BlackLine Unveils Industry's First 'Tax Hyperautomation' Capabilities for Intercompany Financial Management

BlackLine, Inc (Nasdaq: BL) has launched innovative 'tax hyperautomation' capabilities aimed at enhancing intercompany financial management for global corporations. This new technology facilitates compliance with complex tax regulations, automates intercompany tax workflows, and minimizes risks associated with financial reporting. Key features include automatic invoicing compliant with jurisdiction-specific tax laws, predefined transaction flows, and standards-based APIs for interoperability. This initiative addresses increasing scrutiny and demands for real-time tax reporting from authorities, promoting efficiency and transparency in financial operations.

- Launch of 'tax hyperautomation' capabilities to enhance financial management for multinational corporations.

- Automated invoicing ensures compliance with tax regulations across jurisdictions.

- Features include predefined transaction flows and standards-based APIs for improved efficiency.

- None.

Insights

Analyzing...

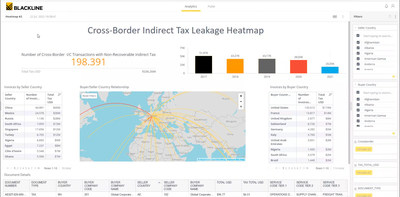

Advanced automation and analytics to optimize intercompany tax flows for improved control and transparency

LOS ANGELES, Sept. 27, 2022 /PRNewswire/ -- Accounting automation software leader BlackLine, Inc. (Nasdaq: BL) has unveiled the industry's first 'tax hyperautomation' capabilities for intercompany financial management, designed to help multinational corporations navigate the complexities of transacting across multiple legal entities, billing routes and jurisdictional boundaries.

The extension to BlackLine's market-leading intercompany solutions comes in response to organizations facing increasing intercompany tax scrutiny globally, including cross-border reporting arrangements and greater calls from tax authorities for real-time reporting and e-compliance. Designed to reduce the financial compliance, tax and other risks associated with today's complex and globally connected business environment, BlackLine's new tax hyperautomation capabilities offer a range of functionality to help multinational organizations understand and automate intercompany tax workflows, including:

- Pre-defined Transaction Flows: to automatically apply country- and service-specific tax treatments for increased accuracy without the need for additional resourcing.

- Tax Compliant and Auditable Invoicing: automatically generated across jurisdictions to ensure compliance, audit support and support deductibility claims.

- BEAT and Exempt Charge Identification and Classification: to manage BEAT (base erosion and anti-abuse tax) and BEPS (base erosion and profit shifting) exposure without manual intervention.

- Preconfigured Service Types: to automatically inform which tax treatment is applied based on the nature of the service, which provides greater granularity while improving overall deductibility.

- Standards-Based Open APIs: to allow for interoperability across indirect tax engines that clients choose based on their needs.

In the recent report 'Top Technology Trends for 2022'* from global industry research firm Gartner®, David Groombridge, VP analyst, Gartner Infrastructure and Communication Services, states: "Increased focus on growth, digitalization and operational excellence have highlighted a need for better, more widespread automation. Hyperautomation is a business-driven approach to identify, vet and automate as many business processes as possible."

Embracing this approach, BlackLine defines tax hyperautomation as the holistic mapping and orchestrated use of tax-critical automation capabilities to break down the financial silos in intercompany processes. Tax hyperautomation optimizes an organization's total tax incidence across multiple legal entities and billing routes.

"Tax considerations are critical for any company's intercompany operations, but too often they are managed independently and related-party processes and automation in this area lag significantly behind the control and attention given to third-party transactions," said Varun Tejpal, managing director, Intercompany, at BlackLine. "Intercompany Financial Management, on the other hand, is an approach that weaves tax considerations into how intercompany operations are optimized. BlackLine's new functionality gives the tax function a seat at the table by providing foundational technology and business process optimization that will help to significantly improve control, transparency and overall business outcomes for our customers."

BlackLine's enhanced tax features to ensure global tax control are part of the company's broader strategy for Intercompany Financial Management, an emerging category of intercompany solutions that aim to maximize staff efficiency and accounting accuracy, while simultaneously optimizing tax exposure, minimizing tax leakage, and ensuring consistent tax and regulatory compliance.

"As the volume of both regulations and transactions grow, multinational organizations can face challenges in supporting their intercompany activity and decisioning for reporting to tax authorities," said Tom Toppen, Deloitte's BlackLine alliance leader and a Deloitte Risk & Financial Advisory managing director, Deloitte & Touche LLP. "By automating intercompany flows across the global transaction value chain, organizations can reduce manual efforts and increase overall tax compliance while also finding new ways to provide value-added insights that support broader business strategy."

For more information about BlackLine's Intercompany Financial Management solutions, please visit https://www.blackline.com/intercompany.

* Gartner E-book, Gartner Top Strategic Technology Trends for 2022, David Groombridge, https://www.gartner.com/en/information-technology/insights/top-technology-trends. GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Companies come to BlackLine (Nasdaq: BL) because their traditional manual accounting processes are not sustainable. BlackLine's cloud-based financial operations management platform and market-leading customer service help companies move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility. BlackLine provides solutions to manage and automate financial close, accounts receivable and intercompany accounting processes, helping large enterprises and midsize companies across all industries do accounting work better, faster and with more control.

More than 4,000 customers trust BlackLine to help them close faster with complete and accurate results. The company is the pioneer of the cloud financial close market and recognized as the leader by customers at leading end-user review sites including G2 and TrustRadius. BlackLine is a global company with operations in major business centers around the world including Los Angeles, New York, the San Francisco Bay area, London, Paris, Frankfurt, Tokyo, Singapore and Sydney. For more information, please visit blackline.com.

This release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "could," "expect," "plan," anticipate," "believe," "estimate," "predict," "intend," "potential," "would," "continue," "ongoing" or the negative of these terms or other comparable terminology. Forward-looking statements in this release include statements regarding our growth plans and opportunities.

Any forward-looking statements contained in this press release are based upon BlackLine's current plans, estimates and expectations and are not a representation that such plans, estimates, or expectations will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management's good faith beliefs and assumptions as of that time with respect to future events and are subject to risks and uncertainties. If any of these risks or uncertainties materialize or if any assumptions prove incorrect, actual performance or results may differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks related to the Company's ability to execute on its strategies, attract new customers, enter new geographies and develop, release and sell new features and solutions; and other risks and uncertainties described in the other filings we make with the Securities and Exchange Commission from time to time, including the risks described under the heading "Risk Factors" in our Annual Report on Form 10-K. Additional information will also be set forth in our Quarterly Reports on Form 10-Q.

Forward-looking statements should not be read as a guarantee of future performance or results, and you should not place undue reliance on such statements. Except as required by law, we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/blackline-unveils-industrys-first-tax-hyperautomation-capabilities-for-intercompany-financial-management-301634012.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/blackline-unveils-industrys-first-tax-hyperautomation-capabilities-for-intercompany-financial-management-301634012.html

SOURCE BlackLine