Tunkillia Scoping Study Outlines Competitive Large-Scale Gold Operation

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) has announced a live webinar hosted by Sharewise to discuss the results of a preliminary Scoping Study at the Tunkillia Gold Project. The study outlines a prospective 5Mtpa bulk open pit mining and processing project with:

- Average annual production of ~130koz Au at an AISC of A$1,917/oz

- A high-grade 'Starter' pit producing ~181,000 oz payable gold and 420,000 oz payable silver in the first 18 months

- NPV7.5% of ~A$512m, 40% IRR, and 1.9-year payback period (unlevered, pre-tax)

The webinar, scheduled for August 12, 2024, will feature Barton MD Alex Scanlon discussing the study results and ongoing corporate activities. With over A$10m in cash, Barton is well-positioned to advance its strategy and optimize the Tunkillia project.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) ha annunciato un webinar dal vivo ospitato da Sharewise per discutere i risultati di uno Studio Preliminare di Fattibilità presso il Tunkillia Gold Project. Lo studio delinea un progetto minerario e di lavorazione a cielo aperto con una capacità prospettica di 5Mtpa che prevede:

- Produzione annuale media di ~130koz Au a un AISC di A$1,917/oz

- Un 'Starter' pit ad alta gradazione che produce ~181.000 once di oro pagabile e 420.000 once di argento pagabile nei primi 18 mesi

- NPV7.5% di ~A$512m, 40% IRR, e un periodo di recupero di 1,9 anni (senza leva, pre-tasse)

Il webinar, programmato per il 12 agosto 2024, vedrà Alex Scanlon, MD di Barton, discutere i risultati dello studio e le attività aziendali in corso. Con oltre A$10m in contante, Barton è ben posizionata per avanzare nella sua strategia e ottimizzare il progetto Tunkillia.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) ha anunciado un seminario web en vivo organizado por Sharewise para discutir los resultados de un Estudio de Viabilidad Inicial en el Proyecto Tunkillia Gold. El estudio describe un proyecto de minería a cielo abierto y procesamiento a granel con una capacidad prospectiva de 5Mtpa que incluye:

- Producción anual promedio de ~130koz Au a un AISC de A$1,917/oz

- Un 'Starter' pit de alta ley que produce ~181,000 onzas de oro pagable y 420,000 onzas de plata pagable en los primeros 18 meses

- NPV7.5% de ~A$512m, 40% IRR, y un período de recuperación de 1.9 años (sin apalancamiento, antes de impuestos)

El seminario web, programado para el 12 de agosto de 2024, contará con Alex Scanlon, MD de Barton, discutiendo los resultados del estudio y las actividades corporativas en curso. Con más de A$10m en efectivo, Barton está bien posicionada para avanzar en su estrategia y optimizar el proyecto Tunkillia.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF)는 Sharewise가 주최하는 실시간 웨비나를 발표하여 Tunkillia Gold Project의 초기 스코핑 연구 결과를 논의할 예정입니다. 이 연구는 연간 5Mtpa의 대규모 노천 채굴 및 처리 프로젝트를 개요로 제시하며:

- 평균 연간 생산량 약 130koz Au, AISC가 A$1,917/oz에서

- 첫 18개월 동안 약 181,000 oz의 금과 420,000 oz의 은이 지급되는 고품질 'Starter' pit

- NPV7.5%가 약 A$512m, 40% IRR, 1.9년의 회수 기간(무레버리지, 세전)

2024년 8월 12일로 예정된 이번 웨비나에서는 Barton의 관리자인 Alex Scanlon이 연구 결과와 진행 중인 기업 활동에 대해 논의할 것입니다. 1천만 호주 달러 이상의 현금을 보유한 Barton은 전략을 추진하고 Tunkillia 프로젝트를 최적화하는 데 좋은 위치에 있습니다.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) a annoncé un webinaire en direct organisé par Sharewise pour discuter des résultats d'une Étude de Préfaisabilité au Projet Aurifère Tunkillia. L'étude décrit un projet de mine à ciel ouvert et de traitement à grande échelle avec une capacité prospective de 5Mtpa, comprenant :

- Production annuelle moyenne d'environ 130koz Au avec un AISC de A$1,917/oz

- Une 'Starter' pit de haute qualité produisant environ 181 000 oz d'or payable et 420 000 oz d'argent payable au cours des 18 premiers mois

- NPV7.5% d'environ A$512m, 40% IRR et une période de retour de 1,9 an (non endettée, avant impôts)

Le webinaire, prévu pour le 12 août 2024, mettra en vedette Alex Scanlon, MD de Barton, discutant des résultats de l'étude et des activités d'entreprise en cours. Avec plus de 10 millions de dollars australiens en liquidités, Barton est bien positionnée pour faire avancer sa stratégie et optimiser le projet Tunkillia.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) hat ein Live-Webinar angekündigt, das von Sharewise veranstaltet wird, um die Ergebnisse einer Vorläufigen Machbarkeitsstudie zum Tunkillia Goldprojekt zu erörtern. Die Studie beschreibt ein potenzielles Großprojekte zur Tagebau- und Aufbereitungsanlage mit einer Kapazität von 5Mtpa, das Folgendes umfasst:

- Durchschnittliche Jahresproduktion von ~130koz Au bei einem AISC von A$1,917/oz

- Eine reichhaltige 'Starter' Grube, die in den ersten 18 Monaten ~181.000 oz zahlbares Gold und 420.000 oz zahlbares Silber produziert

- NPV7.5% von ~A$512m, 40% IRR und eine Amortisationszeit von 1,9 Jahren (unverschuldet, vor Steuern)

Das Webinar, das für den 12. August 2024 geplant ist, wird Barton MD Alex Scanlon präsentieren, der die Studienergebnisse und laufenden Unternehmensaktivitäten erörtert. Mit über A$10m in bar ist Barton gut positioniert, um seine Strategie voranzutreiben und das Tunkillia-Projekt zu optimieren.

