Aqua Metals Expands Vision for Commercial Giga-Scale Lithium Battery Recycling – More than Doubling the Output of Battery Grade Lithium at Sierra ARC Phase 1

Aqua Metals (NASDAQ: AQMS) has announced an accelerated strategy for its commercial-scale AquaRefining™ facility at the Tahoe-Reno industrial center. The company plans to more than double its initial production targets for battery grade lithium carbonate, while also producing Mixed Hydroxide Precipitate (MHP) containing nickel and cobalt, along with copper and manganese.

The revised strategy aims to streamline market entry, optimize capital efficiency, and meet customer demands. The company has already demonstrated its capability to recover battery grade lithium and high-purity metals at its pilot facility. This new approach is expected to accelerate commercialization, reduce capital requirements, and position Aqua Metals as a key supplier of domestic, low-carbon, battery-grade materials.

The optimized plan is projected to achieve a ~3 year payback at current metals prices, with lower capital and operational intensity than the previous design. The company maintains its long-term vision while adapting to market conditions, with plans for modular expansion and continued engagement with financial backers, feedstock suppliers, and off-take partners.

Aqua Metals (NASDAQ: AQMS) ha annunciato una strategia accelerata per il suo impianto di AquaRefining™ su scala commerciale nel centro industriale Tahoe-Reno. L'azienda prevede di più che raddoppiare i suoi obiettivi di produzione iniziali per carbonato di litio di grado batteria, producendo anche un Precipitato di Idrossido Misto (MHP) contenente nichel e cobalto, oltre a rame e manganese.

La strategia rivista mira a semplificare l'ingresso nel mercato, ottimizzare l'efficienza del capitale e soddisfare le esigenze dei clienti. L'azienda ha già dimostrato la propria capacità di recuperare litio di grado batteria e metalli di alta purezza presso il suo impianto pilota. Questo nuovo approccio dovrebbe accelerare la commercializzazione, ridurre i requisiti di capitale e posizionare Aqua Metals come fornitore chiave di materiali domestici a bassa emissione di carbonio e di grado batteria.

Il piano ottimizzato prevede un recupero dell'investimento in ~3 anni ai prezzi attuali dei metalli, con un'intensità di capitale e operativa inferiore rispetto al design precedente. L'azienda mantiene la propria visione a lungo termine mentre si adatta alle condizioni di mercato, con piani per un'espansione modulare e un continuo coinvolgimento con sostenitori finanziari, fornitori di materie prime e partner di acquisto.

Aqua Metals (NASDAQ: AQMS) ha anunciado una estrategia acelerada para su instalación de AquaRefining™ a escala comercial en el centro industrial de Tahoe-Reno. La empresa planea más que duplicar sus objetivos de producción iniciales para carbonato de litio de grado batería, mientras también produce Precipitado de Hidróxido Mixto (MHP) que contiene níquel y cobalto, junto con cobre y manganeso.

La estrategia revisada tiene como objetivo simplificar la entrada al mercado, optimizar la eficiencia del capital y satisfacer las demandas de los clientes. La empresa ya ha demostrado su capacidad para recuperar litio de grado batería y metales de alta pureza en su instalación piloto. Se espera que este nuevo enfoque acelere la comercialización, reduzca los requisitos de capital y posicione a Aqua Metals como un proveedor clave de materiales domésticos de bajo carbono y de grado batería.

El plan optimizado se proyecta para lograr un retorno de la inversión en ~3 años a los precios actuales de los metales, con una intensidad de capital y operativa inferior al diseño anterior. La empresa mantiene su visión a largo plazo mientras se adapta a las condiciones del mercado, con planes para una expansión modular y un continuo compromiso con financistas, proveedores de materias primas y socios de compra.

Aqua Metals (NASDAQ: AQMS)는 타호-리노 산업 센터의 상업 규모 AquaRefining™ 시설을 위한 가속화된 전략을 발표했습니다. 이 회사는 배터리 등급 리튬 탄산염에 대한 초기 생산 목표를 두 배 이상 늘릴 계획이며, 니켈과 코발트를 포함한 혼합 수산화물 침전물(MHP)과 구리 및 망간도 생산할 예정입니다.

