Bitfarms Reports Fourth Quarter 2024 Results

Bitfarms (NASDAQ/TSX: BITF) reported Q4 2024 financial results with revenue of $56 million, up 21% year-over-year. The company achieved a gross mining margin of 47%, down from 57% in Q4 2023. Hashrate increased significantly to 18.6 EH/s, up 186% from Q4 2023, with improved efficiency of 19w/TH, representing a 45% improvement.

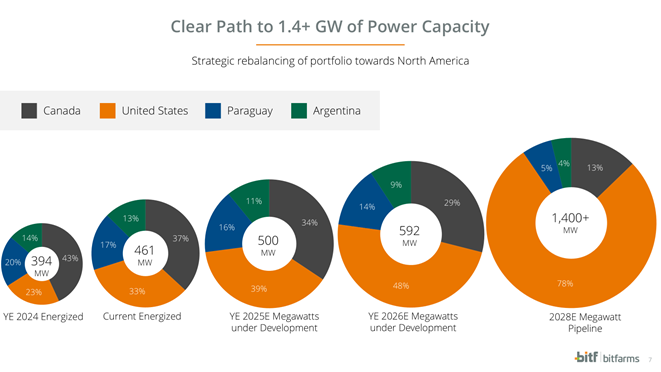

Key developments include completing the acquisition of Stronghold Digital Mining and selling the 200 MW Yguazu data center. The company has expanded its energized capacity by 90% to 461 MW and secured a pipeline of over 1.4 GW, with ~80% based in the U.S. Bitfarms reported net income of $15 million ($0.03 per share) compared to a net loss of $62 million in Q4 2023. As of March 26, 2025, the company maintained liquidity of approximately $135 million and held 1,093 Bitcoin.

Bitfarms (NASDAQ/TSX: BITF) ha riportato i risultati finanziari del quarto trimestre 2024 con un fatturato di 56 milioni di dollari, in aumento del 21% rispetto all'anno precedente. L'azienda ha raggiunto un margine lordo di mining del 47%, in calo rispetto al 57% del quarto trimestre 2023. L'Hashrate è aumentato significativamente a 18,6 EH/s, con un incremento del 186% rispetto al quarto trimestre 2023, e un'efficienza migliorata di 19w/TH, che rappresenta un miglioramento del 45%.

Sviluppi chiave includono il completamento dell'acquisizione di Stronghold Digital Mining e la vendita del data center Yguazu da 200 MW. L'azienda ha ampliato la sua capacità attiva del 90% a 461 MW e ha assicurato un portafoglio di oltre 1,4 GW, di cui circa l'80% negli Stati Uniti. Bitfarms ha riportato un reddito netto di 15 milioni di dollari (0,03 dollari per azione) rispetto a una perdita netta di 62 milioni di dollari nel quarto trimestre 2023. Al 26 marzo 2025, l'azienda ha mantenuto una liquidità di circa 135 milioni di dollari e possedeva 1.093 Bitcoin.

Bitfarms (NASDAQ/TSX: BITF) reportó los resultados financieros del cuarto trimestre de 2024 con ingresos de 56 millones de dólares, un aumento del 21% en comparación con el año anterior. La compañía alcanzó un margen bruto de minería del 47%, en descenso desde el 57% en el cuarto trimestre de 2023. El hashrate aumentó significativamente a 18.6 EH/s, un incremento del 186% desde el cuarto trimestre de 2023, con una eficiencia mejorada de 19w/TH, lo que representa una mejora del 45%.

Los desarrollos clave incluyen la finalización de la adquisición de Stronghold Digital Mining y la venta del centro de datos Yguazu de 200 MW. La empresa ha expandido su capacidad activa en un 90% a 461 MW y ha asegurado una cartera de más de 1.4 GW, con aproximadamente el 80% en los EE. UU. Bitfarms reportó un ingreso neto de 15 millones de dólares (0.03 dólares por acción) en comparación con una pérdida neta de 62 millones de dólares en el cuarto trimestre de 2023. Al 26 de marzo de 2025, la compañía mantenía una liquidez de aproximadamente 135 millones de dólares y poseía 1,093 Bitcoin.

Bitfarms (NASDAQ/TSX: BITF)는 2024년 4분기 재무 결과를 보고하며 수익이 5,600만 달러로 전년 대비 21% 증가했다고 발표했습니다. 회사는 2023년 4분기의 57%에서 감소한 47%의 총 채굴 마진을 달성했습니다. 해시레이트는 18.6 EH/s로 크게 증가했으며, 2023년 4분기 대비 186% 증가하였고, 19w/TH의 개선된 효율성을 보여주며 45%의 개선을 나타냈습니다.

