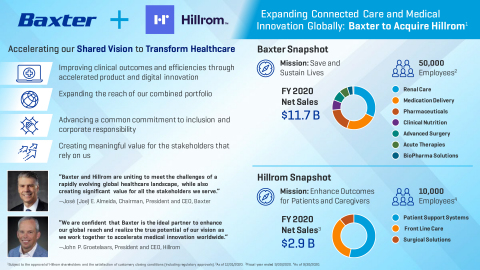

Baxter to Acquire Hillrom, Expanding Connected Care and Medical Innovation Globally

Transaction valued at

- Brings together two leading medical technology companies to broaden access to care in the hospital, home and alternate site settings

- Accelerates digitally-enabled connected care solutions across the continuum of care

- Builds on Baxter’s global footprint to expand Hillrom’s penetration of international markets

- Creates significant opportunities to position Baxter for faster top- and bottom-line growth

- Expected to generate high single-digit ROIC by year five

Expanding Connected Care and Medical Innovation Globally: Baxter to Acquire Hillrom (Graphic: Business Wire)

Hillrom brings a highly complementary product portfolio and innovation pipeline that will enable Baxter to provide a broader array of medical products and services to patients and clinicians across the care continuum and around the world, facilitating the delivery of healthcare that is patient- and customer-centered and focused on improving clinical outcomes. The combination is also expected to accelerate the companies’ expansion into digital and connected care solutions that are increasingly enabling patients with access to hospital-level care at home or in other care settings.

“Baxter and Hillrom share a common vision for transforming healthcare to better serve all patients and providers,” said

Strategic Rationale

The Baxter-Hillrom combination will expand access to Hillrom’s portfolio globally; broaden the presence of the combined companies across sites of care; accelerate and strengthen the combined organization’s digital transformation; and is expected to generate compelling financial returns for Baxter’s shareholders.

Key benefits of the acquisition include:

- A common vision for transforming healthcare to improve efficiencies and clinical outcomes, drive actionable insights and lead across the care continuum: The complementary product offering of the combined companies will support the patient in the hospital, at home, and in alternate sites of care, allowing better integration and coordination of healthcare delivery.

- A strengthened portfolio with opportunity to accelerate digitally-enabled connected healthcare and expand penetration of combined solutions worldwide: The companies’ combined capabilities in therapeutic delivery, monitoring, blood purification, diagnostics and communications for patients and caregivers will enhance opportunities for truly connected care that result in better patient outcomes, improved workflow efficiencies and data-driven insights while lowering healthcare costs overall.

- A robust combined platform for shareholder value creation through meaningful anticipated synergies with a continued commitment to strong cash flow generation: The transaction provides a significant opportunity to build upon Baxter’s established global infrastructure to grow Hillrom’s international business, which currently represents approximately one-third of Hillrom’s total 2020 revenue. It should also meaningfully enhance Baxter’s earnings growth through the realization of substantial cost synergies and potential opportunities to accelerate revenue growth over the longer term.

- A shared culture that values inclusivity, innovation and corporate responsibility: The combination unites two organizations that have each been recognized for achievements in workplace diversity and corporate responsibility, and for fostering an environment that supports and encourages high performance, respect for individuals, and professional growth.

Transaction Highlights

Upon completion of the transaction, Baxter will pay

Baxter expects the combination to result in approximately

The transaction is expected to be low double-digit accretive to Baxter’s adjusted earnings per share (EPS) in the first full year post close, increasing to more than

Baxter will finance the transaction through a combination of cash and fully committed debt financing. At closing, Baxter estimates that it will have net leverage of approximately 4.2x net debt to pro forma1 adjusted EBITDA of the combined companies (as estimated by Baxter management). Baxter is committed to an investment grade credit rating and deleveraging to 2.75x net leverage within two years of closing.

Approvals and Timing

The Boards of Directors of both companies have unanimously approved the acquisition. The transaction is subject to the approval of Hillrom shareholders and the satisfaction of customary closing conditions, including regulatory approvals. The transaction is expected to close by early 2022.

