Barinthus Bio Reports Second Quarter 2024 Update on Corporate Developments and Financial Results

Barinthus Biotherapeutics plc (NASDAQ: BRNS) reported its Q2 2024 financial results and corporate developments. The company is prioritizing its HBV and celiac disease programs, with plans to initiate a Phase 1 trial for VTP-1000 in celiac disease in Q3. Key highlights include:

- Positive interim data from two Phase 2 trials of VTP-300 in chronic hepatitis B (CHB)

- Cash position of $117.8 million as of June 30, 2024

- R&D expenses of $11.7 million in Q2 2024

- Net loss of $16.9 million or $(0.43) per share in Q2 2024

- Expected cash runway into Q2 2026

The company anticipates updated interim data from HBV trials in Q4 2024 and continues to advance its pipeline in immunotherapeutics.

Barinthus Biotherapeutics plc (NASDAQ: BRNS) ha pubblicato i risultati finanziari per il secondo trimestre del 2024 e gli sviluppi aziendali. L'azienda sta dando priorità ai suoi programmi per l'HBV e la celiachia, con piani per avviare uno studio di Fase 1 per VTP-1000 nella celiachia nel terzo trimestre. I punti salienti includono:

- Dati intermedi positivi da due studi di Fase 2 di VTP-300 nella epatite cronica B (CHB)

- Posizione di cassa di 117,8 milioni di dollari al 30 giugno 2024

- Spese per R&S di 11,7 milioni di dollari nel secondo trimestre del 2024

- Perdita netta di 16,9 milioni di dollari o $(0,43) per azione nel secondo trimestre del 2024

- Autonomia finanziaria prevista fino al secondo trimestre del 2026

L'azienda prevede dati intermedi aggiornati dagli studi sull'HBV nel quarto trimestre del 2024 e continua a far progredire il suo portfolio in immunoterapeutiche.

Barinthus Biotherapeutics plc (NASDAQ: BRNS) informó sobre sus resultados financieros del segundo trimestre de 2024 y desarrollos corporativos. La compañía está priorizando sus programas para el HBV y la enfermedad celíaca, con planes de iniciar un ensayo de Fase 1 para VTP-1000 en la enfermedad celíaca en el tercer trimestre. Los puntos destacados incluyen:

- Datos intermedios positivos de dos ensayos de Fase 2 de VTP-300 en hepatitis B crónica (CHB)

- Posición de efectivo de 117,8 millones de dólares a 30 de junio de 2024

- Gastos de I+D de 11,7 millones de dólares en el segundo trimestre de 2024

- Pérdida neta de 16,9 millones de dólares o $(0,43) por acción en el segundo trimestre de 2024

- Se espera que el margen de efectivo se extienda hasta el segundo trimestre de 2026

La compañía anticipa datos intermedios actualizados de ensayos de HBV en el cuarto trimestre de 2024 y sigue avanzando en su pipeline de inmunoterapéuticos.

Barinthus Biotherapeutics plc (NASDAQ: BRNS)가 2024년 2분기 재무 결과와 기업 동향을 보고했습니다. 이 회사는 HBV 및 셀리악 질환 프로그램에 우선순위를 두고 있으며, 3분기에는 셀리악 질환에 대한 VTP-1000의 1상 시험을 시작할 계획입니다. 주요 내용은 다음과 같습니다:

- 만성 B형 간염(CHB)에서 VTP-300의 두 개의 2상 시험의 긍정적인 중간 데이터

- 2024년 6월 30일 기준 현금 보유액 1억 1,780만 달러

- 2024년 2분기 R&D 비용 1,170만 달러

- 2024년 2분기 순손실 1,690만 달러 또는 주당 $(0.43)

- 2026년 2분기까지 현금 여유 예상

회사는 2024년 4분기에 HBV 시험의 중간 데이터 업데이트를 예상하고 면역 치료제 파이프라인을 계속 발전시켜 나가고 있습니다.

