Huntsman Closes $2.1 Million Private Placement

Huntsman Exploration Inc. (OTC PINK: BBBMF) has completed a private placement, issuing 31,027,529 shares at a price of $0.07 per share, generating $2,171,927 in gross proceeds. A total of $114,092.81 was paid in finder's fees. Insiders acquired 882,857 shares, classified as a related party transaction. The funds will support exploration at the Canegrass property, cover acquisition costs for the Baxter Spring property, and provide general working capital. Additionally, the Company surrendered 40% of its tenement tenure due to regulatory requirements but deemed it non-impactful for ongoing operations.

- None.

- None.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / November 29, 2021 / Huntsman Exploration Inc. (TSXV:HMAN)(OTC PINK:BBBMF) (the "Company" or "Huntsman") is pleased to announce that it has closed a private placement of 31,027,529 shares of the Company at

For its efforts in finding certain placees, the Company paid a total of

Two insiders of the Company participated in the private placement for aggregate subscriptions of 882,857 shares. Participation of insiders of the Company in the private placement constitutes a related party transaction as defined under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company has relied on the exemption from the formal valuation requirements of Section 5.4 of MI 61-101 pursuant to Subsection 5.5(a) of MI 61-101 and the exemption from the minority approval requirements of Section 5.6 of MI 61-101 pursuant to Subsection 5.7(1)(a) of MI 61-101.

Proceeds of the private placement will be used for exploration on the Company's Canegrass property, acquisition costs relating to the final payment and exploration work on the Baxter Spring property, and general working capital. All securities issued under the placement will be subject to regulatory hold periods expiring four months and one day from the date of issue..

Canegrass Property Update

With funding for future exploration work now secured, the Company looks forward to providing a further detailed update with respect to the planned exploration program at Canegrass once it is finalized in the coming weeks.

The Company also wishes to advise that as part of the Western Australian Mining Act, the Company is required to surrender

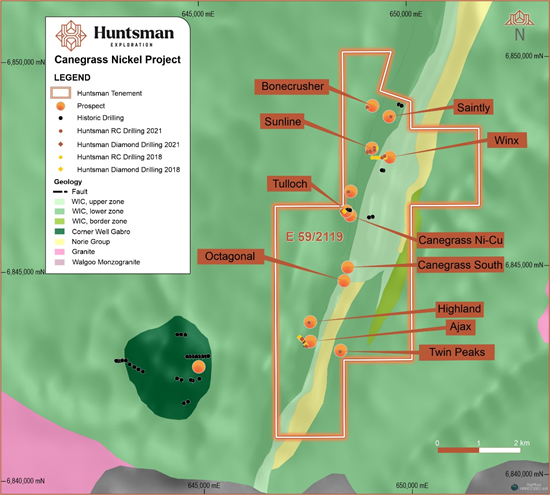

A comprehensive review of the exploration potential for nickel and base metals was conducted by the Company together with its consultants, and it was concluded that the tenure surrendered was deemed the least prospective given the levels of historical exploration conducted and would not in any way hinder the Company's exploration efforts at the Canegrass Project on a go forward basis.

A map of the new tenement outline is included in Figure 1.

Figure 1: Updated Tenure at Canegrass

On Behalf of the Board of Huntsman Exploration Inc.

Scott Patrizi

President and Chief Executive Officer

For more information, please contact 1-855-584-0160 or info@huntsmanx.com.

Neither TSX Venture Exchange, the Toronto Stock Exchange nor their Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements: Statements contained in this news release that are not historical facts are forward-looking statements, which are subject to a number of known and unknown risks, uncertainness and other factors that may cause the actual results to differ materially from those anticipated in our forward-looking statements. Although we believe that the expectations in our forward-looking statements are reasonable, actual results may vary, and we cannot guarantee future results, levels of activity, performance or achievements.

SOURCE: Huntsman Exploration Inc.

View source version on accesswire.com:

https://www.accesswire.com/674945/Huntsman-Closes-21-Million-Private-Placement