- Competitive AISC of A$1,917/oz for gold production

- High-grade 'Starter' pit with average operating cashflow of ~A$2,265/oz gold

- Attractive project economics with NPV7.5% of ~A$512m and 40% IRR

- Short payback period of 1.9 years

- Strong cash position of over A$10m to advance strategy

- None.

Insights

The Tunkillia Scoping Study presents a promising outlook for Barton Gold's project. With an average annual production of

The 'Starter' pit's higher-grade production in the first 18 months is particularly noteworthy, potentially providing robust early cash flows to support further development. However, investors should note that scoping studies are preliminary and further studies will be needed to confirm these projections. The company's

The Tunkillia project's 5Mtpa bulk open pit mining approach aligns with current industry trends for large-scale, low-grade gold operations. The AISC of

The focus on a higher-grade 'Starter' pit is a smart strategy, potentially de-risking the project by generating strong early returns. However, investors should be aware that maintaining this production profile long-term may be challenging, as grades often decrease with depth. The company's plan to optimize the study and explore neighboring areas for higher-grade mineralization is prudent, potentially extending the project's life and improving its economics.

Live Webinar Hosted by Sharewise

HIGHLIGHTS

Live webinar with Q&A hosted by Sharewise on Monday, 12 August 2024

Starts at 07:30 London / 08:30 Zurich / 14:30 Perth / 16:00 Adelaide / 16:30 Sydney

ADELAIDE, AUSTRALIA / ACCESSWIRE / August 6, 2024 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce a live webinar hosted by Sharewise. Barton MD Alex Scanlon will discuss the results of a preliminary Scoping Study at the Tunkillia Gold Project (Tunkillia) and other ongoing corporate activities.

This study has outlined a prospective 5Mtpa bulk open pit mining and processing project, with:1

aveg annual production of ~130koz Au at a competitive A

$1,917 / oz All-in Sustaining Cost (AISC);a higher-grade ‘Starter' pit producing ~181,000 oz payable gold and 420,000 oz payable silver during the first 18 months of mining, with average operating cashflow of ~A

$2,265 / oz gold; andan NPV

7.5% of ~A$512m , a40% IRR and a 1.9 year payback period (all unlevered, and pre-tax).

Webinar details

The webinar will be hosted by Sharewise with live Q&A following a presentation, starting at 16.30 Sydney on 12 August 2024 (07:30 London, 08:30 Zurich, 14:30 Perth, and 16:00 Adelaide). Register free here.

Commenting on the Tunkillia Project, Barton MD Alexander Scanlon said:

"We are excited to outline a project that, were it in operation today, would rank favourably by AISC among Australian gold producers. We plan to continue systematically building up Tunkillia's potential over the next 12 months, targeting an optimised Scoping Study, while pursuing other higher-grade mineralisation in the neighbouring Tarcoola Goldfield.

"With over A

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Shannon Coates |

|

About Barton Gold

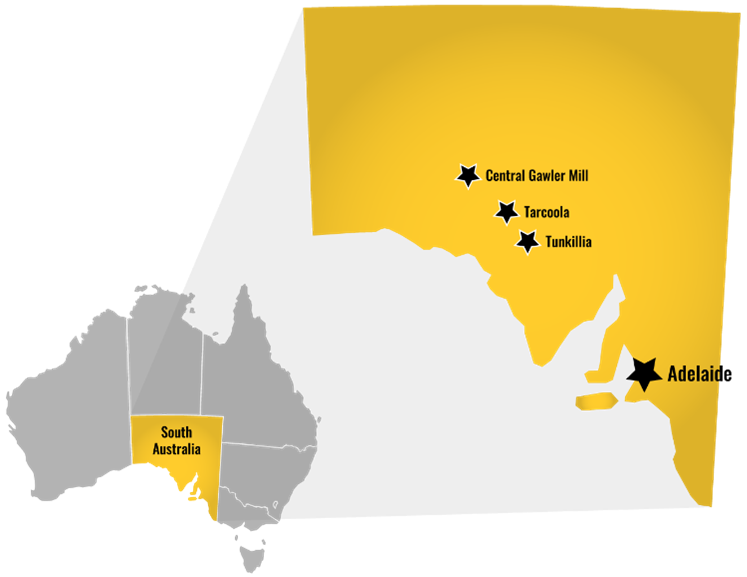

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project

Infrastructure

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1Refer to ASX announcement dated 16 July 2024.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 824koz Au (26.8Mt @ 0.96 g/t Au) in Indicated and 750koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com