Altigen Communications, Inc. Reports Third Quarter Results for Fiscal Year 2022

Altigen Communications (OTCQB:ATGN) announced its third-quarter financial results for the period ending June 30, 2022. The company reported a 6.4% increase in net revenue to $3.0 million, despite a 3.0% decline in cloud services revenue. Professional services revenue surged 163.0% to $0.6 million, while gross margin decreased to 67.8%. The company recorded a GAAP net loss of $0.01 million with a diluted EPS of ($0.01). Customer adoption for new platforms, including CoreInteract, MaxCloud, and FrontStage, is growing, with initial customers secured and significant growth opportunities identified in the UCaaS, CCaaS, and CEaaS markets.

- Secured initial customers for CoreInteract, MaxCloud, and FrontStage platforms.

- Net revenue increased 6.4% to $3.0 million.

- Professional services revenue surged 163.0% to $0.6 million.

- Growing pipeline with approximately 50 potential opportunities submitted.

- Conversion of 500 on-premise clients expected over the next 18-24 months.

- Cloud services revenue decreased 3.0% to $1.9 million.

- Gross margin fell to 67.8% from 70.0%.

- GAAP net loss of $0.01 million and diluted EPS of ($0.01) indicate financial strain.

- Non-GAAP net income of $0.2 million decreased from $0.5 million year-over-year.

Insights

Analyzing...

Secures initial customers for each of its new CoreInteract, MaxCloud and FrontStage platforms

MILPITAS, CA / ACCESSWIRE / August 18, 2022 / Altigen Communications, Inc. (OTCQB:ATGN), a Silicon Valley-based cloud solutions provider for the Unified Communications as a Service (UCaaS), Contact Center as a Service (CCaaS) and our Customer Engagement as a Service (CEaaS) markets, announced today its financial results for the third quarter ended June 30, 2022.

"I'm excited to say that customer interest in our new UCaaS, CCaaS and CEaaS platforms has been substantial, and, in fact, we signed our first customers for each during the second quarter," said Jerry Fleming, chairman and CEO of Altigen. "Additionally, we made great strides towards building a robust pipeline of opportunities and further advancing our new product roadmap, both of which we believe will drive higher revenue growth and profitability in fiscal 2023 and beyond.

"Looking to the future, we have a tremendous opportunity ahead in the UCaaS, CCaaS and CEaaS markets. In addition to CoreInteract (CEaaS) recently being named a Microsoft Preferred Solution, to date, we have closed over a dozen customers for our CoreInteract products for Microsoft Teams. Additionally, our pipeline continues to grow, and we now have about 50 potential opportunities for which we have submitted proposals. We are also continuing to enhance CoreInteract with new features and functionality that customers are requesting for this market.

"I am also very optimistic about our relationship with fintech giant Fiserv for our MaxCloud (UCaaS) and FrontStage (CCaaS) platforms, both of which were recently deployed for a mid-size regional bank. There is a large opportunity here to upgrade existing Fiserv customers to MaxCloud as well as introduce these new solutions to new customers. Additionally, there is a strong demand for contact center solutions by Fiserv customer base, presenting a large upsell opportunity for FrontStage over time.

"Finally, we are seeing customer wins in our third-party channel, whether it be converting our roughly 500 on premise clients to the cloud first model or upgrading our existing base of 350 cloud customers to MaxCloud. We anticipate converting most of these existing customers over the next 18-24 months, which we expect will be an incremental contributor to revenue growth while reducing our costs to service these customers."