주요 개발 사항으로는 Stronghold Digital Mining의 인수 완료와 200 MW Yguazu 데이터 센터의 판매가 포함됩니다. 이 회사는 90% 증가하여 461 MW의 활성 용량을 확장하였고, 1.4 GW 이상의 파이프라인을 확보했으며, 그 중 약 80%가 미국에 기반하고 있습니다. Bitfarms는 2023년 4분기 6,200만 달러의 순손실에 비해 1,500만 달러의 순이익(주당 0.03달러)을 보고했습니다. 2025년 3월 26일 현재, 회사는 약 1억 3,500만 달러의 유동성을 유지하고 있으며 1,093 비트코인을 보유하고 있습니다.

Bitfarms (NASDAQ/TSX: BITF) a annoncé ses résultats financiers pour le quatrième trimestre 2024, avec un chiffre d'affaires de 56 millions de dollars, en hausse de 21 % par rapport à l'année précédente. L'entreprise a atteint une marge brute de minage de 47 %, en baisse par rapport à 57 % au quatrième trimestre 2023. La puissance de hachage a considérablement augmenté à 18,6 EH/s, soit une hausse de 186 % par rapport au quatrième trimestre 2023, avec une efficacité améliorée de 19w/TH, représentant une amélioration de 45 %.

Les développements clés incluent l'achèvement de l'acquisition de Stronghold Digital Mining et la vente du centre de données Yguazu de 200 MW. L'entreprise a élargi sa capacité active de 90 % à 461 MW et a sécurisé un pipeline de plus de 1,4 GW, dont environ 80 % basé aux États-Unis. Bitfarms a déclaré un revenu net de 15 millions de dollars (0,03 dollar par action) par rapport à une perte nette de 62 millions de dollars au quatrième trimestre 2023. Au 26 mars 2025, l'entreprise maintenait une liquidité d'environ 135 millions de dollars et détenait 1 093 Bitcoin.

Bitfarms (NASDAQ/TSX: BITF) hat die finanziellen Ergebnisse für das vierte Quartal 2024 veröffentlicht, mit Einnahmen von 56 Millionen Dollar, was einem Anstieg von 21% im Vergleich zum Vorjahr entspricht. Das Unternehmen erzielte eine Bruttomarge beim Mining von 47%, ein Rückgang von 57% im vierten Quartal 2023. Die Hashrate stieg erheblich auf 18,6 EH/s, was einem Anstieg von 186% im Vergleich zum vierten Quartal 2023 entspricht, mit einer verbesserten Effizienz von 19w/TH, was eine Verbesserung von 45% darstellt.

Wichtige Entwicklungen umfassen den Abschluss der Übernahme von Stronghold Digital Mining und den Verkauf des 200 MW Yguazu-Rechenzentrums. Das Unternehmen hat seine aktive Kapazität um 90% auf 461 MW erweitert und eine Pipeline von über 1,4 GW gesichert, von denen etwa 80% in den USA angesiedelt sind. Bitfarms berichtete von einem Nettogewinn von 15 Millionen Dollar (0,03 Dollar pro Aktie) im Vergleich zu einem Nettverlust von 62 Millionen Dollar im vierten Quartal 2023. Am 26. März 2025 hielt das Unternehmen eine Liquidität von etwa 135 Millionen Dollar und besaß 1.093 Bitcoin.

- Revenue increased 21% Y/Y to $56 million

- Hashrate grew 186% Y/Y to 18.6 EH/s

- Efficiency improved 45% to 19w/TH

- Net income of $15 million vs. net loss of $62 million in Q4 2023

- Strong liquidity position of $135 million

- Energized capacity grew 90% to 461 MW

- Gross mining margin declined to 47% from 57% Y/Y

- Operating loss increased to $16 million from $13 million Y/Y

- Adjusted EBITDA decreased to $14 million from $16 million Y/Y

- General and administrative expenses increased to $18 million from $13 million Y/Y

Insights

Bitfarms' Q4 2024 results reflect a significant strategic pivot from a pure Bitcoin mining play to a diversified North American energy and computing infrastructure company. The 21% year-over-year revenue growth to

However, there are concerning efficiency metrics worth noting. Gross mining margins contracted from

The completed Stronghold acquisition and Paraguay data center sale represent the execution of management's strategic shift toward U.S.-based operations and revenue diversification beyond volatile BTC mining. With

While the 186% increase in hashrate and 45% improvement in efficiency demonstrate strong operational execution in the mining business, the company's focus on developing energy and HPC infrastructure rather than purchasing new miners signals a fundamental business model transformation that could potentially deliver more stable cash flows and unlock better financing options. The reduced capital expenditure requirements (down

Bitfarms' Q4 results present a mixed financial picture within the context of a significant strategic realignment. The company delivered strong topline growth with revenue increasing

The standout financial improvement is Bitfarms' return to profitability, posting

Liquidity remains healthy at approximately

The company's 20% reduction in planned capital expenditures for 2025 and decision to forego large miner purchases should improve free cash flow metrics. More importantly, this pivot toward infrastructure development could potentially yield more predictable revenue streams less correlated with Bitcoin price volatility, potentially warranting a higher valuation multiple over time as the business model evolves from crypto mining to energy/compute infrastructure.

