AuMEGA Metals: Quarterly Activities Report for the 3 Months Ended 31 December 2024

AuMEGA Metals has announced its Q4 2024 activities report, highlighting significant exploration progress and a major C$16 million private placement. The company completed key exploration activities at its Bunker Hill project, including a high-resolution airborne magnetic survey covering 170 km² and a till program that revealed significant gold anomalies up to 148 ppb.

For 2025, AuMEGA plans approximately 20,000 metres of drilling, including a 10,000-metre program at Bunker Hill in Q1. The company's portfolio spans 110 kilometres along the Cape Ray Shear Zone in Newfoundland, hosting a gold Mineral Resource of 450,000 ounces Indicated (6.1Mt at 2.25 g/t) and 160,000 ounces Inferred (3.4Mt at 1.44 g/t).

The financing round was supported by existing shareholders and attracted new global resource funds. The company's exploration strategy focuses on systematic approaches in south-west Newfoundland's complex terrain.

AuMEGA Metals ha annunciato il suo rapporto sulle attività del quarto trimestre del 2024, evidenziando significativi progressi nell'esplorazione e un'importante collocazione privata di 16 milioni di dollari canadesi. L'azienda ha completato attività chiave di esplorazione nel suo progetto Bunker Hill, inclusa un'indagine magnetica aerea ad alta risoluzione che ha coperto 170 km² e un programma di raccolta che ha rivelato anomalie significative di oro fino a 148 ppb.

Per il 2025, AuMEGA prevede circa 20.000 metri di perforazione, incluso un programma di 10.000 metri a Bunker Hill nel primo trimestre. Il portafoglio dell'azienda si estende per 110 chilometri lungo la Cape Ray Shear Zone nel Newfoundland, ospitando una Riserva Minerale d'Oro di 450.000 once Indicate (6.1Mt a 2.25 g/t) e 160.000 once Inferite (3.4Mt a 1.44 g/t).

Il turno di finanziamento è stato supportato dagli azionisti esistenti e ha attratto nuovi fondi globali per le risorse. La strategia di esplorazione dell'azienda si concentra su approcci sistematici nel complesso terreno del sud-ovest del Newfoundland.

AuMEGA Metals ha anunciado su informe de actividades del cuarto trimestre de 2024, destacando un importante avance en la exploración y una colocación privada de 16 millones de dólares canadienses. La empresa completó actividades clave de exploración en su proyecto Bunker Hill, incluyendo un estudio magnético aéreo de alta resolución que cubrió 170 km² y un programa de muestras de sedimentos que reveló anomalías significativas de oro de hasta 148 ppb.

Para 2025, AuMEGA planea aproximadamente 20,000 metros de perforación, incluyendo un programa de 10,000 metros en Bunker Hill en el primer trimestre. El portafolio de la empresa se extiende a lo largo de 110 kilómetros en la Cape Ray Shear Zone en Newfoundland, que alberga un Recurso Mineral de Oro de 450,000 onzas Indicado (6.1Mt a 2.25 g/t) y 160,000 onzas Inferido (3.4Mt a 1.44 g/t).

La ronda de financiamiento fue respaldada por accionistas existentes y atrajo nuevos fondos de recursos globales. La estrategia de exploración de la empresa se centra en enfoques sistemáticos en el terreno complejo del suroeste de Newfoundland.

AuMEGA Metals는 2024년 4분기 활동 보고서를 발표하며, 중요한 탐사 진행 상황과 1,600만 캐나다 달러 규모의 사모에 대해 강조했습니다. 회사는 Bunker Hill 프로젝트에서 170 km²를 커버하는 고해상도 공중 자기 조사를 포함하여 중요한 탐사 활동을 완료했습니다. 이는 최대 148 ppb의 중요한 금 이상을 발견했습니다.

2025년을 위해 AuMEGA는 약 20,000 미터의 시추를 계획하고 있으며, 첫 분기에는 Bunker Hill에서 10,000 미터 프로그램을 포함하고 있습니다. 회사의 포트폴리오는 뉴펀들랜드의 케이프 레이 전단대(Cape Ray Shear Zone)를 따라 110킬로미터에 걸쳐 있으며, 450,000 온스의 금 광물 자원(표시된 자원: 6.1Mt에서 2.25 g/t)과 160,000 온스의 추정 자원(3.4Mt에서 1.44 g/t)을 보유하고 있습니다.

자금 조달 라운드는 기존 주주들의 지원을 받았고 새로운 글로벌 자원 기금을 유치했습니다. 회사의 탐사 전략은 뉴펀들랜드 남서부의 복잡한 지형에서 체계적인 접근 방식에 초점을 맞추고 있습니다.

