5,000m Tunkillia Growth Drilling Program Completed

Barton Gold Holdings has completed a 5,064m reverse circulation drilling program at the Tunkillia Gold Project, targeting extensions of block model to support JORC Mineral Resources Estimate growth and an Optimised Scoping Study. The company has already grown Tunkillia to a 1.5Moz Au JORC MRE in the past 6 months and published an Initial Scoping Study projecting ~130kozpa gold production with an AISC of ~A$1,917/oz Au, a 40% equity IRR, and a 1.9 year payback period.

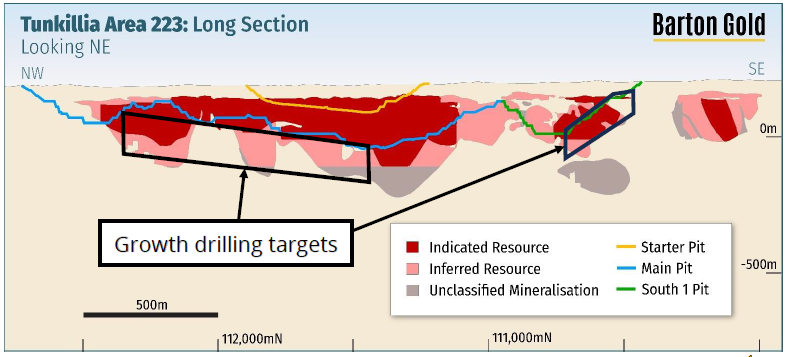

The new drilling program focused on parallel lodes and depth extensions in previously identified gold mineralization areas not yet included in the MRE. The company aims to increase project economics and mine life through optimization of key cost drivers.

Barton Gold Holdings ha completato un programma di perforazione a circolazione inversa di 5.064 metri presso il Tunkillia Gold Project, puntando a estensioni del modello di blocco per supportare la crescita della stima delle risorse minerarie secondo JORC e uno studio di fattibilità ottimizzato. Negli ultimi 6 mesi, l'azienda ha già portato Tunkillia a una stima delle risorse minerarie JORC di 1,5 Moz Au e ha pubblicato uno studio di fattibilità iniziale che prevede una produzione di oro di circa 130 kozpa con un AISC di circa A$1.917/oz Au, un IRR del 40% e un periodo di recupero di 1,9 anni.

Il nuovo programma di perforazione si è concentrato su vene parallele e sulle estensioni in profondità nelle aree di mineralizzazione aurifera precedentemente identificate e non ancora incluse nella stima delle risorse minerarie. L'azienda punta a migliorare l'economia del progetto e la vita mineraria attraverso l'ottimizzazione dei principali fattori di costo.

Barton Gold Holdings ha completado un programa de perforación de circulación inversa de 5,064 metros en el Tunkillia Gold Project, dirigido a extender el modelo de bloque para apoyar el crecimiento de la estimación de recursos minerales JORC y un estudio de viabilidad optimizado. En los últimos 6 meses, la compañía ha incrementado Tunkillia a una estimación de recursos minerales JORC de 1.5 Moz Au y ha publicado un estudio de viabilidad inicial proyectando una producción de oro de aproximadamente 130 kozpa con un AISC de aproximadamente A$1,917/oz Au, un IRR del 40% y un período de recuperación de 1.9 años.

El nuevo programa de perforación se centró en venas paralelas y extensiones en profundidad en áreas de mineralización aurífera previamente identificadas que aún no estaban incluidas en la estimación de recursos minerales. La compañía tiene como objetivo aumentar la economía del proyecto y la vida útil de la mina a través de la optimización de los principales costos.

Barton Gold Holdings는 Tunkillia Gold Project에서 5,064미터의 역순환 드릴링 프로그램을 완료했습니다. 이는 JORC 광물 자원 추정의 성장을 지원하고 최적화된 스코핑 스터디를 위해 블록 모델의 연장을 목표로 하고 있습니다. 회사는 지난 6개월 동안 Tunkillia를 1.5Moz Au JORC MRE로 성장시켰으며, 약 130kozpa의 금 생산과 AISC 약 A$1,917/oz Au, 40%의 지분 IRR, 1.9년의 회수 기간을 예측하는 초기 스코핑 스터디를 발표했습니다.

새로운 드릴링 프로그램은 이전에 확인된 금 광물화 지역의 평행 함과 깊이 연장에 초점을 맞추었습니다. 회사는 주요 비용 요소의 최적화를 통해 프로젝트의 경제성과 광산 수명을 증가시키는 것을 목표로 하고 있습니다.

Barton Gold Holdings a terminé un programme de forage à circulation inversée de 5 064 mètres sur le Tunkillia Gold Project, visant à étendre le modèle de bloc pour soutenir la croissance de l'estimation des ressources minérales selon JORC et une étude de faisabilité optimisée. Au cours des 6 derniers mois, l'entreprise a déjà porté Tunkillia à une estimation des ressources minérales JORC de 1,5 Moz Au et a publié une étude de faisabilité initiale prévoyant une production d'or d'environ 130 kozpa avec un AISC d'environ A$1 917/oz Au, un IRR des fonds propres de 40 % et une période de remboursement de 1,9 an.

Le nouveau programme de forage s'est concentré sur des veines parallèles et des extensions en profondeur dans des zones de minéralisation aurifère précédemment identifiées qui ne sont pas encore incluses dans l'estimation des ressources minérales. L'entreprise vise à améliorer l'économie du projet et la durée de vie de la mine grâce à l'optimisation des principaux moteurs de coût.