Barinthus Biotherapeutics plc (NASDAQ: BRNS) a annoncé ses résultats financiers pour le deuxième trimestre 2024 et les développements de l'entreprise. La société priorise ses programmes sur l'HBV et la maladie cœliaque, avec des projets pour initier un essai de Phase 1 pour VTP-1000 sur la maladie cœliaque au troisième trimestre. Les faits saillants incluent:

- Données intermédiaires positives de deux essais de Phase 2 de VTP-300 dans l'hépatite B chronique (CHB)

- Position de trésorerie de 117,8 millions de dollars au 30 juin 2024

- Dépenses de R&D de 11,7 millions de dollars au 2ème trimestre 2024

- Perte nette de 16,9 millions de dollars ou $(0,43) par action au 2ème trimestre 2024

- Trésorerie prévue jusqu'au 2ème trimestre 2026

L'entreprise anticipe des données intermédiaires mises à jour des essais HBV au 4ème trimestre 2024 et continue de faire avancer son portefeuille en immunothérapeutiques.

Barinthus Biotherapeutics plc (NASDAQ: BRNS) hat die finanziellen Ergebnisse für das 2. Quartal 2024 und Unternehmensentwicklungen veröffentlicht. Das Unternehmen priorisiert seine Programme für HBV und Zöliakie und plant, im 3. Quartal eine Phase-1-Studie für VTP-1000 zur Zöliakie zu starten. Zu den wichtigsten Ergebnissen gehören:

- Positive Zwischen Ergebnisse aus zwei Phase-2-Studien zu VTP-300 bei chronischer Hepatitis B (CHB)

- Bargeldbestand von 117,8 Millionen Dollar zum 30. Juni 2024

- F&E-Ausgaben von 11,7 Millionen Dollar im 2. Quartal 2024

- Nettoverlust von 16,9 Millionen Dollar oder $(0,43) pro Aktie im 2. Quartal 2024

- Erwartete Liquiditätsreserve bis zum 2. Quartal 2026

Das Unternehmen erwartet aktualisierte Zwischen Ergebnisse von HBV-Studien im 4. Quartal 2024 und entwickelt weiterhin sein Portfolio im Bereich Immuntherapeutika.

- Positive interim data from VTP-300 Phase 2 trials in hepatitis B virus (HBV)

- 20% of participants had undetectable HBsAg in VTP-300 treatment group in IM-PROVE II trial

- 84% of participants eligible for NUC discontinuation in VTP-300 treatment group

- Initiation of Phase 1 trial for VTP-1000 in celiac disease planned for Q3 2024

- Strong cash position of $117.8 million, expected to fund operations into Q2 2026

- Net loss increased to $16.9 million in Q2 2024 from $15.5 million in Q1 2024

- R&D expenses increased to $11.7 million in Q2 2024 from $11.1 million in Q1 2024

- General and administrative expenses rose to $7.2 million in Q2 2024 from $6.0 million in Q1 2024

- Strategic pipeline prioritization resulted in workforce reduction

Insights

Barinthus Bio's Q2 2024 results reveal a mixed financial picture. The company's cash position decreased from

R&D expenses increased slightly to

While the company's cash position remains solid, investors should monitor the burn rate closely in coming quarters to ensure sufficient funding for key clinical milestones.

The interim data from Barinthus Bio's HBV trials show promising results. In the HBV003 trial,

The IM-PROVE II trial data also looks encouraging, with

The initiation of the GLU001 trial for VTP-1000 in celiac disease represents an important expansion into autoimmune disorders, addressing a significant unmet need. Overall, these developments position Barinthus Bio well in the competitive immunotherapy landscape.

Barinthus Bio's strategic focus on HBV and celiac disease programs demonstrates a smart market positioning. The HBV market is substantial, with over 290 million chronic carriers worldwide and current treatments rarely achieve functional cure. If successful, VTP-300 could capture a significant market share.

The celiac disease market is also attractive, with an estimated

However, investors should note the competitive landscape. Several companies are developing HBV cures and the celiac disease market is attracting increased attention. Barinthus Bio's success will depend on the efficacy and safety profile of their candidates compared to competitors. The upcoming data releases in Q4 2024 will be crucial in determining the company's market position and potential.

OXFORD, United Kingdom, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Barinthus Biotherapeutics plc (NASDAQ: BRNS), a clinical-stage biopharmaceutical company developing novel T cell immunotherapeutic candidates, provided an overview of the Company’s progress and announced its financial results for the second quarter of 2024.