개정된 전략은 시장 진입을 간소화하고, 자본 효율성을 최적화하며, 고객의 요구를 충족하는 것을 목표로 하고 있습니다. 이 회사는 이미 파일럿 시설에서 배터리 등급 리튬과 고순도 금속을 회수할 수 있는 능력을 입증했습니다. 이 새로운 접근은 상업화 속도를 높이고, 자본 요건을 줄이며, Aqua Metals를 국내 저탄소, 배터리 등급 자재의 주요 공급자로 자리매김할 것으로 예상됩니다.

최적화된 계획은 현재 금속 가격에서 약 3년 내에 투자 회수를 달성할 것으로 예상되며, 이전 설계보다 낮은 자본 및 운영 강도를 갖고 있습니다. 회사는 시장 상황에 적응하면서 장기 비전을 유지하며, 모듈형 확장 및 재정 후원자, 원자재 공급자, 구매 파트너와의 지속적인 참여 계획을 세우고 있습니다.

Aqua Metals (NASDAQ: AQMS) a annoncé une stratégie accélérée pour son installation AquaRefining™ à échelle commerciale au centre industriel de Tahoe-Reno. L'entreprise prévoit de plus que doubler ses objectifs de production initiaux pour carbonate de lithium de qualité batterie, tout en produisant également un Précipité d'Hydroxyde Mixte (MHP) contenant du nickel et du cobalt, ainsi que du cuivre et du manganèse.

La stratégie révisée vise à simplifier l'entrée sur le marché, optimiser l'efficacité du capital et répondre aux demandes des clients. L'entreprise a déjà démontré sa capacité à récupérer du lithium de qualité batterie et des métaux de haute pureté dans son installation pilote. Cette nouvelle approche devrait accélérer la commercialisation, réduire les exigences en capital et positionner Aqua Metals en tant que fournisseur clé de matériaux domestiques à faibles émissions de carbone et de qualité batterie.

Le plan optimisé devrait permettre un retour sur investissement d'environ ~3 ans aux prix actuels des métaux, avec une intensité de capital et d'exploitation inférieure à celle du design précédent. L'entreprise maintient sa vision à long terme tout en s'adaptant aux conditions du marché, avec des projets d'expansion modulaire et un engagement continu envers les financeurs, les fournisseurs de matières premières et les partenaires de vente.

Aqua Metals (NASDAQ: AQMS) hat eine beschleunigte Strategie für seine kommerzielle AquaRefining™-Anlage im Industriezentrum Tahoe-Reno angekündigt. Das Unternehmen plant, die ursprünglichen Produktionsziele für Batterie-Qualitäts-Lithiumcarbonat mehr als zu verdoppeln, während auch Mischhydroxidniederschlag (MHP) mit Nickel und Kobalt sowie Kupfer und Mangan produziert wird.

Die überarbeitete Strategie zielt darauf ab, den Markteintritt zu vereinfachen, die Kapitaleffizienz zu optimieren und die Kundenanforderungen zu erfüllen. Das Unternehmen hat bereits seine Fähigkeit unter Beweis gestellt, Lithium in Batteriequalität und hochreine Metalle in seiner Pilotanlage zurückzugewinnen. Dieser neue Ansatz soll die Kommerzialisierung beschleunigen, die Kapitalanforderungen reduzieren und Aqua Metals als wichtigen Anbieter von inländischen, kohlenstoffarmen Materialien in Batteriequalität positionieren.

Der optimierte Plan wird voraussichtlich bei den aktuellen Metallpreisen einen Renditezeitraum von ~3 Jahren erreichen, mit geringerer Kapital- und Betriebskostenintensität als das vorherige Design. Das Unternehmen verfolgt weiterhin eine langfristige Vision, während es sich an die Marktbedingungen anpasst, mit Plänen für modulare Expansion und fortlaufende Beteiligung an Finanzierungsgebern, Rohstofflieferanten und Abnehmerpartnern.

- More than doubled production targets for battery grade lithium carbonate

- Reduced capital requirements and operational costs

- Projected ~3 year payback period at current metal prices

- Successfully demonstrated battery grade lithium recovery at pilot facility

- Scalable technology allows future expansion to full metal refining

- Delayed full metal refining capabilities to future phases

- Strategy shift indicates possible challenges with original plan

- Dependent on securing financial backers and partnerships

Insights

Aqua Metals' strategic shift marks a pivotal moment in the domestic battery recycling landscape. By more than doubling its battery-grade lithium carbonate output targets, the company is positioning itself to capture a larger share of the most profitable segment of the battery recycling value chain. The focus on lithium carbonate and MHP production represents a shrewd market adaptation for several reasons:

Strategic Advantages:

- The streamlined product suite reduces operational complexity and capital requirements while maintaining future optionality for metal refining

- Targeting a ~3-year payback period at current metals prices demonstrates robust unit economics and potential resilience to market volatility

- The modular approach enables rapid scaling while preserving the ability to expand into high-purity metal refining as market conditions evolve

Market Positioning:

This pivot positions Aqua Metals advantageously within the domestic battery materials supply chain. The U.S. currently faces a significant shortfall in domestic battery-grade lithium carbonate production capacity, making this expanded focus particularly timely. The company's clean technology approach, emphasizing low-carbon production, aligns with both regulatory trends and OEM sustainability requirements.

Financial Implications:

The accelerated commercialization strategy could significantly improve the company's financial trajectory. By prioritizing higher-margin products and reducing capital intensity, Aqua Metals is positioning itself for potentially stronger cash flow generation in the near term. The focus on lithium carbonate production could also enhance the company's attractiveness to strategic partners and financial backers, particularly given the critical nature of domestic lithium supply.

Company positions itself for a multi-gigawatt-hour scale facility designed to produce higher margins and targeting a ~3 year payback, while enabling faster commercialization of battery-grade materials

RENO, Nev., Feb. 04, 2025 (GLOBE NEWSWIRE) -- Aqua Metals, Inc. (NASDAQ: AQMS), a pioneer in sustainable lithium battery recycling, today announced an accelerated pathway intended to increase revenue and margin at its planned commercial-scale AquaRefining™ facility at the Tahoe-Reno industrial center. To streamline market entry, optimize capital efficiency, scale core patented and licensable technology, and meet evolving customer demands, the Company intends to prioritize the production of battery grade lithium carbonate, more than doubling the initial production targets. Mixed Hydroxide Precipitate (MHP), a widely traded, high-value nickel and cobalt product, along with copper and manganese, will make up the rest of its product suite at its Sierra ARC recycling campus.

This near-term focus should enable faster and larger revenue generation, additional technology validation at scale, and expanded industry partnership potential while maintaining a clear roadmap for scaling toward high-purity metal refining that will eventually complement the lithium carbonate production.

Aqua Metals’ Strategy for Scaling a Low-Cost, Decarbonized Critical Minerals Supply Chain, while Creating Highly Desirable Jobs

Aqua Metals has already proven its ability to recover battery grade lithium as well as high purity nickel and cobalt from spent batteries and manufacturing scrap at its pilot facility. By prioritizing lithium carbonate and MHP production, the Company believes it can accelerate commercialization, reduce remaining capital requirements to complete the Sierra ARC, and position itself as a key supplier of domestic, low-carbon, battery-grade materials. The scalable nature of AquaRefining™ is the basis upon which Aqua Metals believes that full metal refining remains within reach as part of future scaling. The Company will continue qualifying battery-grade materials with its pilot program and through ongoing engagements with OEMs, cell, and CAM manufacturers.

“We are taking a smart, market-driven approach that we believe will allow us to scale faster, generate revenue sooner, and strengthen our position in the domestic critical minerals supply chain,” said Steve Cotton, CEO of Aqua Metals. “Our proven technology can already refine MHP into pure metals, but prioritizing a higher-throughput facility should allow us to increase the production of our highest margin material, battery grade lithium carbonate. This plan is designed to accelerate commercialization while maintaining full compatibility with our long-term vision for battery-grade materials that close the loop domestically.”

Optimized Strategy for Near-Term Growth & Long-Term Market Leadership

Aqua Metals' updated strategy reflects the Company's ability to adapt to market conditions while staying focused on long-term goals:

- Faster Path to Market, Lower CAPEX – Prioritizing lithium carbonate along with MHP as the product suite should reduce capital and operational intensity, enable a larger-scale facility that generates more revenue at a higher margin than our previous design – and achieve an attractive ~3 year payback even at today’s lower metals prices.

- Strengthened Industry Partnerships – Aqua Metals is in active discussions with feedstock suppliers and offtake partners, aligning with this accelerated commercialization and product suite plan.

- Future-Ready, Modular Expansion – The Company’s scalable technology should provide an easy transition to refining battery-grade nickel and cobalt sulfates and lithium hydroxide as market conditions and partner demand evolve.

Aqua Metals is continuing its engagement with several prospective financial backers, feedstock supply, and off-take partners, and expects to be able to provide updates later in Q1.

To listen to a Q&A on this topic visit our blog here: https://aquametals.com/blog/

Aqua Metals team standing with battery grade lithium produced at the Pilot facility in Tahoe-Reno Industrial Center

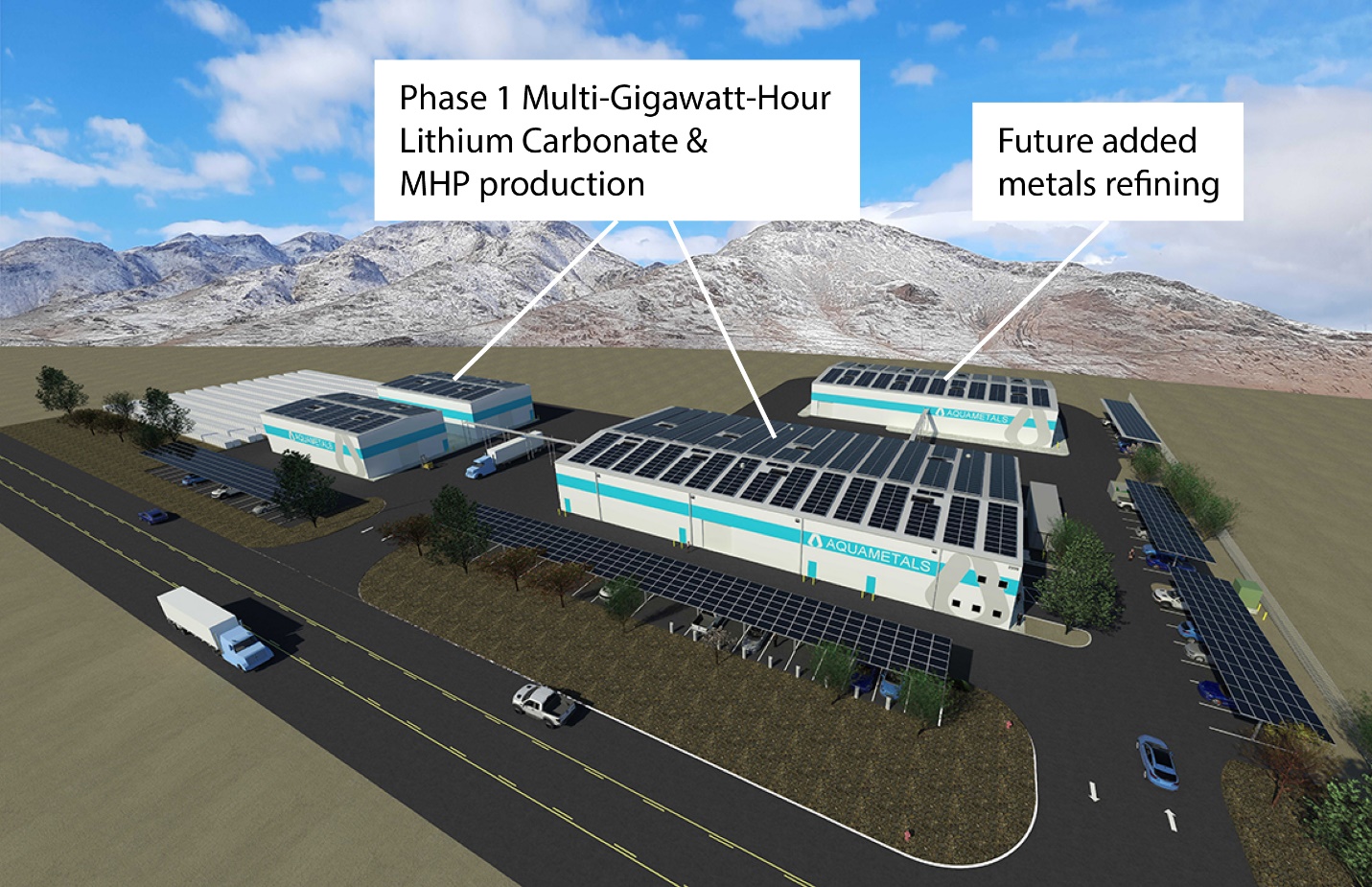

Rendering of Sierra ARC campus with layout to support Lithium Carbonate and MHP production along with future AquaRefining™ to metals

About Aqua Metals

Aqua Metals, Inc. (NASDAQ: AQMS) is reinventing metals recycling with its patented AquaRefining™ technology. The Company is pioneering a sustainable recycling solution for materials strategic to energy storage and electric vehicle manufacturing supply chains. AquaRefining™ is a low-emissions, closed-loop recycling technology that replaces polluting furnaces and hazardous chemicals with electricity-powered electroplating to recover valuable metals and materials from spent batteries with higher purity, lower emissions, and minimal waste. Aqua Metals is based in Reno, NV and operates the first sustainable lithium battery recycling facility at the Company’s Innovation Center in the Tahoe-Reno Industrial Center. To learn more, please visit www.aquametals.com.

Aqua Metals Social Media

