Wealth Managers Call on Asset Managers to Bolster Product Specialist Talent, New MMI-Broadridge Survey Reveals

Rhea-AI Summary

A new survey by the Money Management Institute (MMI) and Broadridge Financial Solutions (NYSE: BR) reveals that 74% of wealth managers are urging asset managers to increase their product specialist talent, up from 38% in 2023. This demand is driven by the rapid expansion of complex investment products like alternatives and active ETFs.

Key findings include:

- 60% of asset managers plan to invest in product specialists, focusing on alternative investments and private markets

- 85% of asset and wealth managers agree that younger generations require different products and service models

- 89% of wealth managers expect increased allocations to active ETFs and alternative investments

- 93% of asset and wealth managers allow some use of AI, with 79% currently leveraging it

The survey highlights a growing demand for innovative products and specialized expertise in the investment management industry, particularly in areas like direct/custom indexing and liquid fund wrappers for alternative investments.

Positive

- None.

Negative

- None.

News Market Reaction – BR

On the day this news was published, BR gained 0.11%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Active ETFs and alternative investments drive product lineups as interest in mutual funds declines

"As part of our ongoing program of delivering comprehensive thought leadership on important industry trends to MMI's member firms, we are excited to share our latest annual survey results in conjunction with Broadridge," said Craig Pfeiffer, President & CEO of the Money Management Institute. "The survey provides multiple insights into the state of the investment management industry to help drive actionable strategies and informed decision-making for investment solutions providers. In particular, our survey found that product lineup is one of the top three characteristics that sets best-in-class asset managers apart from others, so being thoroughly prepared to meet these demands is mission critical. As such, building and resourcing the right product specialist teams will be instrumental in helping asset management firms stay ahead of the curve."

In its second year, the survey explores how MMI members view trends and challenges across four topics: distribution, products and strategies, artificial intelligence, and business outlook. This year's survey found that asset managers are making progress but not keeping pace with advisors' evolving product offering needs.

Asset managers leaving money on the table with undiversified products and expertise

"The investment management landscape is rapidly evolving due to an influx of younger investors and unsteady markets forcing wealth managers to look at newer, non-traditional products for alpha generation. As a result, asset managers now more than ever have an opportunity to provide innovative products and onboard the right talent to meet the demands of today's investor," said Tim Kresl, Principial, Distribution Insight at Broadridge. "Our survey reveals that the future of investing is in newer products in private markets and active ETFs, and asset managers can strengthen relationships by providing the right products and services."

The survey also finds that wealth managers are increasingly leveraging direct/custom indexing, typically to address tax efficiencies and clients' unique investment preferences, yet

Further, asset managers may also be missing the mark when it comes to converting mutual funds into ETFs, as interest in mutual funds wanes;

In addition to evolving product lineups to meet the demand for new investment opportunities, a majority (

Alternative investments and active ETFs are the new battleground among investment managers

Investing in the right talent is increasingly important as overall industry allocations to products are expected to change. A majority of wealth and asset managers expect to see the industry increase allocations to active ETFs and alternative investments (

While asset and wealth managers are aligned on the opportunities these products offer, when it comes to alternative investments specifically, there is misalignment in managers' vision for the go-to-market strategy. Eighty-three percent of wealth managers agree that their vision is to offer these products as an integrated component of an overall portfolio versus standalone investments, compared to

In addition, nearly 8 in 10 (

AI to advance opportunities among asset and wealth managers

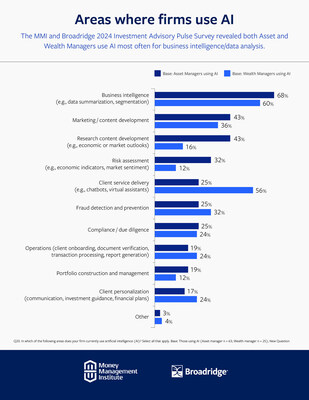

Nearly all (

Of those leveraging AI, nearly all (

While enhanced efficiencies and opportunities abound within AI, concerns remain around errors/inaccuracies, data security/privacy, and regulatory compliance, and some managers report that the use of AI as well as the cost of keeping up with continually advancing technology is a threat to their business. However, despite these challenges and threats, managers are taking steps such as evaluating contracts with service providers, being deliberate about the deployment of technologies, and reducing costs in order to keep up with the pace of change.

Methodology

The survey was conducted by the Money Management Institute (MMI) in conjunction with Broadridge and 8 Acre Perspective, an independent marketing research firm. A total of 175 MMI members completed the survey, which was fielded from May 23 – June 28, 2024.

For further details on survey methodology, please contact a media representative.

About Broadridge

Broadridge Financial Solutions (NYSE: BR), is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than

About the Money Management Institute (MMI)

Established in 1997, the Money Management Institute (MMI) is the industry association representing financial services firms that provide financial advice and investment advisory solutions to investors. Through conferences, educational resources, and thought leadership, MMI facilitates peer-to-peer connections, fosters industry knowledge and professionalism, and supports the development of the next generation of industry leadership. MMI member firms are dedicated to helping individual and institutional investors, at every level of assets, plan for and fulfill their financial goals. For more information, visit www.MMInst.org.

Media Contact:

Matthew Luongo

Prosek Partners

+1 646-818-9279

mluongo@prosek.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/wealth-managers-call-on-asset-managers-to-bolster-product-specialist-talent-new-mmi-broadridge-survey-reveals-302276287.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/wealth-managers-call-on-asset-managers-to-bolster-product-specialist-talent-new-mmi-broadridge-survey-reveals-302276287.html

SOURCE Broadridge Financial Solutions, Inc.