“Following the positive VTP-300 Phase 2 data in hepatitis B virus (HBV) in the second quarter, we made the strategic decision to prioritize our HBV and celiac disease programs. These two programs have the greatest probability for success and value creation, and represent significant opportunities in therapeutic areas with substantial unmet patient need,” said Bill Enright, Chief Executive Officer of Barinthus Bio. "We are very excited as we plan to initiate our first in human clinical trial of VTP-1000 in celiac disease in the third quarter, utilizing our novel SNAP-TI platform. Celiac disease is an increasingly common autoimmune disease with no FDA or EMA-approved treatments. Towards the end of the year we look forward to sharing updated data from our HBV program as our two Phase 2 trials utilizing VTP-300, which are evaluating a potential functional cure regimen, mature further."

Second Quarter 2024 and Recent Corporate Developments

Clinical developments: VTP-300 (HBV)

In June 2024, we announced updated data from two ongoing Phase 2 clinical trials in people with chronic hepatitis B (CHB) at the European Association for the Study of the Liver (EASL) Congress 2024. The presentations included updated interim data from the Phase 2b clinical trial (HBV003), as well as updated interim data from the Phase 2a clinical trial (IM-PROVE II, AB-729-202) in partnership with Arbutus Biopharma, both in people with CHB receiving ongoing standard of care nucleos(t)ide analogue (NUC) therapy.

Interim HBV003 data: VTP-300 and Low-dose Nivolumab

Interim data from the HBV003 trial showed;

- Nearly

20% of participants across the groups had undetectable HBsAg and this was maintained for ≥16 weeks in the two cases who had reached that time point.

76% of participants were eligible for NUC discontinuation.71% of those who did discontinue remained off NUCs at time of data cutoff on April 15, 2024.67% of participants across all groups assessed for NUC discontinuation had HBsAg <10 IU/mL at Week 24 or later.- Robust T cell responses were observed to all VTP-300 encoded antigens.

- There were no Serious Adverse Events (SAEs), Grade 3 or 4 Adverse Events (AEs) related to treatment.

Interim IM-PROVE II data: imdusiran and VTP-300

Interim data from the IM-PROVE II clinical trial showed;

20% of participants had undetectable HBsAg at Week 72 in the VTP-300 treatment group, compared to none in the placebo group.84% of participants in the VTP-300 treatment group were eligible for NUC discontinuation, compared to52% in the placebo group.88% of those who did discontinue remained off NUCs, compared to80% in the placebo group remaining off NUCs at time of data cutoff on April 12, 2024.- Robust reductions of HBsAg were observed during the imdusiran lead-in period with

95% of participants achieving HBsAg <100 IU/mL before undergoing dosing in the VTP-300 treatment or placebo groups at week 24. A statistically significant difference (p<0.05) in HBsAg levels between the VTP-300 treatment and placebo groups was recorded at Week 72. - Treatment with imdusiran and VTP-300 was generally well-tolerated, with no SAEs or treatment discontinuations reported.

Corporate Updates

- On June 3, 2024, Dr. Leon Hooftman joined the Company as Chief Medical Officer. He brings significant drug development expertise across a broad array of therapeutic areas including immunology, autoimmunity, hematology, oncology and infectious diseases.

- In June 2024, we announced a strategic pipeline prioritization following the positive interim data from VTP-300 in CHB presented at EASL. This announcement included the prioritization of the development of VTP-300 in CHB and VTP-1000 in celiac disease, and consequently a reduction in workforce.

Upcoming Milestones

- In the third quarter of 2024, the Company expects to:

- VTP-1000 (Celiac Disease):

- Dose the first patient in GLU001, a randomized, placebo-controlled Phase 1 trial including a controlled gluten challenge to evaluate the safety, tolerability, pharmacokinetics and pharmacodynamics of VTP-1000 in adults with celiac disease.

- VTP-1000 (Celiac Disease):

- In the fourth quarter of 2024, the Company expects to:

- VTP-300 (HBV):

- Announce updated interim data from HBV003, our Phase 2b trial evaluating additional dosing of VTP-300 and timing of PD-1 inhibition, in people with CHB on NUC therapy.