AuMEGA Metals a annoncé son rapport d'activités pour le quatrième trimestre 2024, mettant en avant des progrès significatifs en matière d'exploration et un placement privé de 16 millions de dollars canadiens. L'entreprise a terminé des activités clés d'exploration sur son projet Bunker Hill, y compris une enquête magnétique aéroportée haute résolution couvrant 170 km² et un programme de prélèvement qui a révélé des anomalies significatives en or allant jusqu'à 148 ppb.

Pour 2025, AuMEGA prévoit environ 20 000 mètres de forage, incluant un programme de 10 000 mètres à Bunker Hill au premier trimestre. Le portefeuille de l'entreprise s'étend sur 110 kilomètres le long de la zone de cisaillement Cape Ray à Terre-Neuve, abritant une ressource minérale d'or de 450 000 onces indiquées (6,1 Mt à 2,25 g/t) et 160 000 onces inférées (3,4 Mt à 1,44 g/t).

Le tour de financement a été soutenu par des actionnaires existants et a attiré de nouveaux fonds mondiaux en ressources. La stratégie d'exploration de l'entreprise se concentre sur des approches systématiques dans le terrain complexe du sud-ouest de Terre-Neuve.

AuMEGA Metals hat seinen Bericht über die Aktivitäten im vierten Quartal 2024 veröffentlicht, der bedeutende Fortschritte bei der Erkundung und eine private Platzierung in Höhe von 16 Millionen kanadischen Dollar hervorhebt. Das Unternehmen hat wichtige Erkundungsarbeiten in seinem Projekt Bunker Hill abgeschlossen, darunter eine hochauflösende luftgestützte Magnetuntersuchung, die 170 km² umfasst, sowie ein Probenahmeprogramm, das signifikante Goldanomalien von bis zu 148 ppb aufdeckte.

Für 2025 plant AuMEGA etwa 20.000 Meter Bohrungen, darunter ein Programm von 10.000 Metern in Bunker Hill im ersten Quartal. Das Portfolio des Unternehmens erstreckt sich über 110 Kilometer entlang der Cape Ray Scherzone in Neufundland und beherbergt eine Goldmineralressource von 450.000 Unzen angezeigt (6,1 Mt bei 2,25 g/t) und 160.000 Unzen geschätzt (3,4 Mt bei 1,44 g/t).

Die Finanzierungsrunde wurde von bestehenden Aktionären unterstützt und zog neue globale Rohstofffonds an. Die Erkundungsstrategie des Unternehmens konzentriert sich auf systematische Ansätze im komplexen Gelände im Südwesten von Neufundland.

- Secured C$16 million through private placement with institutional and professional investors

- Holds significant gold resource: 450,000 oz Indicated and 160,000 oz Inferred

- Till program revealed high-grade gold anomalies up to 148 ppb at Bunker Hill

- Planned 20,000-metre drilling program for 2025

- Strong shareholder support including B2Gold Corp and global resource funds

- None.

Highlights

Exploration

- Subsequent to the year end, announced plans for a major exploration in 2025 that includes total drilling of approximately 20,000 metres including a 10,000 metre drill program at Bunker Hill in the first quarter and drill programs planned for Cape Ray and Hermitage.

- High-resolution airborne magnetic and Very Low Frequency ("VLF") Electromagnetic geophysical survey completed over Bunker Hill, covering an area of approximately 170 km2 consisting of 3,140 line-kilometres1. Preliminary magnetic data received with finalisation underway.

- Limited till program at Bunker Hill West delivered significant gold-in-till anomalies including 148 ppb and 94 ppb gold, nearly 40 times the crustal abundance level2.

- Results from limited reconnaissance diamond drilling at Malachite confirmed further gold and copper mineralisation in bedrock2.

- Inaugural reconnaissance till program over Intersection Project has yielded several priority follow-up targets. A total of 914 samples were collected over a survey area of 15 kilometres by 7 kilometres3.

- Till results have identified four large areas with significant gold anomalism for future targeting, including the largest area of anomalism within the Windsor Point Group Sediments, the host rocks of the Company's Central Zone deposits.

Corporate

- During the quarter, the Company completed a private placement of approximately C

$16 million (before costs)4,5,6 through an upsized financing to institutional, professional and accredited investors. - The financing was supported by existing shareholders and included several new investors including global resource funds.

Edmonton, Alberta--(Newsfile Corp. - January 31, 2025) - AuMEGA Metals Ltd (ASX: AAM) (TSXV: AUM) (OTCQB: AUMMF) ("AuMEGA" or the "Company") is pleased provide its Quarterly Activities Report for the quarter ended 31 December 2024. All dollar amounts are Canadian dollars unless stated otherwise.

AuMEGA is a mineral exploration company focused primarily on the discovery of precious and critical metals in Newfoundland and Labrador ("Newfoundland"), Canada. AuMEGA employs a world-class, systematic approach to exploration which is necessary for a terrain that has significant cover and a complex glacial history such as in south-west Newfoundland.

