Exxe Group Announces Record Revenue and Net Income for September 30th, 2022 Quarter

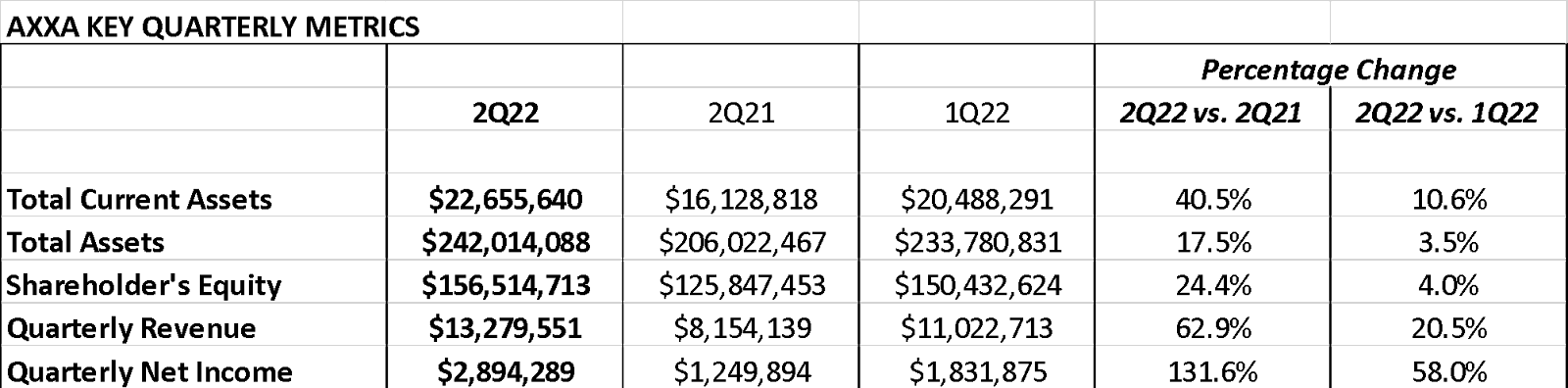

Exxe Group reported record growth in its financial performance for the second quarter of 2022, with a 62.9% revenue increase to $13.28M compared to the same quarter in 2021. Net income surged by 131.6% to $2.9M. Over six months, revenue reached $24.3M, an increase of 68%, while net income rose 83% to $4.73M. The company also saw significant increases in gross profit and margin. Exxe plans to release a corporate roadmap on Nov. 29.

- Record revenue growth of 62.9% year-over-year to $13.28M.

- Net income increased by 131.6% to $2.9M.

- Six-month revenue grew by 68% to $24.3M.

- Gross profit surged by 146% to $5.9M, achieving a gross profit margin of 45.1%.

- Current assets rose by 40.5% to $22.66M.

- None.

Insights

Analyzing...

-Exxe generates major growth year-over-year, and sequentially

-2Q22 revenue jumped by

-Net income soared to a record

-Exxe to provide financial forecasts, milestones, in new PowerPoint on Nov. 29nd

NEW YORK, NY / ACCESSWIRE / November 16, 2021 / Exxe Group, Inc. (OTC PINK:AXXA), ("Exxe" or the "Company") a diversified fintech company, is pleased to announce that the Company has published its three-month and six-month results for the period ended September 30, 2021.

Financial Highlights

Exxe Group generated record quarterly results for both revenue and net income for the period. Revenue for 1Q22 was

For the six month period, revenue grew by

The Company enjoyed a big rise in gross profit and gross profit margin. Gross profit grew by over

Exxe also enjoyed large increases in assets and shareholder's equity for the fiscal September 2022 quarter. Current assets of

Business Highlights

For the period ended September 2021, medical company Mmeditec recorded approximately

Interestingly, the current supply chain challenges have been a boon to key Exxe businesses, such as medical and agribusiness, which is a trend we believe will continue into the current quarter and beyond. In the medical segment, the combination of supply shortages and increased consumption and demand have ensured that existing customers, especially hospitals, nursing services, outpatient care, etc. are expanding their stockpiles. Mmeditech management was ahead of this situation and secured additional inventory of products. As a result, the September quarter was the strongest quarter in company history and the current quarter should see further increases in sales and profit.

