BeMetals Drilling Results Define Target Zones within Seta Vein and Identify Corridor of Gold Mineralization at Kato Project in Japan

VANCOUVER, BC / ACCESSWIRE / July 12, 2023 / BeMetals Corp. (TSXV:BMET), (OTCQB:BMTLF), (Frankfurt:1OI.F) (the "Company" or "BeMetals") is pleased to announce a batch of recent assay results from its ongoing drilling program at the Kato Gold Project ("Kato" or the "Property") in Hokkaido, Japan.

HIGHLIGHTS OF RECENT KATO DRILLING RESULTS:

- KT23-19: Interval 1: 6.40 metres ("m") grading 1.74 g/t grams per tonne ("g/t") gold ("Au") and 5.4 g/t silver ("Ag")

- Including: 1.70 m grading 5.58 g/t Au and 11.5 g/t Ag

- Interval 2: 5.60 m grading 3.29 g/t Au and 7.9 g/t Ag

- Including: 1.00 m grading 9.46 g/t Au and 17.6 g/t Ag

- Also including: 0.43 m grading 9.65 g/t Au and 8.7 g/t Ag

- KT23-20: Interval 3: 13.55 m grading 1.19 g/t Au and 18.32 g/t Ag

- Including: 1.95 m grading 3.55 g/t Au and 21.66 g/t Ag

- KT23-18: Interval 2: 10.54 m grading 1.28 g/t Au and 17.4 g/t Ag

- Including: 1.37 m grading 4.48 g/t Au and 75.5 g/t Ag

- Interval 5: 6.70 m grading 2.48 g/t Au and 36.1 g/t Ag

- Including: 1.90 m grading 7.50 g/t Au and 91.7 g/t Ag

- KT23-17: Interval 3: 3.60 m grading 2.12 g/t Au and 14.9 Ag

- Including: 1.00 m grading 6.31 g/t Au and 17.8 g/t Ag

- Interval 6: 3.15 m grading 1.18 g/t Au and 7.7 Ag

- Including: 0.75 m grading 3.32 g/t Au and 13.0 g/t Ag

Note: Intertek Testing Services completed the analytical work with the core samples processed at their accredited laboratory in Manila, Philippines (See details in QA/QA section below). Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 55 to

John Wilton, President and CEO of BeMetals stated, "This batch of drilling results includes intersections from both the Seta and Kamitake veins at our Kato Project in Hokkaido, Japan. Combining these results with existing data has motivated targets with potential to further extend the higher-grade zones within the Seta Vein. Drill testing of these high-grade target zones is in progress. This drilling also recognized other gold bearing epithermal veins southwest of the Seta and Kamitake veins which indicates a wide corridor of mineralization exists. KT23-17 returned eight mineralized zones, including some shallow depth intercepts, and is the Company's southeastern most drill hole to date. This suggests the Kato corridor hosting gold vein mineralization has dimensions at least 200 metres wide and 1.3 kilometres of strike extent. These factors confirm the large-scale potential of gold mineralization on the Property."

KATO PROJECT DRILLING RESULTS

The Company reports results from approximately 1,660 metres of drilling completed in six drill holes at the Kato Project. This drilling has returned multiple zones of epithermal gold mineralization related to the Seta, Kamitake and other new vein zones intersected in the program to date.

SETA VEIN

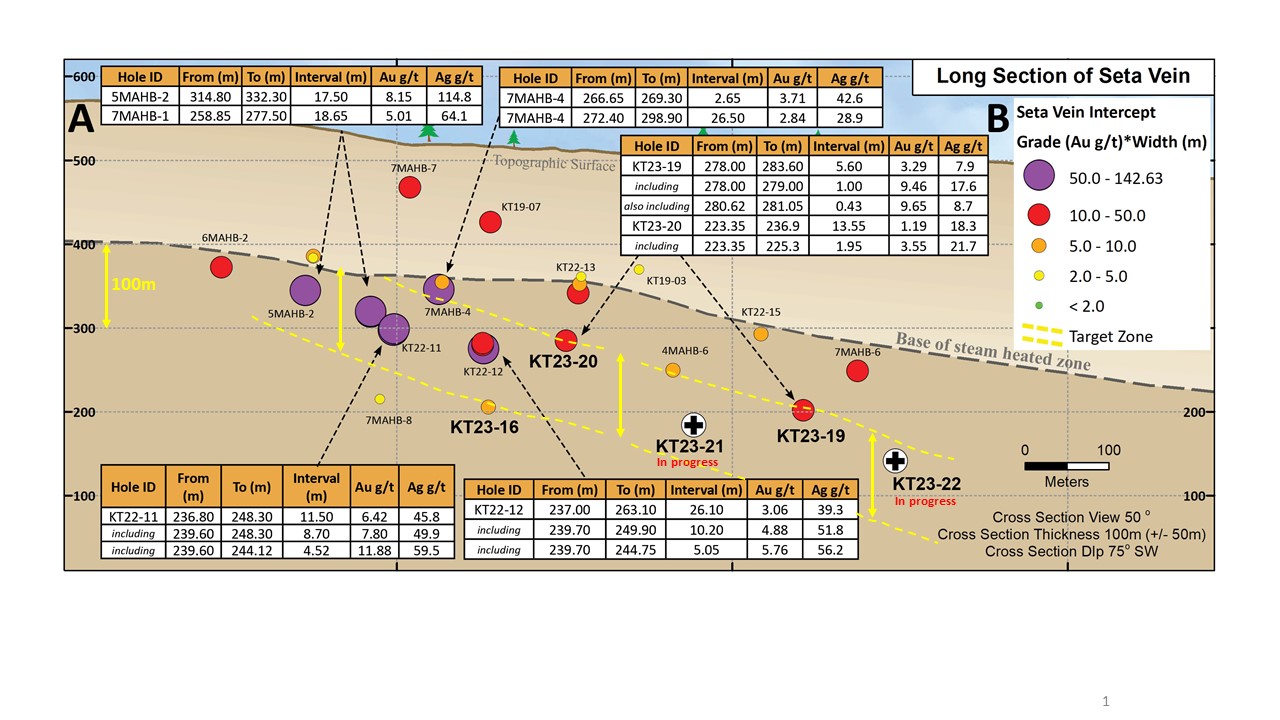

Figure 1 is a simplified long section cut parallel to the strike of the Seta Vein (see section line A-B on Figure 2). It illustrates the drill hole intersection pierce points of the Seta Vein intervals with labelled depths, widths, gold, and silver grades. These new assay results when combined with previous BeMetals and historical results, have defined an interpreted target zone for higher-grade zones and shoots of gold mineralization within the Seta Vein.

Drill hole KT23-19, some 400 metres along strike to the southeast from KT22-12, intersected the Seta Vein in the transition zone where we observe both clay (kaolinite) overprint and pristine epithermal, gold-bearing quartz vein. The favourably textured quartz plus adularia vein zones in the KT23-19 Seta Vein intersection are demonstrated by the included intervals of 9.46 g/t and 9.65 g/t gold over 1.00 and 0.43 metres, respectively. These occur within a broader lower grade zone where the Seta Vein has been overprinted by clay alteration. Drill testing a target zone for potentially higher-grade gold mineralization below and along strike from the KT23-19 intersection is motivated. The drilling of two holes to test this zone are in progress with the planned Seta Vein intersection points shown on Figure 1 as KT23-21 and KT23-22. Hole KT23-19A was drilled as a wedged deflection from the KT23-19 mother hole and returned a comparable gold intersection of the Seta Vein to the original hole (see Tables 1 & 2 for details).

Figure 1: Long Section (Looking NE) of Seta Vein Intersections (KT23-16, KT23-19 and KT23-20)

Note: Results of the historical drill hole intersections have been previously reported reported, and are detailed in the Company's technical report entitled, "Kato Gold Project Japan NI 43-101 Technical Report" with an effective date of July 13, 2021, and BeMetals' news release; BeMetals further extends Seta Vein and advances all Kazan Gold Projects in Japan dated January 11, 2023.

Drill hole KT23-20 was targeted to intersect the Seta Vein below hole KT22-13 which intersected the steam-heated zone, as previously reported, with a mineralized zone of 30.00 metres grading 0.47 g/t Au, including: 5.25 metres grading 1.25 g/t Au. The tenor of the gold mineralization interval in KT23-20 is higher than that in KT22-13 to provide 13.55 metres grading 1.19 g/t Au, including 1.95 metres grading 3.55 g/t Au. The results of KT23-20, relative to its observed quartz vein textures, might suggest that the Seta Vein, in certain areas, includes zones commonly referred to as shoots of higher-grade gold mineralization. Further drilling is required in such areas to better understand this control on the higher-grade.