Barton Gold Holdings hat ein Reverse-Circulation-Bohrprogramm über 5.064 Meter im Tunkillia Gold Project abgeschlossen, das auf Erweiterungen des Blockmodells abzielt, um das Wachstum der JORC-Mineralressourcenschätzung und eine optimierte Machbarkeitsstudie zu unterstützen. Das Unternehmen hat Tunkillia in den letzten 6 Monaten bereits auf eine JORC-MRE von 1,5 Moz Au ausgeweitet und eine erste Machbarkeitsstudie veröffentlicht, die mit rund 130kozpa Goldproduktion, einer AISC von etwa A$1.917/oz Au, einer Eigenkapital-IRR von 40 % und einer Amortisationszeit von 1,9 Jahren rechnet.

Das neue Bohrprogramm konzentrierte sich auf parallele Gang- und Tiefenverlängerungen in zuvor identifizierten Goldmineralisierungsbereichen, die noch nicht in der MRE enthalten sind. Das Unternehmen zielt darauf ab, die Wirtschaftlichkeit des Projekts und die Lebensdauer der Mine durch die Optimierung der Hauptkostentreiber zu erhöhen.

- Tunkillia project grown to 1.5Moz Au JORC MRE

- Initial Scoping Study shows strong 40% equity IRR

- Projected gold production of ~130kozpa

- Quick payback period of 1.9 years

- Completion of 5,064m drilling program for resource expansion

- Relatively high AISC of ~A$1,917/oz Au

Focus on Resources Growth in Parallel with Optimised Scoping Study

HIGHLIGHTS

Tunkillia: 5,064m reverse circulation (RC) drilling completed targeting extensions of block model to support JORC Mineral Resources Estimate (MRE) growth and an Optimised Scoping Study

ADELAIDE, AU / ACCESSWIRE / December 11, 2024 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) ( Barton or Company ) is pleased to confirm that 5,064m RC drilling metres have been completed at the Tunkillia Gold Project ( Tunkillia ).

Fig 1 - Tunkillia A223 long section showing pit design in stages, March 2024 MRE & key targets 1

During the past 6 months, Barton has grown Tunkillia to a 1.5Moz Au JORC MRE and published an Initial Scoping Study for ~130kozpa gold production with an all-in sustaining cost ( AISC ) of ~A

Commenting on the Company's ongoing drilling programs, Barton MD Alexander Scanlon said:

"Barton is working non-stop to advance a long-term South Australian gold platform anchored by a competitive, large-scale asset. Tunkillia has demonstrated its attractiveness based on conservative assumptions relating to comminution design, power consumption, development schedule and procurement. The next few quarters will be exciting as we complete an Optimised Scoping Study, while turning our attention to identifying options for an initial ‘Stage 1' operation which can leverage our existing Central Gawler Mill while we are permitting Tunkillia."

1 Refer to ASX announcements dated 4 March and 16 July 2024

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

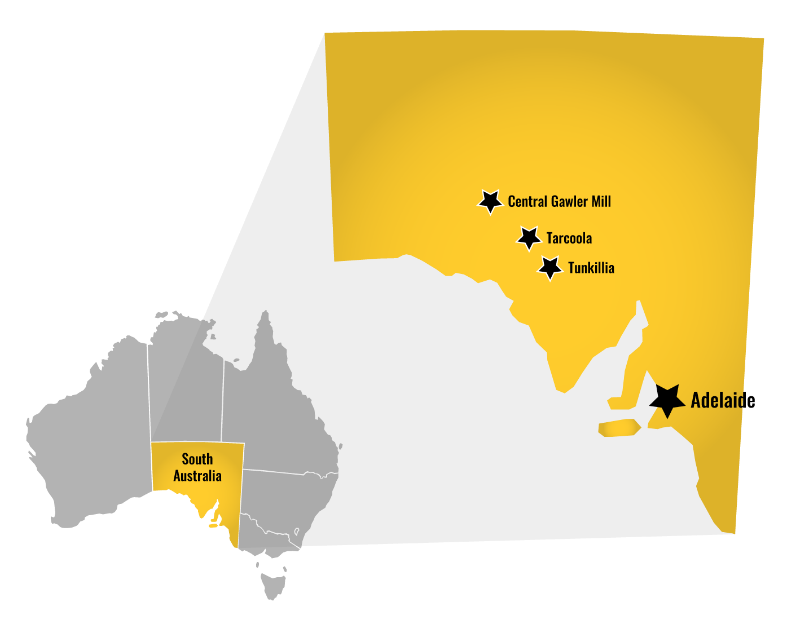

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000oz annually, with ~1.6Moz Au JORC Mineral Resources (52.3Mt @ 0.94 g/t Au), multiple advanced exploration projects and brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project *

Infrastructure

|

|

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 ( JORC ).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au . The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

*Refer to Barton Prospectus dated 14 May 2021 and ASX announcements dated 4 March and 16 July 2024. Total Barton JORC (2012) Mineral Resources include 833koz Au (26.9Mt @ 0.96 g/t Au) in Indicated and 754koz Au (25.4Mt @ 0.92 g/t Au) in Inferred categories.

SOURCE: Barton Gold Holdings Limited

View the original press release on accesswire.com