- Revenue of

- Gross mining margin of

- 18.6 EHuM up

- Current efficiency of 19w/TH a

-Total energy pipeline of ~1.4 GW, ~

-Completed acquisition of Stronghold Digital Mining & sale of Yguazu, Paraguay data center-

This news release constitutes a “designated news release” for the purposes of the Company’s second amended and restated prospectus supplement dated December 17, 2024, to its short form base shelf prospectus dated November 10, 2023.

TORONTO, Ontario and BROSSARD, Québec, March 27, 2025 (GLOBE NEWSWIRE) -- Bitfarms Ltd. (Nasdaq/TSX: BITF), a global vertically integrated Bitcoin data center company, reported its financial results for the fourth quarter ended December 31, 2024. All financial references are in U.S. dollars.

CEO Ben Gagnon stated, “Bitfarms is a completely different company than we were at the beginning of 2024. Across nearly every metric, we have rapidly transformed from the international Bitcoin miner to a North American energy and compute company. We now have one of the largest portfolios of flexible MW in the PJM market among Bitcoin miners and are well-positioned to capitalize on macro tailwinds and surging demand for U.S. power and infrastructure. From January 2024, we’ve grown our energized capacity over

“Just last week, we closed both the transformative acquisition of Stronghold Digital Mining, the largest M&A deal between two public miners in our industry, and the strategic sale of our 200 MW Yguazu data center, our largest constructed site. Thus far this quarter, we advanced our HPC/AI strategy with the engagement of two new advisors, hired two new critical team members, an SVP of HPC and an SVP of Infrastructure, and significantly improved our hashrate, reaching 18.6 EHuM, which we expect will generate operating cash flow through 2026 and beyond.

“While we remain confident in the significant upside potential of our BTC mining operations and continue to maximize the value of our assets, our revenue diversification strategy—both in the U.S. and with HPC/AI—is geared toward driving greater shareholder value. We aim to secure long-term, predictable cash flows from a well-capitalized HPC/AI customer, while diversifying our revenue streams, reducing our dependency on BTC price volatility, and capitalizing on the growing demand for AI computing. Our two recent strategic transactions, the Stronghold acquisition and the Yguazu data center sale, demonstrate execution of this strategy," concluded Mr. Gagnon.

SVP of Mining Operations Alex Brammer stated, “We’ve made significant progress with our mining operations over the past year, nearly tripling our hashrate and improving our efficiency by over

CFO Jeff Lucas stated, “The recent acquisition of Stronghold and sale of Yguazu have expanded our growth opportunities and strengthened our financial profile. Our identified capex requirements for 2025 are now

Anticipated Megawatt Growth

Mining Operations

- Current hashrate of 18.6 EHuM, up from 6.5 EHuM in Q4 2023

- Current efficiency of 19 w/TH, a

45% improvement from Q4 2023

Recent Strategic Developments

- Completed previously announced acquisition of Stronghold Digital Mining, Inc.

- Completed previously announced sale of 200 MW data center in Yguazu, Paraguay to HIVE Digital Technologies

- Secured two strategic partners, ASG and World Wide Technology, to advance HPC/AI business

- Strengthened Management team with two new strategic hires, James Bond, SVP of HPC/AI, and Craig Hibbard, SVP of Infrastructure

- Initiated Bitcoin One program following the success of Synthetic HODL program in 2024, which achieved a

135% return since the program's inception in Q4 2023 through December 31, 2024.

Q4 2024 Financial Highlights

- Total revenue of

$56 million , up21% Y/Y - Gross mining margin of

47% , down from57% in Q4 2023 - General and administrative expenses of

$18 million , compared to$13 million in Q4 2023 - Operating loss of

$16 million compared to an operating loss of$13 million in Q4 2023 - Net income of

$15 million , or$0.03 per basic and diluted share compared to a net loss of$62 million or$0.21 per basic and diluted share in Q4 2023 - Adjusted EBITDA* of

$14 million , or25% of revenue, down from$16 million or35% of revenue in Q4 2023 - The Company earned 654 BTC at an average direct cost of production per BTC* of

$40,800 - Total cash cost of production per BTC* was

$60,800 in Q4 2024

Liquidity**

As of March 26, 2025, the Company had total liquidity of approximately

Q4 2024 and Recent Financing Activities

- Sold 502 BTC at an average price of

$81,400 for total proceeds of$41 million in Q4 2024 and sold 117 of the 414 BTC earned during January and February 2025, generating total proceeds of$11 million . A portion of the funds was used to pay capital expenditures to support the Company’s growth and efficiency improvement objectives. - As of March 26, 2025, the Company held 1,093 Bitcoin.