The Company holds a district scale land package that spans 110 kilometres along the Cape Ray Shear Zone ("CRSZ"), a significant under-explored geological feature recognised as Newfoundland's largest identified gold structure. This structure currently hosts Calibre Mining's (TSX: CXB) Valentine Gold Project, which is the region's largest gold deposit that is under construction and expected to produce in the middle of 2025, along with AuMEGA's Mineral Resource.

AuMEGA's portfolio over the CRSZ hosts a few dozen high potential targets and its existing gold Mineral Resource of 6.1 million tonnes of ore grading an average of 2.25 g/t, totalling 450,000 ounces of Indicated Resources, and 3.4 million tonnes of ore grading an average of 1.44 g/t, totalling 160,000 ounces in Inferred Resources.

The Company is supported by a diverse shareholder registry of prominent global institutional investors, and strategic investment from B2Gold Corp, a leading, multi-million-ounce a year gold producer.

Additionally, AuMEGA holds a 27-kilometre stretch of the highly prospective Hermitage Flexure and has also secured an Option Agreement for the Blue Cove Copper Project in southeastern Newfoundland, which exhibits strong potential for copper and other base metals.

Fourth Quarter 2024 Overview

During the December quarter, AuMEGA made significant steps in its exploration activities across its key projects, including Bunker Hill and Intersection.

At Bunker Hill, the Company completed a till survey and airborne magnetic survey, which identified multiple anomalies and highlighted the area's potential for future mineralisation. The till survey revealed peak gold values of 148 ppb and 94 ppb, and the airborne survey further confirmed the structural complexity of the region, making Bunker Hill a high-priority target for future drilling, set for 2025.

At the Intersection Project, a reconnaissance till survey highlighted the potential for a large, buried mineralised systems and revealed highly anomalous gold, silver, and copper values.

The Company is integrating these findings into its broader exploration strategy, focusing particularly on the Bunker Hill Project as a priority project for 2025.

FIGURE 1: AUMEGA PORTFOLIO OF PROJECTS

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_002full.jpg

Exploration Activities

Bunker Hill Project

The Bunker Hill West area is characterised by the east-west trending CRSZ, which displays significant structural complexity with several major second order splays.

During the Canadian fall of 2024, the Company completed a limited till program over the Bunker Hill West area2, located at the eastern edge of the Malachite Project and site of the Company's large 2021 geochemistry survey7. The Bunker Hill West till survey included grid lines 400 metres apart with stations spaced at 100 metres and centred over a cluster of historical high-grade outcropping samples8 that graded 18.67 g/t gold and 12.25 g/t gold.

Till survey results returned peak gold values of 148 ppb and 94 ppb. Importantly, the results revealed a large, multi-station anomaly located 270 metres from historic high-grade outcrop and float samples, proximal to a major fault cutting through the CRSZ and trending to the northeast.

Interpretation of the recent airborne magnetic survey announced in October9 revealed a dominant north-northwest striking structure, truncated by the CRSZ proximal to the intersection of the major second order fault and the historic gold showing. This structure is coincident with till results of 148 ppb and 35 ppb gold approximately 850 metres south of the CRSZ.

These tills samples are also anomalous in silver and lead, and are coincident with the high-grade gold in outcrop, with peak silver at 35.3 g/t and lead at

FIGURE 2: OVERVIEW OF BUNKER HILL WEST TARGET & RESULTS

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_003full.jpg

In 2021, the Company completed a high-resolution, airborne magnetic survey over a 44 kilometre stretch from the Cape Ray and Isle Aux Morts Projects to the boundary limit of the Malachite Project11. In 2024, the Company continued the high-resolution airborne geophysical survey from Malachite over the Bunker Hill area, collecting a dataset of magnetic, VLF-EM and radiometric data1.

The survey consisted of 3,142 line-kilometres over 25 kilometres of strike flown across Bunker Hill for a total of approximately 170 km2 of coverage. Data was acquired at 60-metre line spacing with a sensor height of 30 metres.

FIGURE 3: BUNKER HILL PRELIMINARY HIGH-RESOLUTION MAGNETIC SURVEY (TOTAL MAGNETIC INTENSITY (TMI)) WITH PROSPECTING RESULTS (PREVIOUSLY RELEASED)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_004full.jpg

FIGURE 4: BUNKER HILL PRELIMINARY B/W HIGH-RESOLUTION AIRBORNE MAGNETIC SURVEY (TOTAL MAGNETIC INTENSITY - FIRST VERTICAL DERIVATIVE)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_005full.jpg

The preliminary data from the airborne geophysical survey revealed significant structural complexity and further confirms Bunker Hill as a high-priority Greenfields target for the Company. The entire project area is structurally unique in the CRSZ corridor anomaly, given its east-west orientation and the geophysical data demonstrates that the Bunker Hill structural domain is favourable to host large dilation zones permissive for the ingress of mineralising fluids.

