BlackRock 2025 Private Markets Outlook: A New Era of Growth

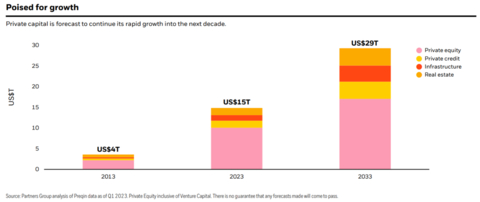

BlackRock (NYSE:BLK) has released its 2025 Private Markets Outlook, projecting sector growth from $13 trillion today to over $20 trillion by 2030. The report highlights key trends across private debt, infrastructure, private equity, and real estate.

Private debt, currently at $1.6 trillion AUM, represents 10% of alternative investments, with significant growth potential in asset-backed finance. Infrastructure investments are expected to benefit from AI developments, with data center capex projected to exceed $1.5 trillion by 2030. Private equity saw a 21% jump in deal activity, exceeding pre-pandemic averages by 45%. Real estate is entering a new cycle with improved sentiment and opportunities in Asia-Pacific markets.

The outlook emphasizes AI-driven opportunities, increased M&A and IPO activity, and growing demand for long-term capital across all client segments, particularly retail wealth.

BlackRock (NYSE:BLK) ha pubblicato il suo Outlook 2025 sui Mercati Privati, prevedendo una crescita del settore da 13 trilioni di dollari oggi a oltre 20 trilioni di dollari entro il 2030. Il report mette in evidenza tendenze chiave nel debito privato, nelle infrastrutture, nel private equity e nel settore immobiliare.

Il debito privato, attualmente pari a 1,6 trilioni di dollari AUM, rappresenta il 10% degli investimenti alternativi, con un significativo potenziale di crescita nel finanziamento garantito da attivi. Si prevede che gli investimenti in infrastrutture beneficeranno dello sviluppo dell'IA, con le spese in conto capitale per i data center previste per superare i 1,5 trilioni di dollari entro il 2030. Il private equity ha registrato un aumento del 21% nell'attività di transazione, superando di 45 punti percentuali le medie pre-pandemia. Il settore immobiliare sta entrando in un nuovo ciclo con un sentiment migliorato e opportunità nei mercati dell'Asia-Pacifico.

Le prospettive enfatizzano le opportunità guidate dall'IA, un aumento dell'attività di fusioni e acquisizioni e delle IPO, e una crescente richiesta di capitale a lungo termine in tutti i segmenti di clientela, in particolare nella ricchezza al dettaglio.

BlackRock (NYSE:BLK) ha publicado su Perspectiva de Mercados Privados 2025, proyectando un crecimiento del sector de 13 billones de dólares hoy a más de 20 billones de dólares para 2030. El informe destaca tendencias clave en deuda privada, infraestructura, capital privado y bienes raíces.

La deuda privada, actualmente en 1.6 billones de dólares AUM, representa el 10% de las inversiones alternativas, con un potencial de crecimiento significativo en el financiamiento respaldado por activos. Se espera que las inversiones en infraestructura se beneficien de los desarrollos de IA, con gastos de capital en centros de datos que superarán los 1.5 billones de dólares para 2030. El capital privado vio un aumento del 21% en la actividad de transacciones, superando los promedios prepandémicos en un 45%. El sector de bienes raíces está entrando en un nuevo ciclo con un sentimiento mejorado y oportunidades en los mercados de Asia-Pacífico.

La perspectiva enfatiza las oportunidades impulsadas por IA, un aumento en la actividad de fusiones y adquisiciones, y una creciente demanda de capital a largo plazo en todos los segmentos de clientes, especialmente en la riqueza minorista.

블랙록 (NYSE:BLK)이 2025년도 사모 시장 전망을 발표하였으며, 이 시장이 현재 13조 달러에서 2030년까지 20조 달러 이상으로 성장할 것으로 예측하고 있습니다. 보고서는 사모 채권, 인프라, 사모펀드 및 부동산 분야의 주요 트렌드를 강조합니다.