- Raised

$50 million in net proceeds during Q4 2024 bringing the total net proceeds to$314 million through March 26, 2025 under the Company's 2024 at-the-market equity offering program.

| Quarterly Operating Performance | |||

| Q4 2024 | Q3 2024 | Q4 2023 | |

| Total BTC earned | 654 | 703 | 1,236 |

| Average Watts/Average TH efficiency*** | 22 | 23 | 35 |

| BTC sold | 502 | 461 | 1,135 |

| As of December 31, | As of September 30, | As of December 31, | |

| 2024 | 2024 | 2023 | |

| Operating EH/s | 12.8 | 11.3 | 6.5 |

| Operating capacity (MW) | 394 | 310 | 240 |

| Quarterly Average Revenue**** and Cost of Production per BTC* | ||||||||||

| Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 | ||||||

| Avg. Rev****/BTC | ||||||||||

| Direct Cost*/BTC | ||||||||||

| Total Cash Cost*/BTC | ||||||||||

* Gross mining profit, gross mining margin, EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Direct Cost per BTC and Total Cash Cost per BTC are non-IFRS financial measures or ratios and should be read in conjunction with, and should not be viewed as alternatives to or replacements of measures of operating results and liquidity presented in accordance with IFRS. Readers are referred to the reconciliations of non-IFRS measures included in the Company’s MD&A and at the end of this press release.

** Liquidity represents cash and balance of unrestricted digital assets.

*** Average watts represent the energy consumption of miners.

**** Average revenue per BTC is for mining operations only and excludes Volta revenue.

Conference Call

Management will host a conference call today at 8:00 am EST. All Q4 2024 materials will be available before the call and can be accessed on the ‘Financial Results’ section of the Bitfarms investor site.

The live webcast and a webcast replay of the conference call can be accessed here. To access the call by telephone, register here to receive dial-in numbers and a unique PIN to join the call.

Non-IFRS Measures*

As a Canadian company, Bitfarms follows International Financial Reporting Standards (IFRS) which are issued by the International Accounting Standard Board (IASB). Under IFRS rules, the Company does not reflect the revaluation gains on the mark-to-market of its Bitcoin holdings in its income statement. It also does not include the revaluation losses on the mark-to-market of its Bitcoin holdings in Adjusted EBITDA, which is a measure of the cash profitability of its operations and does not reflect the change in value of its assets and liabilities.

The Company uses Adjusted EBITDA to measure its operating activities' financial performance and cash generating capability.

About Bitfarms Ltd.

Founded in 2017, Bitfarms is a global Bitcoin data center company that contributes its computational power to one or more mining pools from which it receives payment in Bitcoin. Bitfarms develops, owns, and operates vertically integrated mining farms with in-house management and company-owned electrical engineering, installation service, and multiple onsite technical repair centers. The Company’s proprietary data analytics system delivers best-in-class operational performance and uptime.

Bitfarms currently has 15 operating Bitcoin data centers and two under development situated in four countries: Canada, the United States, Paraguay, and Argentina. Powered predominantly by environmentally friendly hydro-electric and long-term power contracts, Bitfarms is committed to using sustainable and often underutilized energy infrastructure.

To learn more about Bitfarms’ events, developments, and online communities:

www.bitfarms.com

https://www.facebook.com/bitfarms/

http://x.com/Bitfarms_io

https://www.instagram.com/bitfarms/

https://www.linkedin.com/company/bitfarms/

Glossary of Terms

- BTC BTC/day = Bitcoin or Bitcoin per day

- EHuM = Exahash Under Management, which includes Bitfarms’ proprietary hashrate and hashrate being hosted by Bitfarms for third-party hosting clients

- EH or EH/s = Exahash or exahash per second

- MW or MWh = Megawatts or megawatt hour

- w/TH = Watts/Terahash efficiency (includes cost of powering supplementary equipment)

- Q/Q = Quarter over Quarter

- Y/Y = Year over Year

- Synthetic HODL™ = the use of instruments that create Bitcoin equivalent exposure

- HPC/AI = High Performance Computing / Artificial Intelligence

Forward-Looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) that are based on expectations, estimates and projections as at the date of this news release and are covered by safe harbors under Canadian and United States securities laws. The statements and information in this release regarding the the Company’s energy pipeline and its anticipated megawatt growth in each of the years 2025, 2026 and 2028, its revenue diversification strategy, the success of the Company’s HPC/AI strategy and its ability to capitalize on growing demand for AI computing while securing predictable cash flows, the Company’s ability to drive greater shareholder value, and other statements regarding future growth, plans and objectives of the Company are forward-looking information.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “prospects”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information.