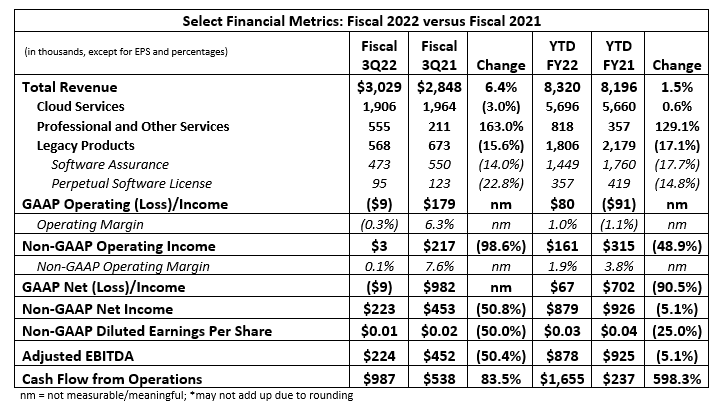

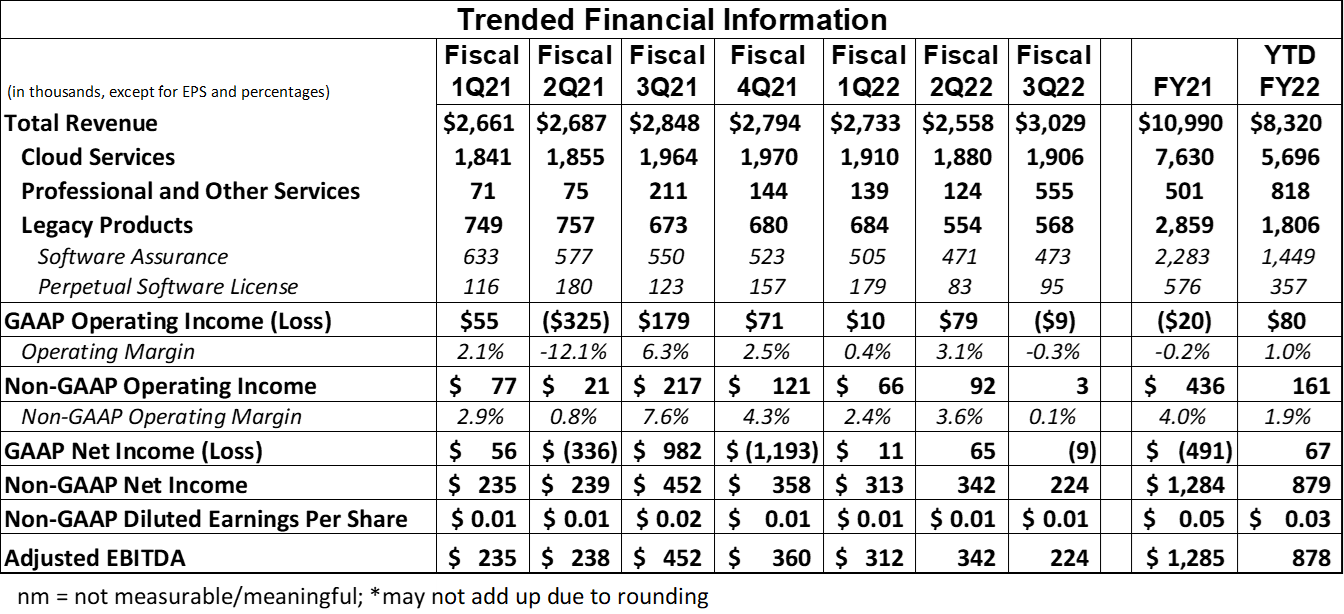

Third-Quarter Highlights (Fiscal 2022 versus Fiscal 2021)

- Net Revenue increased

6.4% to$3.0 million ; - Cloud services revenue decreased (

3.0% ) to$1.9 million ; - Professional services and other revenue increased

163.0% to$0.6 million ; - Gross margin decreased to

67.8% , compared with70.0% ; - GAAP net loss was

$0.01 million and diluted EPS of ($0.01) ; - Non-GAAP net income1 and non-GAAP diluted EPS1 of

$0.2 million and$0.01 , respectively, compared to$0.5 million and$0.02 , respectively; - Cash flow from operations increased to

$1.0 million , compared to$0.5 million .

nm = not measurable/meaningful; *may not add up due to rounding

(1) Throughout this release, the use of non-GAAP financial measures is intended to provide useful information that supplements Altigen's results in accordance with GAAP. Please refer to the Reconciliation of Non-GAAP Financial Measure at the end of this release.

Subsequent News

Chief Strategy Officer Ryan Day will transition from his current role to a consulting role on August 19, 2022.