- Announce updated interim data from the Phase 2a AB-729-202 clinical trial evaluating the combination of VTP-300 and Arbutus’ imdusiran, in people with CHB on NUC therapy.

- VTP-300 (HBV):

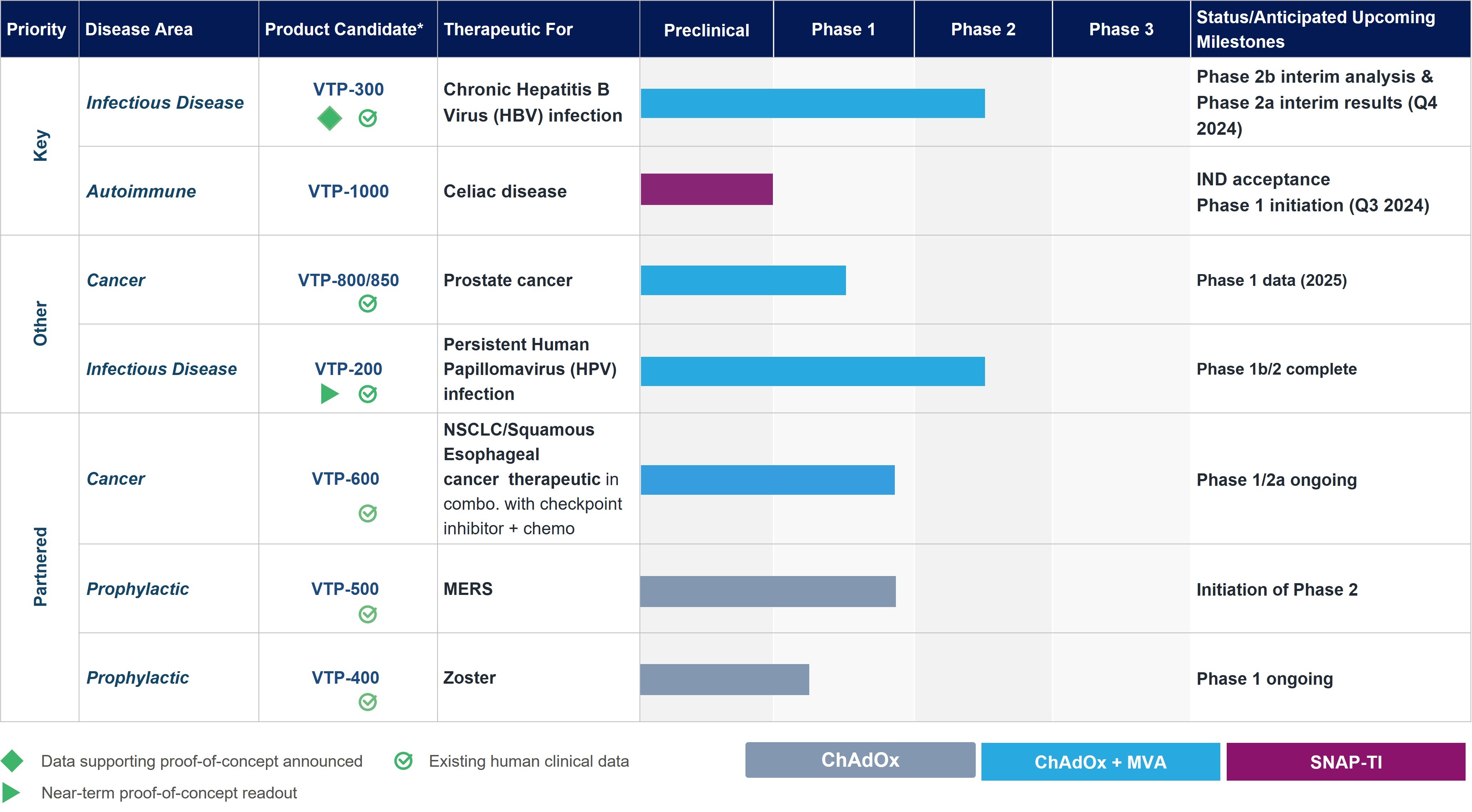

Pipeline

These are estimated timelines only and our pipeline may be subject to change.