Daskonzept Group's growth can be attributed to the confluence of several market trends favorably impacting the company's business today and setting the stage for major growth going forward. These include new design and product markets for home office solutions as well as with "multiple kitchen solutions". Plus, new, digital utilization concepts such as co-working, joint venture agreements, and profit-sharing models with real estate companies, have driven scalable, profitable, high-growth verticals. In fact,

We continue to provide significant resources to 1Myle, our UK-based cryptocurrency exchange, which began to contribute to revenue at the end of the September quarter. We remain very excited regarding the prospects for this segment and envision substantial financial performance ahead. To ensure scalability, security, and functionality, three issues that have recently plagued some of the larger exchanges, we are taking a staged approach to risk, business execution, and growth. As a result, our customer portal will offer enviable customer security and our model will reduce company risk while entering its first major growth phase, beginning in the current quarter. Sign-up and revenue growth should be aided in part by our third-party, six million strong, marketplace relationships. In addition, it is our objective to make 1Myle's services available to US investors as early as next year. We are evaluating all of the compliance requirements. In addition, It is our intention to ensure any/all bugs or issues are resolved prior to the introduction of the platform in the US, given the current and expected pent-up demand.

Separately, our Agribusiness, Exxe Group's largest revenue-generating category, is performing well despite global inflation. Much like Mmeditech, the Company's Agribusiness groups have benefitted from customers stockpiling products, a situation we foresee will continue. Moreover, this segment does not appear to be affected by these supply chain constraints in part due to internal policies and procedures in place at the respective businesses.

In recent months, we have made reference to the "New Deal" which is a large, complex transaction that is in the process of being closed in phases. We anticipate that it will fully close in the coming weeks and will provide greater detail at that time.

Given the two straight quarters of record revenue and net income performance, management plans to publish the Company's updated corporate roadmap, including spin-offs, management vision, overall and business category milestones, and projections via a Powerpoint presentation and press release on November 29, 2021. These documents will be available on our website (www.ExxegGroup.com) and through Accesswire's downstream newswire partners.

Dr. Eduard Nazmiev, Exxe Group CEO, commented on the strong financial performance and upcoming publications. "We are very pleased to have back-to-back record quarterly financial results. It is especially impressive as we generated year-over-year and sequential outperformance. These results exceeded our internal expectations and they affirm our business model and approach. The Exxe vision is largely centered on migrating and evolving our businesses, including bricks and mortar, to online and digital infrastructures. This approach can lead us toward potential pubco spin-offs or private sales, as we strive for substantial gains in market value for our shareholders. These objectives are achievable if we continue to execute our model and reach specific milestones along this path. We look forward to sharing details regarding these topics with our loyal investors next week."

About Exxe Group

Exxe Group is a diversified fintech corporation focusing on acquisitions in the following sectors: real estate, financing, agribusiness, sustainability, digital media, and software-related technology platforms. Exxe Group is an acquisition-driven company. The Company strategy is to acquire a controlling equity interest in undervalued companies and undertake an active role in improving their performance - accelerating their growth by providing both access to capital and management expertise.

For additional information please visit the Company's

Website: http://www.exxegroup.com/

Twitter: https://twitter.com/exxegroup

Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by the following words: "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "ongoing," "plan," "potential," "predict," "project," "should," "will," "would," or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are not a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time the statements are made and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this press release.

CONTACT: Exxe Group IR: info@exxegroup.com

SOURCE: Exxe Group, Inc.

View source version on accesswire.com:

https://www.accesswire.com/673067/Exxe-Group-Announces-Record-Revenue-and-Net-Income-for-September-30th-2022-Quarter