American Rare Earths Updated Scoping Study Highlights Billion-Dollar Potential—Positioning the Company as a Future Rare Earth Leader in the USA

American Rare Earths (ARRNF) has announced results from its Updated Halleck Creek Scoping Study, revealing strong economic potential for its rare earths project in Wyoming. The study presents two development scenarios:

The 3 Mtpa base case shows:

- NPV10% of US$558M with 24% IRR

- CAPEX of US$456M with 2.7-year payback

- Annual production of 4,169 metric tons TREO, including 1,833 tons NdPr oxide

The 6 Mtpa case demonstrates:

- NPV10% of US$1.17B with 28.4% IRR

- CAPEX of US$737M with 1.8-year payback

- Annual production of 7,661 metric tons TREO, including 3,344 tons NdPr oxide

The project benefits from state land tenure for accelerated permitting and covers only 16% of the total project area, with significant expansion potential. First production could begin by 2029.

American Rare Earths (ARRNF) ha annunciato i risultati del suo Aggiornamento dello Studio di Fattibilità di Halleck Creek, rivelando un forte potenziale economico per il suo progetto di terre rare nel Wyoming. Lo studio presenta due scenari di sviluppo:

Il caso base da 3 Mtpa mostra:

- NPV10% di 558 milioni di dollari con un IRR del 24%

- CAPEX di 456 milioni di dollari con un periodo di recupero di 2,7 anni

- Produzione annuale di 4.169 tonnellate metriche di TREO, inclusi 1.833 tonnellate di ossido di NdPr

Il caso da 6 Mtpa dimostra:

- NPV10% di 1,17 miliardi di dollari con un IRR del 28,4%

- CAPEX di 737 milioni di dollari con un periodo di recupero di 1,8 anni

- Produzione annuale di 7.661 tonnellate metriche di TREO, inclusi 3.344 tonnellate di ossido di NdPr

Il progetto beneficia della proprietà di terreni statali per un'accelerazione dei permessi e copre solo il 16% dell'area totale del progetto, con un significativo potenziale di espansione. La prima produzione potrebbe iniziare entro il 2029.

American Rare Earths (ARRNF) ha anunciado los resultados de su Estudio de Viabilidad Actualizado de Halleck Creek, revelando un fuerte potencial económico para su proyecto de tierras raras en Wyoming. El estudio presenta dos escenarios de desarrollo:

El caso base de 3 Mtpa muestra:

- NPV10% de 558 millones de dólares con un IRR del 24%

- CAPEX de 456 millones de dólares con un período de recuperación de 2,7 años

- Producción anual de 4.169 toneladas métricas de TREO, incluyendo 1.833 toneladas de óxido de NdPr

El caso de 6 Mtpa demuestra:

- NPV10% de 1,17 mil millones de dólares con un IRR del 28,4%

- CAPEX de 737 millones de dólares con un período de recuperación de 1,8 años

- Producción anual de 7.661 toneladas métricas de TREO, incluyendo 3.344 toneladas de óxido de NdPr

El proyecto se beneficia de la propiedad estatal de tierras para una aceleración en los permisos y cubre solo el 16% del área total del proyecto, con un significativo potencial de expansión. La primera producción podría comenzar en 2029.

American Rare Earths (ARRNF)는 업데이트된 할렉 크릭 타당성 조사 결과를 발표하며 와이오밍의 희토류 프로젝트에 강력한 경제적 잠재력을 드러냈습니다. 이 연구는 두 가지 개발 시나리오를 제시합니다:

3 Mtpa 기본 사례는 다음과 같습니다:

- NPV10%가 5억 5천 8백만 달러, IRR이 24%

- CAPEX가 4억 5천 6백만 달러, 회수 기간이 2.7년

- 연간 4,169 메트릭 톤 TREO 생산, 그 중 1,833 톤은 NdPr 산화물

6 Mtpa 사례는 다음을 보여줍니다:

- NPV10%가 11억 7천만 달러, IRR이 28.4%

- CAPEX가 7억 3천 7백만 달러, 회수 기간이 1.8년

- 연간 7,661 메트릭 톤 TREO 생산, 그 중 3,344 톤은 NdPr 산화물

이 프로젝트는 허가 절차를 가속화하기 위한 주정부 토지 소유의 혜택을 누리며, 전체 프로젝트 면적의 16%만을 차지하며 상당한 확장 잠재력을 가지고 있습니다. 첫 생산은 2029년까지 시작될 수 있습니다.

