Bunker Hill Announces an Enhanced Digbee ESG Rating

Rhea-AI Summary

Bunker Hill Mining Corp. (TSX-V:BNKR; OTCQB:BHLL) has received an enhanced ESG rating from Digbee, achieving an overall score of 'A' in its third annual assessment. This marks the project's upgrade from 'exploration' to 'development' phase. The company aims to revive a historic mine within an active EPA Superfund clean-up site, focusing on remediation, mineral extraction, and community support.

CEO Sam Ash emphasized the company's commitment to ESG excellence and continuous improvement. Bunker Hill's unique corporate governance system, modeled after Ford Motor Company's approach, ensures transparency and effective decision-making. The mine's restart is expected to generate employment opportunities and support local infrastructure and skills development.

Digbee's CEO, Jamie Strauss, commended Bunker Hill's commitment to ESG transparency and performance, noting steady improvement over the past three years. The company is well-positioned to develop a sustainable mine for the essential metals supply chain.

Positive

- None.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, BHLL declined 1.69%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, July 29, 2024 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSX-V:BNKR; OTCQB:BHLL) is pleased to announce the publication of the Company’s third annual Environmental, Social and Governance (“ESG”) report from Digbee ESGTM (“Digbee”), a leading independent ESG assessment platform for the mining industry.

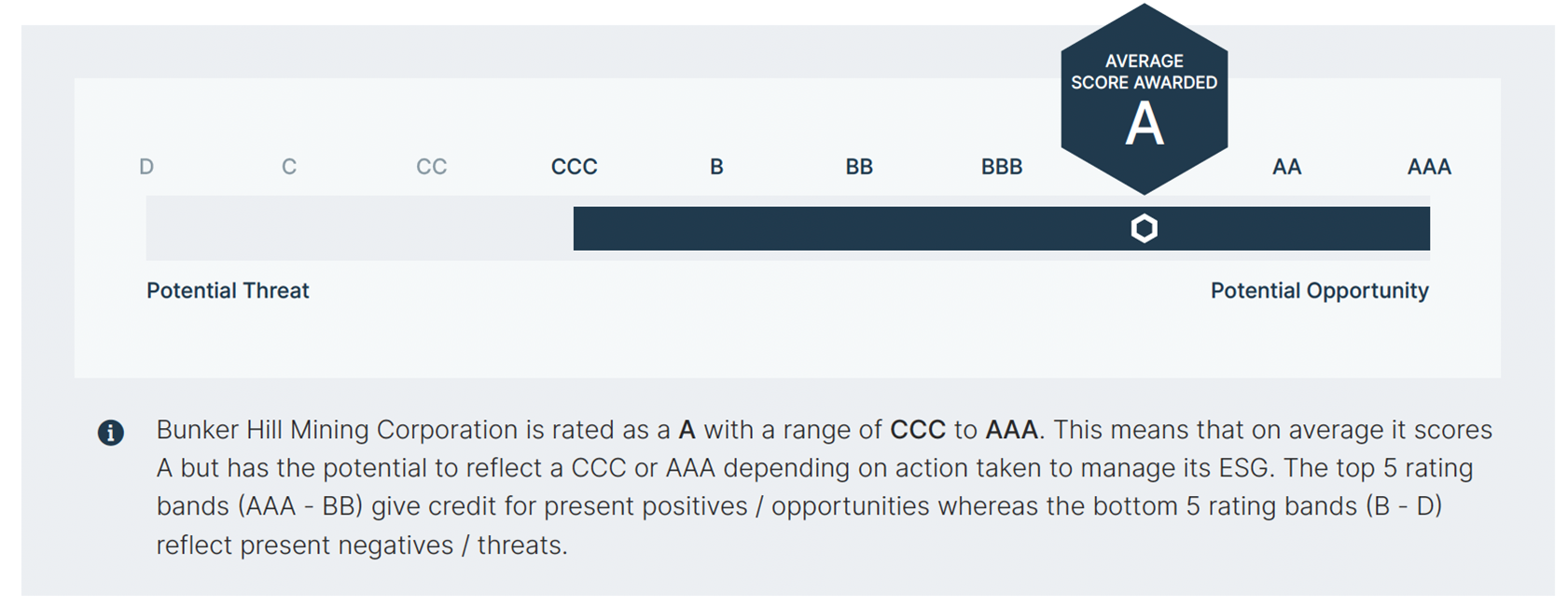

In Digbee’s latest assessment, Bunker Hill achieved an overall ESG score of “A” from Digbee’s independent panel of qualified mining ESG experts who reviewed the Company’s performance against rigorous and standardized scoring criteria. This submission marks the third submission for the Bunker Hill project since April 2021. This is the first time that the project has been upgraded to the ‘development’ phase from ‘exploration’, with additional information being submitted for consideration.

Sam Ash, Bunker Hill’s CEO, stated: “Excellence in ESG has been integral to the Company’s strategy from day one. We aim for continuous improvement as we revive a historic mine, facilitating the remediation of existing mining legacies while extracting valuable minerals, creating employment opportunities and supporting our local community. Our Bunker Hill Mine will be the first mining operation to restart in an active EPA Superfund clean-up site since 1969, which is a significant milestone for the US Mining Industry. The revitalized mine is expected to generate employment opportunities and support the local community, including infrastructure enhancement and skills development”.

Bunker Hill has a highly distinctive and robust corporate governance system, enabled by its weekly Business Plan Review (BPR) system: a disciplined, carefully structured, one-hour video conference attended by all Board Members, Executive Management and key officers and staff. Modelled primarily on the governance model built at the Ford Motor Company by its transformational CEO Alan Mullally, this unique ‘all-hands’ system ensures a level of transparency and situational awareness on risks and opportunities and an ability to better leverage the collective experience of all team and Board members in ways that enhance significantly the quality of decision-making at all levels.

Figure 1: Bunker Hill Mining Corp.’s Rating

Jamie Strauss, founder and CEO of Digbee, commented: “With institutional finance increasingly valuing sustainability, Bunker Hill’s commitment to transparency in ESG performance and disclosure is a credit to the Company and its core ethos. The Company, leveraging its three-year partnership with Digbee, has shown steady improvement over the past three years and is now well-positioned to develop a sustainable mine for the essential metals supply chain. Digbee has identified areas for further improvement which we understand the Company is keen to focus on.”

Details of the Company’s 2023 ESG Report are available on Bunker Hill’s and Digbee’s websites.

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to restart and develop the Bunker Hill Mine sustainably as the first step in consolidating and optimizing a number of mining assets into a high-value portfolio of operations centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine, and the achievement of future short-term, medium-term and long-term operational strategies.

Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the SEC and with applicable Canadian securities regulatory authorities, and the following: the Company’s inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual information form or annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov), respectively.

A figure accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5cabf945-1083-406f-9b54-631029b20d30