Applied Digital Corporation Announces Closing of $450 Million of Convertible Notes Offering

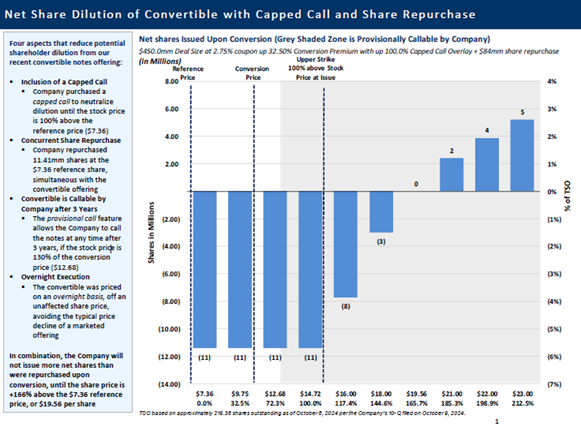

Applied Digital (APLD) has completed its previously announced offering of 2.75% Convertible Senior Notes due 2030, raising $450 million. The offering includes $75 million in additional notes from exercised options by initial purchasers. The company implemented capped call transactions with a cap price of $14.72 and repurchased approximately $84 million of common stock. Net proceeds were $434.5 million after expenses, with allocations of $84 million for share repurchases, $51.8 million for capped call transactions, and the remainder for general corporate purposes.

Applied Digital (APLD) ha completato l'offerta precedentemente annunciata di Note Convertibili Senior al 2,75% con scadenza nel 2030, raccogliendo 450 milioni di dollari. L'offerta comprende 75 milioni di dollari in note aggiuntive derivanti da opzioni esercitate dagli acquirenti iniziali. L'azienda ha implementato transazioni di capped call con un prezzo massimo di 14,72 dollari e ha riacquistato circa 84 milioni di dollari di azioni ordinarie. I proventi netti sono stati di 434,5 milioni di dollari dopo le spese, con allocazioni di 84 milioni per il riacquisto delle azioni, 51,8 milioni per le transazioni di capped call e il resto per scopi aziendali generali.

Applied Digital (APLD) ha completado su oferta previamente anunciada de Notas Senior Convertibles al 2,75% con vencimiento en 2030, recaudando 450 millones de dólares. La oferta incluye 75 millones de dólares en notas adicionales provenientes de opciones ejercidas por los compradores iniciales. La compañía implementó transacciones de 'capped call' con un precio máximo de 14,72 dólares y recompró aproximadamente 84 millones de dólares en acciones comunes. Los ingresos netos fueron de 434,5 millones de dólares después de gastos, con asignaciones de 84 millones para la recompra de acciones, 51,8 millones para transacciones de 'capped call', y el resto para fines corporativos generales.

Applied Digital (APLD)는 2030년 만기 2.75% 전환 선순위 사채의 이전에 발표된 공모를 완료하여 4억 5천만 달러를 모금했습니다. 이 공모에는 초기 구매자들이 행사한 옵션으로 인한 추가 사채 7천5백만 달러가 포함됩니다. 회사는 14.72달러의 한도가 설정된 캡콜 거래를 시행하였으며, 약 8천4백만 달러의 보통주를 재매입했습니다. 경비 후 순수익은 4억 3천4백50만 달러였으며, 8천4백만 달러는 주식 재매입, 5천1백80만 달러는 캡콜 거래에 할당되었고, 나머지는 일반적인 기업 목적으로 사용되었습니다.

Applied Digital (APLD) a complété son offre précédemment annoncée de Titres Senior Convertibles à 2,75% arrivant à échéance en 2030, levant 450 millions de dollars. L'offre comprend 75 millions de dollars en titres supplémentaires provenant des options exercées par les acheteurs initiaux. L'entreprise a mis en œuvre des transactions de capped call avec un prix plafond de 14,72 dollars et a racheté environ 84 millions de dollars d'actions ordinaires. Les recettes nettes se sont élevées à 434,5 millions de dollars après les dépenses, avec des allocations de 84 millions pour le rachat d'actions, 51,8 millions pour les transactions de capped call, et le reste pour des fins générales d'entreprise.