This is observed through the preservation of the thickened Billiards Brook Formation (type equivalent of the Windsor Point Group – host to Central Zone, Isle aux Morts and Big Pond Deposits12) and intrusive units such as the Nitty Gritty Granite that have intruded within the sedimentary package and become entrained within the CRSZ. Recent outcropping results grading up to

Large zones of a complex fault mosaic are also observed. These zones consist of major second and third order splays that are discordant to the regional geology and are observed cutting through historically mapped units favourable for gold mineralisation such as the iron-rich Cape Ray Fault Gabbro and the Nitty Gritty Granite. An example of this is the Bunker Hill West Target (see Figure 3) where previous prospecting and mapping results have identified the presence of a mafic unit that is cut by a major second order structure with the spatial correlation to gold mineralisation with samples upwards of 18.9 g/t gold13.

Furthermore, the Billiards Brook Formation, which appears similar to the Windsor Point Group (current host of the Company's gold mineral resource), is observed to be upwards of two kilometres thick, representing the thickest occurrence outside of the Company's Central Zone, nearly 50 kilometres away to the southwest.

Malachite Diamond Drill Program Results

During the 2024 summer field season, the Company completed a small, reconnaissance-style diamond drill program to test geochemical targets along three interpreted splays identified from the 2024 winter Reverse Circulation ("RC") bottom-of-hole ("BOH") survey14. The diamond drill program included five drillholes for approximately 1,100 metres combined2.

FIGURE 5: MALACHITE RECONNAISSANCE DRILL RESULTS

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_006full.jpg

CRD385 and CRD386 targeted the major east-west striking splay off the CRSZ, which was identified as potentially being fertile for gold during the winter RC-BOT program. These two scissored holes were designed to test for primary mineralisation below a BOH RC hole that returned values upwards of 0.63 g/t gold,

Diamond hole CRD385 returned peak values of 0.33 g/t gold, 3.93 g/t silver, 2,157 ppm lead and 873 ppm zinc over 0.91 metres. The mineralisation was associated with shearing near the contact of a granodiorite and mafic intrusive unit, with chlorite alteration observed along the structure.

All other drillholes intersected abundant brittle and ductile structural features throughout with hydrothermal alteration assemblages and discrete poly-metallic veining observed. No economic mineralisation was observed in these drillholes.

FIGURE 6: CROSS-SECTION OF CRD385 AND CRD386

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_007full.jpg

The Malachite area displays significant structural complexity and exploration work-to-date, including limited diamond drilling, has confirmed the presence of gold and copper associated with clear evidence of hydrothermal fluid activity and large geochemical signatures. While Malachite continues to demonstrate discovery potential, it will require a larger drill program to test the dozens of structures across the area. This advanced work will be deferred in favour of Bunker Hill that has returned significantly higher gold and copper values in outcrop with several discrete areas of high interest.

Intersection Project

During the Canadian summer of 2024, the Company completed a first coarse reconnaissance till survey over the Intersection Project, located in the far northeast corner of its CRSZ mineral licences, adjacent to Calibre Mining's recently staked ground on the CRSZ and Eldorado Gold's recently announced joint venture3.

The sampling of the glacial till is a proven technique used to make major mineral discoveries, particularly in areas covered by overburden. A recent example of its effectiveness is by Rupert Resources (TSX: RUP), where its coarse reconnaissance till surveys in Finland were followed up by RC bottom of hole drilling, which led them to the Ikkari discovery (4+ million ounce deposit)15.

The Company's till survey at Intersection consisted of grid lines spaced 800 metres apart with stations spaced at 100 metres. Results from the survey highlight the potential for large, buried mineralised systems and the Company's hypothesis is supported by the coarsely spaced sampling grid returning highly anomalous gold, silver, copper and other pathfinder elements across multiple stations and lines. These sample points also overlay prospective lithological domains or structural trends.

FIGURE 7: INTERSECTION RECONNAISSANCE TILL RESULTS WITH SOLID GEOLOGY

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_008full.jpg

The largest zone (Target Area 1) of elevated gold is situated adjacent to several major second and third order structures within the favorable Windsor Point Group, which is the host rock for the Company's high-grade Central Zone Mineral Resource16. This area of structural complexity is two kilometres in strike and one and a half kilometres wide and has the largest concentration of gold in till and elevated suite of pathfinders at Intersection. Till anomalism from this area ranges from 35 to 173 ppb gold across strike and includes a peak silver value of 5.82 g/t with coincident bismuth and copper anomalism in the 99th percentile of the survey. Given the highly encouraging results, the Company staked additional licences adjacent to the northern boundary of the property (Figure 7).

Target Area 2 is observed as having a similar structural position to Target Area 1. It contains a cluster of gold in-till anomalism with a peak gold value of 31 ppb. These anomalous tills occur over an area that appears to have several prospective splays off the CRSZ.

