Accelerated Technologies Holding Corporation, (OTC PINK: ATHC), Announces Letter of Intent to Acquire Food Importer and Distributor For $4,000,000

Accelerated Technologies Holding Corporation (ATHC) announced a letter of intent to acquire a food importer and distributor, the Food Distributor Network, which will add approximately $5 million in annual revenue. The acquisition aims to accelerate the deployment of ATHC's ROMPOS solution, enhancing profitability. The Food Distributor Network, based in New York, distributes to 550 small businesses, projecting a revenue increase of 10% in 2021. ATHC plans to issue 3,200,000 shares for the acquisition at $1.25 per share and expects combined revenues exceeding $10 million for 2022.

- None.

- None.

Insights

Analyzing...

NEW YORK, NY / ACCESSWIRE / January 18, 2022 / Accelerated Technologies Holding Corporation. (the "Company" or "Accelerated") (OTC PINK:ATHC). ATHC is a FinTech holding company that provides business services for SMB's and owns and operates disruptive technologies products in the sectors of artificial intelligence, short-term alternative funding platforms, electronic payment solutions, social engagement, health, and wellness solutions, is pleased to announce a letter of intent to acquire a company with exclusive importation rights, distribution, and sales of food and beverage products. The intended strategic acquisition will fast-track ATHC's deployment of its ROMPOS small business solution while adding in excess of five million (

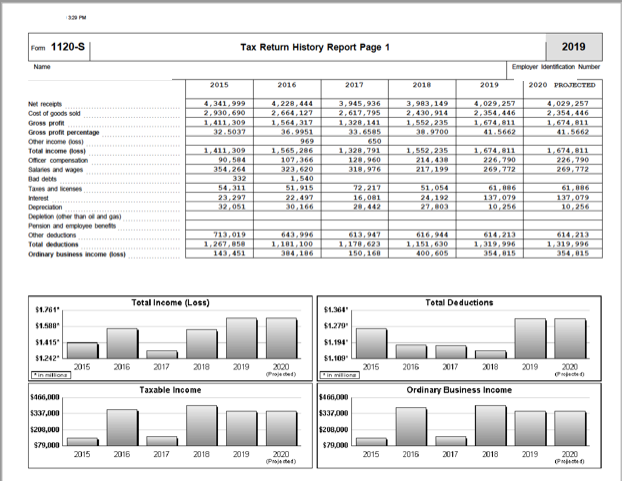

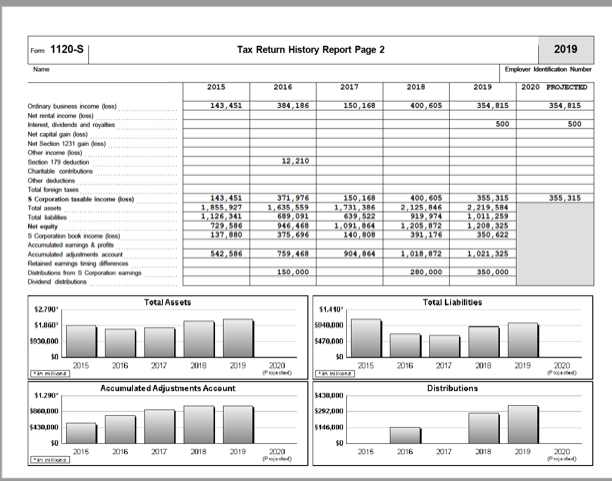

The Food Distributor Network is a New York-based privately held importer and distributor of specialty foods and beverages. Established in 2009, the network distributes to approximately 550 small businesses throughout the United States with the heaviest concentration in New York City. The Food Distributor Network demonstrated stable annual growth and 2021 annual sales of approximately

The letter of intent contemplates the issuance of 3,200,000 common shares as consideration for the acquisition at a deemed price of

"The current limited hiring market causes challenges in expanding internal sales and efficiently gaining market share for ROMPOS and other ATHC brands. Acquiring the Food Distributor Network will enable ATHC to efficiently convert clients and validate the power of ATHC's disruptive technologies. The planned deployment of ROMPOS will generate an estimated additional

The 2020 revenues of

This acquisition affords ATHC to gain revenue from additional verticals by launching on-demand delivery, launching B2C retail specialty websites with cryptocurrency as payment options, and additional marketing for the Food Distribution Network. ATHC's ROMPOS will optimize internal workflow to significantly propel revenues and respective EBITDA. ATHC intends to deploy offerings to the Network's existing clients. In managements discussions and beliefs,

Post Q1, 2022, issuance to debenture investors and 3,200,000 shares as consideration for the acquisition, the total issued and outstanding will adjust to approximately 19,000,000 shares. ATHC anticipates revenue of approximately

Company Update:

- ATHC is considering a five million dollar (

$5,000,000) private debenture sale. Management is contemplating a 506 offering of restricted shares priced between$1.25 -2.00 per share and will pay simple interest at the rate of8% per annum. - S1 registrations and begin up listing efforts are planned for the middle of 2022.