Conference Call

Altigen will be discussing its financial results and outlook on a conference call today at 2:00 p.m. Pacific Time (5:00 p.m. ET). The conference call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international), conference ID #272165. A live webcast will also be made available at www.altigen.com. To access the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international), conference ID #46350. A web archive will be made available at www.altigen.com for 90 days following the call's conclusion.

About Altigen Communications

Altigen Communications Inc. (OTCQB:ATGN), based in Silicon Valley, is a leading Microsoft Cloud Solutions provider, delivering fully managed Cloud-based Unified Communications services based on the Microsoft platform. Our SIP trunk services, enterprise customer engagement and innovative cloud contact center solutions seamlessly integrate with Microsoft Teams to enhance and extend the business communications capabilities for our customers. Altigen's solutions are designed for high reliability, ease of use, seamless integration into Microsoft technologies, all delivered as fully managed cloud services. Our solutions are available through our global network of certified resellers. For more information, call 1-888-ALTIGEN or visit our website at www.altigen.com.

Safe Harbor Statement

This press release contains forward‐looking information. The statements are based on reasonable assumptions, beliefs and expectations of management and the Company provides no assurance that actual events will meet management's expectations. Furthermore, the forward-looking statements contained in this press release are based on the Company's views of future events and financial performances which are subject to known and unknown risks and uncertainties including, but not limited to, statements regarding our ability to grow revenue and profitability in fiscal 2023 and beyond, our ability to accelerate business opportunities and to achieve increased market acceptance for our service offerings, our ability to drive the adoption of our next generation cloud solutions, our ability to accelerate business opportunities with Fiserv, and to our ability to penetrate new markets. There can be no assurances that the Company will achieve expected results, and actual results may be materially different than expectations and from those stated or implied in forward-looking statements.

Please refer to the Company's most recent Annual Report filed with the OTCQB over-the-counter market for a further discussion of risks and uncertainties. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company does not undertake any obligation to update any forward-looking statements.

Contact:

Brian Siegel, IRC, MBA

Senior Managing Director

Hayden IR

(346) 396-8696

brian@haydenir.com

ALTIGEN COMMUNICATIONS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, amounts in thousands)

| June 30, 2022 | September 30, 2021 | |||||||

Cash and cash equivalents | $ | 3,448 | $ | 6,799 | ||||

Accounts receivable, net | 801 | 596 | ||||||

Other current assets | 303 | 145 | ||||||

Property and equipment, net | 15 | 27 | ||||||

Operating lease right-of-use | 660 | 826 | ||||||

Intangible assets, net | 5,256 | 433 | ||||||

Capitalized software, net | 1,482 | 1,669 | ||||||

Deferred tax asset | 6,597 | 6,597 | ||||||

Other long-term assets | 37 | 45 | ||||||

Total assets | $ | 18,599 | $ | 17,137 | ||||

Current liabilities | $ | 3,099 | $ | 1,931 | ||||

Long-term liabilities | 547 | 736 | ||||||

Stockholders' equity | 14,953 | 14,470 | ||||||

Total liabilities and stockholders' equity | $ | 18,599 | $ | 17,137 | ||||

ALTIGEN COMMUNICATIONS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(amounts in thousands, except per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

Net revenue | $ | 3,029 | $ | 2,848 | $ | 8,320 | $ | 8,196 | ||||||||

Gross profit | 2,054 | 1,995 | 5,816 | 5,920 | ||||||||||||

Operating expenses: | ||||||||||||||||

Research and development | 1,252 | 955 | 3,153 | 2,740 | ||||||||||||

Selling, general & administrative | 811 | 861 | 2,583 | 2,959 | ||||||||||||

Litigation | - | - | - | 313 | ||||||||||||

Operating (loss)/income | (9 | ) | 179 | 80 | (92 | ) | ||||||||||

Gain on extinguishment of debt - PPP loan forgiveness (1) | - | 804 | - | 804 | ||||||||||||

Other income/(expense), net | - | - | 1 | - | ||||||||||||

Net (loss) income before provision for income taxes | (9 | ) | 983 | 81 | 712 | |||||||||||

Income tax benefit (expense) | - | (1 | ) | (14 | ) | (11 | ) | |||||||||

Net (loss)/income | $ | (9 | ) | $ | 982 | $ | 67 | $ | 701 | |||||||

Per share data: | ||||||||||||||||

Basic | $ | 0.00 | $ | 0.04 | $ | 0.00 | $ | 0.03 | ||||||||

Diluted | $ | 0.00 | $ | 0.04 | $ | 0.00 | $ | 0.03 | ||||||||

Weighted average shares outstanding: | ||||||||||||||||

Basic | 24,124 | 23,360 | 23,946 | 23,186 | ||||||||||||

Diluted | 24,124 | 25,669 | 25,509 | 25,507 | ||||||||||||

(1) During the third quarter of fiscal 2021, the Company recorded a non-cash gain on debt extinguishment of

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, amounts in thousands)

| Nine Months Ended June 30, | ||||||||

| 2022 | 2021 | |||||||

Cash flows from operating activities: | ||||||||

Net income | $ | 67 | $ | 701 | ||||

Adjustments to reconcile net income to net cash from operating activities: | ||||||||

Depreciation and amortization | 12 | 23 | ||||||

Amortization of intangible assets | 131 | 131 | ||||||

Amortization of capitalized software | 573 | 456 | ||||||

Stock-based compensation | 82 | 94 | ||||||

Gain from extinguishment of debt - PPP loan forgiveness | - | (804 | ) | |||||

Changes in operating assets and liabilities: | ||||||||

Accounts receivable and unbilled accounts receivable | (205 | ) | (91 | ) | ||||

Prepaid expenses and other current assets | (158 | ) | (35 | ) | ||||

Other long-term assets | 8 | (15 | ) | |||||

Accounts payable | (12 | ) | 8 | |||||

Accrued expenses | 1,154 | (62 | ) | |||||

Deferred revenue | 3 | (169 | ) | |||||

Net cash provided by operating activities | 1,655 | 237 | ||||||

Cash flows from investing activities: | ||||||||

Purchase of property and equipment | - | (11 | ) | |||||

Acquisition of business | (4,655 | ) | - | |||||

Capitalized software development costs | (386 | ) | (500 | ) | ||||

Net cash used in investing activities | (5,041 | ) | (511 | ) | ||||

Cash flows from financing activities: | ||||||||

Proceeds from issuances of common stock | 35 | 71 | ||||||

Net cash provided by financing activities | 35 | 71 | ||||||

Net decrease in cash and cash equivalents | (3,351 | ) | (203 | ) | ||||

Cash and cash equivalents, beginning of period | 6,799 | 6,659 | ||||||

Cash and cash equivalents, end of period | $ | 3,448 | $ | 6,456 | ||||

Non-GAAP Financial Measures

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our core operating performance on a period-to-period basis. The excluded items represent stock-based compensation expense, depreciation and amortization expenses and other non-recurring or unusual items that may arise from time to time that we do not consider to be directly related to core operating performance. We use non-GAAP measures to evaluate the core operating performance of our business and to perform financial planning. Since we find these measures to be useful, we believe that investors benefit from seeing results reviewed by management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by facilitating: (i) the comparability of our on-going operating results over the periods presented and (ii) the ability to identify trends in our underlying business.

The following are explanations of each type of adjustment that we incorporate into non-GAAP financial measures:

Stock-based compensation expense

Stock-based compensation expense is impacted by the Company's future hiring and retention needs and the future fair market value of the Company's common stock, all of which are difficult to predict and subject to constant change. Furthermore, stock-based compensation expense is generally fixed at the time of grant, then amortized over a period of several years, and generally cannot be changed or influenced by management after the grant. The Company believes that the exclusion of stock-based compensation expense assists investors in the comparisons of operating results to peer companies. Stock-based compensation expense can vary significantly based on the timing, size and nature of awards granted.

Depreciation and amortization expenses

Depreciation and amortization expense includes the depreciation of property and equipment, amortization of capitalized software, as well as amortization of intangible assets. Such expenses are fixed at the time of an acquisition, then amortized over a period of several years. While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent non-cash current period expense which vary widely from company to company. Management believes that the exclusion of depreciation and amortization expense provides a supplemental measure of the Company's ongoing operating performance.

Acquisition-related amortization

Acquisition-related amortization consists of customer relationships recorded in connection with our acquisition of Blue Panda Communications in September 2020. We exclude acquisition-related amortization as we believe the amount of such non-cash expenses in any specific period may not directly correlate to the underlying performance of our business operations.

Gain on forgiveness of PPP loan

Gain on forgiveness of PPP loan has been excluded because this is a one-time forgiveness of debt that is not recurring across all periods, and we believe inclusion of the gain is not representative of operating performance.

Other non-recurring or unusual charges

The Company has excluded certain other expenses that are the result of other, non-comparable events to measure operating performance. These events arise outside of the ordinary course of continuing operations. Given the unique nature of the matters relating to these costs, the Company believes these items are not normal operating expenses. For example, legal settlements and judgments vary significantly, in their nature, size and frequency, and, due to this volatility, the Company believes the costs associated with legal settlements and judgments are not normal operating expenses. The Company believes that the exclusion of such out-of-the-ordinary-course amounts provides supplemental information to assist in the comparison of the financial results of the Company from period to period and, therefore, provides useful supplemental information to investors.

Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation. They should be considered as a supplement to, not a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP.

ALTIGEN COMMUNICATIONS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(amounts in thousands, except per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

Reconciliation of GAAP to Non-GAAP Gross Profit: | ||||||||||||||||

GAAP gross profit | $ | 2,054 | $ | 1,995 | $ | 5,816 | $ | 5,920 | ||||||||

Amortization of capitalized software | 153 | 131 | 482 | 321 | ||||||||||||

Acquisition related expenses | 43 | 43 | 131 | 131 | ||||||||||||

Non-GAAP gross profit | $ | 2,250 | $ | 2,169 | $ | 6,429 | $ | 6,372 | ||||||||

Reconciliation of GAAP to Non-GAAP Expenses: | ||||||||||||||||

GAAP operating expenses | $ | 2,063 | $ | 1,816 | $ | 5,736 | $ | 6,012 | ||||||||

Litigation | - | - | - | 313 | ||||||||||||

Depreciation and amortization | 3 | 6 | 12 | 23 | ||||||||||||

Amortization of capitalized software | 20 | 56 | 91 | 135 | ||||||||||||

Stock-based compensation | 13 | 38 | 82 | 94 | ||||||||||||

Non-GAAP operating expenses | $ | 2,027 | $ | 1,716 | $ | 5,551 | $ | 5,447 | ||||||||

Reconciliation of GAAP to Non-GAAP Net Income: | ||||||||||||||||

GAAP net (loss) income | $ | (9 | ) | $ | 982 | $ | 67 | $ | 701 | |||||||

Litigation | - | - | - | 313 | ||||||||||||

Depreciation and amortization | 3 | 6 | 12 | 23 | ||||||||||||

Amortization of capitalized software | 173 | 187 | 573 | 456 | ||||||||||||

Stock-based compensation | 13 | 38 | 82 | 94 | ||||||||||||

Acquisition related expenses | 43 | 43 | 131 | 131 | ||||||||||||

Gain on extinguishment of PPP Loan (1) | (804 | ) | (804 | ) | ||||||||||||

Deferred tax asset valuation allowance | - | 1 | 14 | 11 | ||||||||||||

Non-GAAP net income | $ | 223 | $ | 453 | $ | 879 | $ | 925 | ||||||||

Per share data: | ||||||||||||||||

Basic | $ | 0.01 | $ | 0.02 | $ | 0.04 | $ | 0.04 | ||||||||

Diluted | $ | 0.01 | $ | 0.02 | $ | 0.03 | $ | 0.04 | ||||||||

Weighted average shares outstanding: | ||||||||||||||||

Basic | 24,124 | 23,360 | 23,946 | 23,186 | ||||||||||||

Diluted | 25,599 | 25,669 | 25,509 | 25,507 | ||||||||||||

(1) During the third quarter of fiscal 2021, the Company recorded a non-cash gain on debt extinguishment of

SOURCE: Altigen Communications, Inc.

View source version on accesswire.com:

https://www.accesswire.com/712673/Altigen-Communications-Inc-Reports-Third-Quarter-Results-for-Fiscal-Year-2022