현재 자산 운용(AUM) 1.6조 달러인 사모 채권은 대체 투자에서 10%를 차지하며 자산 담보 금융에서 상당한 성장 잠재력을 가지고 있습니다. 인프라 투자는 AI 발전에 힘입어 혜택을 받을 것으로 예상되며, 데이터 센터에 대한 자본 지출이 2030년까지 1.5조 달러를 초과할 것으로 보입니다. 사모펀드는 거래 활동이 21% 증가하여 팬데믹 이전 평균을 45% 초과했습니다. 부동산 시장은 감정이 개선되고 아시아-태평양 시장에서의 기회와 함께 새로운 사이클에 접어들고 있습니다.

이번 전망에서는 AI 주도의 기회, 인수 및 합병(M&A) 및 IPO 활동의 증가, 그리고 모든 고객 세그먼트에서 장기 자본에 대한 수요 증가를 강조하고 있습니다. 특히 소매 자산 부문에서 그렇습니다.

BlackRock (NYSE:BLK) a publié son Outlook 2025 sur les Marchés Privés, prévoyant une croissance du secteur de 13 trillions de dollars aujourd'hui à plus de 20 trillions de dollars d'ici 2030. Le rapport met en évidence les tendances clés dans la dette privée, les infrastructures, le capital-investissement et l'immobilier.

La dette privée, actuellement à 1,6 trillion de dollars AUM, représente 10% des investissements alternatifs, avec un potentiel de croissance significatif dans le financement adossé à des actifs. Les investissements en infrastructures devraient bénéficier des développements en IA, avec des dépenses d'investissement en centres de données projetées à plus de 1,5 trillion de dollars d'ici 2030. Le capital-investissement a connu une augmentation de 21% de l'activité des transactions, dépassant de 45% les moyennes d'avant la pandémie. Le secteur immobilier entre dans un nouveau cycle avec un sentiment amélioré et des opportunités sur les marchés de l'Asie-Pacifique.

Les perspectives soulignent les opportunités pilotées par l'IA, l'augmentation des activités de fusions et acquisitions et d'introductions en bourse, ainsi qu'une demande croissante de capital à long terme dans tous les segments de clients, en particulier dans la richesse de détail.

BlackRock (NYSE:BLK) hat seinen Ausblick für private Märkte 2025 veröffentlicht und prognostiziert ein Wachstum des Sektors von heute 13 Billionen Dollar auf über 20 Billionen Dollar bis 2030. Der Bericht hebt wichtige Trends in den Bereichen private Schulden, Infrastruktur, Private Equity und Immobilien hervor.

Private Schulden, die derzeit bei 1,6 Billionen Dollar AUM liegen, machen 10% der alternativen Investments aus und bieten erhebliches Wachstumspotenzial im asset-backed Financing. Es wird erwartet, dass Infrastrukturinvestitionen von Entwicklungen im Bereich KI profitieren, wobei die Investitionen in Rechenzentren bis 2030 voraussichtlich 1,5 Billionen Dollar überschreiten werden. Private Equity verzeichnete einen Anstieg der Transaktionsaktivitäten um 21%, was 45% über den Durchschnittswerten vor der Pandemie liegt. Der Immobilienmarkt tritt in einen neuen Zyklus ein, begleitet von verbessertem Sentiment und Chancen in den asiatisch-pazifischen Märkten.

Der Ausblick betont KI-gesteuerte Möglichkeiten, zunehmende M&A- und IPO-Aktivitäten sowie eine steigende Nachfrage nach langfristigem Kapital in allen Kundenbereichen, insbesondere im Einzelhandelsvermögen.

- Projected growth from $13T to $20T by 2030 in private markets

- 21% increase in private equity deal activity, 45% above pre-pandemic levels

- Private debt market expansion opportunities in asset-backed finance

- Expected $1.5T investment in AI data centers by 2030

- Distributions exceeding capital calls in private equity for first time in 8 years

- Higher cost of capital affecting real estate sector

- Increased market dispersion in private debt sector

- Real estate recovering from two-year downturn

Insights

- New frontiers in private credit, emerging AI-driven opportunities, more M&A and IPO activity, and tailwinds for real estate are set to define private markets in 2025

-

Industry estimates project private markets will grow from

$13 trillion $20 trillion

(Graphic: Business Wire)