Second Quarter 2024 Financial Highlights

- Cash position: As of June 30, 2024, cash, cash equivalents and restricted cash were

$117.8 million , compared to$130.0 million as of March 31, 2024. The net cash used in operating activities was$12.0 million in the second quarter of 2024, primarily resulting from development of our pipeline and ongoing clinical trials offset by receipt of an R&D tax credit of$1.4 million . Based on current research and development plans, the Company expects its available resources to fund its operating expenses and capital expenditure requirements into the second quarter of 2026. - Research and development expenses: Research and development expenses were

$11.7 million in the second quarter of 2024 compared to$11.1 million in the first quarter of 2024, with the increase mainly attributable to the progression of VTP-300 (HBV) through the two ongoing Phase 2 trials, partially offset by a reduction in expense from VTP-200 (HPV) which completed in the first quarter of 2024 and for which data was presented in April 2024. The quarter-on-quarter R&D expense per program is outlined in the following table.

| Period ended | Three months ended June 30, 2024 | Three months ended March 31, 2024 | Change | |||||||

| Direct research and development expenses by program: | ||||||||||

| VTP-200 HPV | $ | 383 | $ | 1,253 | $ | (870 | ) | |||

| VTP-300 HBV | 3,034 | 1,913 | 1,121 | |||||||

| VTP-500 MERS1 | 304 | 172 | 132 | |||||||

| VTP-600 NSCLC2 | 24 | 164 | (140 | ) | ||||||

| VTP-850 Prostate cancer | 414 | 178 | 236 | |||||||

| VTP-1000 Celiac | 1,371 | 1,374 | (3 | ) | ||||||

| Other and earlier stage programs | 908 | 784 | 124 | |||||||

| Total direct research and development expenses | $ | 6,438 | $ | 5,838 | $ | 600 | ||||

| Indirect research and development expenses: | ||||||||||

| Personnel-related (including share-based compensation) | 4,763 | 4,335 | 428 | |||||||

| Facility related | 342 | 390 | (48 | ) | ||||||

| Other indirect costs | 119 | 562 | (443 | ) | ||||||

| Total indirect research and development expenses | 5,224 | 5,287 | (63 | ) | ||||||

| Total research and development expense | $ | 11,662 | $ | 11,125 | $ | 537 | ||||

1 The development of VTP-500 is funded pursuant to an agreement with the Coalition for Epidemic Preparedness Innovations (CEPI).

2 The VTP-600 NSCLC Phase 1/2a trial is sponsored by Cancer Research UK.

- General and administrative expenses: General and administrative expenses were

$7.2 million in the second quarter of 2024, compared to$6.0 million in the first quarter of 2024. The increase of$1.2 million relates primarily to a loss of$0.1 million on foreign exchange in the second quarter of 2024, compared to a gain of$1.2 million in the first quarter of 2024. - Net loss: For the second quarter of 2024, the Company generated a net loss attributable to its shareholders of

$16.9 million , or$(0.43) per share on both basic and fully diluted bases, compared to a net loss attributable to its shareholders of$15.5 million , or$(0.40) per share on both basic and fully diluted bases in the first quarter of 2024.

About Barinthus Bio

Barinthus Bio is a clinical-stage biopharmaceutical company developing novel T cell immunotherapeutic candidates designed to guide the immune system to overcome chronic infectious diseases and autoimmunity. Helping people living with serious diseases and their families is the guiding principle at the heart of Barinthus Bio. With a focused pipeline built around our proprietary platform technologies, Barinthus Bio is advancing product candidates in infectious disease and autoimmunity, including: VTP-300, an immunotherapeutic candidate utilizing our ChAdOx/MVA platform designed as a potential component of a functional cure for chronic HBV infection and VTP-1000, an autoimmune candidate designed to utilize the SNAP-Tolerance Immunotherapy (TI) platform to treat patients with celiac disease. Barinthus Bio also has a Phase 1 clinical trial for VTP-850, a second-generation immunotherapeutic candidate designed to treat recurrent prostate cancer. Barinthus Bio’s proven scientific expertise, diverse portfolio and focus on pipeline development uniquely positions the company to navigate towards delivering treatments for people with infectious diseases and autoimmunity that have a significant impact on their everyday lives. For more information, visit www.barinthusbio.com.

Forward Looking Statements

This press release contains forward-looking statements regarding Barinthus Bio within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, which can generally be identified as such by use of the words “may,” “will,” “plan,” “forward,” “encouraging,” “believe,” “potential,” "expect", and similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include, without limitation, express or implied statements regarding our future expectations, plans and prospects, including our product development activities and clinical trials, including timing for readouts of any preliminary, interim or final data for any of our programs, the timing for initiation of any clinical trials, including dosing of the first patient in GLU001 for VTP-1000, our anticipated regulatory filings and approvals, our cash runway, and our ability to develop and advance our current and future product candidates and programs. Any forward-looking statements in this press release are based on our management’s current expectations and beliefs and are subject to numerous risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, risks and uncertainties related to the success, cost and timing of our pipeline development activities and planned and ongoing clinical trials, including the risk that the timing for preliminary, interim or final data or initiation of our clinical trials may be delayed, the risk that interim or topline data may not reflect final data or results, our ability to execute on our strategy, regulatory developments, the risk that we may not achieve the anticipated benefits of our pipeline prioritization and corporate restructuring, our ability to fund our operations and access capital, our cash runway, including the risk that our estimate of our cash runway may be incorrect, global economic uncertainty, including disruptions in the banking industry, the conflicts in Ukraine, Israel and Gaza, and other risks identified in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We expressly disclaim any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

| BARINTHUS BIOTHERAPEUTICS PLC CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS) (UNAUDITED) | |||||||

| June 30, 2024 | December 31, 2023 | ||||||

| ASSETS | |||||||

| Cash, cash equivalents and restricted cash | $ | 117,774 | $ | 142,090 | |||

| Research and development incentives receivable | 4,523 | 4,908 | |||||

| Prepaid expenses and other current assets | 9,582 | 9,907 | |||||

| Total current assets | 131,879 | 156,905 | |||||

| Goodwill | 12,209 | 12,209 | |||||

| Property and equipment, net | 10,962 | 11,821 | |||||

| Intangible assets, net | 23,527 | 25,108 | |||||

| Right of use assets, net | 7,286 | 7,581 | |||||

| Other assets | 886 | 882 | |||||

| Total assets | $ | 186,749 | $ | 214,506 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | 2,556 | 1,601 | |||||

| Accrued expenses and other current liabilities | 10,278 | 9,212 | |||||

| Deferred income | 839 | — | |||||

| Operating lease liability - current | 1,916 | 1,785 | |||||

| Total current liabilities | 15,589 | 12,598 | |||||

| Non-current liabilities: | |||||||

| Operating lease liability - non-current | 10,654 | 11,191 | |||||

| Contingent consideration | 1,888 | 1,823 | |||||

| Other non-current liabilities | 1,338 | 1,325 | |||||

| Deferred tax liability, net | 490 | 574 | |||||

| Total liabilities | $ | 29,959 | $ | 27,511 | |||

| Commitments and contingencies (Note 15) | |||||||

| Stockholders’ equity: | |||||||

| Ordinary shares, | 1 | 1 | |||||

| Deferred A shares, | 86 | 86 | |||||

| Additional paid-in capital | 390,273 | 386,602 | |||||

| Accumulated deficit | (209,010 | ) | (176,590 | ) | |||

| Accumulated other comprehensive loss – foreign currency translation adjustments | (24,732 | ) | (23,315 | ) | |||

| Total stockholders’ equity attributable to Barinthus Biotherapeutics plc shareholders | 156,618 | 186,784 | |||||

| Noncontrolling interest | 172 | 211 | |||||

| Total stockholders’ equity | $ | 156,790 | $ | 186,995 | |||

| Total liabilities and stockholders’ equity | $ | 186,749 | $ | 214,506 | |||

| BARINTHUS BIOTHERAPEUTICS PLC CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (IN THOUSANDS, EXCEPT NUMBER OF SHARES AND PER SHARE AMOUNTS) (UNAUDITED) | |||||||||||||||

| Three months ended | Six months ended | ||||||||||||||

| June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 | ||||||||||||

| License revenue 1 | $ | — | $ | 334 | $ | — | $ | 802 | |||||||

| Total revenue | — | 334 | — | 802 | |||||||||||

| Operating expenses | |||||||||||||||

| Research and development | 11,662 | 13,543 | 22,787 | 23,357 | |||||||||||

| General and administrative | 7,201 | 13,128 | 13,195 | 25,266 | |||||||||||

| Total operating expenses | 18,863 | 26,671 | 35,982 | 48,623 | |||||||||||

| Other operating income | 577 | — | 782 | — | |||||||||||

| Loss from operations | (18,286 | ) | (26,337 | ) | (35,200 | ) | (47,821 | ) | |||||||

| Other income/(expense): | |||||||||||||||

| Interest income | 635 | 522 | 1,410 | 2,110 | |||||||||||

| Interest expense | (12 | ) | (14 | ) | (24 | ) | (14 | ) | |||||||

| Research and development incentives | 693 | 559 | 1,287 | 1,716 | |||||||||||

| Other income | 20 | 310 | 20 | 310 | |||||||||||

| Total other income, net | 1,336 | 1,377 | 2,693 | 4,122 | |||||||||||

| Loss before income tax | (16,950 | ) | (24,960 | ) | (32,507 | ) | (43,699 | ) | |||||||

| Tax benefit | 7 | 1,136 | 44 | 1,652 | |||||||||||

| Net loss | (16,943 | ) | (23,824 | ) | (32,463 | ) | (42,047 | ) | |||||||

| Net loss attributable to noncontrolling interest | 12 | 22 | 43 | 65 | |||||||||||

| Net loss attributable to Barinthus Biotherapeutics plc shareholders | (16,931 | ) | (23,802 | ) | (32,420 | ) | (41,982 | ) | |||||||

| Weighted-average ordinary shares outstanding, basic | 39,041,111 | 38,407,672 | 38,907,296 | 38,211,625 | |||||||||||

| Weighted-average ordinary shares outstanding, diluted | 39,041,111 | 38,407,672 | 38,907,296 | 38,211,625 | |||||||||||

| Net loss per share attributable to ordinary shareholders, basic | $ | (0.43 | ) | $ | (0.62 | ) | $ | (0.83 | ) | $ | (1.10 | ) | |||

| Net loss per share attributable to ordinary shareholders, diluted | $ | (0.43 | ) | $ | (0.62 | ) | $ | (0.83 | ) | $ | (1.10 | ) | |||

| Net loss | $ | (16,943 | ) | $ | (23,824 | ) | $ | (32,463 | ) | $ | (42,047 | ) | |||

| Other comprehensive gain/(loss) – foreign currency translation adjustments | 164 | 5,604 | (1,413 | ) | 10,184 | ||||||||||

| Comprehensive loss | (16,779 | ) | (18,220 | ) | (33,876 | ) | (31,863 | ) | |||||||

| Comprehensive loss attributable to noncontrolling interest | 11 | 15 | 39 | 52 | |||||||||||

| Comprehensive loss attributable to Barinthus Biotherapeutics plc shareholders | $ | (16,768 | ) | $ | (18,205 | ) | $ | (33,837 | ) | $ | (31,811 | ) | |||

1 Includes license revenue from related parties for the three and six months ended June 30, 2024 of nil (three and six months ended June 30, 2023:

IR contacts:

Christopher M. Calabrese

Managing Director

LifeSci Advisors

+1 917-680-5608

ccalabrese@lifesciadvisors.com

Kevin Gardner

Managing Director

LifeSci Advisors

+1 617-283-2856

kgardner@lifesciadvisors.com

Media contact:

Audra Friis

Sam Brown, Inc.

+1 917-519-9577

audrafriis@sambrown.com

Company contact:

Jonothan Blackbourn

IR & PR Manager

Barinthus Bio

ir@barinthusbio.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c0677b65-29bb-4869-b045-22325fa94f17