American Rare Earths (ARRNF) a annoncé les résultats de son Étude de Faisabilité Mise à Jour de Halleck Creek, révélant un fort potentiel économique pour son projet de terres rares dans le Wyoming. L'étude présente deux scénarios de développement :

Le scénario de base de 3 Mtpa montre :

- NPV10% de 558 millions de dollars avec un IRR de 24%

- CAPEX de 456 millions de dollars avec un retour sur investissement de 2,7 ans

- Production annuelle de 4.169 tonnes métriques de TREO, incluant 1.833 tonnes d'oxyde de NdPr

Le scénario de 6 Mtpa démontre :

- NPV10% de 1,17 milliard de dollars avec un IRR de 28,4%

- CAPEX de 737 millions de dollars avec un retour sur investissement de 1,8 ans

- Production annuelle de 7.661 tonnes métriques de TREO, incluant 3.344 tonnes d'oxyde de NdPr

Le projet bénéficie de la propriété foncière de l'État pour une accélération des permis et couvre seulement 16% de la superficie totale du projet, avec un potentiel d'expansion significatif. La première production pourrait commencer d'ici 2029.

American Rare Earths (ARRNF) hat die Ergebnisse seiner aktualisierten Machbarkeitsstudie für Halleck Creek bekannt gegeben, die ein starkes wirtschaftliches Potenzial für sein Seltene-Erden-Projekt in Wyoming offenbart. Die Studie präsentiert zwei Entwicklungsszenarien:

Das Basis-Szenario mit 3 Mtpa zeigt:

- NPV10% von 558 Millionen US-Dollar mit einer IRR von 24%

- CAPEX von 456 Millionen US-Dollar mit einer Amortisationszeit von 2,7 Jahren

- Jährliche Produktion von 4.169 metrischen Tonnen TREO, einschließlich 1.833 Tonnen NdPr-Oxid

Das 6 Mtpa-Szenario demonstriert:

- NPV10% von 1,17 Milliarden US-Dollar mit einer IRR von 28,4%

- CAPEX von 737 Millionen US-Dollar mit einer Amortisationszeit von 1,8 Jahren

- Jährliche Produktion von 7.661 metrischen Tonnen TREO, einschließlich 3.344 Tonnen NdPr-Oxid

Das Projekt profitiert von staatlichem Grundbesitz für eine beschleunigte Genehmigung und deckt nur 16% der Gesamtprojektfläche ab, mit erheblichen Expansionsmöglichkeiten. Die erste Produktion könnte bis 2029 beginnen.

- Strong NPV of US$558M (3 Mtpa) to US$1.17B (6 Mtpa)

- Attractive IRR ranges from 24% to 28.4%

- Short payback period of 1.8-2.7 years

- Large JORC resource of 2.63Bt with only 16% of area explored

- Strategic advantage with state land tenure for faster permitting

- Independent from Chinese supply chain and tariffs

- High initial CAPEX requirement of US$456M-737M

- Production timeline extends to 2029

- Only 2.4% of total resource utilized in current 20-year mine plan

- Strong economics, scalable growth: 3 Mtpa base case offers NPV10% of US

$558M , IRR24% , with a low-risk CAPEX of US$456M . - Billion-dollar potential: 6 Mtpa case delivers NPV10% of US

$1.17B , IRR28.4% , and CAPEX of US$737M . - First-mover advantage: State land tenure accelerates permitting, positioning ARR as a leading U.S.-based rare earths developer independent of tariffs and reliance on foreign processing.

- Vast Scalability & Growth: The 3 Mtpa Phase 1 will mine ~62.3Mt of ore over 20 years, utilizing just ~

2.4% of the 2.63Bt JORC resource. With further studies underway, Halleck Creek could support a larger, long-term operation, with potential for extended mine life and increased production capacity. - Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~

16% of the greater Halleck Creek surface area, highlighting significant expansion potential.

DENVER, Feb. 24, 2025 (GLOBE NEWSWIRE) -- American Rare Earths (ASX: ARR | OTCQX: ARRNF and AMRRY) (“ARR” or the “Company”) is pleased to announce the results of its Updated Halleck Creek Scoping Study, confirming the project’s strong economics, scalability, and strategic importance.

Compiled by independent engineering firm Stantec Consulting Services Inc., the Study highlights Halleck Creek’s strong economic potential, strategic advantages, and clear pathway to development as a U.S.-based rare earths project. Located in Wyoming, a Tier 1 mining jurisdiction, Halleck Creek benefits from state land tenure, allowing for accelerated permitting and development.

