Live Webinar Hosted by Sharewise

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) has announced a live webinar hosted by Sharewise on August 12, 2024, to discuss the results of a preliminary Scoping Study at the Tunkillia Gold Project. The study outlines a prospective 5Mtpa bulk open pit mining and processing project with:

- Average annual production of ~130koz Au at an AISC of A$1,917/oz

- A high-grade 'Starter' pit producing ~181,000 oz gold and 420,000 oz silver in the first 18 months

- NPV7.5% of ~A$512m, 40% IRR, and 1.9-year payback period (unlevered, pre-tax)

Barton's MD, Alexander Scanlon, expressed excitement about the project's potential and plans to optimize the Scoping Study over the next 12 months. With over A$10m in cash, the company is well-positioned to advance its strategy.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) ha annunciato un webinar dal vivo ospitato da Sharewise il 12 agosto 2024, per discutere i risultati di uno Studio di Fattibilità Preliminare sul Progetto Aurifero Tunkillia. Lo studio delinea un progetto di estrazione e lavorazione di minerali da 5Mtpa in miniera a cielo aperto con:

- Produzione annua media di ~130koz Au a un costo totale di A$1,917/oz

- Una miniera 'Starter' ad alta grade che produrrà ~181,000 oz di oro e 420,000 oz di argento nei primi 18 mesi

- NPV7.5% di ~A$512 milioni, IRR del 40% e un periodo di recupero di 1,9 anni (non leva, pre-tasse)

Il MD di Barton, Alexander Scanlon, ha espresso entusiasmo per il potenziale del progetto e per i piani di ottimizzare lo Studio di Fattibilità Preliminare nei prossimi 12 mesi. Con oltre A$10 milioni in cassa, l'azienda è ben posizionata per portare avanti la sua strategia.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) ha anunciado un seminario web en vivo organizado por Sharewise el 12 de agosto de 2024, para discutir los resultados de un Estudio de Previabilidad en el Proyecto de Oro Tunkillia. El estudio describe un proyecto de minería a cielo abierto y procesamiento de 5Mtpa con:

- Producción anual promedio de ~130koz Au a un AISC de A$1,917/oz

- Una mina 'Starter' de alta ley que producirá ~181,000 oz de oro y 420,000 oz de plata en los primeros 18 meses

- NPV7.5% de ~A$512 millones, IRR del 40% y un período de recuperación de 1.9 años (sin apalancamiento, antes de impuestos)

El MD de Barton, Alexander Scanlon, expresó su entusiasmo por el potencial del proyecto y los planes para optimizar el Estudio de Previabilidad durante los próximos 12 meses. Con más de A$10 millones en efectivo, la empresa está bien posicionada para avanzar en su estrategia.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF)는 2024년 8월 12일 Sharewise가 주최하는 라이브 웨비나를 통해 Tunkillia 금 프로젝트에 대한 예비 타당성 연구의 결과를 논의한다고 발표했습니다. 이 연구는 연간 5Mt의 대규모 오픈 피트 광산 및 가공 프로젝트를 설명합니다:

- 연간 평균 생산량 약 130koz Au, AISC A$1,917/oz

- 첫 18개월 동안 약 181,000 oz 금과 420,000 oz 은을 생산하는 고등급 '스타터' 피트

- 약 A$512m의 NPV7.5%, 40%의 IRR, 1.9년의 회수 기간(비레버리지, 세전)

Barton의 MD인 Alexander Scanlon은 프로젝트의 잠재력에 대해 흥분을 표하며, 향후 12개월 동안 예비 타당성 연구를 최적화할 계획을 밝혔습니다. 1천만 호주 달러 이상의 현금이 있어 회사는 전략을 추진할 수 있는 좋은 위치에 있습니다.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) a annoncé un webinaire en direct organisé par Sharewise le 12 août 2024, pour discuter des résultats d'une étude de faisabilité préliminaire sur le projet aurifère de Tunkillia. L'étude décrit un projet d'extraction et de traitement de 5Mtpa par open-pit comprenant :

- Production annuelle moyenne d'environ 130koz Au à un AISC de A$1,917/oz

- Une fosse 'Starter' de haute qualité produisant environ 181,000 oz d'or et 420,000 oz d'argent au cours des 18 premiers mois

- NPV7.5% d'environ A$512 millions, IRR de 40%, et une période de retour sur investissement de 1,9 an (sans effet de levier, avant impôts)

Le directeur général de Barton, Alexander Scanlon, a exprimé son enthousiasme pour le potentiel du projet et prévoit d'optimiser l'étude de faisabilité préliminaire au cours des 12 prochains mois. Avec plus de A$10 millions en trésorerie, l'entreprise est bien positionnée pour faire avancer sa stratégie.

