BofA Private Bank Study of Wealthy Americans Finds Generational Divide in Investing, Giving and Preserving Wealth

Rhea-AI Summary

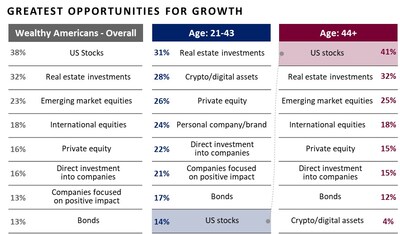

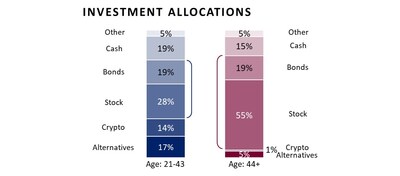

The 2024 Bank of America Private Bank Study reveals significant generational differences in investment strategies among high-net-worth individuals. Millennials and Gen Z allocate three times more of their portfolios to alternative investments compared to older generations.

While 72% of younger investors (ages 21-43) believe traditional stocks and bonds can't yield above-average returns, only 28% of older investors share this view. Younger investors hold 47% of their portfolios in stocks and bonds, compared to 74% for older investors, and allocate 17% to alternatives versus 5% for older generations.

Cryptocurrencies and gold are highly favored by younger investors, with 49% owning cryptocurrencies and 45% owning physical gold. Millennials and Gen Z show keen interest in supporting causes like homelessness and social justice. However, gaps in generational wealth planning persist, with 52% lacking basic estate planning elements.

In the next decade, women are expected to control $30 trillion in U.S. wealth, significantly influencing financial decision-making.

Positive

- Younger investors allocate 17% of their portfolios to alternatives, compared to 5% for older generations.

- 49% of younger investors own cryptocurrencies, indicating strong interest in digital assets.

- Interest in social justice, homelessness, and environmental causes is nearly twice as high among younger donors.

- Over the next decade, $30 trillion in U.S. wealth is expected to be transferred to women, increasing their control over financial decision-making.

Negative

- 52% of wealthy individuals lack the basic elements of an estate plan, including a will and healthcare directive.

- 48% of respondents have not considered hard assets like real estate and collectibles in their estate plans.

- One in five wealthier individuals report strain over inheritance, with 54% of younger respondents experiencing this issue.

- Only 27% of respondents say they understand trusts and their benefits very well.

News Market Reaction

On the day this news was published, BAC gained 1.21%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Millennials and Gen Z Allocate Three Times More of Their Investment Portfolios to Alternative Investments than Older Generations

"We're living through a period of great social, economic and technological change alongside the greatest generational transfer of wealth in history," said Katy Knox, president of Bank of America Private Bank. "Our study shows that wealthy Americans are focused on diversification, long-term goals and making a lasting impact with their wealth."

Younger Investors Driving Demand for Alternative Strategies

Seventy-two percent of younger investors (ages 21-43) believe it is no longer possible to achieve above average investment returns by investing solely in traditional stocks and bonds, compared to only

The study found that among younger high-net-worth investors:

47% of their portfolios are in stocks and bonds, far lower than investors over the age of 44 (74% ).17% of their investment portfolios are allocated to alternatives, compared to5% allocated by older investors. Most (93% ) say they plan to allocate more to alternatives in the next few years.- Nearly half (

49% ) own cryptocurrencies and another38% are interested in owning it. They rank cryptocurrency among the top opportunity areas for growth, second only to real estate investments. 45% own physical gold as an asset and another45% are interested in owning it. Overall,41% of the wealthy own (18% ) or are interested in buying (23% ) physical gold.

Passing on Wealth: Gaps in planning for generational transfer of wealth

Despite the importance placed on sharing and sustaining family money, gaps in planning, communication and guidance could derail these well-intended goals.

- One in five respondents report having experienced strain over an inheritance, including

54% of younger respondents. - Half (

52% ) of wealthy Americans do not have the three basic elements of an estate plan, consisting of a will, advanced healthcare directive and durable power of attorney. - Nearly half (

48% ) of respondents have not considered hard assets, including real estate, art and collectibles and other tangible assets, in their estate plans. 56% of respondents have established a trust; however, only27% say they understand trusts and their benefits very well.69% of parents of adult children have talked with their children about family wealth plans. They start those conversations only after their children have reached the age of 31, on average.

Giving with Purpose, Collecting with Passion

Giving back is a near-universal trait among the wealthy, inspired mostly by a sense of responsibility (

91% of the wealthy are ardent supporters of philanthropy. Younger donors are nearly two times more likely to support homelessness (41% ), social justice (33% ) and the environment/climate change (32% ) compared to older donors (21% ,18% and17% , respectively).40% of the wealthy overall either own or are interested in an art collection, including83% of millennials and Gen Z.65% of study respondents, including94% of those under the age of 44, are interested in collectibles. Millennials and Gen Z are at least two times more likely than older generations to be collectors of watches (46% ), wine or spirits (36% ), rare or classic cars (32% ), sneakers (30% ) and antiques (30% ).

In addition to influencing the next generation, the "Great Wealth Transfer" will also contribute to women controlling more wealth than ever before, according to Bank of America Institute. Over the next decade,

For an in-depth look at insights visit 2024 Bank of America Private Bank Study of Wealthy Americans.

2024 Bank of America Private Bank Study of Wealthy Americans Methodology

Escalent, an independent market research company, conducted an online survey on behalf of Bank of America Private Bank. The survey consisted of 1,007 high-net-worth (HNW) respondents throughout the

About Bank of America Institute

Bank of America Institute is dedicated to uncovering powerful insights that move business and society forward. Established in 2022, the Institute is a think tank that draws on data and analyses from across the bank and the world to provide timely and original perspectives on the economy, sustainability, and global transformation. The Institute leverages the depth and breadth of the bank's proprietary data, from 69 million consumer and small business clients, 57 million verified digital users,

Bank of America

Bank of America is one of the world's leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom. Click here to register for news email alerts.

Reporters may contact:

Julia Ehrenfeld, Bank of America

Phone: 1.646.855.3267

Julia.Ehrenfeld@bofa.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-private-bank-study-of-wealthy-americans-finds-generational-divide-in-investing-giving-and-preserving-wealth-302175516.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bofa-private-bank-study-of-wealthy-americans-finds-generational-divide-in-investing-giving-and-preserving-wealth-302175516.html

SOURCE Bank of America Corporation