Compelling Economics & Scalable Growth

The Updated Scoping Study confirms Halleck Creek as a world-class rare earths project with robust financials and long-term scalability:

- 3 Mtpa Base Case:

- NPV10% of US

$558 million , IRR of24% - CAPEX of US

$456 million , with a 2.7-year payback period - Annual production: ~4,169 metric tons of TREO, including 1,833 metric tons of NdPr oxide

- NPV10% of US

- 6 Mtpa Case:

- NPV10% of US

$1.17 1 billion, IRR of28.4% - CAPEX of US

$737 million , with a 1.8-year payback period - Annual production: ~7,661 metric tons of TREO, including 3,344 metric tons of NdPr oxide

- NPV10% of US

First-Mover Advantage & U.S. Supply Chain Security

As the only large-scale rare earths project in the U.S. with a clear path to production, ARR is positioned to secure a domestic, tariff-free supply of critical minerals for U.S. and allied markets.

- China controls over

90% of global rare earth refining. With the U.S. prioritizing supply chain security, ARR is uniquely positioned as a credible U.S.-based developer to deliver a fully integrated solution—from mining to refining. - State land tenure accelerates permitting, avoiding the lengthy delays often associated with projects on federal land.

- Halleck Creek's

100% U.S.-based production and refining will ensure a secure, domestic supply of rare earth oxide metals—eliminating reliance on foreign supply chains and reinforcing the 'Made in America' commitment. - Deposit remains open at depth and along strike, with the current JORC resource of 2.63Bt covering only ~

16% of the greater Halleck Creek project area, highlighting significant expansion potential.

Clear Development Pathway & Future Growth

Halleck Creek’s staged development approach ensures financial and operational flexibility, allowing ARR to scale production in alignment with market demand:

- Base Case: 3 Mtpa – Low-risk entry to production to produce an average of 4,169 mt of TREO per annum, including 1,833 mt of NdPr Oxide.

- Alternate Case: Scalable to 6 Mtpa – Enhancing project economics, producing an average of 7,661 mt TREO per annum, including 3,334 mt of NdPr Oxide

- Future Expansion Potential: The Cowboy State Mine (“CSM”) represents only Phase 1 of Halleck Creek’s development, benefiting from a strategic permitting advantage. The 20-year CSM LOM plan includes mining approximately 62.3 Mt of ore—just ~

2.4% of the total 2,627 Mt JORC Mineral Resource—highlighting the vast potential for extended mine life and increased production in future phases. Given the increasing demand for rare earths, ARR is evaluating further studies, as Halleck Creek could support a much larger, long-term operation, with potential for extended mine life and increased production capacity that could position ARR among the top rare earth producers outside China.

CEO Commentary

Chris Gibbs, CEO of American Rare Earths, commented:

"The Updated Scoping Study reinforces Halleck Creek strong economic potential, strategic permitting advantage and clear pathway to development. With a large-scale resource and favorable economics, we are uniquely positioned to help secure America’s rare earth supply and reduce dependence on foreign sources.”

"The 6 Mtpa case highlights Halleck Creek’s billion-dollar potential, delivering an NPV10% of US

"With a scalable development pathway under evaluation, Halleck Creek has the potential to become a major supplier to U.S. and allied markets. Future production scenarios could position ARR among the top rare earth producers outside China, reinforcing America’s supply chain security for decades to come.”

"And we’re not just mining—we are developing a fully integrated U.S. supply chain, refining and producing high-purity rare earth oxides for American manufacturers. Halleck Creek aligns with the growing push for Made-in-America critical minerals, securing a domestic supply for defense, aerospace, and high-tech manufacturing.”