As a result of the proposed acquisition, Baxter’s 2021 Investor Conference, originally scheduled for

In the interim, Baxter is issuing long-term financial guidance as a standalone entity. Baxter expects sales to grow 4

Advisors

Baxter Webcast

A special webcast for investors and media regarding the proposed acquisition can be accessed live from a link on Baxter’s website at www.baxter.com beginning at

About Baxter

Every day, millions of patients and caregivers rely on Baxter’s leading portfolio of critical care, nutrition, renal, hospital and surgical products. For 90 years, we’ve been operating at the critical intersection where innovations that save and sustain lives meet the healthcare providers that make it happen. With products, technologies and therapies available in more than 100 countries, Baxter’s employees worldwide are now building upon the company’s rich heritage of medical breakthroughs to advance the next generation of transformative healthcare innovations. To learn more, visit www.baxter.com and follow us on Twitter, LinkedIn and Facebook.

About Hillrom

Hillrom is a global medical technology leader whose 10,000 employees have a single purpose: enhancing outcomes for patients and their caregivers by Advancing Connected Care™. Around the world, our innovations touch over 7 million patients each day. They help enable earlier diagnosis and treatment, optimize surgical efficiency and accelerate patient recovery while simplifying clinical communication and shifting care closer to home. We make these outcomes possible through digital and connected care solutions and collaboration tools, including smart bed systems, patient monitoring and diagnostic technologies, respiratory health devices, advanced equipment for the surgical space and more, delivering actionable, real-time insights at the point of care. Learn more at hillrom.com.

Non-GAAP Financial Measures

This press release contains financial measures that are not calculated in accordance with

Special items include intangible asset amortization, business optimization charges, acquisition and integration expenses, expenses related to European Medical Devices Regulation, investigation and related costs and a tax matter. These items are excluded because they are highly variable or unusual and of a size that may substantially impact the company’s reported operations for a period. Additionally, intangible asset amortization is excluded as a special item to facilitate an evaluation of current and past operating performance and is consistent with how management and the company’s Board of Directors assess performance.

Non-GAAP financial measures may enhance an understanding of the company’s operations and may facilitate an analysis of those operations, particularly in evaluating performance from one period to another. Management believes that non-GAAP financial measures, when used in conjunction with the results presented in accordance with

The company is unable to present a quantitative reconciliation to the most directly comparable

Cautionary Language Regarding Forward-Looking Statements

Baxter Forward-Looking Statements

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995, each as amended, concerning Baxter’s financial results, business development activities, capital structure, cost savings initiatives, R&D pipeline, including results of clinical trials and planned product launches, and financial outlook for 2021 – 2024 for standalone Baxter and the combined companies.

Forward-looking statements provide current expectations of future events and include any statements that do not directly relate to any historical or current fact.

Actual results could differ materially from those discussed in the forward-looking statements, as a result of factors, risks and uncertainties, not under the company’s control, including, but not limited to: (i) conditions to the consummation of the Hillrom acquisition, including Hillrom’s shareholder approval of the proposed acquisition, may not be satisfied or the regulatory approvals required for the proposed acquisition may not be obtained on the terms expected or on the anticipated schedule; (ii) successful integration of Hillrom with the company and the realization of anticipated benefits of the acquisition (including anticipated synergies and net leverage targets) within the expected timeframes or at all; (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement between the parties to the Hillrom acquisition; (iv) potential adverse reactions to the Hillrom acquisition by the company or Hillrom’s strategic partners; (v) the impact of global economic conditions (including potential trade wars) and public health crises and epidemics, such as the ongoing coronavirus (COVID-19) pandemic, on the company and its customers and suppliers, including foreign governments in countries in which the company operates; (vi) the demand for and market acceptance of risks for new and existing products (including the impact of reduced hospital admission rates and elective surgery volumes); (vii) product development risks (including any delays in required regulatory approvals); (viii) product quality or patient safety concerns; (ix) the impact of competitive products and pricing, including generic competition, drug reimportation and disruptive technologies; (x) accurate identification of and execution on business development and R&D opportunities and realization of anticipated benefits (including the acquisitions of Cheetah Medical, Seprafilm Adhesion Barrier and PerClot Polysaccharide Hemostatic System and specified rights to Caelyx/Doxil in territories outside the