For additional inquiries and direct messaging to ATHC: info@athc.com

Follow us on Twitter for updates: https://twitter.com/ATHCOTC

About Accelerated Technologies Holding Corporation (OTC PINK: ATHC)

Accelerated Technologies Holding Corporation (OTC PINK: ATHC) is a publicly-traded holding company. Via ATHC brands and affiliates, it provides business services for SMB's and is a full-service end-to-end business solution and technology company that specializes in cloud-based disruptive technologies. ATHC provides consulting and enterprise-level technology services and operates disruptive technologies products in the sectors of artificial intelligence, short-term alternative funding platforms, electronic payment solutions, social engagement, health, and wellness solutions. ATHC's expertise lies in consumer Internet, cloud computing and software-as-a-service (SaaS), mobile software and services, software-powered consumer electronics, infrastructure and applications software, networking, storage, databases, and other backend systems. ATHC's infrastructure can accommodate most business sectors ranging from small local businesses to national conglomerates.

About ROMPOS: RETAIL - ONLINE - MOBILE - PROCESSES - OPTIMIZATION - SOLUTION

ROMPOS, an exemplary all-in-one solution automates and digitizes workflows intended to enable small businesses to increase efficiencies, quality control, customer satisfaction, brand recognition, and maximize bottom lines. ROMPOS has been tested in fast-paced quick serve environments and is capable to accommodate small businesses in retail, online and mobile environments. ROMPOS Command Center provides management and staff all in one access and controls over inventories, sales, staff management, analytics, payments, working capital, micro-targeted marketing, online sales, and gamification. Deployment for ROMPOS has begun.

For ROMPOS, we intend to sign a significant number of strategic resellers. We will be engaging business service providers with portfolios primarily in the sectors of payment processing, alternative lending,

About KashOnDemand

KashOnDemand delivers access for small businesses to sustainable financing 24/7. AI-driven underwriting with Bi gathered via ROMPOS will enable merchants to fund purchase orders, receivables, expansion, and refinance alternative debt at favorable rates. The microfinancing product fills the gap between traditional banking inefficiencies and the draconian rates merchants pay for Merchant Cash Advances. Business owners nationwide will dynamically prequalify for financing and funded within one hour during banking hours. ATHC's tech team is currently working on version 2 and intends to offer 24/7 funding via utilizing cryptocurrencies and exchanges. Version 1 is anticipated to launch in Q1, 2022.

About ShieldMost

Shield Most is a health, wellness, and media platform. A public safety solution that delivers local, remote, single, and multi-channel technologies for automated and manned temperature screening, surveillance, access control conveniently and safely. As we expand market share, Shield Most intends to launch a media platform for its IOS and Android tablets.

About InstaMaven

InstaMaven is a mobile application that allows professionals and hobbyists to monetize their skills, knowledge, and experience by connecting them with people seeking such services and advice, instantly, online and on-demand. The platform enables a broad spectrum of services to be rendered in a safe and secure environment. Tutors, chefs, bartenders, plumbers, dog walkers, you name it will be able to earn extra income while helping others at discounted rates. Instamaven charges a percentage of the collected funds. The platform has been in beta for approximately 18 months. Forms of payment are all major credit and debit cards, bank transfers and crypto will be accepted. Our own Accelerated Coin is highly probable. ATHC intends to launch InstaMaven in a limited capacity in Q2, 2022.

About Food Distribution Network (FDN)

Based on certain non-disclosure agreements, ATHC is prohibited from revealing the actual legal name of the entity. In the management's efforts to maintain transparency, disclosures with respect to key components of the planned transaction have been made.

Forward-Looking Statements

Certain information contained in this press release, including any information as to our strategy, plans or future financial or operating performance and other statements that express management's expectations or estimates of future performance, constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, are forward-looking statements. The words "believe," "expect," "will," "anticipate," "contemplate," "target," "plan," "continue," "budget," "may," "intend," "estimate," "project" and similar expressions identify forward-looking statements. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including, but not limited to, certain delays beyond the company's control with respect to its plans or operations. Our actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including, without limitation those set forth as "Risk Factors" in our filings with the SEC which can be found at www.sec.gov. There may be other factors not mentioned above or included in the Company's SEC filings that may cause actual results to differ materially from those projected in any forward-looking statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise, except as required by applicable law. Anticipated launch dates may vary due to technical issues, timing, and other variables that may affect actual launch dates.

For further information, please contact the company info@athcorp.com

Related Links:

ATHC.COM

ROMPOS.COM

INSTAMAVEN.COM

KASHONDEMAND.COM

SHIELDMOST.COM

SOURCE: Accelerated Technologies Holding Corporation.

View source version on accesswire.com:

https://www.accesswire.com/684324/Accelerated-Technologies-Holding-Corporation-OTC-PINK-ATHCAnnounces-Letter-of-Intent-to-Acquire-Food-Importer-and-Distributor-For-4000000