This forward-looking information is based on assumptions and estimates of management of Bitfarms at the time they were made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of Bitfarms to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors, risks and uncertainties include, among others: the construction and operation of new facilities may not occur as currently planned, or at all; expansion of existing facilities may not materialize as currently anticipated, or at all; new miners may not perform up to expectations; revenue may not increase as currently anticipated, or at all; the ongoing ability to successfully mine digital currency is not assured; failure of the equipment upgrades to be installed and operated as planned; the availability of additional power may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the power purchase agreements and economics thereof may not be as advantageous as expected; potential environmental cost and regulatory penalties due to the operation of the former Stronghold plants which entail environmental risk and certain additional risk factors particular to the former business and operations of Stronghold including, land reclamation requirements may be burdensome and expensive, changes in tax credits related to coal refuse power generation could have a material adverse effect on the business, financial condition, results of operations and future development efforts, competition in power markets may have a material adverse effect on the results of operations, cash flows and the market value of the assets, the business is subject to substantial energy regulation and may be adversely affected by legislative or regulatory changes, as well as liability under, or any future inability to comply with, existing or future energy regulations or requirements, the operations are subject to a number of risks arising out of the threat of climate change, and environmental laws, energy transitions policies and initiatives and regulations relating to emissions and coal residue management, which could result in increased operating and capital costs and reduce the extent of business activities, operation of power generation facilities involves significant risks and hazards customary to the power industry that could have a material adverse effect on our revenues and results of operations, and there may not have adequate insurance to cover these risks and hazards, employees, contractors, customers and the general public may be exposed to a risk of injury due to the nature of the operations, limited experience with carbon capture programs and initiatives and dependence on third-parties, including consultants, contractors and suppliers to develop and advance carbon capture programs and initiatives, and failure to properly manage these relationships, or the failure of these consultants, contractors and suppliers to perform as expected, could have a material adverse effect on the business, prospects or operations; the digital currency market; the ability to successfully mine digital currency; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of hydroelectricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power to operate cryptocurrency mining assets; the risks of an increase in electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which Bitfarms operates and the potential adverse impact on profitability; future capital needs and the ability to complete current and future financings, including Bitfarms’ ability to utilize an at-the-market offering program ( “ATM Program”) and the prices at which securities may be sold in such ATM Program, as well as capital market conditions in general; share dilution resulting from an ATM Program and from other equity issuances; volatile securities markets impacting security pricing unrelated to operating performance; the risk that a material weakness in internal control over financial reporting could result in a misstatement of financial position that may lead to a material misstatement of the annual or interim consolidated financial statements if not prevented or detected on a timely basis; risks related to the Company ceasing to qualify as an “emerging growth company”; risks related to unsolicited investor interest, takeover proposals, shareholder activism or proxy contests relating to the election of directors; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; and the adoption or expansion of any regulation or law that will prevent Bitfarms from operating its business, or make it more costly to do so. For further information concerning these and other risks and uncertainties, refer to Bitfarms’ filings on www.sedarplus.ca (which are also available on the website of the U.S. Securities and Exchange Commission (the “SEC") at www.sec.gov), including the management’s discussion & analysis for the year-ended December 31, 2024 Although Bitfarms has attempted to identify important factors that could cause actual results to differ materially from those expressed in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended, including factors that are currently unknown to or deemed immaterial by Bitfarms. There can be no assurance that such statements will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on any forward-looking information. Bitfarms does not undertake any obligation to revise or update any forward-looking information other than as required by law. Trading in the securities of the Company should be considered highly speculative. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the Toronto Stock Exchange, Nasdaq, or any other securities exchange or regulatory authority accepts responsibility for the adequacy or accuracy of this release.

Investor Relations Contacts:

Bitfarms

Tracy Krumme

SVP, Head of IR & Corp. Comms.

+1 786-671-5638

tkrumme@bitfarms.com

Media Contacts:

Caroline Brady Baker

Director, Communications

cbaker@bitfarms.com

| Bitfarms Ltd. Consolidated Financial & Operational Results | ||||||||||||||||

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Revenues | 56,163 | 46,241 | 9,922 | 21 | % | 192,881 | 146,366 | 46,515 | 32 | % | ||||||

| Cost of revenues | (54,776 | ) | (44,484 | ) | (10,292 | ) | 23 | % | (225,240 | ) | (167,868 | ) | (57,372 | ) | 34 | % |

| Gross (loss) profit | 1,387 | 1,757 | (370 | ) | (21) | % | (32,359 | ) | (21,502 | ) | (10,857 | ) | 50 | % | ||

| Gross margin (1) | 2 | % | 4 | % | — | — | (17) | % | (15) | % | — | — | ||||

| Operating expenses | ||||||||||||||||

| General and administrative expenses | (18,042 | ) | (13,405 | ) | (4,637 | ) | 35 | % | (71,240 | ) | (39,292 | ) | (31,948 | ) | 81 | % |

| Reversal of revaluation loss on digital assets | — | 1,183 | (1,183 | ) | (100) | % | — | 2,695 | (2,695 | ) | (100) | % | ||||

