BitMine Immersion Technologies Reports Annual Sales Increase of 413%

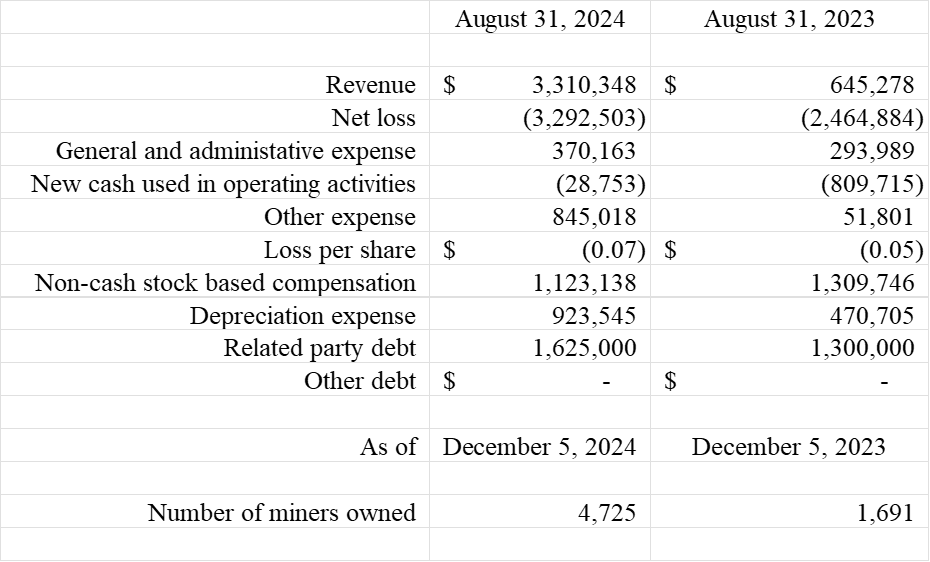

BitMine Immersion Technologies (OTCQX:BMNR) reported significant growth for fiscal year 2024, with a 413% increase in annual sales. The company's bitcoin self-mining operations achieved record revenue of $3.03 million, representing a 679% year-over-year increase. BitMine is expanding its operations by deploying 3,000 new ASICs to its existing fleet of 1,640 units.

The company operates facilities in Trinidad with 1.6 Megawatts deployed (out of 100 MW available) at $0.035/kWh, and in Pecos, Texas with 5 MW capacity. BitMine has announced a share buyback program of up to $250,000 through December 31, 2025. Despite GAAP losses, net cash used in operating activities improved to $(28,753) in 2024 from $(809,715) in 2023.

BitMine Immersion Technologies (OTCQX:BMNR) ha riportato una crescita significativa per l'anno fiscale 2024, con un aumento del 413% delle vendite annuali. Le operazioni di mining di bitcoin dell'azienda hanno raggiunto un fatturato record di $3,03 milioni, che rappresenta un aumento del 679% rispetto all'anno precedente. BitMine sta espandendo le sue operazioni con l'implementazione di 3.000 nuovi ASIC nella sua flotta esistente di 1.640 unità.

L'azienda gestisce impianti a Trinidad con 1,6 Megawatt deployed (su 100 MW disponibili) a $0,035/kWh, e a Pecos, Texas, con una capacità di 5 MW. BitMine ha annunciato un programma di riacquisto di azioni fino a $250.000 entro il 31 dicembre 2025. Nonostante le perdite secondo i GAAP, il liquidità netta utilizzata nelle attività operative è migliorata a $(28.753) nel 2024 rispetto a $(809.715) nel 2023.

BitMine Immersion Technologies (OTCQX:BMNR) reportó un crecimiento significativo para el año fiscal 2024, con un incremento del 413% en las ventas anuales. Las operaciones de auto-minado de bitcoin de la compañía lograron ingresos récord de $3.03 millones, lo que representa un aumento del 679% en comparación con el año anterior. BitMine está ampliando sus operaciones al desplegar 3,000 nuevos ASIC a su flota existente de 1,640 unidades.

La compañía opera instalaciones en Trinidad con 1.6 Megavatios desplegados (de 100 MW disponibles) a $0.035/kWh, y en Pecos, Texas, con una capacidad de 5 MW. BitMine ha anunciado un programa de recompra de acciones de hasta $250,000 hasta el 31 de diciembre de 2025. A pesar de las pérdidas según los GAAP, el efectivo neto utilizado en actividades operativas mejoró a $(28,753) en 2024 desde $(809,715) en 2023.