Fundamentals across private markets remain resilient, setting the stage for a new phase of growth in 2025, marked by elevated investment activity, a rise in exits, lower financing costs and more demand for long-term capital. Industry estimates project private markets will grow from

“Investors everywhere are keen on private markets,” said Mark Wiedman, Head of BlackRock’s Global Client Business. “Today, the sector accounts for

Private Debt: Double Down on Growth

Private debt continues to cement its status as a sizable and scalable asset class for a wide range of long-term investors. But there is plenty of room for growth. At

Private debt is taking on more deals as banks become increasingly selective, and the public debt markets focus on deals that are often too large for middle-market businesses. More companies have come to value the certainty of execution and flexibility that private debt provides. At the same time, investors increasingly look to private credit as a portfolio diversifier.

There is plenty of room to grow as the asset class continues to expand its role. One of the newest frontiers is asset-backed finance, where private lenders only hold a roughly

Private debt is also becoming more global. While

One of the main themes we see persisting into 2025 is dispersion, but not widespread market disruption. While the private debt market has proven itself resilient, dispersion will likely remain the case across private debt, highlighting the importance of granular credit selection and structural protections.

Infrastructure and AI: Unlocking Opportunities

Artificial Intelligence (AI) is driving a transformative shift in global economies and industries are increasingly reliant on private capital to unlock AI’s full potential. Private assets offer opportunities to invest across the entire AI value chain – including data centers and data infrastructure.

While capex for AI data centers is expected to exceed

Given the massive investment required to meet growing AI data center demand and the complexity of integrating power and data center development capabilities, we believe this represents a significant opportunity for experienced infrastructure investors.

Private Equity: A Turning Tide

The tide is turning for private equity. In 2024, deal activity jumped

Valuations in private equity continue to track below public markets, offering attractive entry points. Among sectors, we continue to see opportunities across healthcare, specifically take-private deals and corporate carveouts, and we believe AI will fuel LBO activity among incumbent businesses with data that can be tapped with large language models.

We see significant opportunity in private equity overall, particularly within the middle market, as both M&A activity and IPOs increase, driving more exits and distributions, and leading, in turn, to new investments.

Real Estate: A New Cycle

After a challenging two-year downturn, we believe the real estate sector is now poised to benefit from a number of economic tailwinds, with both cyclical and structural trends at play in the sector. We’ve seen sentiment improve, with an uptick in bidding interest. The new cycle will likely look very different compared to the period following the global financial crisis, with a relatively higher cost of capital and further dispersion between winners and losers.

In a world of higher volatility, we see real estate opportunities aligned with long-term structural trends around aging demographics in developed countries, properties that can facilitate e-commerce and new trade partners, as well as a heightened demand among tenants for energy-efficient buildings.

The

To download BlackRock’s 2025 Private Markets Outlook, please click here.

Forward Looking Statements

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of forward looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties inherent in the capital markets or otherwise facing the asset management industry, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

About BlackRock

BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. For additional information on BlackRock, please visit www.blackrock.com/corporate.

______________________________

1 2025 Private Markets Outlook, p. 3; Source: Preqin, September 18, 2024. Note: There is no guarantee that any forecasts will come to pass.

2 Ibid.

3 2025 Private Markets Outlook, p. 14; Source: Preqin, September 2024. Note: There is no guarantee that any forecasts will come to pass.

4 Ibid.; Source: “Private Credit's Next Act,” April 2024, Oliver Wyman. Note: The Oliver Wyman analysis and estimates were aggregated from a range of sources including, but not limited to: Federal Reserve Board (Z1 tables, G19, G20 and H8); Federal Reserve Bank of

5 Ibid.; Preqin, November 2024.

6 2025 Private Markets Outlook, p. 11. Source: McKinsey Data Center Demand Models, RBC BlackRock Investment Institute, BNEF, Grid Strategies, Goldman Sachs Research. Note: There can be no assurances that any forecasts or estimates will materialize.

7 2025 Private Markets Outlook, p. 18; Pitchbook Q3 2024 Global PE First Look. Note: Changes quoted are based on YTD 9/30/24 figures annualised.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241216468500/en/

Media

Christa Zipf

christa.zipf@blackrock.com

+1-646-231-0013

+1-347-814-3447

Source: BlackRock