KT23-16 intersected a unit known as black breccia at the targeted Seta Vein elevation. This breccia is interpreted to postdate gold mineralization and disrupts the epithermal veins and gold grades in certain areas. This unit in KT23-16 includes fragments of gold-bearing vein quartz material suggesting a more consistent quartz vein could be developed below or adjacent to this intersection.

KATO CORRIDOR

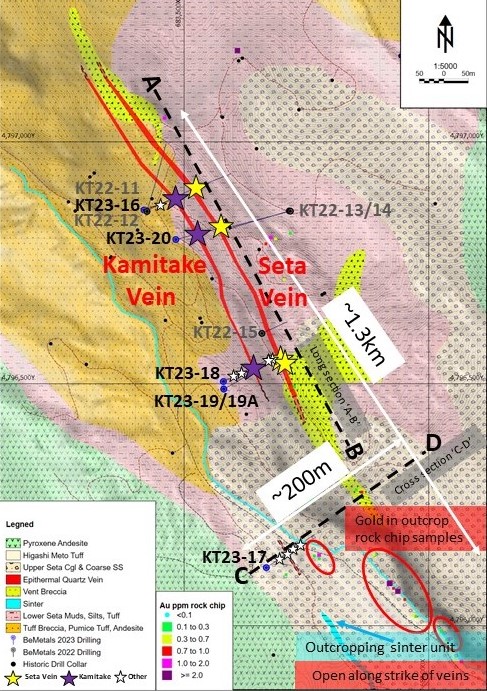

Figure 2 shows the location of the recent Seta, Kamitake and other newly intersected epithermal veins. These combined results, that now include KT23-17, and surface outcrop samples farther to the southeast outline a ‘Kato corridor' target that is 1.3 kilometres in strike by 200m in width.

