BlackRock Introduces Model Portfolios Designed to Help Investment Outcomes for Women

Solution considers differences in life expectancy, income, and employment

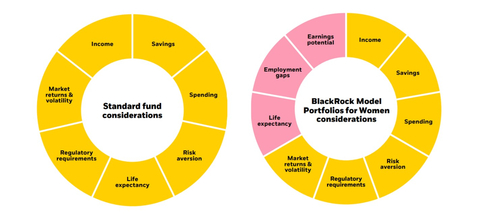

The illustration on the left depicts the standard inputs to life cycle models. On the right, the inputs that may have a differentiated impact on a woman’s long-term investing success. (Graphic: Business Wire)

-

Life expectancy: On average, women in the

U.S. live more than five years longer than men.1 -

Income gap: On average, women in the

U.S. earn approximately$0.82 $1 - Employment gap: On average, women spend 1.2 years out of the workforce to care for children or elderly relatives.3

When not factoring these inputs, BlackRock has found that, on average, women may be under allocated to equities at critical periods during their long investment horizon.

“This investment strategy is one way in which BlackRock looks to help women achieve better long-term financial outcomes while we - as a society - continue to work toward closing the gender pay gap and finding more equitable solutions for caregiving,” said

BlackRock’s Model Portfolios for Women include investment mixes for women across different life stages and can serve as the core of a woman’s investment portfolio.

“The financial challenges women face are not new. Now, advisors have a bespoke, actively managed, and low-cost solution to help women clients achieve their financial goals,” said

“Our LifePath framework provides a flexible avenue for customization. Incorporating gender-specific demographics into our lifecycle model resulted in a tailored risk profile to better support women’s spending throughout retirement,” said

BlackRock’s Model Portfolios seek to offer advisors a consistent, high-quality investment process that combines the firm’s macro-economic insight, asset class expertise and proprietary Aladdin® risk management.

The introduction of Model Portfolios for Women builds on BlackRock’s commitment to advancing gender equity. In May, BlackRock and UN Women, the

This information should not be relied upon as investment advice, research, or a recommendation by BlackRock regarding (i) the funds, (ii) the use or suitability of the model portfolios or (iii) any security in particular. Only an investor and their financial professional know enough about their circumstances to make an investment decision.

Carefully consider the investment objectives, risk factors, charges and expenses of funds within the model portfolios before investing. This and other information can be found in the funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting each fund company’s website or calling their toll-free number. For BlackRock and iShares Funds, please visit www.BlackRock.com or www.iShares.com Investing involves risk, including possible loss of principal. Read the prospectus carefully before investing. Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns.

The model portfolios are made available to financial professionals by

The BlackRock model portfolios are provided for illustrative and educational purposes only. The BlackRock model portfolios do not constitute research, are not personalized investment advice or an investment recommendation from BlackRock to any client of a third party financial professional, and are intended for use only by a third party financial professional, with other information, as a resource to help build a portfolio or as an input in the development of investment advice for its own clients. Such financial professionals are responsible for making their own independent judgment as to how to use the BlackRock model portfolios. BlackRock does not have investment discretion over, or place trade orders for, any portfolios or accounts derived from the BlackRock model portfolios. [CG1] BlackRock is not responsible for determining the appropriateness or suitability of the BlackRock model portfolios, or any of the securities included therein, for any client of a financial professional. Information concerning the BlackRock model portfolios – including holdings, performance, and other characteristics – may vary materially from any portfolios or accounts derived from the BlackRock model portfolios. There is no guarantee that any investment strategy or model portfolio will be successful or achieve any particular level of results. The BlackRock model portfolios themselves are not funds.

The BlackRock model portfolios include investments in shares of funds. Clients will indirectly bear fund expenses in respect of portfolio assets allocated to funds, in addition to any fees payable associated with any applicable advisory or wrap program. BlackRock intends to allocate all or a significant percentage of the BlackRock model portfolios to funds for which it and/or its affiliates serve as investment manager and/or are compensated for services provided to the funds (“BlackRock Affiliated Funds”). BlackRock has an incentive to (a) select BlackRock Affiliated Funds and (b) select BlackRock Affiliated Funds with higher fees over BlackRock Affiliated Funds with lower fees. The fees that BlackRock and its affiliates receive from investments in the BlackRock Affiliated Funds constitute BlackRock’s compensation with respect to the BlackRock model portfolios. This may result in BlackRock model portfolios that achieve a level of performance less favorable to the model portfolios, or reflect higher fees, than otherwise would be the case if BlackRock did not allocate to BlackRock Affiliated Funds.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

©2022

____________________

1

2

3 BGC, “Managing the Next Decade of Women’s Wealth,” 2020

4 BGC, “Managing the Next Decade of Women’s Wealth,” 2020

View source version on businesswire.com: https://www.businesswire.com/news/home/20220721005350/en/

Media

646-231-1626

barbara.williams1@blackrock.com

Source: