Alexandria Real Estate Equities, Inc. Announces Long-Term Tenant AstraZeneca Is Investing $300 Million in a Next-Generation Cell Therapy Manufacturing Facility at the Alexandria Center for Life Science - Shady Grove Mega Campus in Rockville, Maryland

- None.

- None.

Insights

The announcement by Alexandria Real Estate Equities regarding AstraZeneca's investment in a new cell therapy manufacturing facility is a significant development within the life sciences real estate sector. This move demonstrates a growing trend of biopharmaceutical companies investing heavily in specialized facilities to support advanced treatment modalities like cell therapies. The creation of over 150 highly skilled jobs is a positive signal for the local economy and the life science labor market, indicating a healthy demand for specialized talent.

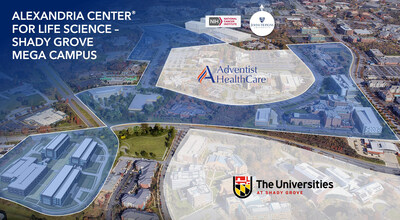

Furthermore, the strategic location of the facility within the Alexandria Center for Life Science – Shady Grove mega campus underlines the importance of innovation clusters that foster synergies between academia, industry and regulatory bodies. The high occupancy rate of 96.6% and the ongoing development of additional real estate space reflect a robust market presence and potential for future growth, which is beneficial for stakeholders in the life sciences ecosystem and real estate investors alike.

AstraZeneca's commitment of $300 million towards a next-generation cell therapy manufacturing facility underscores the biopharmaceutical industry's focus on cutting-edge cancer treatments. Engineered cell therapies such as CAR-T and TCR-T have been pivotal in reducing cancer mortality rates, as evidenced by recent declines despite the American Cancer Society's projection of over 2 million cancer cases. The facility's role in supporting clinical trials and future commercial supply chains for these therapies is critical in accelerating the availability of lifesaving treatments to patients globally.

The investment also reflects the company's confidence in the potential of its cell therapy pipeline and its readiness to meet increasing demand. This could have a profound impact on the oncology sector, potentially leading to improved patient outcomes and advancements in personalized medicine. The presence of the NIH and FDA in close proximity to the mega campus may facilitate expedited regulatory processes and foster collaborative research efforts.

AstraZeneca's $300 million investment in a cell therapy manufacturing facility represents a substantial capital commitment that could have significant financial implications for Alexandria Real Estate Equities. The 13-year lease term for the Class A+ property provides long-term revenue stability and is indicative of AstraZeneca's confidence in Alexandria's real estate offerings. This deal could potentially enhance Alexandria's financial performance and attractiveness to investors seeking exposure to the life sciences real estate market.

Moreover, the investment in a high-barrier-to-entry submarket like Rockville could lead to an appreciation of property values and attract additional biopharmaceutical tenants, further solidifying Alexandria's market dominance. The expected job creation and the facility's contribution to the life sciences sector's growth could also have positive ripple effects on the stock performance of companies within this industry, as well as on the broader market, considering the increasing importance of healthcare innovation.

The American Cancer Society projects over 2 million cancer cases and over 600,000 cancer deaths in

Alexandria has been at the vanguard and heart of growing, shaping and leading the

About Alexandria Real Estate Equities, Inc.

Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500® company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche since our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator and developer of collaborative life science, agtech and advanced technology mega campuses in AAA innovation cluster locations, including

Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include, without limitation, statements regarding the impact of Alexandria's facilities on the advancement of medicines and treatments. These forward-looking statements are based on Alexandria's present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by Alexandria's forward-looking statements as a result of a variety of factors, including, without limitation, the risks and uncertainties detailed in its filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this press release, and Alexandria assumes no obligation to update this information. For more discussion relating to risks and uncertainties that could cause actual results to differ materially from those anticipated in Alexandria's forward-looking statements, and risks and uncertainties to Alexandria's business in general, please refer to Alexandria's filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and any subsequently filed quarterly reports on Form 10-Q.

CONTACT: Sara Kabakoff, Senior Vice President – Chief Content Officer, (626) 788-5578, skabakoff@are.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-announces-long-term-tenant-astrazeneca-is-investing-300-million-in-a-next-generation-cell-therapy-manufacturing-facility-at-the-alexandria-center-for-life-science--shady-grove-mega-campus-in-302059136.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/alexandria-real-estate-equities-inc-announces-long-term-tenant-astrazeneca-is-investing-300-million-in-a-next-generation-cell-therapy-manufacturing-facility-at-the-alexandria-center-for-life-science--shady-grove-mega-campus-in-302059136.html

SOURCE Alexandria Real Estate Equities, Inc.