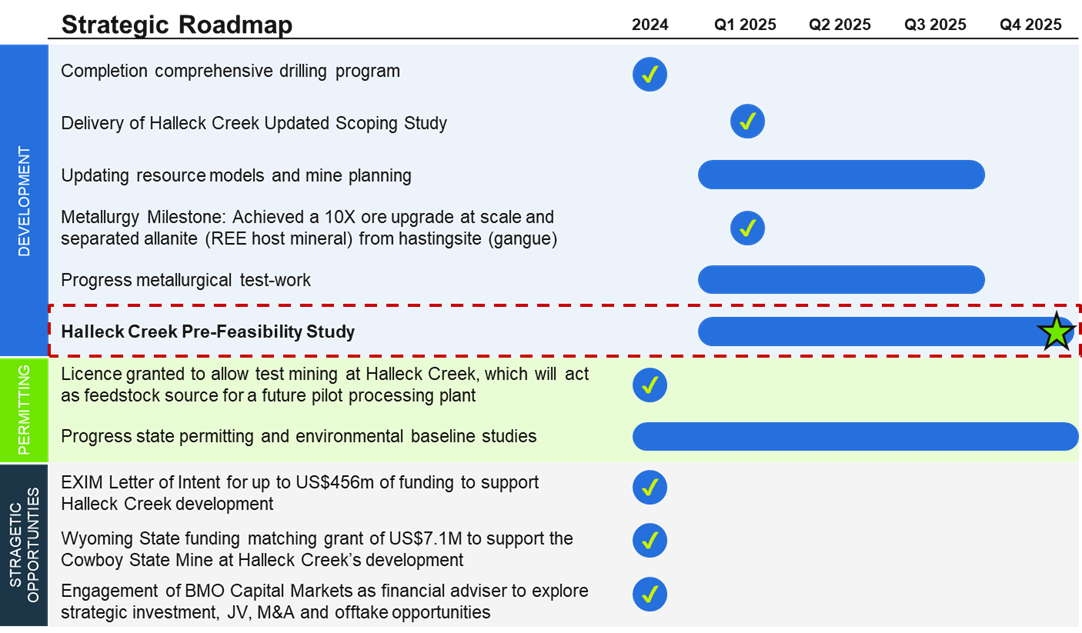

Next Steps & Milestones

Building on strong execution in 2024, ARR is advancing key milestones to further de-risk and develop Halleck Creek, as outlined in the Updated Scoping Study and supported by recent metallurgy results. These developments reinforce the project's scalability and strategic importance as a leading U.S. rare earths asset. With a staged development approach, first production could be as early as 2029, subject to ongoing technical and economic assessments. The Company is looking at ways to fast-track development, including plans to commence Phase One of a pilot plant for the beneficiation process. The roadmap ahead highlights key next steps for 2025 and the next major stage gate in the project’s development.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/224ae98d-757f-41a1-9001-3bd9344cb207

A full Appendix and Technical Summary for the Updated Scoping Study can be found here. The study was completed with the expertise of experienced and reputable independent engineering consulting firms: Stantec, Tetra Tech and Odessa Resources.

This release was authorized by the board of directors of ARR.

About American Rare Earths Limited:

American Rare Earths (ASX: ARR | OTCQX: ARRNF | ADR: AMRRY) is a critical minerals company at the forefront of reshaping the U.S. rare earths industry. Through its wholly owned subsidiary, Wyoming Rare (USA) Inc., the company is advancing the Halleck Creek Project in Wyoming—a world-class rare earth deposit with the potential to secure America’s critical mineral independence for generations. The Halleck Creek Project boasts a JORC-compliant resource of 2.63 billion tonnes, representing approximately

With plans for onsite mineral processing and separation facilities, Halleck Creek is strategically positioned to reduce U.S. reliance on imports—predominantly from China—while meeting the growing demand for rare earth elements essential to defense, advanced technologies, and economic security. As exploration progresses, the project’s untapped potential on both State and Federal lands further reinforces its significance as a cornerstone of U.S. supply chain security. In addition to its resource potential, American Rare Earths is committed to environmentally responsible mining practices and continues to collaborate with U.S. Government-supported R&D programs to develop innovative extraction and processing technologies for rare earth elements.

The opportunities ahead for Halleck Creek are transformational, positioning it as a multi-generational resource that aligns with U.S. national priorities for critical mineral independence.

For additional information

Media Contact:

Susan Assadi

sassadi@americanree.com

347 977 7125

Investor Relations US Contact:

Beverly Jedynak

Beverly.jedynak@viriathus.com

312 943 1123

Table 1 – Mineral Resource Estimate at Halleck Creek (1000ppm TREO cut off)

| Classification | Tonnage | Grade | Contained Material | ||||||

| TREO | LREO | HREO | MREO | TREO | LREO | HREO | MREO | ||

| t | ppm | ppm | ppm | ppm | t | t | t | t | |

| Measured | 206,716,068 | 3,720 | 3,352 | 370 | 904 | 769,018 | 692,935 | 76,550 | 186,836 |

| Indicated | 1,272,604,372 | 3,271 | 2,900 | 360 | 852 | 4,162,386 | 3,689,999 | 458,140 | 1,084,256 |

| Meas + Ind | 1,479,320,439 | 3,334 | 2,963 | 361 | 859 | 4,931,405 | 4,382,934 | 534,691 | 1,271,092 |

| Inferred | 1,147,180,795 | 3,239 | 2,878 | 361 | 837 | 3,715,661 | 3,302,005 | 413,651 | 960,355 |

| Total | 2,626,501,234 | 3,292 | 2,926 | 361 | 850 | 8,647,066 | 7,684,939 | 948,341 | 2,231,447 |