-Frank-Giustra