BitMine Immersion Technologies (OTCQX:BMNR)는 2024 회계연도에 중요한 성장을 보고했으며, 연간 판매가 413% 증가했습니다. 회사의 비트코인 자가 채굴 작업은 $3.03 백만의 기록적 수익을 달성하여 전년 대비 679% 증가했습니다. BitMine은 기존 1,640대의 장비에 3,000개의 새로운 ASIC을 배치하여 운영을 확대하고 있습니다.

회사는 트리니다드에 1.6메가와트가 배치된 시설을 운영하고 있으며 (사용 가능한 100MW 중), 텍사스의 페코스에는 5MW 용량의 시설이 있습니다. BitMine은 2025년 12월 31일까지 최대 $250,000의 자사주 매입 프로그램을 발표했습니다. GAAP 손실에도 불구하고 운영 활동에서 사용된 순 현금은 2023년 $(809,715)에서 2024년 $(28,753)로 개선되었습니다.

BitMine Immersion Technologies (OTCQX:BMNR) a rapporté une croissance significative pour l'exercice fiscal 2024, avec une augmentation de 413 % des ventes annuelles. Les opérations de minage autonome de bitcoin de l'entreprise ont atteint un chiffre d'affaires record de 3,03 millions de dollars, soit une augmentation de 679 % par rapport à l'année précédente. BitMine élargit ses opérations en déployant 3 000 nouveaux ASIC dans sa flotte existante de 1 640 unités.

L'entreprise exploite des installations à Trinidad avec 1,6 mégawatt déployés (sur 100 MW disponibles) à 0,035 $/kWh, et à Pecos au Texas avec une capacité de 5 MW. BitMine a annoncé un programme de rachat d'actions allant jusqu'à 250 000 $ d'ici le 31 décembre 2025. Malgré les pertes selon les normes GAAP, la trésorerie nette utilisée dans les activités opérationnelles s'est améliorée à $(28 753) en 2024, contre $(809 715) en 2023.

BitMine Immersion Technologies (OTCQX:BMNR) hat für das Geschäftsjahr 2024 ein signifikantes Wachstum gemeldet, mit einem Anstieg des Jahresumsatzes um 413%. Die Bitcoin-Selbstmine-Betriebe des Unternehmens erzielten einen Rekordumsatz von $3,03 Millionen, was einem Anstieg von 679% im Vergleich zum Vorjahr entspricht. BitMine erweitert seine Aktivitäten, indem es 3.000 neue ASICs zu seiner bestehenden Flotte von 1.640 Einheiten hinzufügt.

Das Unternehmen betreibt Anlagen in Trinidad mit 1,6 Megawatt (von 100 MW verfügbar) zu einem Preis von $0,035/kWh und in Pecos, Texas, mit einer Kapazität von 5 MW. BitMine hat ein Aktienrückkaufprogramm von bis zu $250.000 bis zum 31. Dezember 2025 angekündigt. Trotz GAAP-Verlusten verbesserte sich der Nettobetrag an Bargeld, das für betriebliche Tätigkeiten verwendet wurde, auf $(28.753) im Jahr 2024, im Vergleich zu $(809.715) im Jahr 2023.

- Record revenue of $3.03M from bitcoin self-mining, up 679% YoY

- Total revenue increased 400% year-over-year

- Secured competitive electricity rate of $0.035/kWh in Trinidad

- Significant improvement in operating cash flow from -$809,715 to -$28,753

- Announced $250,000 share buyback program

- Company continues to operate at a GAAP loss

- Terminated existing hosting contracts

- deployment of available capacity (1.6MW out of 100MW in Trinidad)

Announces Share Buyback Program

LAS VEGAS, NV / ACCESSWIRE / December 9, 2024 / Bitmine Immersion Technologies, Inc. (OTCQX:BMNR) ("Bitmine" or "the Company"), a leading blockchain technology firm specializing in immersion-cooled bitcoin mining, today announced annual results and achievements for the fiscal year ended August 31, 2024 summarized in key metrics below. BitMine continues to expand its operational footprint and is currently deploying 3000 recently purchased ASICs to its existing fleet of approximately 1,640 units. Separately, BitMine has established a corporate share buyback plan, and established a relationship with a brokerage firm that specializes in corporate share repurchases.