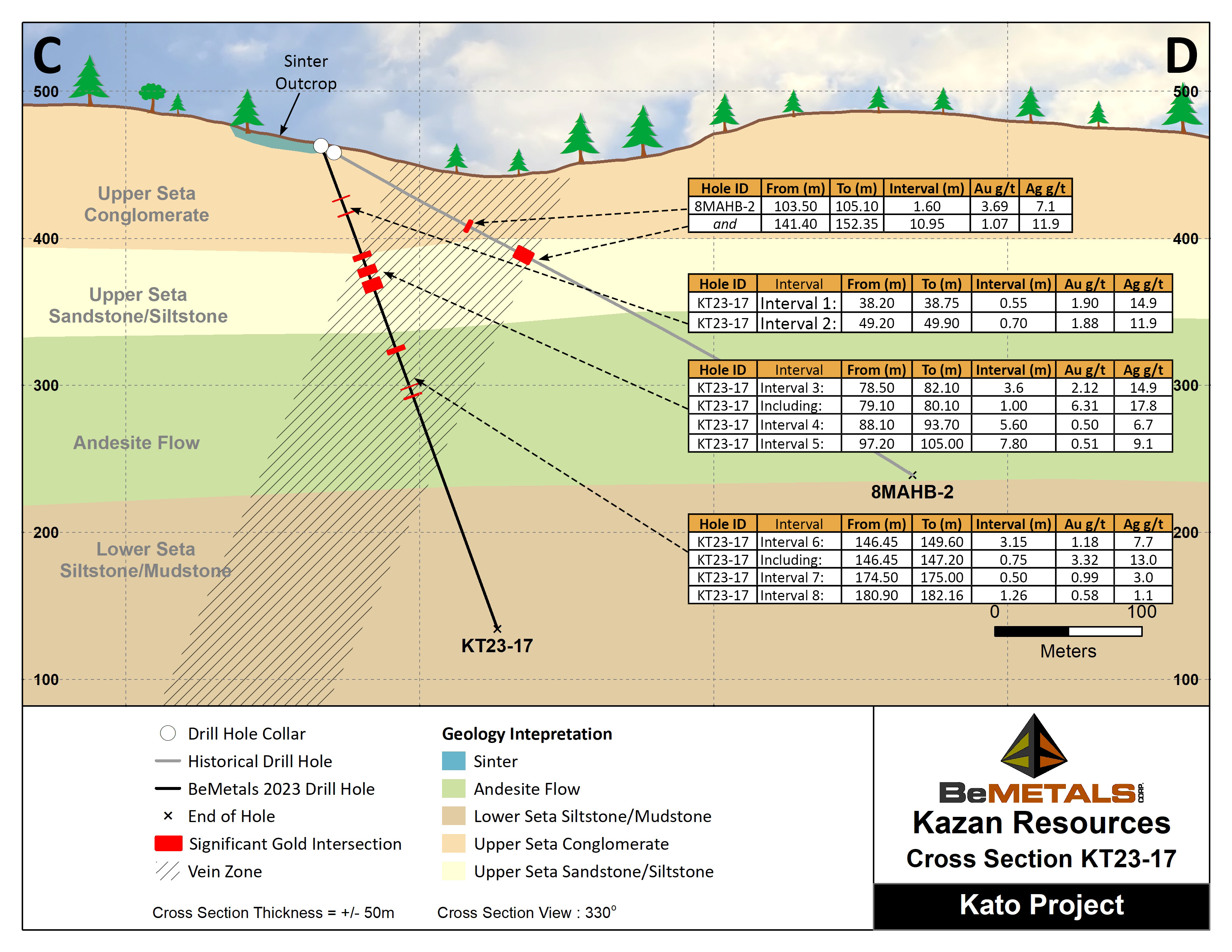

Drill hole KT23-17 was collared close to the outcrop of an extensive sinter unit. Such units represent the surface expression of epithermal systems, and their existence shows the full system is preserved. Figure 3 illustrates a cross section through KT23-17 and the eight mineralized intervals intersected between 38.20 and 182.16 metres (see Table 1). Examples of this mineralization are 3.60 metres grading 2.12 g/t Au and 14.9 Ag from 78.50 metres, including 1.00 metres grading 6.31 g/t Au and 17.8 g/t Ag and 3.15 metres grading 1.18 g/t Au and 7.7 g/t Ag from 146.45 metres, including: 0.75 metres grading 3.32 g/t Au and 13.0 g/t Ag. The results from this drill hole indicate the extensive nature of the Kato Corridor with mineralized quartz veins and stockwork zones developed in both the upper sediment and andesite host units.

Assay results from quartz veins in KT23-18 returned an intersection of 10.54 metres grading 1.28 g/t Au and 17.4 g/t Ag, including 1.37 metres grading 4.48 g/t Au and 75.5 g/t Ag from 88.26 metres down-hole depth. This intersection does not correlate with either the Seta or Kamitake veins but appears to be a new, relatively shallow zone of mineralization. An additional zone of mineralization in this hole of 6.70 metres grading 2.48 g/t Au and 36.1 g/t Ag from 229.60 metres, including 1.90 metres grading 7.50 g/t Au and 91.7 g/t Ag is currently interpreted to lie between the Kamitake and Seta Veins. KT23-18, however, did not reach the Seta Vein target.

Figure 2. Kato Corridor: Location of Reported Drill Hole Intersections (KT23-16 to KT23-20) on Simplified Geological Map (Location of Seta Vein long section (A-B) and KT23-17 cross section (C-D) also shown)

Note: Results of the historical rock chip sampling have been previously reported reported, and are detailed in the Company's technical report entitled, "Kato Gold Project Japan NI 43-101 Technical Report" with an effective date of July 13, 2021.

Figure 3. Cross section (Looking NW) through KT23-17 showing the multiple veins intersected & simplified geology

Table 1 lists the gold intersections returned from drill holes KT23-16 to KT23-20 during the ongoing 2023 drilling program at the Kato Project. Table 2 provides details of the drill hole locations, dips, and azimuths.

Table 1: Drill Hole Intersection Results Holes KT23-16 to KT23-20

Drill hole and Interval | From (m) | To (m) | Core Interval (m) | Au g/t | Ag g/t | Comments |