No Solicitation

Baxter, its directors and executive officers are not soliciting proxies from the shareholders of Hillrom in connection with the proposed acquisition and are not participants in the solicitation of proxies by Hillrom. Baxter is making this communication for informational purposes only and does not intend to file any communication relating to the proposed acquisition on a proxy statement on Schedule 14A with the

Hillrom Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements concerning general economic conditions, our financial condition, results of operations, cash flows and business and our expectations or beliefs concerning future events, including the demand for our products, the ability to operate our manufacturing sites at full capacity, future supplies of raw materials for our operations, product launches, share repurchases, international market conditions, expectations regarding our liquidity, our capital spending, plans for future acquisitions and divestitures, and our operating plans; and any statements using phases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “intends,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases are forward-looking statements that involve certain factors, risks and uncertainties that could cause Hillrom’s actual results to differ materially from those anticipated. Such factors, risks and uncertainties include: (1) the future impact of the COVID-19 pandemic on Hillrom’s business, including but not limited to, the impact on its workforce, operations, supply chain, demand for products and services, and Hillrom’s financial results and condition; (2) Hillrom’s ability to successfully manage the challenges associated with the COVID-19 pandemic; (3) increasing regulatory focus on privacy and data security issues; (4) breaches or failures of Hillrom’s information technology systems or products, including by cyberattack, unauthorized access or theft; (5) failures with respect to compliance programs; (6) Hillrom’s ability to achieve expected synergies from acquisitions; (7) risks associated with integrating recent acquisitions; (8) global economic conditions; (9) demand for and delays in delivery of Hillrom’s products; (10) Hillrom’s ability to develop, commercialize and deploy new products; (11) changes in regulatory environments; (12) the effect of adverse publicity; (13) the impact of competitive products and pricing; (14) Hillrom’s ability to maintain or increase margins; (15) the potential loss of key distributors or key personnel; (16) the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any applicable healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; (17) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement between the parties to the proposed transaction; (18) the failure to obtain the approval of Hillrom’s shareholders, (19) the failure to obtain certain required regulatory approvals or the failure to satisfy any of the other closing conditions to the completion of the proposed transaction within the expected timeframes or at all; (20) risks related to disruption of management’s attention from Hillrom’s ongoing business operations due to the transaction; (21) the effect of the announcement of the transaction on the ability of Hillrom to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results and business generally; (22) the ability to meet expectations regarding the timing and completion of the transaction; (23) uncertainty regarding actual or potential legal proceedings; and (24) the other risks listed from time to time in Hillrom’s filings with the

Additional Information About the Merger and Where to Find It

This release relates to the proposed transaction involving Hillrom. This release is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In connection with the proposed transaction, Hillrom will file relevant materials with the

Participants in the Solicitation

Hillrom and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Hillrom’s common stock in respect of the proposed transaction. Information about the directors and executive officers of Hillrom and their ownership of Hillrom’s common stock is set forth in the definitive proxy statement for Hillrom’s 2021 Annual Meeting of Stockholders, which was filed with the

Baxter is a registered trademark of

1Pro forma amounts as presented in this press release represent the combined results of Baxter and Hillrom and are not intended to represent pro forma financial information under Article 11 of Securities and Exchange Commission Regulation S-X.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210902005394/en/

Media Contacts

Baxter:

media@baxter.com

Hillrom:

howard.karesh@hillrom.com

Investor Contacts

Baxter:

clare_trachtman@baxter.com

Hillrom:

marykay.ladone@hillrom.com

Source: