Golden Minerals Announces Return of El Quevar Silver Project

- None.

- None.

Insights

The withdrawal of Barrick Gold Corporation from the Earn-In Agreement with Golden Minerals on the El Quevar silver project could signal strategic shifts within Barrick's portfolio or a reevaluation of the project's potential. The termination, effective in 2024, means that Golden Minerals will retain full ownership of the project, which could be both an opportunity and a challenge for the company. The El Quevar property's high sulfidation alteration system is notable within the region, suggesting a significant exploration upside. However, Golden Minerals must now shoulder the financial and operational burden of advancing the project without the capital and expertise contribution from Barrick.

Golden Minerals' pivot from production to exploration and development is a critical strategic move. The potential of the high-grade Yaxtché silver deposit and the newly identified gold prospect could attract other investors or partners. However, this move also comes with increased risk, as exploration and development are capital-intensive and the company will need to manage these expenses while seeking to prove the economic viability of the deposits.

From a financial perspective, Barrick's decision to exit the agreement after investing $6.0 million without proceeding to the $10.0 million commitment may raise questions about the project's economic viability or fit within Barrick's broader strategy. Golden Minerals' stock price and investor sentiment could be affected by this news, as the market absorbs the implications of the changed partnership dynamics. The company's ability to finance continued exploration and development on its own will be closely watched by investors.

Furthermore, the requirement for an NI 43-101-compliant Pre-Feasibility Study to describe a potentially profitable operation with not less than 2 million gold equivalent ounces was a significant milestone that will no longer be pursued with Barrick's backing. This could impact Golden Minerals' ability to attract new partners or financing, as such studies provide a level of credibility and assurance about a project's prospects.

The presence of vuggy silica alteration in drill samples is a positive indicator for the potential of high sulfidation epithermal gold-silver deposits at El Quevar. This geological feature, along with the identification of potentially economic gold values in one of the drill holes, underscores the prospectivity of the land package. However, the challenge for Golden Minerals will be to continue exploration efforts to delineate the resource and prove its economic feasibility.

The geological complexities of high sulfidation systems require careful analysis and a detailed understanding of the mineralization processes. The company will need to invest in further drilling and geological studies to advance the Yaxtché silver deposit and the newly identified gold prospect. The expertise of a seasoned geologist will be important for Golden Minerals to navigate the technical challenges and to maximize the value of their assets.

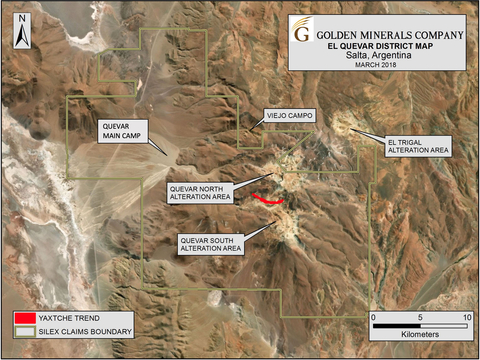

El Quevar District Map (Graphic: Business Wire)

Golden Minerals President and Chief Executive Officer, Warren Rehn, commented today, “The timing of the return of the El Quevar project is fortuitous and quite favorable to the Company as we pivot from production to exploration and development. The El Quevar property is one of the largest contiguous high sulfidation alteration systems in northern

To date, Barrick has spent more than

The Agreement offered Barrick the opportunity to earn an undivided

About El Quevar and Next Steps

Golden Minerals has previously defined a high-grade silver deposit at El Quevar’s Yaxtché deposit, totaling 2.9 million tonnes of Indicated material containing 45.3 million ounces (“oz”) of silver at an average grade of 482 grams per tonne (“gpt”), plus 0.3 million tonnes of Inferred material containing 4.1 million oz of silver at an average grade of 417 gpt1. The Yaxtché deposit encompasses less than one percent of Quevar’s vast 57,000-hectare land area. Most of the area outside the Yaxtché deposit has yet to be explored and the Yaxtché deposit itself is open to both the east and west.

The Company views the return of the El Quevar project very positively. Quevar’s land package now holds a potential gold prospect whose drilling was funded by Barrick. Meanwhile, most of Quevar’s holding costs have been funded by Barrick since April 2020 as well.

Golden Minerals intends to further advance the El Quevar project and update its resource, subject to the availability of capital. The Company’s focus will be on updating the Preliminary Economic Assessment for the Yaxtché silver deposit and in step-out drilling to follow up on the gold intercept drilled in 2022 by Barrick.

The attached district map shows the El Quevar project and the Yaxtché deposit within it.

Endnotes

1 February 2018. Resources prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure of Mineral Projects (“NI 43-101”). Amec Foster Wheeler E&C Services, Inc., a Wood Group PLC company. “NI 43-101 Technical Report on Updated Mineral Resource Estimate”, February 26, 2018. Cutoff grade 250 g/t Ag.

About Golden Minerals

Golden Minerals is a precious metals mining exploration company based in

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the Company’s views on the return of the El Quevar project; the potential gold prospect of the Quevar land package; the assumptions and estimates contained in the February 2018 NI 43-101 mineral resource estimate; and the Company’s intention to further advance the El Quevar project and update the Preliminary Economic Assessment for the Yaxtché silver deposit. These statements are subject to risks and uncertainties, including the potential future re-suspension of non-essential activities in

For additional information, please visit http://www.goldenminerals.com/.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240327707450/en/

Golden Minerals Company

Karen Winkler, Director of Investor Relations

(303) 839-5060

Source: Golden Minerals Company