Barton Gold Holdings (ASX:BGD, OTCQB:BGDFF) hat ein Live-Webinar, das von Sharewise am 12. August 2024 veranstaltet wird, angekündigt, um die Ergebnisse einer Voruntersuchung zum Tunkillia Goldprojekt zu besprechen. Die Studie beschreibt ein 5Mtpa Großprojekt für den Tagebau und die Verarbeitung mit:

- Jährlicher Durchschnitt von ~130koz Au zu AISC von A$1,917/oz

- Ein hochgradiges 'Starter'-Loch, das in den ersten 18 Monaten ~181,000 oz Gold und 420,000 oz Silber produziert

- NPV7.5% von ~A$512 Millionen, 40% IRR und eine Amortisationsdauer von 1,9 Jahren (unlevered, vor Steuern)

Der Geschäftsführer von Barton, Alexander Scanlon, zeigte sich begeistert von dem Potenzial des Projekts und plant, die Voruntersuchung in den nächsten 12 Monaten zu optimieren. Mit über A$10 Millionen in bar ist das Unternehmen gut positioniert, um seine Strategie voranzutreiben.

- Scoping Study outlines competitive large-scale gold operation with 5Mtpa production capacity

- Average annual production of ~130koz Au at a competitive AISC of A$1,917/oz

- High-grade 'Starter' pit with ~181,000 oz gold and 420,000 oz silver in first 18 months

- Strong project economics with NPV7.5% of ~A$512m, 40% IRR, and 1.9-year payback period

- Company has over A$10m cash to advance its strategy

- None.

Tunkillia Scoping Study Outlines Competitive Large-Scale Gold Operation

HIGHLIGHTS

Live webinar with Q&A hosted by Sharewise on Monday, 12 August 2024

Starts at 07:30 London / 08:30 Zurich / 14:30 Perth / 16:00 Adelaide / 16:30 Sydney

ADELAIDE, AUSTRALIA / ACCESSWIRE / August 6, 2024 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce a live webinar hosted by Sharewise. Barton MD Alex Scanlon will discuss the results of a preliminary Scoping Study at the Tunkillia Gold Project (Tunkillia) and other ongoing corporate activities.

This study has outlined a prospective 5Mtpa bulk open pit mining and processing project, with:1

aveg annual production of ~130koz Au at a competitive A

$1,917 / oz All-in Sustaining Cost (AISC);a higher-grade ‘Starter' pit producing ~181,000 oz payable gold and 420,000 oz payable silver during the first 18 months of mining, with average operating cashflow of ~A

$2,265 / oz gold; andan NPV

7.5% of ~A$512m , a40% IRR and a 1.9 year payback period (all unlevered, and pre-tax).

Webinar details

The webinar will be hosted by Sharewise with live Q&A following a presentation, starting at 16.30 Sydney on 12 August 2024 (07:30 London, 08:30 Zurich, 14:30 Perth, and 16:00 Adelaide). Register free here.

Commenting on the Tunkillia Project, Barton MD Alexander Scanlon said:

"We are excited to outline a project that, were it in operation today, would rank favourably by AISC among Australian gold producers. We plan to continue systematically building up Tunkillia's potential over the next 12 months, targeting an optimised Scoping Study, while pursuing other higher-grade mineralisation in the neighbouring Tarcoola Goldfield.

"With over A

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Shannon Coates |

|

About Barton Gold

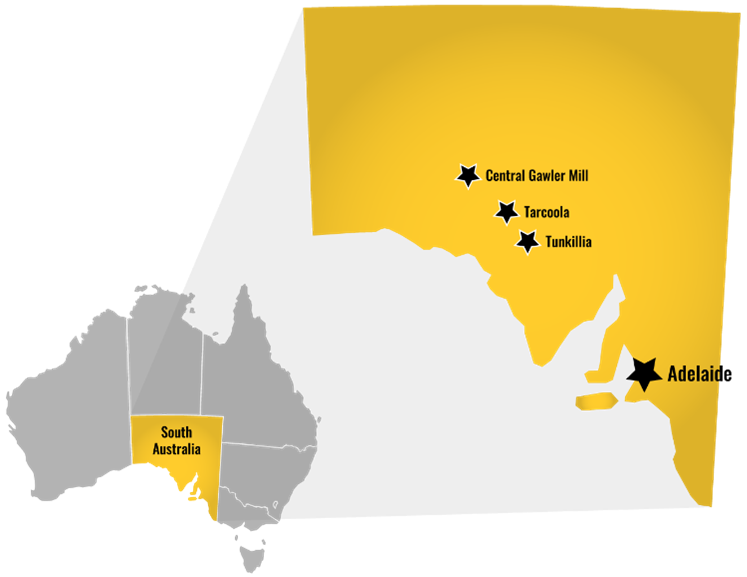

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project

Infrastructure

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

1Refer to ASX announcement dated 16 July 2024.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 824koz Au (26.8Mt @ 0.96 g/t Au) in Indicated and 750koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com