Applied Digital (APLD) hat sein zuvor angekündigtes Angebot von 2,75% Wandelanleihen mit Fälligkeit 2030 abgeschlossen und 450 Millionen Dollar gesammelt. Das Angebot umfasst 75 Millionen Dollar an zusätzlichen Anleihen aus ausgeübten Optionen durch die ursprünglichen Käufer. Das Unternehmen hat Transaktionen mit capped calls mit einem Höchstpreis von 14,72 Dollar implementiert und etwa 84 Millionen Dollar an Stammaktien zurückgekauft. Die Nettomittel beliefen sich nach Abzug der Kosten auf 434,5 Millionen Dollar, wobei 84 Millionen für den Rückkauf von Aktien, 51,8 Millionen für capped call-Transaktionen und der Rest für allgemeine Unternehmenszwecke vorgesehen waren.

- Successfully raised $450 million through convertible notes offering

- Initial purchasers exercised full $75 million additional notes option

- Net proceeds of $434.5 million strengthen company's financial position

- Potential future dilution from convertible notes

- Increased debt liability with 2.75% interest rate

- Significant cash outlay of $84 million for share repurchases

Insights

This

The net proceeds of

DALLAS, Nov. 04, 2024 (GLOBE NEWSWIRE) -- Applied Digital Corporation (Nasdaq: APLD) (“Applied Digital” or the “Company”), a designer, builder, and operator of next-generation digital infrastructure designed for High-Performance Computing applications, today completed its previously announced offering of

In conjunction with the issuance of the Convertible Notes, the Company entered into capped call transactions with a cap price of

The table below illustrates the potential net dilution expectations from the overall transaction.

The net proceeds from the sale of the Convertible Notes were approximately

About Applied Digital

Applied Digital (Nasdaq: APLD) develops, builds and operates next-generation data centers and cloud infrastructure. Different by design, the company’s purpose-built facilities are engineered to unleash the power of accelerated compute and deliver secure, scalable and sustainable digital hosting, along with turnkey CSaaS and GPU-as-a-Service solutions. Backed by deep hyperscale expertise and a robust pipeline of available power, Applied Digital accommodates AI Factories and beyond to support the world’s most exacting AI/ML, blockchain and high-performance computing (HPC) workloads.

Forward-Looking Statements

This release contains "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, the intended use of the proceeds and the effects of entering into, the capped call transactions and prepaid forward repurchase described above. These statements use words, and variations of words, such as “continue,” “build,” “future,” “increase,” “drive,” “believe,” “look,” “ahead,” “confident,” “deliver,” “outlook,” “expect,” “intend,” “hope,” “remain,” “project” and “predict.” You are cautioned not to rely on these forward-looking statements. These statements are based on current expectations of future events and thus are inherently subject to uncertainty. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the Company's expectations and projections. These risks, uncertainties, and other factors include: decline in demand for our products and services; the volatility of the crypto asset industry; the inability to comply with developments and changes in regulation; cash flow and access to capital; and maintenance of third-party relationships. The Company cannot provide any assurances regarding its ability to effectively apply the net proceeds as described above. Information in this release is as of the dates and time periods indicated herein, and the Company does not undertake to update any of the information contained in these materials, except as required by law.

Investor Relations Contacts

Matt Glover and Ralf Esper

Gateway Group, Inc.

(949) 574-3860

APLD@gateway-grp.com

Media Contact

Buffy Harakidas, EVP and Jo Albers

JSA (Jaymie Scotto & Associates)

jsa_applied@jsa.net

(856) 264-7827

Source: Applied Digital Corporation

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4892d38d-29e4-4243-89d3-18e692313154