KT23-16 | ||||||

| Interval 1: | 178.30 | 187.20 | 8.90 | 0.58 | 5.6 | |

Including: | 180.50 | 183.40 | 2.90 | 0.90 | 7.8 | |

Interval 2: | 236.20 | 241.70 | 5.50 | 0.95 | 8.3 | Kamitake Vein |

Interval 3: | 266.80 | 271.30 | 4.50 | 1.35 | 10.3 | |

Including: | 266.80 | 268.80 | 2.00 | 2.38 | 10.7 | |

Interval 4: | 288.50 | 320.40 | 31.90 | 0.34 | 9.1 | Seta Vein Zone (1) |

Including: | 288.50 | 292.65 | 4.15 | 0.42 | 4.2 | |

Including: | 311.15 | 316.30 | 5.15 | 0.46 | 15.6 | |

KT23-17 | ||||||

Interval 1: | 38.20 | 38.75 | 0.55 | 1.90 | 14.9 | |

Interval 2: | 49.20 | 49.90 | 0.70 | 1.88 | 11.9 | |

Interval 3: | 78.50 | 82.10 | 3.60 | 2.12 | 14.9 | |

Including: | 79.10 | 80.10 | 1.00 | 6.31 | 17.8 | |

Interval 4: | 88.10 | 93.70 | 5.60 | 0.50 | 6.7 | |

Interval 5: | 97.20 | 105.00 | 7.80 | 0.51 | 9.1 | |

Interval 6: | 146.45 | 149.60 | 3.15 | 1.18 | 7.7 | |

Including: | 146.45 | 147.20 | 0.75 | 3.32 | 13.0 | |

Interval 7: | 174.50 | 175.00 | 0.50 | 0.99 | 3.0 | |

Interval 8: | 180.90 | 182.16 | 1.26 | 0.58 | 1.1 | |

KT23-18 | ||||||

Interval 1: | 34.45 | 35.55 | 1.10 | 0.63 | 10.9 | |

Interval 2: | 88.26 | 98.80 | 10.54 | 1.28 | 17.4 | |

Including: | 88.26 | 89.63 | 1.37 | 4.48 | 75.5 | |

Interval 3: | 129.95 | 131.16 | 1.21 | 1.36 | 13.6 | |

Interval 4: | 184.97 | 188.95 | 3.98 | 0.64 | 21.1 | Kamitake Vein |

Interval 5: | 229.60 | 236.30 | 6.70 | 2.48 | 36.1 | |

Including: | 229.60 | 231.50 | 1.90 | 7.50 | 91.7 | Did not reach Seta Vein |

KT23-19 | ||||||

Interval 1: | 243.90 | 250.30 | 6.40 | 1.74 | 5.4 | |

Including: | 248.60 | 250.30 | 1.70 | 5.58 | 11.5 | |

Interval 2: | 278.00 | 283.60 | 5.60 | 3.29 | 7.9 | Seta Vein |

Including: | 278.00 | 279.00 | 1.00 | 9.46 | 17.6 | |

Also including: | 280.62 | 281.05 | 0.43 | 9.65 | 8.7 | |

| KT23-19A(Deflection from KT23-19 mother hole) | ||||||

Interval 1: | 247.50 | 249.50 | 2.00 | 3.54 | 19.9 | |

Interval 2: | 279.50 | 284.20 | 4.70 | 3.17 | 6.2 | Seta Vein |

Including | 279.50 | 280.30 | 0.80 | 8.34 | 13.1 | |

Also including: | 281.40 | 282.00 | 0.60 | 8.49 | 20.3 | |

KT23-20 | ||||||

Interval 1: | 197.10 | 201.05 | 3.95 | 1.12 | 9.0 | Kamitake Vein |

Interval 2: | 214.50 | 223.35 | 8.85 | 0.50 | 9.6 | Seta Vein |

Interval 3: | 223.35 | 236.90 | 13.55 | 1.19 | 18.32 | |

Including: | 223.35 | 225.30 | 1.95 | 3.55 | 21.66 | |

Table 1 Notes: Intertek Testing Services completed the analytical work with the core samples processed at their accredited laboratory in Manila, Philippines (See details in QA/QA section below). Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 55 to

Table 2: Core Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

Drill Hole ID | Azimuth Degree | Dip Degree | End of hole Depth (m) | Easting (m) | Northing (m) | Elevation (m) |