| Gain (loss) on disposition of property, plant and equipment and deposits | 270 | (2 | ) | 272 | nm | (336 | ) | (1,778 | ) | 1,442 | (81) | % | ||||

| Impairment on short-term prepaid deposits, property, plant and equipment and assets held for sale | — | (2,270 | ) | 2,270 | 100 | % | (3,628 | ) | (12,252 | ) | 8,624 | (70) | % | |||

| Operating loss | (16,385 | ) | (12,737 | ) | (3,648 | ) | 29 | % | (107,563 | ) | (72,129 | ) | (35,434 | ) | 49 | % |

| Operating margin (1) | (29) | % | (28) | % | — | — | (56) | % | (49) | % | — | — | ||||

| Net financial income (expenses) | 21,843 | (49,686 | ) | 71,529 | 144 | % | 39,210 | (37,194 | ) | 76,404 | 205 | % | ||||

| Net (loss) income before income taxes | 5,458 | (62,423 | ) | 67,881 | 109 | % | (68,353 | ) | (109,323 | ) | 40,970 | (37) | % | |||

| Income tax recovery | 9,707 | 378 | 9,329 | nm | 14,290 | 401 | 13,889 | nm | ||||||||

| Net (loss) income | 15,165 | (62,045 | ) | 77,210 | 124 | % | (54,063 | ) | (108,922 | ) | 54,859 | (50) | % | |||

| Basic (loss) earnings per share (in U.S. dollars) | 0.03 | (0.21 | ) | — | — | (0.13 | ) | (0.42 | ) | — | — | |||||

| Diluted earnings (loss) per share (in U.S. dollars) | 0.03 | (0.21 | ) | — | — | (0.13 | ) | (0.42 | ) | — | — | |||||

| Change in revaluation surplus - digital assets, net of tax | 26,421 | 7,675 | 18,746 | 244 | % | 39,120 | 9,242 | 29,878 | 323 | % | ||||||

| Total comprehensive income (loss), net of tax | 41,586 | (54,370 | ) | 95,956 | 176 | % | (14,943 | ) | (99,680 | ) | 84,737 | (85 | %) | |||

| Gross Mining profit (2) | 25,786 | 25,454 | 332 | 1 | % | 94,469 | 70,277 | 24,192 | 34 | % | ||||||

| Gross Mining margin (2) | 47 | % | 57 | % | — | — | 50 | % | 50 | % | — | — | ||||

| EBITDA (2) | 29,752 | (40,542 | ) | 70,294 | 173 | % | 68,315 | (21,879 | ) | 90,194 | 412 | % | ||||

| EBITDA margin (2) | 53 | % | (88) | % | — | — | 35 | % | (15) | % | — | — | ||||

| Adjusted EBITDA (2) | 14,315 | 16,332 | (2,017 | ) | (12) | % | 54,661 | 43,558 | 11,103 | 25 | % | |||||

| Adjusted EBITDA margin (2) | 25 | % | 35 | % | — | — | 28 | % | 30 | % | — | — | ||||

| 1 | Gross margin and Operating margin are supplemental financial ratios; refer to Section 10 - Non-IFRS and Other Financial Measures and Ratios of the Company's MD&A. |

| 2 | Gross Mining profit, Gross Mining margin, EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin are non-IFRS measures or ratios; refer to Section 10 - Non-IFRS and Other Financial Measures and Ratios of the Company's MD&A. |

| Bitfarms Ltd. Reconciliation of Consolidated Net Income (loss) to EBITDA and Adjusted EBITDA | ||||||||||||||||

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Revenues | 56,163 | 46,241 | 9,922 | 21 | % | 192,881 | 146,366 | 46,515 | 32 | % | ||||||

| Net (loss) income before income taxes | 5,458 | (62,423 | ) | 67,881 | nm | (68,353 | ) | (109,323 | ) | 40,970 | (37) | % | ||||

| Interest (income) and expense | (290 | ) | 91 | (381 | ) | (419) | % | (4,299 | ) | 2,659 | (6,958 | ) | (262) | % | ||

| Depreciation and amortization | 24,584 | 21,790 | 2,794 | 13 | % | 149,727 | 84,785 | 64,942 | 77 | % | ||||||

| Sales tax recovery - depreciation and amortization | — | — | — | — | % | (8,760 | ) | — | (8,760 | ) | 100 | % | ||||

| EBITDA | 29,752 | (40,542 | ) | 70,294 | nm | 68,315 | (21,879 | ) | 90,194 | nm | ||||||

| EBITDA margin | 53 | % | (88) | % | — | — | 35 | % | (15) | % | — | nm | ||||

| Share-based payment | 4,021 | 3,906 | 115 | 3 | % | 13,949 | 10,915 | 3,034 | 28 | % | ||||||