Aqua Metals has used, and intends to continue using, its investor relations website (https://ir.aquametals.com), in addition to its Twitter, Threads, LinkedIn and YouTube accounts at https://twitter.com/AquaMetalsInc (@AquaMetalsInc), https://www.threads.net/@aquametalsinc (@aquametalsinc), https://www.linkedin.com/company/aqua-metals-limited and https://www.youtube.com/@AquaMetals respectively, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Safe Harbor

This press release contains forward-looking statements concerning Aqua Metals, Inc. Forward-looking statements include, but are not limited to, our plans, objectives, expectations and intentions and other statements that contain words such as "expects," "contemplates," "anticipates," "plans," "intends," "believes", "estimates", "potential" and variations of such words or similar expressions that convey the uncertainty of future events or outcomes, or that do not relate to historical matters. The forward-looking statements in this press release include our expectations for our pilot and commercial-scale recycling plants, our acquisition of the necessary funding to fully develop the Sierra ARC facility, our ability to recycle lithium-ion batteries on a scaled and economically efficient basis and the expected benefits of recycling lithium-ion batteries. Those forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially, including, but not limited to, (1) the risk that we may not be able to successfully acquire the funding necessary to develop our Sierra ARC facility, (2) even if we are to able acquire the necessary funding, the risk we may not be able to successfully develop the Sierra ARC facility or realize the expected benefits from such facility; (3) the risk that we may not be able to acquire the funding necessary to maintain our current level of operations; and (4) those risks disclosed in the section "Risk Factors" included in our Annual Report on Form 10-K filed on March 28, 2024. Aqua Metals cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake and specifically disclaims any obligation to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by law.

Contact Information

Investor Relations

Bob Meyers & Rob Fink

FNK IR

646-878-9204

aqms@fnkir.com

Media

David Regan

Aqua Metals

415-336-3553

david.regan@aquametals.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/696afff5-3463-4487-8de6-9eb1f6c27216

https://www.globenewswire.com/NewsRoom/AttachmentNg/2434d814-11ab-4948-a847-c95ecbc380ff