KT23-16 | 65 | -68 | 353.0 | 683418 | 4796859 | 495 |

KT23-17 | 55 | -70 | 350.0 | 683668 | 4796120 | 463 |

KT23-18 | 63 | -65 | 300.0 | 683580 | 4796505 | 454 |

KT23-19 | 63 | -62 | 312.5 | 683581 | 4796489 | 454 |

KT23-19A | 63 | -62 | 308.2 (Deflection from 206m) | 683659 | 4796535 | 269 |

KT23-20 | 75 | -65 | 242.9 | 683483 | 4796798 | 490 |

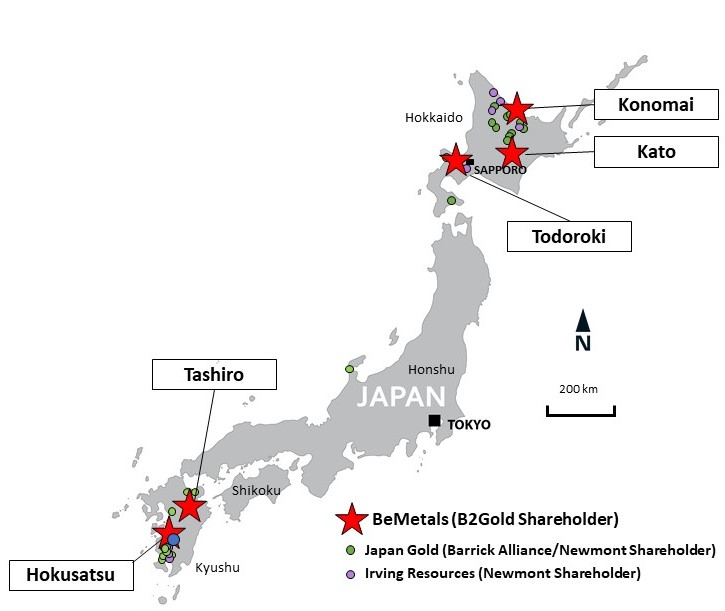

THE KATO GOLD PROJECT

The Kato Gold Project is BeMetals' most advanced, of its five exploration projects in Japan based on the amount of available historical drilling information in central Hokkaido (See Figure 2). The Kato Project (historically referred to as the Seta River Prospect) is an example of a remarkably well-preserved epithermal gold system. This mineralization style is an example of an epithermal system and the classic analogy for this deposit type in Japan is the Hishikari Gold Mine, in Kyushu island. Global examples of this type of mineralization include mines such as Lihir (Papua New Guinea), Kupol and Julietta (Russia), Waihi (New Zealand) and Masbate (Philippines).*

The Kato property was previously drilled by MMAJ the Japanese state agency in the 1990s and during that time results included high-grade intervals such as 17.5 metres grading 8.15 g/t Au in hole 5MAHB-2 and 18.65 metres grading 5.01 g/t Au in hole 7MAHB-1.*

*Please refer to technical report entitled, "Kato Gold Project Japan NI 43-101 Technical Report" with an effective date of July 13, 2021.

Figure 4. Location of BeMetals Kazan Gold Projects in Japan

QUALITY ASSURANCE AND QUALITY CONTROL

The new results reported here for this core drilling program were analyzed by Intertek Testing Services, an independent and accredited laboratory. Samples were prepared and analytical work conducted in Manila, Philippines. The results were obtained using the following analytical methods as appropriate to determine the gold grades; FA50N/AA of 50g fire assay, with Atomic Absorption Spectrometry ("AAS") finish and FA50GR/GR of 50g fire assay with Gravimetric finish for over limit samples exceeding 10 g/t Au. The core sampling was conducted with a robust sampling protocol that included the appropriate insertion of standard reference material, duplicates, and blanks into the sample stream.

Field operations and management have been conducted by BeMetals' personnel. The core drilling was conducted by Energold Drilling.

ABOUT BEMETALS CORP.

BeMetals is a precious and base metals exploration and development company focused on becoming a leading metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company has established itself in the gold sector with the acquisition of a portfolio of wholly owned exploration projects in Japan. BeMetals is also progressing its tier-one targeted, Pangeni Copper Exploration Project in the prolific Zambian Copperbelt with co-funding investor the Japanese state agency JOGMEC ("Japan Organization for Metals and Energy Security"). Guiding and leading BeMetals' growth strategy is a strong board and management team, founders, and significant shareholders of the Company, who have an extensive proven record of delivering exceptional value in the mining sector, over many decades, through the discovery, construction and operation of mines around the world.

QUALIFIED PERSON STATEMENT

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a "Qualified Person" as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

"John Wilton"

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-928-2797

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (as defined under applicable securities laws), based on management's best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to future exploration, development and advancement of the Kazan Projects in Japan and the Pangeni Project in Zambia, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreement for the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward-looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward-looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company's most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.

SOURCE: BeMetals Corp.

View source version on accesswire.com:

https://www.accesswire.com/767229/BeMetals-Drilling-Results-Define-Target-Zones-within-Seta-Vein-and-Identify-Corridor-of-Gold-Mineralization-at-Kato-Project-in-Japan