| Impairment on short-term prepaid deposits, property, plant and equipment and assets held for sale | — | 2,270 | (2,270 | ) | 100 | % | 3,628 | 12,252 | (8,624 | ) | (70) | % | ||||

| Reversal of revaluation loss on digital assets | — | (1,183 | ) | 1,183 | 100 | % | — | (2,695 | ) | 2,695 | 100 | % | ||||

| Gain on extinguishment of long-term debt and lease liabilities | — | — | — | — | % | — | (12,835 | ) | 12,835 | 100 | % | |||||

| (Gain) loss revaluation of warrants | (6,314 | ) | 42,760 | (49,074 | ) | (115) | % | (19,603 | ) | 42,974 | (62,577 | ) | (146) | % | ||

| Gain on disposition of marketable securities | (782 | ) | (999 | ) | 217 | (22) | % | (2,313 | ) | (12,245 | ) | 9,932 | (81) | % | ||

| Service fees not associated with ongoing operations | 1,287 | — | 1,287 | 100 | % | 13,766 | — | 13,766 | 100 | % | ||||||

| Sales tax recovery - prior years - energy and infrastructure and G&A expenses (1) | — | 2,485 | (2,485 | ) | 100 | % | (16,081 | ) | 9,281 | (25,362 | ) | (273) | % | |||

| Net financial (income) expense and other | (13,649 | ) | 7,635 | (21,284 | ) | (279) | % | (7,000 | ) | 17,790 | (24,790 | ) | (139) | % | ||

| Adjusted EBITDA | 14,315 | 16,332 | (2,017 | ) | (12) | % | 54,661 | 43,558 | 11,103 | 25 | % | |||||

| Adjusted EBITDA margin | 25 | % | 35 | % | — | — | 28 | % | 30 | % | — | — | ||||

nm: not meaningful

| 1 | Sales tax recovery relating to energy and infrastructure and general and administrative expenses have been allocated to their respective periods; refer to Note 29b - Additional Details to the Statement of Profit or Loss and Comprehensive Profit or Loss (Canadian sales tax refund) to the Financial Statements. |

| Bitfarms Ltd. Calculation of Gross Mining Profit and Gross Mining Margin | ||||||||||||||||

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Gross (loss) profit | 1,387 | 1,757 | (370 | ) | (21) % | (32,359 | ) | (21,502 | ) | (10,857 | ) | 50 | % | |||

| Non-Mining revenues¹ | (1,592 | ) | (1,285 | ) | (307 | ) | 24 | % | (5,102 | ) | (5,060 | ) | (42 | ) | 1 | % |

| Depreciation and amortization | 24,584 | 21,790 | 2,794 | 13 | % | 149,727 | 84,785 | 64,942 | 77 | % | ||||||

| Sales tax recovery - depreciation and amortization | — | — | — | — | % | (8,760 | ) | — | (8,760 | ) | (100) | |||||

| Electrical components and salaries | 1,403 | 1,095 | 308 | 28 | % | 4,081 | 4,151 | (70 | ) | (2) | % | |||||

| Sales tax recovery - prior years - energy and infrastructure² | — | 2,211 | (2,211 | ) | 100 | % | (14,338 | ) | 8,366 | (22,704 | ) | (271) | % | |||

| Other | 4 | (114 | ) | 118 | nm | 1,220 | (463 | ) | 1,683 | nm | ||||||

| Gross Mining profit | 25,786 | 25,454 | 332 | 1 | % | 94,469 | 70,277 | 24,192 | 34 | % | ||||||

| Gross Mining margin | 47 | % | 57 | % | — | — | 50 | % | 50 | % | — | — | ||||

nm: not meaningful

| (1 | ) | Non-Mining revenues reconciliation: |

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Revenues | 56,163 | 46,241 | 9,922 | 21 | % | 192,881 | 146,366 | 46,515 | 32 | % | ||||||

| Less Mining related revenues for the purpose of calculating gross Mining margin: | ||||||||||||||||

| Mining revenues³ | (54,571 | ) | (44,956 | ) | (9,615 | ) | 21 | % | (187,779 | ) | (141,306 | ) | (46,473 | ) | 33 | % |

| Non-Mining revenues | 1,592 | 1,285 | 307 | 24 | % | 5,102 | 5,060 | 42 | 1 | % | ||||||

| (2 | ) | Sales tax recovery relating to energy and infrastructure expenses has been allocated to their respective periods; refer to Note 29b - Additional Details to the Statement of Profit or Loss and Comprehensive Profit or Loss (Canadian sales tax refund) to the Financial Statements. |

| (3 | ) | Mining revenues include revenues from sale of computational power used for hashing calculations and revenues from computational power sold in exchange of services. |

| Bitfarms Ltd. Calculation of Direct Cost and Direct Cost per BTC | ||||||||||||||||