Propagating off the eastwards trending major fault named the Gunflap Hills Fault (Hermitage Flexure), is a series of northeast to (Target Area 3) east-northeast (Target Area 4) trending second and third order splays that have returned a coincident anomalous gold-in-till signature with values upwards of 49 ppb gold and continues for over seven kilometres and four kilometres along strike respectively. The Company is currently assessing the potential of this unit for gold mineralisation as all historic exploration was focused on base metals.

Overall, the Company is seeing a gold association with silver-bismuth-copper. This association was recognised from the previously released Bunker Hill prospecting program earlier this summer17. This geochemical association is further compounding Intersection's position as a critical piece in the Company's district-scale portfolio.

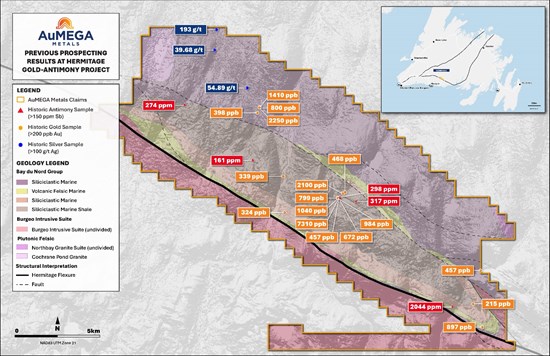

Hermitage Gold and Antimony Project

The Company's Hermitage property consists of 27 kilometres of continuous strike along the large crustal scale suture zone between the Dunnage and Gander zones, known as the Hermitage Flexure. Regionally, the Dunnage zone contains volcanic packages hosting turbidite sequences, which are considered regionally prospective for hosting gold deposits throughout Newfoundland, and globally in places such as the Bendigo Terrane in Victoria, Australia, including Agnico Eagle's prolific Fosterville gold mine, also in Victoria.

FIGURE 8: OVERVIEW OF THE HERMITAGE PROJECT DISPLAYING THE PROJECT'S TARGET BLOCKS AND KEY GOLD SHOWINGS

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_009full.jpg

2025 Exploration Program

Subsequent to the end of the quarter, the Company announced an expansive 2025 exploration, including major drill program on highly prospective projects, mainly Bunker Hill.

Bunker Hill Project

The Bunker Hill Project is the primary focus of the Company's 2025 exploration program and will receive the largest amount of this year's budget. The Company's exploration activities from the past two years along with historic results have highlighted Bunker Hill as a highly prospective opportunity and the top priority.

The historic and recent results from Bunker Hill have culminated in the identification of three large priority areas of interest that will be subject to inaugural drilling in the first quarter of 2025. The drill program will include a combination of diamond drilling and Reverse Circulation ("RC") bottom-of-hole ("BOH") drilling will be the basis for the largest winter drill program ever carried out by the Company. The Company plans to drill 10,000 metres in total including both diamond and RC drilling. The diamond drilling will be focused on areas of historic outcrops and follow-up deep drilling in areas identified through the RC drilling.

The Company has mobilising equipment along a 30 kilometre logging road and 15 kilometre winter access trail to a central fly camp location. Mobilisation of the RC drill rig is expected to be completed during the last week of January with drilling to commence shortly thereafter. Diamond drilling is expected to commence a week after the start of RC drilling. The timing of the program as well as progress will be dependent on weather conditions. All work will be completed with limited to no helicopter dependency which mitigates downtime related to inclement weather.

The results from the winter program will inform the Company on future exploration activities at Bunker Hill including additional diamond drilling in the second half of the year. The planned drill metres from other projects may be reallocated to Bunker Hill as necessary.

FIGURE 9: CAPE RAY PROJECT OVERVIEW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_010full.jpg

Cape Ray Project

The second major focus of the Company's 2025 exploration program is the advancement of several new targets identified within the Cape Ray Project in areas outside of the Company's mineral resources. These targets were identified through the Company's comprehensive data analysis and limited exploration work over the past two years.

For this year's exploration activities at Cape Ray, the Company will initially complete a VTEM airborne geophysical survey in the first quarter. The objective of this survey is to identify graphitic schists within the resource corridor as previous Company analysis indicates gold being associated with graphitic sedimentary sequences within the corridor. Additionally, the Company will prospect, and sample areas never explored previously to the west of Big Pond called Huebner target.

FIGURE 10: CAPE RAY PROJECT OVERVIEW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_011full.jpg

Hermitage Gold-Antimony Project

For 2025, the Company plans for geological mapping and prospecting activities that will be based on the results of the geophysics. The Company is also expecting to deploy an inaugural diamond drill program at Hermitage with between 3,000 to 4,000 metres of drilling in the second half of 2025. The amount of drilling will be based on results and can be scaled up or down and will also be weather dependent given additional logistical support is required for such activities here.

FIGURE 11: HERMITAGE GOLD-ANTIMONY PROJECT OVERVIEW

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/239220_188a8a7d84dcaa0b_012full.jpg

Corporate

Private Placement

During the quarter, the Company completed a private placement of approximately C

The Financing was well supported by the Company's existing shareholders including B2Gold Corp who increased their overall ownership to

The New Share issuance utilised the Company's placement capacity under ASX Listing Rules 7.1 and 7.1A. With the increased demand, the Company structured the Financing in two tranches.

Under the Tranche One Placement5, the Company issued an aggregate of 131,152,889 ordinary shares ("New Shares") to institutional, professional and accredited investors consisting of : (i) 9,259,259 New Shares at a price of C

Under the Tranche Two Placement6, the Company issued an aggregate of 128,035,776 ordinary shares ("New Shares") to institutional, professional and accredited investors for aggregate gross proceeds of C

- Hard Dollars: 65,236,111 New Shares at a price of C

$0.05 0/A$0.05 4 per share; and - Flow Through: Constituting as "flow-through shares" as defined in subsection 66(15) of the Income Tax Act (Canada) as follows:

- Traditional Flow Through: 34,299,666 New Shares at a price of C

$0.06 /A$0.06 5 per share; - Premium Flow Through: 28,500,000 New Shares at a premium flow through price of at a price of C

$0.06 825/A$0.07 408 per share.

- Traditional Flow Through: 34,299,666 New Shares at a price of C

The proceeds from the Financing will be used primarily to advance the Company's exploration program in Newfoundland and Labrador, which is expected to include the Company's largest drill program in the last three years of up to 20,000 metres with an aim to grow the existing Mineral Resource and discovery at the highly prospective Bunker Hill Project. Additionally, the Company will continue to invest in early stage exploration activities to further define and advance new and existing targets at Hermitage and Malachite. Finally, proceeds from the Financing will also be used for working capital and general corporate purposes.

Cash

As at 31 December 2024, the Company had a cash balance of approximately

Cashflow Discussion

Operating cash outflow for the quarter was

Exploration expenditure for the December quarter was

Share Capital

As at 31 December 2024, the Company had 787,012,708 fully paid Ordinary shares on issue. As at 31 December 2024, there were there were 33,446,305 stock options, 14,252,879 zero-priced options and 8,530,499 performance rights outstanding.

Payments to Related Parties

During the quarter, the Company made payments to related parties of

Tenement Interests

TABLE 1: TENEMENT INTERESTS AS AT 31 DECEMBER 2024

| Holder | Licence No. | Project Name | No. of Claims | Area (km2) | Comments |

| Cape Ray Mining Limited | 025560M | Cape Ray | 20 | 5.00 | |

| Cape Ray Mining Limited | 025855M | Long Range | 32 | 8.00 | Royalty (d) |

| Cape Ray Mining Limited | 025856M | Long Range | 11 | 2.75 | Royalty (d) |

| Cape Ray Mining Limited | 025857M | Long Range | 5 | 1.25 | Royalty (d) |

| Cape Ray Mining Limited | 025858M | Long Range | 30 | 7.50 | Royalty (d) |

| Cape Ray Mining Limited | 026125M | Bunker Hill | 190 | 47.50 | |

| Cape Ray Mining Limited | 030881M | Intersection | 255 | 63.75 | |

| Cape Ray Mining Limited | 030884M | Intersection | 255 | 63.75 | |

| Cape Ray Mining Limited | 030996M | Malachite | 205 | 51.25 | |

| Cape Ray Mining Limited | 030997M | Long Range | 60 | 15.00 | Royalty (d) |

| Cape Ray Mining Limited | 031557M | Long Range | 154 | 38.5 | |

| Cape Ray Mining Limited | 031558M | Cape Ray | 96 | 24 | |

| Cape Ray Mining Limited | 031559M | Grandy's | 32 | 8 | |

| Cape Ray Mining Limited | 031562M | Grandy's | 37 | 9.25 | |

| Cape Ray Mining Limited | 032060M | Cape Ray | 81 | 20.25 | Royalties (a) (b) (c) |

| Cape Ray Mining Limited | 032061M | Cape Ray | 76 | 19 | Royalties (a) (b) (c) |

| Cape Ray Mining Limited | 032062M | Isle aux Morts | 72 | 18 | Royalties (a) (b) (c) |

| Cape Ray Mining Limited | 032764M | Hermitage | 256 | 64 | |

| Cape Ray Mining Limited | 032770M | Hermitage | 252 | 63 | |

| Cape Ray Mining Limited | 032818M | Hermitage | 95 | 23.75 | |

| Cape Ray Mining Limited | 032941M | Malachite | 256 | 64 | |

| Cape Ray Mining Limited | 033080M | Bunker Hill | 190 | 47.5 | |

| Cape Ray Mining Limited | 033110M | Hermitage | 183 | 45.75 | |

| Cape Ray Mining Limited | 035822M | Bunker Hill | 38 | 9.5 | |

| Cape Ray Mining Limited | 032256M | Hermitage | 12 | 3 | Royalty (e) |

| Cape Ray Mining Limited | 036567M | Hermitage | 44 | 11 | |

| Cape Ray Mining Limited | 036749M | Hermitage | 10 | 2.5 | |

| Cape Ray Mining Limited | 032774M | Hermitage | 8 | 2 | Royalty (e) |

| Cape Ray Mining Limited | 036866M | Blue Cove | 20 | 5 | Royalty (f) |

| Cape Ray Mining Limited | 036879M | Blue Cove | 10 | 2.5 | Royalty (f) |

| Cape Ray Mining Limited | 037158M | Blue Cove | 22 | 5.5 | Royalty (f) |

| Cape Ray Mining Limited | 037159M | Blue Cove | 8 | 2 | Royalty (f) |

| Cape Ray Mining Limited | 037160M | Blue Cove | 18 | 4.5 | Royalty (f) |

| Cape Ray Mining Limited | 037478M | Intersection | 104 | 26 | |

| Cape Ray Mining Limited | 037525M | Hermitage | 10 | 2.5 | |

| Spencer Vatcher | 037526M | Hermitage | 4 | 1 | |

| Cape Ray Mining Limited | 037529M | Hermitage | 4 | 1 | |

| Spencer Vatcher | 037774M | Blue cove | 30 | 7.5 | |

| Spencer Vatcher | 037775M | Blue cove | 13 | 3.25 | |

| Spencer Vatcher | 037776M | Blue Cove | 11 | 2.75 | |

| Spencer Vatcher | 037777M | Blue Cove | 7 | 1.75 | |

| Spencer Vatcher | 037778M | Blue Cove | 13 | 3.25 | |

| Spencer Vatcher | 037790M | Blue Cove | 39 | 9.75 | |

| Cape Ray Mining Limited | 038327M | Hermitage | 56 | 14 | |

| Cape Ray Mining Limited | 038337M | Isle aux Morts | 49 | 12.25 | |

| Cape Ray Mining Limited | 038374M | Intersection | 62 | 15.5 | |

| Cape Ray Mining Limited | 037301M | Koorae | 12 | 3 | Royalty (g) |

| Total | 47 | 3447 | 861.75 |

The Crown holds all surface rights in the Project area. None of the property or adjacent areas are encumbered in any way. The area is not in an environmentally or archeologically sensitive zone and there are no Aboriginal land claims or entitlements in this region of the province.

There has been no commercial production at the property as of the time of this report.

Royalty Schedule legend:

1.75% Net Smelter Return ("NSR") royalty held by Alexander J. Turpin pursuant to the terms of an agreement dated 25 June 2002, as amended 27 February 2003 and 11 April 2008. The agreement between Alexander J. Turpin, Cornerstone Resources Inc., and Cornerstone Capital Resources Inc., of which1.0% NSR can be repurchased or$1,000,000 reducing such royalty to a0.75% NSR. The agreement which royalty applies to Licences 14479M, 17072M, 9338M, 9339M and 9340M covering 229 claims, all as described in the foregoing agreements.0.25% NSR royalty held by Cornerstone Capital Resources Inc. and Cornerstone Resources Inc. (collectively the "Royalty Holder") pursuant to the terms of an agreement dated 19 December 2012, as amended 26 June 2013, between the Royalty Holders and Benton, which royalty applies to Licence 017072M, as described in the foregoing agreement.- Sliding scale NSR royalty held by Tenacity Gold Mining Company Ltd. pursuant to the terms of an agreement dated 7 October 2013 with Benton Resources Inc.:

3% NSR when the quarterly average gold price is less than US$2,000 per once (no buy-down right).4% NSR when the quarterly average gold price is equal to or greater than US$3,000 per ounce with the right to buy-down the royalty from5% to4% for CAD$500,000 ; On Licences 7833M, 8273M, 9839M and 9939M as described in Schedule C of the foregoing agreement.

1.0% NSR royalty held by Benton Resources Inc pursuant to the terms of the sale agreement between Benton and AuMEGA of which0.5% NSR can be repurchased for$1,000,000 reducing such royalty to a0.5% NSR. The agreement which the royalty applies to covers licences 025854M, 025855M, 025858M, 025856M and 025857M covering 131 claims.1.0% NSR royalty pursuant to an option agreement with Roland and Eddie Quinlan (50% each) with an option to repurchase0.5% of the royalty at a later date for a sum of C$500,000. T he Company retained a First Right of Refusal on the sale of the royalty1.0% NSR royalty pursuant to an option agreement with Wayde and Myrtle Guinchard with an option to repurchase0.5% of the royalty at a later date for a sum of C$500,000. T he Company retained a First Right of Refusal on the sale of the royalty.1.0% NSR royalty pursuant to an option agreement with Wayde Guinchard with an option to repurchase0.5% of the royalty at a later date for a sum of C$500,000. T he Company retained a First Right of Refusal on the sale of the royalty.

- ENDS -

This announcement has been authorised for release by the Company's Board of Directors.

To learn more about the Company, please visit www.aumegametals.com, or contact:

Sam Pazuki, Managing Director & CEO

Canada Phone: +1 416 915 3178

Australia Phone: +61 8 6117 0478

Email: info@aumegametals.com

About the Company

AuMEGA Metals Ltd (ASX: AAM) (TSXV: AUM) (OTCQB: AUMMF) is utilising best-in-class exploration to explore on its district scale land package that spans 110 kilometers along the Cape Ray Shear Zone, a significant under-explored geological feature recognised as Newfoundland, Canada's largest identified gold structure. This zone currently hosts Calibre Mining's Valentine Gold Project, which is the region's largest gold deposit (+5 million ounces), along with AuMEGA's expanding Mineral Resource.

The Company is supported by a diverse shareholder registry of prominent global institutional investors, and strategic investment from B2Gold Corp, a leading, multi-million-ounce a year gold producer.

Additionally, AuMEGA holds a 27-kilometer stretch of the highly prospective Hermitage Flexure and has also secured an Option Agreement for the Blue Cove Copper Project in southeastern Newfoundland, which exhibits strong potential for copper and other base metals.

AuMEGA's Cape Ray Shear Zone hosts several dozen high potential targets along with its existing defined gold Mineral Resource of 6.1 million tonnes of ore grading an average of 2.25 g/t, totaling 450,000 ounces of Indicated Resources, and 3.4 million tonnes of ore grading an average of 1.44 g/t, totaling 160,000 ounces in Inferred Resources18.

AuMEGA acknowledges the financial support of the Junior Exploration Assistance Program, Department of Industry, Energy and Technology, Provincial Government of Newfoundland and Labrador, Canada.

Reference to Previous ASX Announcements

In relation to this news release, all data used to assess targets have been previously disclosed by the Company and referenced in previous JORC Table 1 releases. Please see announcements dated: Mineral Resource estimate announced on 30 May 2023, Company 2024 exploration announcements on 28 August 2019, 31 October 2019, 29 October 2020, 16 January 2024, 23 May 2024 and 22 January 2025, Malachite announcements dated 20 April 2022, 8 June 2022, 12 September 2022, 14 September 2022, 6 October 2022, 12 December 2022, 25 January 2023, 11 October 2023 and 22 November 2024, Long Range announcements on 14 April 2021, 31 October 2019, 23 February 2023 and 24 August 2023, Bunker Hill announcements on 14 April 2021, 22 March 2023, 6 April 2023, 24 September 2024 and 22 November 2024, Hermitage prospecting results announced on 18 May 2023, 13 November 2023, and 5 September 2024, Grandy's announcements on 29 October 2020, 17 February 2021, 18 November 2021, 11 October 2023, Intersection related announcements 29 October 2020, 16 January 2024 and 30 October 2024, Hermitage announcement on 18 March 2024, Winter RC drill results reported on 23 April 2024 and 28 May 2024 and the Resource Corridor announcement on 5 June 2024.

In relation to the Mineral Resource estimate announced on 30 May 2023, the Company confirms that all material assumptions and technical parameters underpinning the estimates in that announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person's findings are presented have not been materially modified from the original market announcement.

Competent Person's Statements

The information contained in this announcement that relates to exploration results is based upon information reviewed by Mr. Rick Greenwood, P. Geo., Vice President of Exploration for AuMEGA Metals. Mr. Greenwood is a Member of the Professional Geoscientists of Ontario (PGO) and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code 2012. Mr. Greenwood consents to the inclusion in the announcement of the matters based upon the information in the form and context in which it appears.

1 ASX Announcement 15 October 2024

2 ASX Announcement 22 November 2024

3 ASX Announcement 30 October 2024

4 ASX Announcement 22 October 2024

5 ASX Announcement 4 November 2024

6 ASX Announcement 10 December 2024

7 ASX Announcement 20 April 2022 & 8 June 2022

8 ASX Announcement 24 September 2024 & 22 March 2023

9 ASX Announcement 15 October 2024

10 ASX Announcement 22 March 2023

11 ASX Announcement 17 June 2021

12 ASX Announcement 30 May 2023

13 ASX Announcement 22 March 2023 and 24 September 2024

14 ASX Announcement 23 April 2024 & 28 May 2024

15 https://rupertresources.com/ikkari-discovery/

16 ASX Announcement 30 May 2023

17 ASX Announcement 24 September 2024

18 ASX Announcement 30 May 2023

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/239220