Key metrics summary:

Management Commentary

Jonathan Bates, CEO of BitMine Immersion Technologies, stated:

"2024 has been a transformative year for Bitmine, as we substantially expanded revenue and scaled operations. We are very excited about the prospects for 2025, especially given the significant rise in the price of bitcoin. In order to fully understand our operating results, it is important to note that despite our losses on a GAAP basis, there are several key metrics to analyze in our financial results. There are a number of significant non-cash charges on our income statement which include stock-based compensation, depreciation, and certain items included in other expenses. As a result, net cash used in operating activities on our statement of cash flows for the fiscal year ended 2024 was

Mr. Bates continued, "Our operating expenses are low compared to our peers, and more importantly we were able to leverage our low overhead and significantly increase sales without adding any additional employees. We expect this trend to continue in the short-term. Finally, the interest of management is fully aligned with our shareholders as evidenced by the fact that management are the largest shareholders, and collectively our executive officers and Board members have taken virtually no cash compensation since the inception of the Company.Furthermore, by diversifying our offerings to include advanced financial services through hashrate buying and selling, and exploring new opportunities within the Bitcoin ecosystem, we are creating additional pathways for growth. Leveraging technology and strategic geographic expansion, we remain focused on delivering sustained value to our shareholders while broadening our focus on the continued adoption of Bitcoin."

Lastly, Mr. Bates stated, "We have made the decision to establish a corporate share buyback program, because we feel it is a prudent use of shareholder capital at this time. Our board has approved the repurchase of up to

Key Highlights

Record Self-Mining Operations:

Bitmine's bitcoin self-mining operations achieved record annualized revenue of

Trinidad Operations:

The Company resolved prior utility disputes at its Trinidad facility, and is now operating at a competitive electricity rate of$0.03 5 per kWh. This site has become a cornerstone of Bitmine's low-cost hosting strategy. The company has 1.6 Megawatts deployed as part of up to 100 Megawatts available. BitMine is scouting locations for the next 1.6 Megawatts, with all of the data center equipment already in Trinidad.Pecos, Texas Operation

Revenue Growth and Diversification:

Bitmine reported a400% year-over-year increase in total revenue, driven primarily by gains in self-mining. The Company also capitalized on equipment sales and plans to expand both throughout fiscal 2025. The Company opted to terminate its existing hosting contracts, and utilize all of its capacity for its self-mining operations for the foreseeable future.Exploration of Bitcoin Services Expansion:

Bitmine continues to integrate complementary Bitcoin services into its operations, aiming to enhance long-term value creation and solidify its position within the growing Bitcoin ecosystem. The Company has been both a buyer and seller, at various times, of bitcoin-denominated hashrate. The Company is exploring various non-mining efforts within the Bitcoin Network and data center arenas that will diversify the company into a unique overall Bitcoin operating company, rather than simply a pure-play miner.

This site is approved for 5 Megawatts. The company operates one immersion container with 0.6 Megawatts of capacity for its own use and owns approximately

Looking Ahead

The company is excited about the growth in Bitcoin adoption, as well as the price of Bitcoin itself. Bitmine remains poised to navigate market dynamics by optimizing operations, expanding capacity, and diversifying into complimentary lines of business that support the growth of Bitcoin adoption and the Bitcoin Network. The Company will continue to pursue innovative solutions and partnerships that align with its commitment to drive revenue growth and value to BitMine shareholders.

About Bitmine Immersion Technologies, Inc.

BitMine is a technology company focused on Bitcoin mining using immersion technology, an advanced cooling technique where computers are submerged in specialized oil circulated to keep units operating at optimal ambient temperature. Immersion technology is more environmentally friendly than conventional mining methodologies, while lowering operating expenses and increasing yield. BitMine's operations are located in low-cost energy regions in Trinidad, Pecos, Texas, and Murray, Kentucky.

Forward-Looking Statements:

This press release contains statements that constitute "forward-looking statements." The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond BitMine's control, including those set forth in the Risk Factors section of BitMine's Annual Report on Form 10-K filed with the Securities and Exchange Commission (the "SEC") on December 9, 2024, and any other SEC filings, as amended or updated from time to time. Copies of BitMine's filings with the SEC are available on the SEC's website at www.sec.gov/edgar/searchedgar/companysearch. BitMine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

For more information, visit https://www.bitminetech.io

Contact:

Jonathan Bates

Chairman and CEO

info@bitminetech.io

SOURCE: BitMine Immersion Technologies Inc.

View the original press release on accesswire.com