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Cost of revenues | 54,776 | 44,484 | 10,292 | 23 | % | 225,240 | 167,868 | 57,372 | 34 | % | ||||||

| Depreciation and amortization | (24,584 | ) | (21,790 | ) | (2,794 | ) | 13 | % | (149,727 | ) | (84,785 | ) | (64,942 | ) | 77 | % |

| Sales tax recovery - depreciation and amortization | — | — | — | — | % | 8,760 | — | 8,760 | 100 | % | ||||||

| Electrical components and salaries | (1,403 | ) | (1,091 | ) | (312 | ) | 29 | % | (4,081 | ) | (4,141 | ) | 60 | (1) | % | |

| Infrastructure | (1,456 | ) | (1,607 | ) | 151 | (9) | % | (5,784 | ) | (3,909 | ) | (1,875 | ) | 48 | % | |

| Sales tax recovery - prior years - energy and infrastructure (1) | — | (2,211 | ) | 2,211 | 100 | % | 14,338 | (8,366 | ) | 22,704 | 271 | % | ||||

| Other | (649 | ) | — | (649 | ) | (100) | % | — | 82 | (82 | ) | (100) | % | |||

| Direct Cost | 26,684 | 17,785 | 8,899 | 50 | % | 88,746 | 66,749 | 21,997 | 33 | % | ||||||

| Quantity of BTC earned | 654 | 1,236 | (582 | ) | (47) | % | 2,914 | 4,928 | (2,014 | ) | (41) | % | ||||

| Direct Cost per BTC (in U.S. dollars) | 40,800 | 14,400 | 26,400 | 183 | % | 30,500 | 13,500 | 17,000 | 126 | % | ||||||

nm: not meaningful

| Bitfarms Ltd. Calculation of Total Cash Cost and Total Cost per BTC | ||||||||||||||||

| Three months ended December 31, | Year ended December 31, | |||||||||||||||

| (U.S.$ in thousands except where indicated) | 2024 | 2023 | $ Change | % Change | 2024 | 2023 | $ Change | % Change | ||||||||

| Cost of revenues | 54,776 | 44,484 | 10,292 | 23 | % | 225,240 | 167,868 | 57,372 | 34 | % | ||||||

| General and administrative expenses | 18,042 | 13,405 | 4,637 | 35 | % | 71,240 | 39,292 | 31,948 | 81 | % | ||||||

| 72,818 | 57,889 | 14,929 | 26 | % | 296,480 | 207,160 | 89,320 | 43 | % | |||||||

| Depreciation and amortization | (24,584 | ) | (21,790 | ) | (2,794 | ) | 13 | % | (149,727 | ) | (84,785 | ) | (64,942 | ) | 77 | % |

| Non-cash service expense (2) | (688 | ) | — | (688 | ) | (100) | % | (1,252 | ) | — | (1,252 | ) | (100) | % | ||

| Sales tax recovery - depreciation and amortization | — | — | — | — | % | 8,760 | — | 8,760 | 100 | % | ||||||

| Electrical components and salaries | (1,403 | ) | (1,091 | ) | (312 | ) | 29 | % | (4,081 | ) | (4,141 | ) | 60 | (1) | % | |

| Share-based payment | (4,021 | ) | (3,906 | ) | (115 | ) | 3 | % | (13,949 | ) | (10,915 | ) | (3,034 | ) | 28 | % |

| Service fees not associated with ongoing operations | (1,287 | ) | — | (1,287 | ) | (100) | % | (13,766 | ) | — | (13,766 | ) | (100) | % | ||

| Sales tax recovery - prior years - energy and infrastructure and G&A expenses (1) | — | (2,485 | ) | 2,485 | 100 | % | 16,081 | (9,281 | ) | 25,362 | 273 | % | ||||

| Other | (1,078 | ) | 201 | (1,279 | ) | (636) | % | (5,659 | ) | 890 | (6,549 | ) | (736) | % | ||

| Total Cash Cost | 39,757 | 28,818 | 10,939 | 38 | % | 132,887 | 98,928 | 33,959 | 34 | % | ||||||

| Quantity of BTC earned | 654 | 1,236 | (582 | ) | (47) | % | 2,914 | 4,928 | (2,014 | ) | (41) | % | ||||

| Total Cash Cost per BTC (in U.S. dollars) | 60,800 | 23,300 | 37,500 | 161 | % | 45,600 | 20,100 | 25,500 | 127 | % | ||||||

nm: not meaningful

| 1 | Sales tax recovery relating to energy and infrastructure and general and administrative expenses have been allocated to their respective periods; refer to Note 29b - Additional Details to the Statement of Profit or Loss and Comprehensive Profit or Loss (Canadian sales tax refund) to the Financial Statements. |

| 2 | Non-cash service expense, included in infrastructure, which was exchanged for computational power sold. |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d24a5e36-6201-4d4f-a4f9-8fdc9aaeb95b